Smart Moves With Strong Returns for Real Estate Investment

Real Estate Investment 2026 is shaping how buyers and investors plan for the future. Many people want safety, growth, and steady income. In New Hampshire, smart investing still starts with local knowledge and timing. Areas like South Nashua houses for sale and Southern NH Houses for sale continue to draw attention from both new and experienced investors. Therefore, understanding the market now helps investors move with confidence later.

The 2026 market feels steady but selective. Rates, prices, and inventory all matter. However, opportunity still exists for those who plan well. Investors who stay patient and informed often win. This guide shares current conditions, strong locations, and proven strategies that work in today’s market.

Understanding the 2026 Real Estate Market

The real estate market in 2026 feels more balanced than past years. Prices remain strong, yet growth feels calmer. Buyers act with care and sellers price with strategy. Because of this, smart investors focus on value instead of hype.

Interest rates matter more now. They influence monthly costs and long term returns. Even so, many buyers accept rates as the new normal. Therefore, deals still happen when numbers make sense. Investors who run clear math stay ahead.

Inventory remains tight in many New Hampshire towns. This supports prices and rental demand. However, some areas offer more options than others. Knowing where to look makes a big difference in Real Estate Investment 2026 success.

Why New Hampshire Attracts Investors

New Hampshire offers strong lifestyle appeal. It also offers steady job markets and stable communities. These factors support long term housing demand. Investors like markets that feel safe and predictable.

The state has no sales tax or income tax on wages. This attracts residents and retirees. As population holds steady, housing demand stays strong. Therefore, rental and resale opportunities remain healthy.

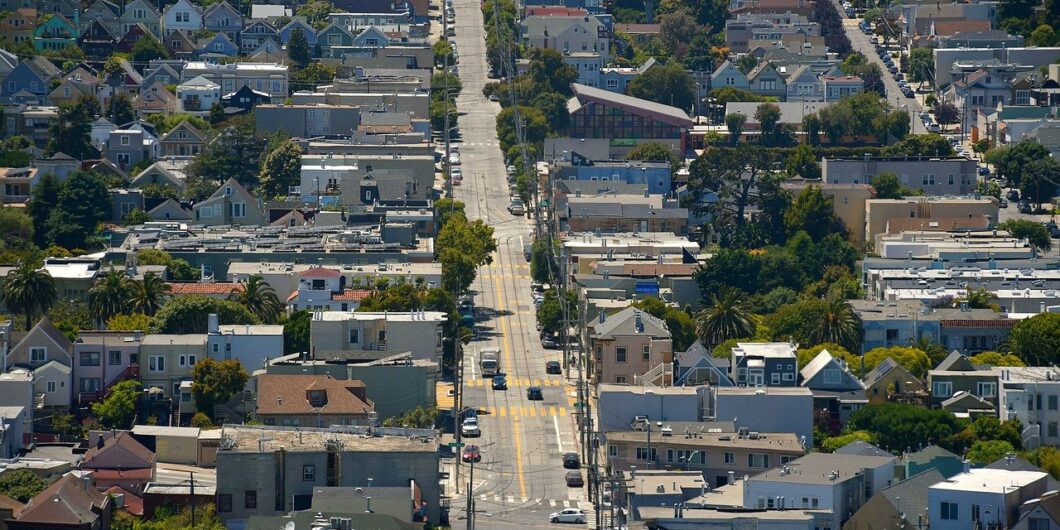

Southern New Hampshire stands out for access and growth. It offers proximity to jobs and highways. This makes it attractive for commuters and families. Because of this, investors often focus on this region first.

Best Locations to Invest in 2026

Location still drives success. In 2026, buyers want convenience, safety, and quality schools. Towns near highways and job centers lead the list. Investors should watch areas with steady demand.

South Nashua houses for sale attract attention due to location and amenities. The area offers shopping, dining, and easy travel. Rental demand stays strong from professionals and families. Therefore, this market suits both short and long term investors.

Southern NH Houses for sale for sale also draw wide interest. Many buyers look for value just outside city centers. These towns offer space, charm, and strong community feel. As a result, they often deliver stable appreciation.

Single Family Homes as Core Investments

Single family homes remain popular in Real Estate Investment 2026. They attract long term renters and future buyers. Maintenance feels simpler compared to larger properties. Because of this, many investors start here.

Families often rent before buying. This supports steady rental income. Also, single family homes tend to hold value well. Investors gain both cash flow and appreciation over time.

In New Hampshire, these homes perform well in strong school districts. They also appeal to relocating buyers. Therefore, single family rentals remain a solid base strategy.

Multi Family Properties Build Strong Cash Flow

Multi family homes offer higher income potential. They also spread risk across units. If one unit turns over, others still produce income. Because of this, many investors move into this space.

In 2026, small multi family properties feel easier to manage. Duplexes and triplexes fit local zoning well. They also blend into neighborhoods. This helps maintain value and community support.

Financing may require stronger numbers. However, returns often justify the effort. For investors focused on income, multi family homes remain powerful tools.

Condos and Townhomes Gain Attention

Condos and townhomes attract a wide range of renters. Young professionals and downsizers often choose them. Maintenance responsibilities stay lower, which appeals to busy owners.

In Southern New Hampshire, these properties sit near jobs and services. This boosts rental demand. Investors benefit from predictable costs and stable occupancy.

HOA fees matter and require review. However, many investors accept them for ease. In Real Estate Investment 2026, convenience often equals value.

Short Term Rentals and Local Rules

Short term rentals remain popular but require care. Rules vary by town and change over time. Investors must review local laws before buying.

Tourism areas still support this strategy. Lakes, mountains, and seasonal attractions draw visitors. However, income may fluctuate by season. Therefore, planning matters.

Some investors mix short and long term rentals. This adds flexibility. Still, local compliance remains key to success.

Buy and Hold Strategy Still Works

Buy and hold remains a favorite strategy in 2026. It focuses on long term growth and rental income. Investors ride out market shifts and build equity.

This strategy suits stable markets like New Hampshire. Prices may rise slowly, yet consistency matters. Over time, rent growth improves returns.

Tax benefits also support this approach. Depreciation and expenses help reduce taxable income. Because of this, many investors choose buy and hold for security.

Fix and Improve With Caution

Fix and improve strategies still exist. However, costs remain high for labor and materials. Investors must budget carefully and allow extra time.

Homes needing light updates perform best. Paint, flooring, and fixtures offer strong returns. Major structural work adds risk and delay.

In Real Estate Investment 2026, speed and planning matter. Investors who know their numbers still succeed. Those who rush often struggle.

Financing Strategies for 2026

Financing shapes every deal. In 2026, lenders remain cautious yet active. Strong credit and reserves matter more than ever.

Fixed rate loans offer predictability. Adjustable loans may offer short term savings but add risk. Investors must match loans to their plans.

Some investors use partnerships to grow faster. Others leverage equity from existing homes. Smart financing supports long term success.

Managing Risk in Today’s Market

Risk management matters in every market. In 2026, investors plan for slower growth. They also prepare for higher holding costs.

Cash reserves protect against surprises. Vacancy, repairs, and rate changes happen. Investors who plan ahead feel less stress.

Diversification also helps. Owning different property types spreads risk. This approach supports stable returns over time.

Rental Demand Trends in 2026

Rental demand stays strong across New Hampshire. Many renters wait longer to buy. This supports occupancy and rent growth.

Remote work still shapes choices. Renters seek space and comfort. Properties with offices or bonus rooms stand out.

In areas like South Nashua houses for sale, rental demand remains high. Access and amenities drive interest. Therefore, well located rentals perform well.

Appreciation Versus Cash Flow Balance

Investors often choose between appreciation and cash flow. In reality, balance works best. Properties that offer both feel safer.

Some areas offer higher rent yields. Others offer stronger price growth. Knowing goals helps guide choices.

In Southern NH Houses for sale for sale, many markets offer balance. Investors gain steady rent and long term value. This mix suits many plans.

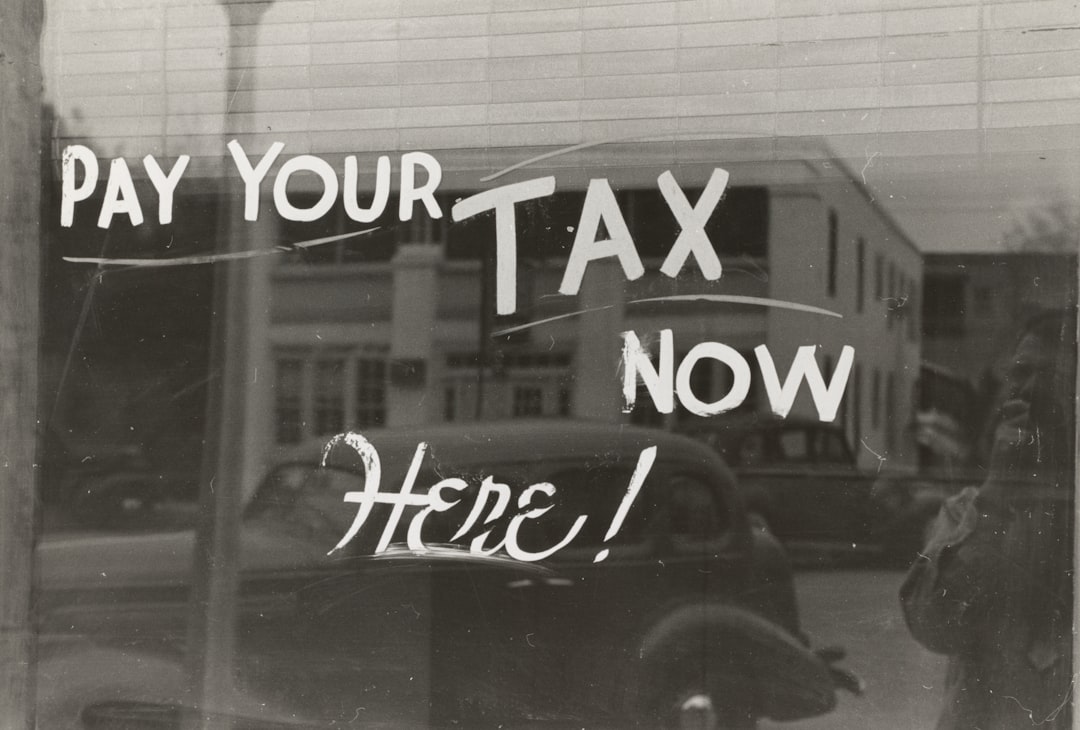

Tax Planning for Real Estate Investors

Tax planning plays a key role in returns. Investors should work with professionals. Proper planning protects income and growth.

Depreciation lowers taxable income. Expense tracking adds savings. Long term ownership may reduce capital gains later.

In Real Estate Investment 2026, tax awareness adds power. Smart planning often separates average from strong investors.

Working With a Local REALTOR

Local REALTORS add insight and access. They know neighborhoods, pricing, and trends. This knowledge saves time and money.

REALTORS also help spot value. They guide negotiations and inspections. For investors, this support reduces risk.

In New Hampshire, local experience matters. Town rules and markets vary. A trusted REALTOR becomes a key partner.

Exit Strategies Matter From Day One

Every investment needs an exit plan. Investors should decide early how they will sell or refinance. This guides purchase decisions.

Some plan to sell after appreciation. Others plan to hold for life. Both paths work with clear planning.

In 2026, flexibility matters. Markets change and life changes too. A clear exit strategy keeps options open.

Emotional Discipline Leads to Success

Investing involves emotion. Fear and excitement can cloud judgment. Successful investors stay calm and patient.

They focus on numbers and goals. They avoid chasing trends without research. This discipline supports long term success.

Real Estate Investment 2026 rewards steady thinkers. Those who stay grounded often win.

Real Estate Investment 2026

Real Estate Investment 2026 offers opportunity for prepared investors. The market favors planning, patience, and local knowledge. New Hampshire continues to attract buyers and renters. Markets like South Nashua houses for sale remain strong for both income and growth. Southern NH Houses for sale also offer balance and long term value. With the right strategy, investors can move forward with confidence and clarity.

If you need more tips on real estate investment 2026, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.