Category Archives for "Blog"

Many people dream about leaving their regular job and building a life filled with more freedom and financial stability. The truth is that many have already done it through real estate investing. This path can feel exciting and life changing once you understand how it works. The steps are simple but they must be followed with patience and focus. You can turn your interest in property into a full time business that supports your goals. This includes investing in local areas such as South Hudson houses for sale or other popular Southern NH houses for sale.

Real estate offers many ways to grow your income. Some investors choose rental properties. Some flip homes for profit. Others explore short term rentals or commercial buildings. When you learn the basics and build skills over time, you can create a business that grows with you. It does not matter if you are starting small. What matters is learning, planning, and taking steps every week.

Real estate can feel rewarding because it creates both short term income and long term value. You are building something real that stands on the land. People will always need places to live and work. This is why real estate stays strong in almost every economy. Property also grows in value over time which helps investors build wealth.

Another reason this field works is the flexibility. You can begin small with one rental. You can buy a fixer upper and make a profit. You can work part time while learning the ropes. As you feel more comfortable you can grow your business slowly or quickly. Many investors reach a point where they feel ready to go full time because the income becomes steady.

Real estate also creates emotional satisfaction. Investors enjoy helping families find homes. They enjoy improving neglected properties. They enjoy watching tenants thrive. It is a business that can feel personal which encourages loyalty and pride.

Every strong real estate career begins with knowledge. You need to understand what makes a property valuable. You need to learn how rental income works. You need to know local market trends. Luckily these things are easy to learn with practice.

Start by studying your local area. Look at prices in Nashua, Hudson, Londonderry, and other Southern NH towns. Pay attention to days on market and average rent. Notice which neighborhoods grow quickly. This simple research will help you make smarter choices later.

It also helps to understand common terms used in real estate investing. These include cash flow, equity, appreciation, cap rate, and return on investment. Learning these terms may feel strange at first but they become natural with use. You can read books, attend local seminars, or watch online videos. Make time each week to practice your skills.

Surround yourself with people who already invest. This can be through local real estate groups, networking events, or community meetings. Ask questions and learn from their experiences. Most investors enjoy helping beginners because they remember what it felt like to start.

There are many ways to invest because different personalities enjoy different strategies. You can decide which path fits your skills and comfort level.

Many investors choose long term rental homes because they create steady monthly income. Rental homes can be single family homes, condos, or even small multi family buildings. You earn money each month while your tenant pays down the loan. You also earn value as the property increases in price.

Some investors buy older homes that need repairs. They make improvements then sell for a profit. This path can earn larger paychecks but the risk can feel higher. It requires good contractors, strong budgets, and smart planning.

Short term rentals can work well in tourist areas or busy towns. These properties are rented for days or weeks. They can earn more than traditional rentals but require more hands on management.

Commercial real estate includes office buildings, retail centers, and warehouses. These properties often have higher income but require more knowledge. Many investors enter this field later in their career.

The best path is the one that feels comfortable to you. There is no wrong place to start. Many full time investors begin by purchasing one rental home in their town. For example, investing in South Hudson houses for sale can be a great first step because the area stays in high demand.

Real estate feels easier when you are not alone. A solid team can support your career and help you grow safely. This includes a REALTOR who knows the local market. It includes a trustworthy lender who offers smart financing options. It includes contractors, inspectors, attorneys, insurance agents, and property managers.

Your REALTOR becomes one of your most valuable partners. They help you find strong deals. They help you understand neighborhood trends. They help you negotiate fair prices. They also help you avoid mistakes. A REALTOR with Southern NH experience can guide you to homes that appreciate well.

A good lender helps you secure financing for each deal. They explain different loan types and show which options fit your income and goals. They help you plan your credit and your future purchases.

Contractors help you repair and upgrade properties. Inspectors help you avoid hidden problems. Attorneys help you understand legal paperwork. Insurance agents help you protect your investments.

When you have a strong team, you feel more confident and ready to take bigger steps.

Real estate investing requires money but you do not need to be wealthy to begin. Many investors start with low down payment loans. Some use FHA loans. Some use conventional loans with small down payments. Others use creative financing such as seller financing or private lenders.

You can also use equity from your current home to make your first purchase. Homeowners in New Hampshire often have strong equity because prices have grown. Using equity wisely can help you buy your first rental or flip property.

It is important to understand your monthly expenses. You should know your mortgage payment, taxes, insurance costs, and repair budgets. When these numbers are clear, you can plan your income correctly. You will understand how much rent you need to make the property profitable.

The better you understand your money, the smoother your transition into full time real estate investing will feel.

Full time real estate investors follow habits that keep their business strong. They check new listings each day. They study market changes. They visit open houses. They run numbers on possible deals. These habits keep their minds active and ready for action.

Investors also track their income and expenses. They monitor tenant issues and property conditions. They keep legal documents organized. They communicate clearly with their team. They plan ahead for maintenance and renovations.

Real estate investing becomes a full time career when you treat it like one. You do not need to work twenty four hours a day. You simply need a steady routine. Over time these habits create structure and help your business grow.

Investing can feel exciting but also a little stressful at times. You may worry about making mistakes. You may feel nervous during negotiations. You may second guess yourself before buying your first property.

These feelings are normal. Every full time investor felt them at the start. The key is to move slowly and stay educated. Celebrate your small wins. Learn from your challenges. Over time your confidence will grow and decisions will feel easier.

Real estate also brings joy. You help families find rentals. You improve neighborhoods by updating homes. You build a business that supports your dreams. This emotional reward keeps many investors motivated.

Every investment includes some level of risk. Your goal is to control that risk. You do this through research, education, and planning. You also do this by keeping savings available for unexpected repairs.

Real estate usually becomes safer the longer you hold it. Property values grow. Mortgage balances drop. Rental income increases. When you plan for the long term, risk becomes smaller.

Many full time investors begin small to stay safe. They buy one home. They learn how to manage tenants. They build confidence. Then they buy another. This steady growth helps reduce risk and builds wealth at the same time.

Southern New Hampshire remains a very strong area for new and experienced investors. Cities such as Nashua, Hudson, Londonderry, and Manchester attract renters and buyers year round. These areas offer good jobs, strong schools, and easy travel to Boston. This keeps demand high for rental homes.

Investors often enjoy stable results in towns like Hudson. South Hudson houses for sale remain popular because they offer great value and comfort. These neighborhoods make long term rentals easy to fill. They also give investors dependable appreciation.

Southern NH houses for sale offer many opportunities for flips and rentals. Many homes are older and ready for updates. These projects can increase value and create strong returns.

When you choose to become a full time investor, it helps to build a brand. This does not need to feel complicated. It simply means presenting yourself as a professional who cares about quality.

You can create a simple website or social media page that shares your work. You can post photos of your renovations and rented homes. You can share real estate tips that help others. Over time people will recognize your name and trust your business.

A strong brand helps you find deals more easily. Sellers will reach out to you. Buyers will ask for your help. Other investors will want to partner with you. This becomes a powerful part of your long term success.

There is no perfect moment where a sign appears and tells you to quit your job. You will know you are ready when your income feels steady and your confidence feels strong. Most investors feel prepared once they have at least two or three successful properties.

Before going full time, make sure your financial safety net is strong. Keep savings available for repairs and slow months. Create a plan for your next five deals. Review your goals and update your budget.

You will feel a mix of excitement and nervousness. This is normal. That feeling means you are stepping into something meaningful. With time, your business will grow and your confidence will increase.

Turning your passion for real estate investing into a full time career is possible when you build knowledge, create habits, and surround yourself with strong partners. The journey takes patience but it also brings excitement and pride. When you choose the right properties such as Southern NH houses for sale or South Hudson houses for sale, you create long term stability.

The best part is that you can shape your career to fit your life. You can grow slowly or quickly. You can focus on rentals or flips. You can adjust your plan whenever needed. When you use the principles of real estate investing with care, your future becomes brighter and more secure.

This path has already changed the lives of many investors. It can change yours too. With courage, focus, and the right guidance, you can build a full time real estate career that feels rewarding every single day.

If you need more tips on real estate investing, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

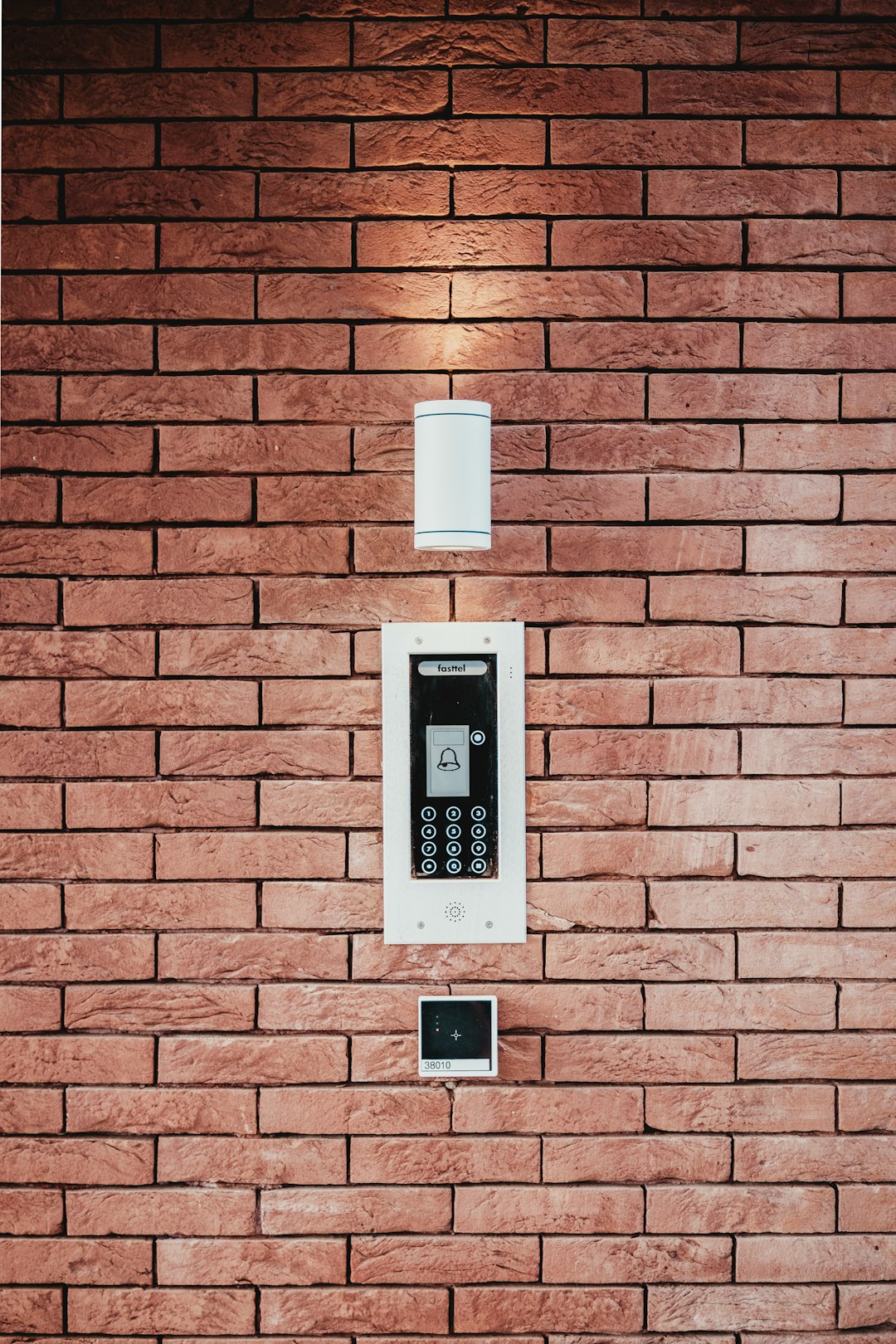

Top home security cameras play a growing role in how buyers feel about a home. Safety, comfort, and peace of mind now guide many real estate decisions. In New Hampshire, buyers often ask about smart security before making offers. This comes up often when viewing South Nashua houses for sale and Southern NH Houses for sale. Because of this, understanding camera options helps sellers and buyers feel confident.

Home security cameras feel less complex than before. Many systems now install easily and work right away. They also blend into the home without distraction. For homeowners, these systems add daily comfort. For buyers, they signal care and modern living.

Security affects how people feel inside a home. Buyers want to feel safe the moment they walk in. A visible camera system creates trust and reassurance. Therefore, homes with security features often feel more appealing.

In real estate, perception matters. Even simple systems can improve first impressions. Buyers see cameras as a sign of smart ownership. As a result, listings with security features often gain more interest.

In New Hampshire markets, safety ranks high for families and retirees. Buyers want peace of mind in every season. Because winters bring longer nights, security feels even more important.

Top home security cameras do more than watch doors. They support lifestyle and property value. Buyers see them as practical upgrades, not luxury extras. This mindset helps listings stand out.

Cameras can lower insurance costs in some cases. They also help owners monitor property when away. Because of this, cameras support both financial and emotional value.

For sellers, leaving a system in place can help negotiations. Buyers feel they gain something extra. That feeling often leads to stronger offers.

Storage options matter to buyers. Cloud storage offers easy access and backup. Local storage appeals to those who value privacy.

Buyers ask how long footage stays available. They also ask who can access it. Clear answers help build confidence.

Privacy settings matter too. Cameras should respect neighbors and family spaces. Responsible setup supports trust and peace of mind.

Some camera styles stand out to buyers. Doorbell cameras remain very popular. They offer convenience and security in one device.

Bullet cameras cover wide outdoor areas. Dome cameras feel discreet and professional. Each style serves a different need.

Buyers appreciate when sellers explain these choices. Simple guidance helps them see value. This clarity supports better decisions.

Families value safety above most features. Cameras help parents feel calm. They also help kids feel protected.

Seeing activity around the home builds awareness. Alerts notify parents of movement. This support feels reassuring during busy schedules.

In family focused areas, security matters more. Buyers exploring South Nashua houses for sale often ask about safety features. Cameras help answer those concerns.

Security cameras also reflect neighborhood care. They show pride and awareness. This can influence buyer perception of the area.

When many homes have cameras, buyers feel safer. This sense of community matters. It also supports property values.

In Southern NH Houses for sale for sale, buyers often notice these details. Small signs of care add up during decision making.

Landlords use cameras to protect property. They also help manage rentals from afar. This adds efficiency and oversight.

Tenants appreciate secure buildings. Clear rules and visible cameras build trust. However, privacy must remain respected.

For investors, cameras protect income and assets. They also reduce risk. This makes them a smart addition to rentals.

New Hampshire weather affects camera choice. Cold winters demand durable equipment. Cameras must handle snow and ice.

Buyers ask about temperature ratings. They want systems that work year round. Because of this, quality matters.

Sellers who choose weather ready cameras gain an edge. These systems feel reliable and thoughtful.

Easy installation matters to buyers. Many prefer systems that need little setup. Clear instructions and simple apps help.

Professional installation adds value for some. It ensures proper placement and coverage. However, many buyers like doing it themselves.

In real estate, ease often wins. Systems that feel simple attract wider interest.

Buyers consider cost carefully. They want fair pricing and clear benefits. Cameras that offer strong value stand out.

Subscription fees can raise questions. Buyers want to know monthly costs. Transparency helps build trust.

When sellers explain value clearly, buyers respond well. Cameras then feel like smart investments.

Some insurance providers offer discounts. Cameras reduce risk and claims. Buyers like potential savings.

Not all systems qualify. Buyers should check with providers. Still, the possibility adds appeal.

In listings, this benefit can be mentioned. It shows thoughtful ownership and planning.

REALTORS can highlight security in listings. Photos and descriptions matter. Clear mention of cameras adds interest.

During showings, sellers can explain features. This builds confidence. Buyers appreciate honesty and clarity.

Security features help listings feel complete. They also support emotional comfort during tours.

Buyers ask if systems stay with the home. They want to know how to use them. They also ask about privacy.

Clear answers help deals move forward. REALTORS play a key role here. Knowledge builds trust.

Top home security cameras often spark positive conversations. They show modern care and awareness.

Camera technology continues to improve. Better video and smarter alerts lead the way. Buyers expect these improvements.

In the future, cameras may predict patterns. They may also integrate deeper with homes. This progress excites buyers.

Homes that already use modern systems feel ahead. This supports long term value.

Buying a home feels emotional. Safety plays a big role. Cameras support that feeling.

When buyers feel safe, they relax. Relaxed buyers make confident decisions. This benefits everyone.

Top home security cameras support peace of mind. That peace often seals the deal.

Top home security cameras now feel essential, not optional. They support safety, value, and buyer confidence. In New Hampshire, these systems match lifestyle and climate needs. Buyers looking at South Nashua houses for sale often see cameras as a strong benefit. The same holds true for Southern NH Houses for sale where safety remains a top priority. With smart choices, cameras help homes feel protected and ready for the future.

If you need more tips on top home security cameras, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Open houses still matter in 2026. They just look different now. Buyers expect more comfort, more clarity, and more value. Open House Best Practices help meet those needs in a natural way. A great open house should feel helpful, relaxed, and welcoming. It should never feel rushed or sales heavy. Buyers want space to imagine life in the home. They also want answers when they ask.

Today’s buyers often arrive prepared. Many already viewed the home online. Some tracked prices for months. Others follow South Hudson houses for sale daily. Your open house should confirm their interest. It should also build trust fast.

The market keeps changing. Buyers have more tools than ever. They compare homes quickly. They notice details faster. Open House Best Practices help your listing rise above the noise.

Open houses are no longer about balloons and sign in sheets. They are about experience. Buyers want ease. They want honesty. They want to feel respected. When done right, open houses build emotional connection. That connection often leads to offers.

Southern NH houses for sale remain competitive. First impressions still matter. A strong open house can shorten days on market. It can also protect your price.

Every great open house starts before the door opens. Preparation builds confidence. It also reduces stress on the day of the event.

Start with a clean home. This step never changes. Buyers notice floors, windows, and kitchens first. A fresh smell helps too. Avoid strong scents. Clean air feels safer and more inviting.

Next focus on lighting. Open curtains fully. Turn on lamps. Bright spaces feel larger and happier. Buyers stay longer in well lit rooms.

Remove clutter from all surfaces. Less stuff helps buyers picture their own life there. Storage space should feel open and useful.

Open House Best Practices now include strong digital marketing. Most buyers learn about open houses online. Your photos must match reality. Accurate listings build trust.

Promote the open house early. Share it on social media. Add it to real estate websites. Email your buyer list. Clear dates and times matter.

Short videos work well too. A simple walkthrough video builds excitement. It also attracts serious buyers.

Use clear signs on open house day. Directional signs reduce frustration. Easy parking instructions help visitors relax before entering.

Technology supports modern open houses when used wisely. It should never feel distracting. Digital sign in systems save time. They also feel cleaner and more secure. Buyers appreciate a quick process.

QR codes offer instant access to listing details. Buyers can review floor plans and disclosures on their phone. This keeps conversations natural.

Consider soft background music. Smart speakers allow easy control. Music should stay low and neutral.

Virtual tours help buyers who arrive later. They also support follow up conversations.

Comfort is central to Open House Best Practices. Buyers need time and space. Avoid crowding rooms. Guide traffic gently.

Greet visitors warmly. A smile goes far. Offer a brief welcome. Then give them space to explore. Be available for questions. Do not follow closely. Buyers talk more freely when they feel relaxed.

Provide simple printed information. Highlight features. Include utility costs if available. Buyers appreciate transparency.

Simple refreshments add warmth. They should never feel messy or distracting. Offer bottled water. Light snacks work well. Avoid strong smells or crumbs.

Local touches create connection. A small sign mentioning a local bakery can spark conversation. This works well for South Hudson houses for sale.

Clean up often during the event. A tidy space maintains a professional feel.

Staging remains important in 2026. The style feels lighter now. Neutral colors still win. Soft textures add comfort. Buyers respond well to cozy yet clean spaces.

Use fewer decorations. Focus on scale. Furniture should show room size clearly. Add life with plants. Greenery feels fresh and calming. Avoid artificial looks.

Bathrooms and kitchens deserve extra care. These rooms drive decisions.

Safety matters for everyone involved. Clear plans reduce risk. Secure valuables before the event. Lock private areas if needed.

Keep personal items out of sight. Buyers should focus on the home. Have a second person present for busy events. This helps manage traffic.

Follow local guidelines when needed. Buyers value thoughtful precautions.

Strong conversations build trust. Listen more than you speak. Ask open questions. Learn what buyers value most.

Answer honestly. If you do not know, say so. Follow up later. Avoid pressure. Buyers move at their own pace. Support that process.

Mention neighborhood benefits naturally. Schools, trails, and commutes matter.

Local insight sets professionals apart. Buyers rely on it. Share trends in Southern NH houses for sale. Explain pricing clearly.

Mention recent activity in South Hudson houses for sale when relevant. Talk about community features. Restaurants, parks, and events help buyers connect.

Local stories make the home feel grounded and real.

The open house does not end when the door closes. Follow up matters. Send a short thank you message. Keep it friendly and helpful.

Share answers to questions asked. Provide missing details promptly. Ask for feedback. Buyer insight improves future showings.

Stay present but respectful. Trust builds over time.

Success looks different now. It is not only about attendance. Quality conversations matter most. Serious buyers ask deeper questions.

Track online engagement after the event. Listing views often rise. Monitor showing requests. Strong open houses drive private tours.

Evaluate feedback honestly. Small changes can improve results fast.

Open houses remain powerful in 2026. They just require care and intention. Open House Best Practices focus on experience, trust, and connection. Buyers remember how a home made them feel.

When done well, open houses support strong offers. They shorten market time. They protect value.

In competitive areas like Southern NH houses for sale, details matter. A modern open house creates confidence. Confidence leads to action.

If you need more info on Open House best practices, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Let’s start with a simple truth. A well organized home feels better to live in. It also shows better when guests walk through the door. That matters whether you plan to stay forever or explore Litchfield houses for sale or Southern NH Houses for sale someday. Home organization tips help you breathe easier and think clearer right now.

Clutter sneaks up on all of us. One drawer here. One closet there. Then suddenly you cannot find your favorite spatula. Sound familiar? You are not alone. The good news is that organizing does not require perfection or matching bins everywhere.

It just takes a plan and a little patience.

Trying to organize the entire house in one weekend rarely works. It usually ends with frustration and pizza boxes.

Pick one space. A drawer. A shelf. A closet corner. Finish it fully before moving on.

Small wins build momentum. Momentum builds confidence. That is how real change sticks.

These home organization tips work best when you keep expectations realistic.

Organizing clutter does not solve clutter. It just moves it around.

Before buying bins or shelves, decide what stays. If you have not used it in a year, question why it is there.

Ask yourself if the item serves your current life. Not your past life. Not your future fantasy life.

This step alone transforms homes buyers tour across Southern NH Houses for sale.

Items wander when they lack a home. Keys land everywhere. Mail piles grow.

Choose a specific spot for frequently used items. Stick with it. Consistency matters more than perfection.

When items return to the same place, mess stays under control.

These home organization tips reduce daily stress more than people expect.

Walls matter. Shelves matter. Hooks matter.

Vertical storage frees floor space and creates visual calm. This works especially well in smaller homes.

Buyers touring Litchfield houses for sale often notice how tall storage makes rooms feel larger.

Look up. You may find space you forgot existed.

Closets should work for you. Not fight you.

Use bins for small items. Group clothes by type. Keep seasonal items separate.

If you cannot see it, you forget it. Clear containers help.

Strong closet organization supports these home organization tips beautifully.

Kitchens get messy fast. They also organize well with zones.

Create areas for cooking, baking, food storage, and cleanup. Keep tools near where you use them.

This saves time and reduces frustration. It also makes kitchens feel functional.

Buyers exploring Southern NH Houses for sale love kitchens that feel efficient and calm.

Paper piles grow quietly. Then suddenly they take over.

Create one paper station. Sort mail immediately. Recycle often.

Digitize when possible. Keep important documents in labeled folders.

Paper control is one of the most underrated home organization tips.

Pinterest homes look great. Real life looks different.

Choose storage that fits your habits. If you toss shoes, use baskets. If you hang coats, install hooks.

Organization should support how you live now.

This mindset creates sustainable results.

Bathrooms do not need fancy systems. They need consistency.

Use drawer organizers. Limit countertop items. Store backups elsewhere.

Clear bathrooms feel cleaner. They also photograph better.

This matters when preparing homes in Litchfield houses for sale.

Bedrooms are for rest. Clutter disrupts that.

Keep surfaces clear. Limit furniture. Store items out of sight.

Under bed storage works well when labeled clearly.

Calm bedrooms support emotional comfort and better sleep.

The first step inside matters.

Create a drop zone for shoes, bags, and coats. Use mats and hooks.

Garages benefit from zones too. Tools here. Sports gear there.

These home organization tips make daily life smoother and safer.

Organization is not one and done. It is a habit.

Spend ten minutes a day resetting spaces. Put items back where they belong.

Weekly check ins prevent buildup. Monthly reviews keep systems working.

This approach keeps homes buyer ready without stress.

Clutter shrinks space. Organization expands it visually.

Clear floors and surfaces make rooms feel larger. Buyers notice this instantly.

Homes across Southern NH Houses for sale benefit from this effect.

You do not need more square footage. You need clarity.

Well organized homes show care. Care signals pride of ownership.

Buyers trust homes that feel maintained. They feel confident making offers.

These home organization tips protect both comfort and value.

That is a win either way.

I have seen buyers fall in love with organized pantries. Truly.

I have also seen clutter distract from beautiful spaces.

Organization lets your home shine without shouting.

It lets buyers imagine living there.

Perfection is not required. Progress is enough.

Your home should support your life. Not the other way around.

Laugh when mess happens. Reset and move on.

These home organization tips work best with grace.

Organizing your home is about comfort, clarity, and confidence.

Small changes create big results. One space leads to another.

Whether you are enjoying your home now or considering Litchfield houses for sale or Southern NH Houses for sale later, organization always pays off.

A calm home feels good today and sells better tomorrow.

If you need more tips on home organization tips, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Let’s play a quick game. Picture a house with a long sloping roof in the back and a shorter roof in the front. Does that ring a bell? That classic shape is a saltbox, and it is just one of many NH home styles you will see when touring Litchfield houses for sale or browsing Southern NH Houses for sale.

New Hampshire is full of character homes. Some look formal. Some look cozy. Some make you tilt your head and ask what style even is that. Knowing home styles helps you shop smarter and talk real estate with confidence. It also makes open houses more fun. Yes, really.

Put your architectural knowledge to the test as we walk through the most common home styles found in New Hampshire. No quiz at the end. Promise.

Home style is not just about looks. It affects layout, maintenance, resale value, and how a home lives day to day.

Some styles offer open space. Others favor smaller rooms. Rooflines affect snow load. Window placement affects light and heat. In New Hampshire, style and weather go hand in hand.

Understanding NH home styles helps buyers choose homes that fit their lifestyle and long term goals. It also helps sellers highlight the right features when listing.

Plus, it feels good to know what you are looking at.

Let’s start with the star of the show. The saltbox house.

A saltbox has two stories in the front and one story in the back. The roof slopes long and low toward the rear. This design came from early New England settlers who needed simple, strong homes.

Why the shape? Snow slides off easier. Wind resistance improves. Extra space appears without building taller.

You will still see saltboxes today, especially in older neighborhoods and historic areas. Many buyers touring Southern NH Houses for sale fall in love with their charm without knowing the name.

Now you know.

Let’s play a quick game. Picture a house with a long sloping roof in the back and a shorter roof in the front. Does that ring a bell? That classic shape is a saltbox, and it is just one of many NH home styles you will see when touring Litchfield houses for sale or browsing Southern NH Houses for sale.

New Hampshire is full of character homes. Some look formal. Some look cozy. Some make you tilt your head and ask what style even is that. Knowing home styles helps you shop smarter and talk real estate with confidence. It also makes open houses more fun. Yes, really.

Put your architectural knowledge to the test as we walk through the most common home styles found in New Hampshire. No quiz at the end. Promise.

Home style is not just about looks. It affects layout, maintenance, resale value, and how a home lives day to day.

Some styles offer open space. Others favor smaller rooms. Rooflines affect snow load. Window placement affects light and heat. In New Hampshire, style and weather go hand in hand.

Understanding NH home styles helps buyers choose homes that fit their lifestyle and long term goals. It also helps sellers highlight the right features when listing.

Plus, it feels good to know what you are looking at.

Let’s start with the star of the show. The saltbox house.

A saltbox has two stories in the front and one story in the back. The roof slopes long and low toward the rear. This design came from early New England settlers who needed simple, strong homes.

Why the shape? Snow slides off easier. Wind resistance improves. Extra space appears without building taller.

You will still see saltboxes today, especially in older neighborhoods and historic areas. Many buyers touring Southern NH Houses for sale fall in love with their charm without knowing the name.

Now you know.

Victorian homes are hard to miss. They feature steep roofs, decorative trim, and bold personality.

These homes often have many rooms, tall ceilings, and unique layouts. No two feel exactly alike.

Maintenance can be higher, but charm is off the charts.

Victorians are part of the architectural fabric of NH home styles, especially in historic towns.

Farmhouses were built for work and family life. They feel welcoming and practical.

These homes often feature wide porches, large kitchens, and flexible space. Many have been updated over time.

Modern farmhouse style draws inspiration from these roots while adding clean finishes.

Farmhouses remain popular among buyers seeking character and comfort.

Contemporary homes focus on clean lines and open space. They often use large windows and modern materials.

These homes may look different from traditional New England designs. They stand out.

Energy efficiency often plays a big role in contemporary builds.

Buyers seeking something unique often gravitate toward this end of NH home styles.

Townhomes and condos offer lower maintenance living. They are popular with first time buyers and downsizers.

These homes vary widely in style. Some look colonial. Others feel modern.

Location often drives demand. Community features matter too.

When browsing Litchfield houses for sale, buyers sometimes overlook attached options that fit their needs perfectly.

In New Hampshire, winter matters. Roof pitch affects snow load. Window placement affects heat loss.

Saltbox and cape homes handle snow well. Ranch homes may need roof maintenance.

Understanding style helps buyers plan for maintenance and comfort.

This is where NH home styles and local climate intersect in real ways.

Do you love open space? Do you want defined rooms? Do stairs matter?

Home style influences how a home lives. There is no perfect style, only the right fit.

Buyers who take time to learn styles often feel more confident making offers.

Knowledge reduces stress.

Buyers often tell me this is the fun part. Touring homes becomes a learning experience.

They start guessing styles before I say anything. They notice details.

That confidence grows quickly.

This is one reason understanding NH home styles helps buyers feel in control of their search.

Some styles appeal to wider audiences. Others attract niche buyers.

Knowing this helps buyers think long term. It helps sellers market better.

Homes in Southern NH Houses for sale benefit when style features are highlighted clearly.

Older does not always mean outdated. Smaller does not mean cramped.

Modern does not mean cold. Traditional does not mean boring.

Style myths stop buyers from seeing potential.

Seeing past them opens doors.

Next time you tour a home, look up. Look at the roofline. Look at symmetry and layout.

You will start spotting styles everywhere.

Whether you are exploring Litchfield houses for sale or searching through Southern NH Houses for sale, understanding NH home styles helps you buy smarter and enjoy the process more.

And yes, now you know a saltbox when you see one.

If you need more tips on NH Home styles, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Let’s be honest. If you’re buying a home, schools are probably on your mind. Maybe they are at the top of your list. Maybe you do not even have kids but still care about resale value. Either way, this question always comes up early. REALTOR school guidance helps you get real answers without guesswork. If you’re touring Litchfield houses for sale or browsing Southern NH Houses for sale, schools often shape your entire search.

You might be thinking, just tell me if the school is good. I get why you’d ask. Schools feel important and personal. At the same time, there is no single definition of a good school. What works for one family may not work for another. My job is not to judge schools for you. My job is to help you see the full picture so you can decide with confidence.

So let’s talk about how to look beyond test scores and what you can do to really understand schools in the neighborhoods you love.

Test scores are everywhere. They are easy to find and easy to compare. That makes them tempting. Still, they only show a small slice of daily life inside a school.

Test scores do not show class size. They do not show teacher support. They do not show art rooms, music programs, or counseling services. They also do not show how students feel when they walk through the door each morning.

Some schools focus heavily on academics. Others shine in trades, technology, or hands on learning. Some schools support students who need extra help. Others challenge students who want advanced work. REALTOR school guidance helps you understand that one number cannot capture all of that.

You might wonder what I can tell you and what I cannot. That is a fair question.

I can share factual information. I can tell you which school district a home falls into. I can explain which grades are served at each school. I can show you where the schools are located and how far they are from the home.

I can also guide you to official school websites and public resources. These sources share programs, calendars, and policies straight from the school district. That way, you are getting information directly from the source.

This type of REALTOR school guidance keeps everything accurate and helpful while keeping the decision in your hands.

Instead of relying on rankings alone, think about what actually matters to your daily life.

You may want to ask about class size. Smaller classes feel different than larger ones. You may want to ask about student support services. These can include tutoring, counseling, or special education programs.

Ask about extracurricular activities. Sports, clubs, music, and art all shape a child’s experience. Ask about before and after school care if schedules matter for your family.

Communication matters too. How do teachers communicate with families? How involved can parents be? These details often make a big difference.

Whether you are looking at Litchfield houses for sale or exploring nearby towns, these questions help you get clarity.

Reading about a school is helpful. Visiting a school is powerful.

When you visit, you notice things quickly. You notice how staff greet families. You notice how students move through hallways. You notice the overall feel of the building.

Many buyers tell me their visit changed their perspective completely. A school they worried about felt warm and welcoming. Another school that looked great on paper felt less like the right fit.

REALTOR school guidance often includes encouraging you to visit schools when possible. Seeing it yourself builds confidence.

New Hampshire offers more flexibility than many buyers expect. Some towns offer school choice for certain grades. Some have tuition agreements with nearby districts.

Charter schools and private schools may also be options depending on location and availability. Each town handles this differently, so it is important to check official sources.

If you are considering Southern NH Houses for sale, understanding these options early can open up your search.

School boundaries matter. They influence where buyers look and how homes are priced.

Boundaries are set by school districts, not real estate agents. They can also change over time. That is why it is always smart to confirm boundaries directly with the school district.

I can show you where to find this information and help you ask the right questions. That is part of REALTOR school guidance that protects you from surprises later.

This is the moment that feels awkward for buyers sometimes. You ask if the school is good. I pause. Then I explain.

I cannot give personal opinions about schools. Still, I can help you decide what good means to you. Some families want strong academics. Others want strong support. Others want balance.

Think of schools like neighborhoods. Everyone experiences them differently. My role is to help you explore facts and resources so you feel confident in your choice.

Most buyers appreciate this approach once they understand it.

Some buyers bring printed rankings to showings. Others worry because friends shared stories online. Some buyers do not even think about schools until resale value comes up.

Every buyer starts in a different place. That is okay.

The buyers who feel best at the end are the ones who took time to explore, visit, and ask questions. REALTOR school guidance supports that process without pressure.

You might not have children. You might not plan to. Schools still matter.

Strong schools often support stable property values. Buyers often ask about schools when it is time to sell. Understanding the school landscape helps protect your investment.

When shopping for Southern NH Houses for sale, school awareness gives you long term confidence.

School district websites are your best starting point. State education websites also offer public data and reports.

Town websites sometimes share school related updates. Community events hosted by schools can also give you insight.

I can help you find these resources quickly so you are not digging through outdated information.

School decisions feel emotional. That is normal.

Try not to rush this part of the process. Give yourself permission to explore and learn. Ask questions. Visit when you can.

My goal with REALTOR school guidance is to keep this part of your home search calm, clear, and supportive.

When you feel confident about schools, you move forward with more certainty. You worry less. You enjoy the process more.

That confidence matters in competitive markets. It helps you make strong decisions without regret.

Whether you are narrowing down Litchfield houses for sale or considering other Southern NH Houses for sale, school clarity supports smarter choices.

You deserve more than a number on a screen. You deserve real understanding.

Schools are part of the community you are joining. Taking time to explore them helps you choose a home that truly fits your life.

My role is to guide you, not decide for you. With clear facts, helpful resources, and honest direction, REALTOR school guidance helps you see the full picture.

When you are ready to talk homes, neighborhoods, or next steps, I am always here to help.

If you need more info on school guidance, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Winter in New Hampshire is beautiful. It’s also messy, cold, and sometimes expensive. Every year, homeowners learn the hard way why winter snow home safety matters. Ice builds up. Roofs leak. Heating bills soar. Sound familiar? If you own a home or are shopping in Litchfield houses for sale or South Hudson houses for sale, this topic hits close to home.

Snow does not just sit quietly on your property. It melts. It refreezes. It sneaks into small cracks. Then it causes big problems. The good news is that most winter damage can be prevented with smart planning and simple habits. You do not need fancy tools or superhero strength. You just need to know what to watch for and when to act.

As New Hampshire REALTORS, we hear the same winter stories every year. A roof leak that started as an ice dam. A frozen window that would not open in spring. A heating system that worked overtime because heat escaped through unseen gaps. Let’s talk about how to avoid those headaches while keeping your home safe, warm, and market ready.

Snow removal seems simple. Grab a shovel. Clear the driveway. Done. Not quite. Snow clearing plays a major role in winter snow home safety, especially around entryways, foundations, and roofs.

Start with your walkways and steps. Ice loves to hide under fresh snow. One wrong step and winter wins. Use ice melt early and often. Sand also helps when temperatures drop too low for salt to work. Clear snow away from doors so they open easily during emergencies.

Next, think about your foundation. Piled snow melts and seeps into small cracks. That water refreezes and expands. Over time, this causes foundation damage. Try to push snow away from the house instead of stacking it along the walls. Your future self will thank you.

Buyers touring South Nashua houses for sale in winter often notice snow management right away. A well cleared property feels cared for. It signals pride of ownership. That matters more than many sellers realize.

Roofs carry a lot in winter. Snow may look fluffy, but it adds weight fast. Wet snow weighs even more. Too much snow can stress roof structures, especially older homes common in Southern NH Houses for sale.

Watch for sagging gutters or creaking sounds after heavy storms. These are warning signs. Roof rakes are your friend here. Use them safely from the ground to remove excess snow. Never climb onto an icy roof. That story rarely ends well.

Ice dams form when warm air escapes through the attic. Snow melts. Water runs down. Then it refreezes at the edge. That ice traps more water behind it. Eventually, water sneaks under shingles and into your home.

Stopping ice dams is a major part of winter snow home safety. Proper insulation and ventilation matter more than people think. Sealing attic air leaks can make a huge difference.

Icicles are pretty. They also signal heat loss. Big icicles mean warm air is escaping and melting snow unevenly. That usually leads to ice dams.

They can also be dangerous. Falling icicles can damage siding, windows, or worse, someone’s head. Keep gutters clear before winter starts. Clogged gutters hold water and speed up ice buildup.

Londonderry houses for sale often show these winter patterns clearly because many have longer rooflines. If you see heavy icicles, it is time to investigate insulation and attic airflow.

Removing icicles safely helps protect your roof edge, gutters, and anyone walking below. Never knock them down while standing under them. Gravity is not forgiving.

Cold drafts make rooms uncomfortable and heating bills higher. Windows play a big role in winter snow home safety and energy efficiency.

Check for drafts by feeling around window frames on cold days. If you feel air moving, heat is escaping. Simple weather stripping or caulking can fix many issues. Plastic window film kits are affordable and effective. They may not look fancy, but they work.

Condensation on windows also tells a story. A little is normal. Heavy moisture or frost means indoor humidity is too high or insulation is lacking. That moisture can lead to mold or rot over time.

Buyers looking at houses for sale often comment on window comfort during showings. Warm rooms feel welcoming. Cold drafts do not.

Doors get overlooked. They should not. Gaps under doors let cold air rush in and warm air escape. Door sweeps are inexpensive and easy to install.

Check door frames for cracked seals. Replace worn weather stripping. Make sure storm doors close tightly. These small steps improve comfort quickly.

In winter, doors also deal with snow buildup. Clear snow away from door thresholds. Melting snow can refreeze overnight and trap doors shut. That is never fun at six in the morning.

Strong doors and seals matter when showing houses for sale during winter months. First impressions start at the front door.

Your heating system is the hero of winter snow home safety. Treat it well. Schedule annual maintenance before cold weather hits. A tuned system runs more efficiently and breaks down less often.

Change filters regularly. Dirty filters restrict airflow and make systems work harder. That leads to higher bills and shorter equipment life.

Listen for unusual noises. Smells matter too. Burning odors or frequent cycling should be checked by a professional.

Homes across Southern NH Houses for sale vary widely in heating systems. Some use oil. Others use gas, propane, or heat pumps. Each system needs proper care to perform well in winter.

Frozen pipes cause major damage. They often freeze overnight when temperatures drop suddenly. Exterior walls, basements, and crawl spaces are high risk areas.

Insulate exposed pipes. Let faucets drip slightly during extreme cold. Keep cabinet doors open under sinks to allow warm air to circulate.

If you leave town, never turn heat off completely. Set thermostats to at least fifty five degrees, possibly higher if the temps plan to get really cold. It costs less than repairing burst pipes.

Winter snow home safety includes protecting what you cannot see. Pipes fall into that category.

Attics play a huge role in ice dams and heat loss. Poor insulation allows heat to escape upward. That warms the roof surface unevenly.

Proper insulation keeps heat inside the home where it belongs. Ventilation allows cold air to flow and keep roof temperatures stable.

Many homes in South Nashua were built before modern insulation standards. Upgrading attic insulation improves comfort and resale value.

If you notice uneven snow melt on your roof, your attic may be sending signals. It is worth investigating.

Winter pushes animals to seek warmth. Snow piled near foundations gives pests easy access to entry points.

Clear snow away from vents and openings. Check for gaps around utility lines. Seal small holes before winter sets in.

Rodents inside walls create damage and noise. No one wants surprise attic guests in January.

Maintaining winter snow home safety means thinking beyond snow and ice. It includes protecting the entire structure.

Every winter brings new stories. One homeowner ignored ice dams for years. One warm spell later, water poured through a ceiling light. Another skipped window sealing. Heating bills doubled during a cold snap.

Then there are the smart ones. The family who raked their roof after every storm. The seller who sealed drafts before listing. The buyer who spotted good insulation and felt confident making an offer.

These small choices add up. Winter rewards preparation and punishes neglect.

Winter condition tells buyers a lot. A well maintained home in winter signals year round care. It builds trust.

Homes shown during winter often sell faster when they feel warm, dry, and safe. Buyers notice snow management, roof condition, and heating comfort immediately.

That is why winter snow home safety is also a marketing advantage. Especially in competitive areas like Londonderry and South Hudson.

Winter damage often reveals itself in spring. Leaks, stains, warped wood, and mold appear once snow melts.

Preventing problems now saves repair costs later. It also protects property value.

Spring buyers touring Litchfield houses for sale appreciate homes that came through winter strong.

Winter in New Hampshire will always bring snow, ice, and cold. You cannot control the weather. You can control how your home handles it.

By focusing on winter snow home safety, you protect your roof, windows, heating system, and investment. You also reduce stress and surprises.

Whether you live in South Nashua houses for sale, Londonderry houses for sale, South Hudson houses for sale, Litchfield houses for sale, or are exploring Southern NH Houses for sale, smart winter care makes every season easier.

If you ever have questions about winter prep, home value, or buying and selling during snow season, I’m always happy to talk. Winter may be long, but it does not have to be painful.

If you need more information on winter snow home safety, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Learning how to remove wallpaper can feel overwhelming at first. Many homeowners worry about time, mess, and wall damage. Yet this task often brings big rewards in home value and buyer appeal. This topic comes up often when preparing Litchfield houses for sale and Southern NH Houses for sale. Because wallpaper dates a space quickly, removing it helps homes feel fresh and inviting.

Wallpaper removal does not need to cause stress. With the right plan, patience, and tools, it becomes manageable. Homeowners often feel proud once the walls are clean. Buyers then see potential instead of distraction. That shift can change how a home shows and sells.

Wallpaper reflects the style of another time. While some patterns feel charming, many buyers see them as work. This reaction affects emotion during showings. When buyers feel unsure, they hesitate.

Neutral walls help buyers imagine their own style. Clean surfaces also photograph better for listings. Because online views matter so much, walls play a key role.

In competitive New Hampshire markets, small details count. Removing wallpaper helps homes stand out. This effort often leads to faster sales and stronger offers.

Why would you remove wallpaper? Not every wallpaper needs removal. Some newer designs still appeal. However, busy or dark patterns often limit buyer interest.

If wallpaper peels or bubbles, removal feels urgent. Damage sends the wrong message. Buyers may worry about hidden issues.

When preparing Litchfield houses for sale, sellers often remove wallpaper in main rooms. This choice creates a clean slate. It helps buyers focus on layout and light.

Many homeowners feel anxious before starting. Wallpaper removal has a bad reputation. Stories of torn walls and long hours scare people.

However, preparation reduces stress. Knowing what to expect helps calm nerves. Each step forward builds confidence.

Once finished, homeowners often feel relief and pride. That emotional lift matters. It turns a dreaded task into a win.

Good tools make the job easier. A scoring tool helps break the wallpaper surface. This allows moisture to reach the glue.

A spray bottle or pump sprayer works well. Warm water often does the trick. Some people add mild soap or vinegar.

Plastic scrapers protect walls better than metal ones. Drop cloths keep floors safe. Preparation saves time later.

Always test a small area first. Wallpaper types vary widely. Some peel easily, while others fight back.

Testing shows how much moisture helps. It also reveals wall condition underneath. This step prevents surprises.

If the paper comes off clean, the rest will follow. If not, adjust your approach early.

The peel and spray method works for many homes. Start by lifting a corner of the paper. Peel slowly and evenly.

Once the top layer comes off, spray the backing. Let moisture soak in for several minutes. Patience helps here.

Then scrape gently from top to bottom. Avoid rushing. Slow progress protects the wall surface.

Some wallpaper resists water alone. Steam adds heat and moisture together. This softens tough glue.

Steamers work well in older homes. Many New Hampshire houses fall into this category. The heat loosens layers faster.

However, steam requires care. Too much heat can damage drywall. Short passes work best for control.

Wall damage worries many homeowners. Gentle tools and patience reduce risk. Avoid sharp blades when possible.

Work in small sections. Let moisture do the work. Forcing the paper causes tears and gouges.

If damage happens, repairs remain manageable. Minor patches fix easily before painting. Do not panic if walls look rough at first.

After removal, glue residue often remains. This sticky film affects paint adhesion. Cleaning matters.

Warm water and a sponge usually remove residue. Some people use mild cleaners. Rinse walls well afterward.

Let walls dry fully before moving on. Dry surfaces reveal any missed spots. This step prepares walls for the next phase.

Small holes or tears happen sometimes. Joint compound fills these areas easily. Smooth with a putty knife.

Once dry, sand lightly for a flat finish. Wipe dust away before priming. Clean prep leads to smooth paint.

Primer seals repaired areas. It also blocks old patterns from bleeding through. This step ensures a fresh look.

Paint color influences buyer emotion. Neutral tones appeal to more people. Soft whites and light grays work well.

These colors reflect light and make rooms feel larger. Buyers appreciate bright and open spaces.

In Southern NH Houses for sale, neutral paint helps homes compete. It creates a move in ready feel.

Wallpaper removal takes time. A small room may take a day. Larger spaces may need more.

Costs remain low if done yourself. Tools cost little compared to professional services. Sweat equity pays off.

Professional removal helps for tough jobs. Sellers should weigh time versus cost. Both paths add value.

Some wallpaper proves very stubborn. Multiple layers increase difficulty. Plaster walls need special care.

Professionals bring experience and tools. They reduce risk of damage. This option suits tight timelines.

Before listing a home, timing matters. Hiring help may speed preparation. Faster listings often attract more buyers.

When you remove wallpaper you can refresh a space instantly. Buyers see clean walls and imagine furniture placement.

Homes feel more modern and cared for. This impression influences perceived value. Buyers often respond with stronger interest.

In markets with Litchfield houses for sale, updated interiors stand out. Small updates make a big difference.

REALTORS often suggest that you remove wallpaper, especially if it’s dated. They know buyer reactions well. Their advice comes from experience.

During walkthroughs, agents point out areas to update. Wallpaper often tops the list. Simple changes improve marketability.

Working together helps sellers prioritize tasks. Wallpaper removal often delivers strong returns for effort.

Wallpaper in kitchens and baths raises concerns. Moisture causes peeling and stains. Buyers notice these flaws quickly.

Buyers prefer the seller to remove wallpaper from these rooms. It makes them feel more neutral and move-in ready. Clean walls signal care and maintenance.

Paint or tile replacements feel fresh. Buyers feel confident about upkeep. This confidence supports offers.

Wallpaper affects light reflection. Dark patterns absorb light. Rooms feel smaller and dimmer.

After removal and painting, light spreads better. Spaces feel larger and more inviting. This change feels dramatic.

Good lighting supports listing photos. Better photos lead to more showings. This chain reaction starts with clean walls.

Many homeowners feel surprised by relief afterward. The task feels less painful than expected. Accomplishment replaces dread.

This positive energy carries into other projects. Sellers feel motivated to finish preparation. Momentum builds.

Buyers sense this care during showings. Homes feel loved and ready.

Take breaks often. Hydrate and stretch. Small pauses prevent frustration.

Work room by room instead of all at once. Progress feels clearer that way. Celebrate small wins.

Music or podcasts help pass time. Keeping a relaxed mindset matters. Stress shows in rushed work.

Skipping wall testing leads to surprises. Always test first. This saves time later.

Using sharp tools risks damage. Gentle methods work better. Patience protects walls.

Skipping cleaning and priming causes paint issues. Do not rush this step. Preparation ensures lasting results.

Older homes often have multiple wallpaper layers. Each layer tells a story. Removal takes extra care that buyers prefer not to tackle. They prefer a move-in ready home where they don’t have to remove wallpaper themselves.

Plaster walls differ from drywall. Moisture levels must stay controlled. Gentle scraping matters even more.

Many Southern NH Houses for sale fall into this category. Thoughtful removal preserves charm while modernizing style.

When buyers see fresh walls, they relax. They feel less work lies ahead. This comfort matters.

Sellers can share before and after stories. Buyers appreciate the effort invested. Transparency builds trust.

Updated walls signal readiness. Homes feel closer to move in ready status.

Some wallpaper styles remain tasteful. Subtle patterns may work in small spaces. However, broad appeal matters most.

If unsure, neutral paint usually wins. Buyers prefer flexibility. Paint offers a blank canvas.

REALTORS often guide this decision. Their market insight helps sellers choose wisely.

Removing wallpaper feels challenging but rewarding. Clean walls improve emotion, style, and value. In New Hampshire, these updates help homes shine in competitive markets. Sellers preparing Litchfield houses for sale often see strong results from this effort. The same holds true for Southern NH Houses for sale where buyers value move in ready spaces. With patience and the right approach, this project becomes a smart and satisfying step forward.

If you need more tips on how to remove wallpaper, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Choosing a golf course home feels exciting and rewarding for many buyers. It blends lifestyle, beauty, and long term value in one setting. In New Hampshire, buyers often explore this option while touring South Nashua houses for sale and Southern NH Houses for sale. A golf course home offers more than a view, since it creates a daily experience many people love. Because of this, these properties continue to attract strong interest across the market.

Living near a course brings calm and open space. Buyers enjoy scenic views and quiet mornings. They also enjoy the sense of community that often comes with golf neighborhoods. For many, this choice feels like a personal win and a smart real estate move.

Golf course homes offer a unique lifestyle. Open greens create a peaceful setting. Wide views add natural beauty and light.

Buyers often feel relaxed the moment they arrive. This emotional response matters in real estate. When people feel good, they connect faster with a home.

These properties also feel special. Limited supply adds appeal. Therefore, demand often stays steady even during slower markets.

Life near a golf course feels calm and active at the same time. Residents enjoy walking paths and fresh air. Many courses maintain beautiful landscapes year round.

Neighbors often share similar interests. This builds a friendly and social environment. Community events and gatherings feel common.

Even non golfers enjoy the setting. The space and quiet create a retreat feel. This lifestyle draws buyers of all ages.

Views matter more than many realize. Looking out over green space feels soothing. It also brings changing scenery through the seasons.

Homes with course views often feel brighter. Natural light fills rooms. This improves mood and comfort.

Buyers touring South Nashua houses for sale often pause longer at homes with views. That extra moment builds connection and interest.

Golf course homes often hold value well. Location and setting support pricing. Buyers view these homes as premium options.

Because supply stays limited, demand remains strong. This helps protect value over time. Owners often see steady appreciation.

In Southern NH Houses for sale, golf communities stand out. Buyers recognize the added benefit and plan accordingly.

Many golf course homes offer more privacy. Fairways create distance between homes. This spacing feels rare and valuable.

Backyards often feel larger without fences. Open views replace close neighbors. This adds to the sense of peace.

Privacy remains a top buyer request. Golf course settings answer that need naturally.

While benefits feel clear, buyers should consider details. Course location matters within the community. Homes near tees differ from homes near greens.

Noise and activity vary by spot. Some buyers enjoy watching play. Others prefer quieter sections.

A REALTOR can guide buyers through these choices. Local knowledge makes a big difference.

Many golf communities include homeowner associations. These groups manage shared spaces. Fees support course upkeep and amenities.

Buyers should review rules and costs. Understanding expectations avoids surprises later.

Well managed associations add value. They protect appearance and community standards.

New Hampshire seasons shape the experience. Spring and summer bring lush greens. Fall adds color and beauty.

Winter changes views yet keeps open space. Snow covered fairways still feel peaceful.

Buyers appreciate year round scenery. Golf course homes offer beauty in every season.

Golfers enjoy easy access to the course. Morning rounds feel simple and fun. Practice becomes part of daily life.

This convenience adds lifestyle value. Time saved feels meaningful.

Homes near courses attract active buyers. These buyers often commit quickly.

Many buyers do not play golf. Still, they love the setting. Open land and quiet streets appeal widely.

Walking paths and views support wellness. Nature feels close without extra travel.

This broad appeal supports resale value. Golf course homes attract many buyer types.

Some courses sit near town centers. Others feel more private. Buyers should consider daily needs.

Access to shops and schools matters. Commute times also play a role.

In areas with Southern NH Houses for sale, golf communities often balance access and retreat. This mix feels ideal for many buyers.

Resale potential stays strong for these homes. Many buyers search specifically for course settings.

Marketing these homes highlights lifestyle and views. Photos and descriptions matter greatly.

Because demand stays steady, sellers often feel confident. This confidence supports pricing strength.

From an investment view, these homes perform well. Stable demand reduces risk.

They also attract quality buyers. Pride of ownership feels common in these communities.

Long term planning often includes resale appeal. Golf course homes fit that plan well.

Local expertise matters greatly here. Each course and community differs.

A knowledgeable REALTOR explains pros and cons clearly. This guidance builds trust.

Buyers feel confident when questions get answered early. This leads to smoother transactions.

Buyers ask about course access and fees. They also ask about rules and privacy.

Clear answers help buyers decide faster. Transparency builds comfort.

REALTORS who prepare these answers add strong value.

Lenders often view golf course homes favorably. Appraisals reflect setting and demand.

Comparable sales matter. Strong past sales support value.

Buyers should work with experienced lenders. This ensures smooth financing.

Many buyers describe a feeling when touring these homes. Calm and joy stand out.

This emotional pull influences decisions. Homes that feel special stand apart.

Golf course settings create that feeling often. This supports quicker offers.

Families enjoy safe streets and open space. Kids play and explore with ease.

Community events often include families. This builds connection and comfort.

Buyers seeking balance find it here. Lifestyle and safety align well.

Retirees value quiet and beauty. Golf course homes meet these needs.

Second home buyers also enjoy ease and upkeep. Many communities offer maintenance support.

These buyer groups add to demand. This keeps markets active.

Compared to busy streets, these homes feel calm. Compared to wooded lots, they feel open.

Each option has value. However, golf course homes combine many benefits.

Buyers often return to this choice after exploring others.

Choosing a golf course home blends lifestyle, comfort, and long term value. Buyers enjoy beauty, privacy, and strong community feel. In New Hampshire, this choice continues to attract attention and respect. Buyers exploring South Nashua houses for sale often see golf communities as premium options. The same holds true for Southern NH Houses for sale where demand remains steady and strong. With thoughtful planning and local guidance, this choice truly feels like scoring a hole in one.

If you need more tips on (idea here), or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Redecorate home apps are changing how people plan home updates. Homeowners now use phones to picture new spaces with ease. This matters in real estate because design affects value and emotion. Buyers touring South Nashua houses for sale and Southern NH Houses for sale often picture changes before making offers. Therefore, these apps help buyers and sellers feel confident and excited.

Phone based design tools feel friendly and simple. They help people test ideas without stress. Many homeowners enjoy seeing instant results. For REALTORS, these apps support better conversations and smarter choices.

Design impacts how buyers feel in a home. When spaces feel fresh, buyers feel welcome. Redecorating apps help people see potential instead of flaws. Because of this, they support stronger first impressions.

In real estate, vision sells homes. Buyers often struggle to imagine changes. Apps solve this problem with clear visuals. This helps homes sell faster and feel more valuable.

In New Hampshire, many homes have strong bones. Simple updates make a big difference. These apps guide smart updates without major costs.

Buyers use apps to test furniture and colors. This helps them connect emotionally. Sellers use apps to plan staging and updates. Both sides gain clarity.

Apps reduce fear of making mistakes. People feel free to explore ideas. Because of this, confidence grows.

REALTORS can suggest apps as helpful tools. This builds trust and value. It also keeps conversations relaxed and productive.

The first app focuses on room planning. Users take a photo and add furniture. The app adjusts scale and lighting. This feels realistic and helpful.

Homeowners enjoy moving items with a finger. They see what fits and what does not. This saves time and money.

For buyers, this app helps picture life in the home. It supports decisions during tours and showings.

Sellers often wonder what to change. This app answers that question. It shows which layouts feel open and inviting.

Small changes often bring big impact. Moving furniture can improve flow. Buyers notice this right away.

In markets like South Nashua houses for sale, presentation matters. Clean layouts help homes stand out online and in person.

Color choices affect mood and value. This app lets users test paint colors instantly. Walls change with a tap.

Users see how light affects color. This helps avoid poor choices. Soft tones often feel best for resale.

Buyers touring Southern NH Houses for sale for sale respond well to calm colors. This app helps sellers choose wisely.

Color sets emotion. Neutral tones feel safe and inviting. Bold colors can limit appeal.

This app removes guesswork. Sellers gain confidence before painting. Buyers feel relaxed during tours.

Because paint costs less, it offers strong return. Apps guide these smart updates with ease.

This app focuses on décor and style. Users place sofas, tables, and art in rooms. The results feel real and fun.

People enjoy seeing style options. Modern, classic, and cozy looks appear easily. This inspires creativity.

For buyers, this app helps imagine personal touches. It turns houses into future homes.

Many buyers struggle with empty rooms. Décor apps fill that gap. They show scale and purpose.

REALTORS can suggest this app during showings. It helps buyers connect emotionally. Emotional connection often leads to offers.

This tool works well for condos and homes alike. It supports confidence across price ranges.

This app uses smart technology. Users answer questions about style and budget. The app suggests full room designs.

It feels like working with a designer. Yet it costs much less. This appeals to many homeowners.

In real estate, this app helps plan updates before listing. It also helps buyers plan after purchase.

AI tools feel simple and helpful. They reduce stress and doubt. Users follow guided steps.

Because choices feel guided, people act faster. This supports timely updates and decisions.

Homes prepared with care attract stronger interest. This app supports that process.

This app focuses on structure and flow. Users scan rooms to create floor plans. They then test layout changes.

This helps with open concepts and room changes. People see walls and space clearly. This supports renovation planning.

Buyers appreciate knowing what is possible. This app answers those questions early.

Understanding layout reduces fear. Buyers want to know space works for them. Floor plans provide clarity.

This app helps buyers feel prepared. It also helps sellers explain possibilities.

In competitive markets, clarity matters. Tools like this support confident offers.

Design choices affect value perception. Clean, modern spaces feel worth more. Apps guide these choices.

Small updates often improve appeal. Paint, layout, and décor matter. Apps help prioritize changes.

In New Hampshire, thoughtful updates stand out. These apps support smart investments.

Before listing, sellers often ask what to update. Apps provide visual answers. This saves time and cost.

REALTORS can review app results with sellers. Together they plan updates. This teamwork builds trust.

Listings prepared with care attract more views. Apps support this preparation step.

This app focuses on structure and flow. Users scan rooms to create floor plans. They then test layout changes.

This helps with open concepts and room changes. People see walls and space clearly. This supports renovation planning.

Buyers appreciate knowing what is possible. This app answers those questions early.

Understanding layout reduces fear. Buyers want to know space works for them. Floor plans provide clarity.

This app helps buyers feel prepared. It also helps sellers explain possibilities.

In competitive markets, clarity matters. Tools like this support confident offers.

Design choices affect value perception. Clean, modern spaces feel worth more. Apps guide these choices.

Small updates often improve appeal. Paint, layout, and décor matter. Apps help prioritize changes.

In New Hampshire, thoughtful updates stand out. These apps support smart investments.

Before listing, sellers often ask what to update. Apps provide visual answers. This saves time and cost.

REALTORS can review app results with sellers. Together they plan updates. This teamwork builds trust.