Category Archives for "Boston MA"

Looking for the perfect place to settle down in New Hampshire? You are in luck. Southern NH neighborhoods offer a mix of charm, convenience, and lifestyle that keeps buyers coming back. From vibrant Nashua to cozy Londonderry, these areas have something for everyone. Whether you are searching for Southern NH houses for sale or just exploring your options, understanding which neighborhoods stand out can make your home search easier and even a bit more fun.

Buying a home is more than just walls and a roof. It is about community, schools, and access to daily conveniences. That is why Southern NH neighborhoods are so desirable. They strike a perfect balance between suburban peace and city accessibility. Want to live somewhere that is close to shopping, restaurants, and good schools but still feels like a retreat after a long day? Then these neighborhoods should be on your radar.

Nashua often takes the top spot when people think of Southern NH neighborhoods. It is the second largest city in the state but still feels welcoming and approachable. People love Nashua for its vibrant downtown, excellent schools, and family-friendly parks. If you are looking for Southern NH houses for sale, Nashua offers a wide variety. From charming older homes to modern new constructions, there is something for every taste and budget.

Downtown Nashua has a surprising mix of restaurants, coffee shops, and local boutiques. You can enjoy a quick walk along the Nashua River and still be minutes from highways for commuting. Families especially like the school options here. The public schools consistently score above average, and there are several private schools that offer unique programs for students.

Neighborhoods have a mix of historic charm and modern convenience. You might even find yourself chatting with neighbors at local farmers markets or community events. That sense of connection is part of what makes Nashua one of the most desirable Southern NH neighborhoods.

Hudson is another top choice for buyers searching Southern NH houses for sale. Why? It offers suburban tranquility with easy access to Massachusetts. Many residents commute to Boston for work but come home to spacious yards, quiet streets, and a strong sense of community.

Schools in Hudson are consistently well rated, which makes this area popular with families. The town also has a number of parks, recreational areas, and local shops that make life enjoyable. Plus, Hudson’s neighborhood streets have that “friendly neighbor” vibe that you can feel as soon as you take a walk in the morning.

Neighborhoods stand out for their family-friendly layouts. Streets lined with trees, sidewalks for walking, and homes with spacious backyards make it a place where kids can run around safely. It’s also great for buyers who want a mix of older charm and modern homes. Hudson remains a favorite among those looking to combine lifestyle, comfort, and Southern NH real estate value.

Merrimack is often overlooked, but it deserves a spot on the list of most desirable Southern NH neighborhoods. It is quietly nestled between Nashua and Manchester, giving residents easy access to both cities while maintaining a suburban feel. Many people choose Merrimack because it offers affordable Southern NH houses for sale without compromising on quality of life.

The town is filled with parks, walking trails, and family-friendly activities. Schools are excellent, making it perfect for growing families. Merrimack also boasts a strong sense of community. Neighbors know each other, and local events bring everyone together. If you want a peaceful place to raise a family while still being close to city amenities, Merrimack should be on your list.

If you like more space, Londonderry is worth a serious look. This town is known for its larger lots, newer developments, and quiet streets. It is ideal for buyers who want Southern NH houses for sale with room to grow, maybe even a backyard big enough for a pool or garden.

Londonderry schools are excellent and highly regarded throughout the state. Families are drawn to this area because it feels like a safe haven while still being within reach of Manchester and Boston. Neighborhoods offer modern homes, well-kept streets, and a sense of exclusivity. It is one of those areas where you immediately feel like you have found home.

Looking for Southern NH neighborhoods with character? Amherst and Hollis are perfect examples. These towns are smaller but packed with appeal. Amherst offers historic homes, quiet streets, and top-rated schools. Hollis feels like stepping back in time with its scenic landscapes, farmland, and community events.

These areas are not just pretty. They also provide strong investment potential. Homes here tend to hold value because the demand for Southern NH neighborhoods with charm, good schools, and convenient commuting options stays high. If you love that classic New England feel with modern conveniences, you will want to explore Amherst and Hollis when looking at Southern NH houses for sale.

So why are these neighborhoods so popular? First, they offer a perfect mix of lifestyle benefits. Families get safety, excellent schools, and recreational opportunities. Professionals enjoy commuting options and access to dining and shopping. Retirees appreciate the quiet streets, community feel, and quality healthcare nearby.

Second, Southern NH neighborhoods are diverse. There are older, character-filled homes, newer constructions, and everything in between. That variety makes it easier for buyers to find a home that fits their style and budget.

Typical peaceful town with friendly neighbors will help you decide to own a property for sale in South NH

Finally, these neighborhoods are growing. Local economies are strong, property values are solid, and the communities continue to improve. That means when you invest in Southern NH houses for sale, you are buying more than just a home—you are buying a lifestyle that pays off in happiness, convenience, and long-term value.

If you are considering moving to Southern NH, spend time exploring each neighborhood. Visit local parks, walk the streets, and talk to residents. See how traffic feels during rush hour and check out local businesses. Southern NH neighborhoods offer a lot of options, but the right one depends on your lifestyle, family needs, and budget.

Remember, the most desirable neighborhoods are often the ones that combine strong schools, convenient location, and a sense of community. That is why Nashua, Hudson, Merrimack, Londonderry, Amherst, and Hollis remain at the top of buyers’ lists.

Whether you are a first-time buyer or looking to upgrade, Southern NH houses for sale provide opportunities to find a home that fits your vision. From bustling downtowns to quiet streets, there is a neighborhood waiting to welcome you.

Southern NH neighborhoods continue to be some of the most sought-after areas in the state. From the vibrant city life of Nashua to the peaceful streets of Londonderry, there is something for every buyer. Families, professionals, and retirees all find their perfect fit here. Exploring Southern NH houses for sale will show you why these communities are more than just places to live. They are places to thrive.

If you need more tips on Southern NH Neighborhoods, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Choosing the right home often goes beyond price or style. Families prioritizing education understand that schools shape daily life and long-term value. Parents want safe neighborhoods, strong academic programs, and a sense of community.

Southern New Hampshire offers many options for families seeking the best combination of education and lifestyle. When exploring Southern NH Houses for sale, it is essential to consider the schools in addition to home features. Homes located in strong districts often maintain value and appeal over time.

Understanding local schools gives families confidence. Knowledge ensures children thrive both academically and socially.

School quality drives decisions for families prioritizing education. Strong districts often feature low student-to-teacher ratios and highly trained staff. Extracurricular programs and advanced courses also matter.

Researching performance metrics, standardized test scores, and graduation rates can help families compare districts. Towns like Bedford, Amherst, and Hollis consistently earn high marks for academic achievement.

Families should also visit schools in person. Seeing classrooms, facilities, and community programs provides a real sense of each district's quality.

Education needs vary by age. Families prioritizing education must consider every stage. Elementary schools focus on foundational skills and social development. Middle schools introduce specialized learning. High schools prepare students for college and career paths.

In addition to academics, families should consider extracurricular activities. Sports, music, arts, and clubs enhance growth. These opportunities often define the overall experience for children.

Towns that support all levels of education attract long-term residents. Homes near these schools often hold strong value for years.

Smaller class sizes allow for individual attention. Families prioritizing education often prioritize districts that maintain these ratios. Teachers with advanced degrees and certifications further support learning outcomes.

Many New Hampshire towns offer detailed staff profiles online. Families can learn about experience levels, certifications, and teaching styles. This information helps families gauge the quality of education available.

Smaller classes and dedicated teachers create a nurturing environment that encourages children to thrive.

Specialized programs often differentiate districts. Advanced placement courses, STEM initiatives, and language immersion programs provide extra opportunities.

Families prioritizing education should also consider gifted programs or special education services. Access to these resources ensures children with varying needs succeed.

Schools with strong enrichment programs often reflect overall community investment in learning.

Education goes beyond textbooks. Families prioritizing education recognize the value of sports, arts, and clubs. These programs build confidence, teamwork, and leadership skills.

When visiting schools, families should explore gyms, performance spaces, and club offerings. A well-rounded program often complements strong academics.

Towns with active school programs attract families seeking both education and community engagement.

School ratings influence property values. Homes in highly rated districts often command higher prices but maintain long-term value.

Families prioritizing education must balance budget with desired school quality. Comparing Southern NH Houses for sale across different districts helps families make informed decisions.

Understanding school impact helps buyers avoid surprises and make confident offers.

Proximity to schools affects daily routines. Shorter commutes provide convenience and safety for children.

Families prioritizing education often look for homes within walking distance or a short drive to schools. This factor influences lifestyle and stress levels.

Towns that prioritize walkable neighborhoods and safe routes to schools remain popular among buyers.

Education is intertwined with neighborhood safety. Families prioritizing education value low crime rates, safe streets, and active community involvement.

Local events, parent organizations, and volunteer programs strengthen the connection between schools and neighborhoods. These ties enhance overall quality of life.

Communities that support both education and safety often attract long-term residents.

Growth impacts schools and neighborhoods. Families prioritizing education consider future development plans.

New housing projects can affect class sizes, school funding, and resources. Town planning boards often share upcoming developments.

Researching these plans ensures families choose areas that will continue to support quality education over time.

High-quality schools often come with higher property prices. Families prioritizing education must balance budgets with educational priorities.

Some towns may offer strong academics at a more reasonable price. Exploring Southern NH Houses for sale in multiple communities helps families find ideal combinations.

Financial planning and understanding property tax implications help families make smart, long-term choices.

On-site visits reveal more than statistics. Families prioritizing education benefit from touring schools, meeting teachers, and speaking with local parents.

Parent insights often reveal school culture, teacher engagement, and community involvement.

This information complements research data and helps families feel confident in their choices.

Local agents provide valuable insight for families prioritizing education. They know neighborhoods, school reputations, and property trends.

Realtors can guide families to homes that align with academic priorities while staying within budget.

Working with a knowledgeable agent reduces stress and ensures families do not miss valuable opportunities.

Many communities offer supplemental learning. Libraries, tutoring centers, and enrichment programs enhance education.

Families prioritizing education should explore these resources when evaluating towns.

Access to additional learning options supports children’s growth and provides flexibility for different learning styles.

Education needs change over time. Families prioritizing education think ahead to middle and high school transitions.

Considering future school performance, extracurricular opportunities, and community programs ensures children continue to thrive.

Homes in strong districts often attract families for decades, creating stable communities.

When searching Southern NH Houses for sale, families prioritizing education must consider proximity to top schools.

Homes near highly rated districts often sell faster but provide long-term value.

Balancing location, size, and budget ensures families find homes that support both lifestyle and learning.

Education and Community Values Align

Towns with strong schools often foster family-friendly communities. Families prioritizing education value supportive neighbors and local involvement.

Town activities, sports leagues, and school events enhance social engagement.

Communities that value learning often attract like-minded families, creating lasting bonds.

Education-focused home searches require careful planning. Families prioritizing education gather data, visit schools, and weigh options.

Balancing school quality with affordability and community fit ensures smart decisions.

Patience and research lead to homes where children can grow and families can thrive.

Families prioritizing education face many choices, but knowledge builds confidence. Schools, neighborhoods, and amenities all influence long-term satisfaction.

Southern NH Houses for sale near strong districts provide both lifestyle and educational value. Families can find homes that support growth, comfort, and opportunity.

By understanding school ratings, programs, and community resources, families prioritize education effectively and make informed decisions for the future.

If you need more info on families prioritizing education, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

The housing market keeps changing. Buyers and sellers want to know what comes next. The Southern NH future of real estate already shows clear signs of growth and adjustment. These changes matter for anyone watching Southern NH Houses for sale today.

Southern New Hampshire continues to attract buyers from nearby states. Lifestyle, space, and value drive demand. This article explains the trends shaping the market through 2026 in a clear and friendly way.

Southern New Hampshire offers location and balance. It sits close to Boston while feeling calm and open. Many buyers want that mix.

Low crime rates, strong schools, and outdoor access help fuel interest. Buyers also like the lack of broad income tax. These factors keep demand steady.

As a result, the Southern NH future of real estate looks active rather than slow.

Population trends influence housing demand. Many buyers move north for space and value. Others stay local but move within the region.

Young families seek good schools and yards. Retirees look for manageable homes near services. These shifts create varied demand.

Builders and sellers will respond with more diverse housing options.

Remote and hybrid work changed how people live. That shift will not fade soon. Buyers now prioritize home offices and flexible spaces.

Southern New Hampshire fits this lifestyle well. Commutes matter less for many workers. Space and comfort matter more.

This trend strongly supports the Southern NH real estate future.

Rapid price growth cannot last forever. Many experts expect slower appreciation in 2026. That shift may help buyers.

Prices may level out rather than drop. Inventory still remains limited. Demand continues to support values.

This balance creates a healthier market for long term planning.

Housing supply remains tight today. New construction takes time. Zoning and land limits also slow growth.

However, inventory should rise gradually. More homeowners may list as rates stabilize. Builders will also add homes.

Buyers watching Southern NH Houses for sale may see more options ahead.

Buyers now explore beyond major towns. Lesser known communities offer value and space. This trend will continue through 2026.

Towns like Candia, Raymond, and Chester see growing interest. Buyers appreciate quieter settings and larger lots.

As demand spreads, these towns may see steady price growth.

Lifestyle now drives many decisions. Buyers want comfort and flexibility. Homes that support daily life will stand out.

Features like outdoor space, energy efficiency, and updated layouts matter more. Buyers value function over flash.

Sellers who adapt to this trend will attract stronger offers.

Energy costs influence budgets. Buyers pay closer attention to efficiency. Insulation, windows, and heating systems matter.

Homes with upgrades often sell faster. Buyers see savings and comfort. This trend will continue to grow stronger.

Energy smart homes support long term value.

Builders are adjusting plans. New homes feature open layouts and flexible rooms. Storage and light matter more.

Smaller footprints with smart design will grow popular. Buyers want ease without wasted space.

This approach fits both families and downsizers.

Rates affect affordability. Even small changes impact monthly payments. Buyers will continue to watch rates closely.

However, many buyers now accept higher rates as normal. They focus more on lifestyle and timing.

This shift supports steady activity in the Southern NH real estate future.

First time buyers still face hurdles. Prices and rates create pressure. Creative solutions will help.

Programs, grants, and flexible loan options matter. Education also plays a role.

Agents who guide buyers carefully will stand out.

Many homeowners plan to downsize. They want less upkeep and more freedom. Southern New Hampshire offers many options.

Single level homes and condos will see strong demand. Walkable locations also matter more.

This trend adds variety to the housing market.

Families often combine households. Cost savings and support drive this choice.

Homes with in law layouts attract attention. Buyers plan for long term needs.

Builders and sellers who offer flexibility will benefit.

Technology continues to improve the process. Virtual tours and digital paperwork save time. Buyers expect convenience.

Agents who embrace tech gain trust. Clear communication still matters most.

The blend of tech and service defines modern real estate.

Investors watch stable markets. Southern New Hampshire offers consistent demand. Rental needs remain strong.

Multi family and single family rentals attract interest. Location and condition matter most.

This activity supports pricing and inventory movement.

Not all residents buy. Many rent by choice or need. Job growth supports rental demand.

Towns near highways and employers see steady interest. This trend supports investors and builders.

Rental stability adds strength to the overall market.

Employment drives housing demand. Southern New Hampshire benefits from diverse industries. Health care, tech, and trades all play roles.

Economic balance supports steady growth. It reduces sharp swings.

This stability boosts confidence among buyers and sellers.

School quality remains a top factor. Families plan carefully. Towns with strong schools stay popular.

Buyers often accept higher prices for education. That pattern will continue in 2026.

Schools remain tied closely to home values.

Roads, utilities, and broadband matter. Towns investing in infrastructure attract buyers.

Remote work increases the need for fast internet. Towns that improve access gain advantage.

Infrastructure supports the Southern NH real estate future.

Sellers should prepare for informed buyers. Pricing must reflect condition and market reality.

Homes that show well will still sell. Overpriced homes may sit longer.

Professional guidance helps sellers succeed.

Buyers should watch trends early. Preparation builds confidence.

Working with a local agent helps spot opportunity. Timing and knowledge matter.

Patience and planning lead to better outcomes.

Listings will reflect buyer needs. Homes with updates and flexibility will stand out.

Southern NH Houses for sale will show more variety over time. Buyers gain choice and clarity.

This evolution supports a healthier market.

Southern New Hampshire remains resilient. Demand stays steady. Growth feels balanced rather than rushed.

The Southern NH future of real estate looks positive and stable. Lifestyle, value, and location continue to attract buyers.

Those exploring Southern NH Houses for sale in 2026 can move forward with confidence and optimism.

If you need more tips on Southern NH future of real estate in 2026, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Investing in your home is exciting and rewarding. Many homeowners ask, “Which renovations are truly worth it?” This guide explores home remodeling projects that pay off and help increase your property value.

Whether you own a home in Londonderry or are exploring other Southern NH houses for sale, these upgrades can make your home more attractive to buyers while improving your daily comfort. From kitchen updates to outdoor spaces, the right projects combine style, function, and return on investment.

The kitchen is often the heart of the home. Among home remodeling projects that pay off, updating your kitchen can have a significant impact.

Modern cabinets and hardware make the space look fresh and organized.

Updated appliances improve energy efficiency and appeal to buyers.

New countertops and backsplashes create a visually striking environment.

For Southern NH houses for sale, a well designed kitchen attracts families and professional buyers alike. Even small improvements like changing faucets or lighting fixtures can pay dividends.

Bathrooms are essential to comfort and resale value. When considering home remodeling projects that pay off:

Replacing old fixtures with modern options enhances style and functionality.

Adding new flooring or fresh paint creates a clean, inviting space.

Improving lighting and ventilation boosts both practicality and comfort.

Buyers in Londonderry and surrounding towns often prioritize updated bathrooms when touring homes. Simple updates can significantly enhance your home’s market appeal.

First impressions matter. Among home remodeling projects that pay off, exterior improvements can dramatically influence buyer perception.

Landscaping adds color, texture, and a welcoming feel to your home.

Fresh exterior paint or siding upgrades create a polished, well maintained appearance.

New doors and windows improve both aesthetics and energy efficiency.

For Southern NH homeowners, these improvements attract more interest from potential buyers browsing listings. Enhanced curb appeal often results in faster offers and higher sale prices.

Energy efficiency is increasingly important. Among home remodeling projects that pay off, upgrades that reduce utility costs appeal to environmentally conscious buyers.

Installing smart thermostats allows precise control over heating and cooling.

Energy-efficient windows and insulation reduce energy bills and improve comfort.

LED lighting and energy efficient appliances lower monthly costs and environmental impact.

For Londonderry houses for sale, energy-efficient upgrades differentiate your property in the competitive Southern NH market. Buyers value homes that save money and offer modern convenience.

Additional living space increases usability and value. When thinking about home remodeling projects that pay off:

Finish basements or attics to create extra bedrooms, offices, or playrooms.

Build sunrooms or enclosed patios for indoor/outdoor living.

Expand kitchens or living rooms for open concept designs that appeal to families.

Homes with extra usable space attract buyers seeking flexibility and comfort. This is especially beneficial in Southern NH where families often prioritize space for work, school, and entertainment.

Outdoor living spaces are highly desirable. Among home remodeling projects that pay off, patios, decks, and gardens increase both enjoyment and market value.

Decks and patios provide entertaining areas that buyers love.

Fire pits, outdoor kitchens, and seating areas create a luxurious feel.

Landscaping, walkways, and lighting enhance both functionality and appeal.

For Londonderry homes and other Southern NH properties, well designed outdoor spaces can create emotional connections with buyers, encouraging quicker offers.

Focusing on these six key areas provides multiple advantages:

Increased property value: Smart investments translate directly into higher resale prices.

Enhanced comfort: Everyday living becomes more enjoyable with functional upgrades.

Faster sales: Updated homes attract more buyers and generate stronger offers.

Modern appeal: Contemporary designs and energy-efficient features resonate with today’s buyers.

These advantages are particularly important for homeowners in competitive Southern NH markets. Strategic remodeling ensures your home stands out among Londonderry houses for sale.

Budgeting effectively ensures the best return on investment. When tackling home remodeling projects that pay off:

Identify priority areas that offer the highest ROI.

Get multiple quotes from contractors for comparison.

Set aside a contingency for unexpected costs.

Planning carefully ensures your investment enhances both your lifestyle and your home’s marketability.

Deciding between DIY and professional help depends on the project. For home remodeling projects that pay off:

Simple tasks like painting or landscaping may be done safely by homeowners.

Complex tasks like kitchen remodels, electrical work, or bathroom renovations often require professionals.

Licensed contractors ensure quality workmanship and compliance with local building codes.

For Londonderry houses for sale, professional finishes increase buyer confidence and overall home value.

Timing can impact the return on investment. To maximize results from home remodeling projects that pay off:

Plan renovations during off-season months to save on contractor costs.

Complete projects before listing your home for sale.

Prioritize updates that have high visual impact and immediate value.

Strategic timing ensures your home is ready to impress buyers the moment it hits the market.

A REALTOR can provide guidance on which home remodeling projects that pay off most in your area.

Market knowledge identifies improvements that appeal to local buyers.

Agents advise on trends in Southern NH and Londonderry housing markets.

REALTORS can suggest upgrades that enhance your listing photos and marketing materials.

Local expertise helps ensure your investment delivers the highest possible return.

Once renovations are complete, effective marketing is essential. To showcase home remodeling projects that pay off:

Use high-quality photos highlighting updated kitchens, bathrooms, and outdoor spaces.

Include virtual tours to showcase living areas and outdoor features.

Highlight energy-efficient and smart home upgrades in listing descriptions.

Effective marketing ensures buyers recognize the value of your improvements, driving interest and offers.

It is possible to over-invest in upgrades. When planning home remodeling projects that pay off:

Research comparable properties to understand local market expectations.

Focus on improvements that align with neighborhood standards.

Avoid extravagant upgrades that may not recoup costs in your area.

Balancing value and style ensures your renovations make financial sense for Southern NH homes.

The key to successful remodeling is choosing projects that combine functionality, style, and value. Key strategies include:

Prioritize projects that appeal to most buyers, such as kitchens and bathrooms.

Select neutral designs that attract a wide range of tastes.

Invest in energy efficiency and smart home technology that reduces utility costs.

These strategies help Southern NH homeowners enhance property value and sell faster among Londonderry houses for sale.

Avoiding pitfalls ensures your renovations pay off. When considering home remodeling projects that pay off:

Do not neglect planning and budgeting.

Avoid cutting corners on quality materials or workmanship.

Ensure upgrades complement the home rather than overwhelm it.

Careful planning prevents wasted money and ensures maximum appeal for buyers.

Beyond resale value, renovations improve your living experience. Among home remodeling projects that pay off:

Modern kitchens make cooking and entertaining easier.

Updated bathrooms increase daily comfort.

Outdoor living areas provide spaces for relaxation and socializing.

These benefits create immediate enjoyment and long-term satisfaction for homeowners.

Renovations play a key role in preparing your home for the market. To maximize results from home remodeling projects that pay off:

Stage rooms to showcase new features and functionality.

Maintain updated spaces to make your home move-in ready.

Highlight improvements in listing descriptions and marketing materials.

Prepared homes attract buyers faster and often receive higher offers.

Investing in the right projects makes a real difference. Focusing on home remodeling projects that pay off ensures your Southern NH home appeals to buyers, sells faster, and increases in value.

Key takeaways include:

Kitchen and bathroom updates deliver strong visual and financial returns.

Curb appeal and outdoor spaces attract immediate attention.

Energy efficiency and added living space boost marketability and comfort.

Proper planning, budgeting, and marketing maximize your investment.

Whether you own Londonderry houses for sale or other Southern NH properties, these remodeling strategies help your home stand out in a competitive market.

If you need more tips on home remodeling projects that pay off, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

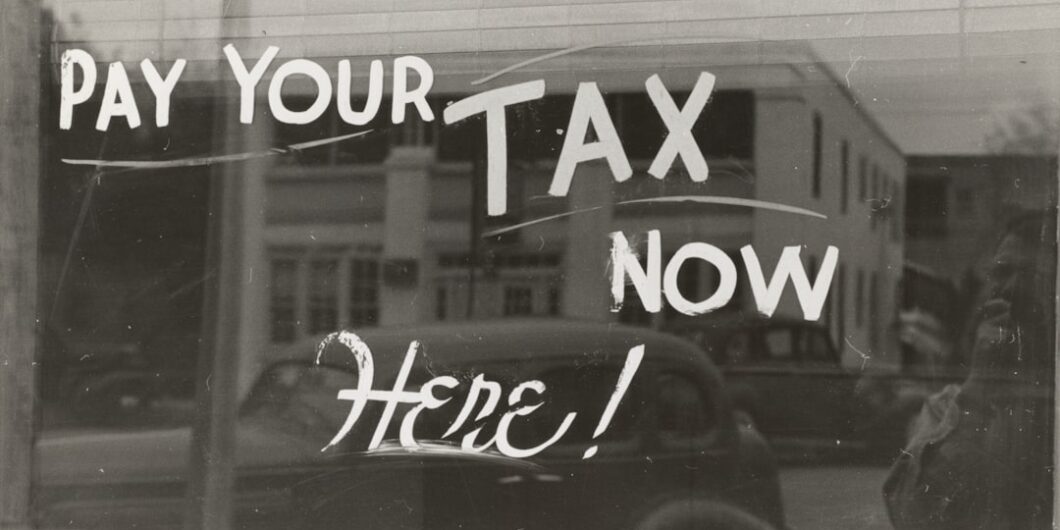

When it comes to buying a home, there’s one thing many people forget to factor into their plans, property taxes. Understanding how taxes vary by town can help you make smarter decisions and avoid surprises down the road.

Property taxes can have a big impact on your monthly payments, your long-term costs, and even your home search strategy. In Southern New Hampshire, every town sets its own tax rate, and those differences can really add up.

Whether you’re exploring Southern NH houses for sale or comparing communities for your next move, knowing how each town’s taxes affect your budget will help you stay informed and confident as a buyer. Let’s break it all down in simple terms.

Property taxes aren’t just another line on your mortgage statement. They’re an ongoing cost of homeownership. These taxes help fund local services like schools, police and fire departments, libraries, and road maintenance.

When you understand how taxes vary by town, you can see why some areas cost more than others. A town with top-rated schools and well maintained parks may have higher tax rates to support those services. Meanwhile, smaller towns with fewer services might have lower rates but may not offer as many amenities.

The key is balance. You want a community that fits both your lifestyle and your budget.

Before diving into how different towns compare, it helps to understand how the math works. Property taxes are based on two main things:

The assessed value of your home – what the town believes your property is worth.

The local tax rate – how much the town charges per $1,000 of assessed value.

For example, if your home is assessed at $400,000 and the town’s tax rate is $20 per $1,000, your annual property tax would be $8,000. So even if two homes cost the same, your yearly costs could differ depending on how taxes vary by town.

Now let’s look at what this means in real life. Southern New Hampshire includes a mix of cities, suburbs, and small towns—all with different tax rates and services.

In general:

Cities like Nashua or Manchester tend to have higher tax rates because they offer more public services and larger school systems.

Towns like Windham, Bedford, or Hollis often have higher home values but lower tax rates, which balance out the total bill.

Smaller towns like Brookline or Lyndeborough may offer lower rates but fewer public amenities.

This is why it’s important to research each area before deciding where to buy. When looking at Southern NH houses for sale, take a few minutes to compare tax rates. It could affect your monthly budget more than you expect.

Tax rates aren’t set in stone. They can shift from one year to the next based on town budgets, property assessments, and local spending decisions.

Here are a few common reasons rates change:

Town budgets increase. If a town needs more money for schools, roads, or emergency services, rates can go up.

Property values rise. When property values increase across a town, the rate may go down—but you might still pay more overall because your assessment is higher.

New development. Growth can sometimes lower taxes, as new businesses or homes expand the tax base.

This is why it’s smart to keep an eye on how taxes vary by town each year, especially if you’re budgeting for long-term costs.

When you take out a mortgage, your property taxes are usually included in your monthly payment through an escrow account.

That means if your town’s taxes increase, your monthly payment could go up even if your mortgage rate stays the same.

For example, let’s say you find a home among Southern NH houses for sale that fits your $2,500 monthly budget. If that includes property taxes, and those taxes rise by $1,200 a year, your new payment could increase by $100 per month. That’s why understanding how taxes vary by town can help you plan ahead and avoid being caught off guard.

Let’s say you’re deciding between two homes—one in Londonderry and one in Hudson.

Londonderry: Tax rate of about $18 per $1,000 of assessed value.

Hudson: Tax rate of about $24 per $1,000 of assessed value.

If both homes are valued at $450,000, here’s how the math plays out:

Londonderry taxes: $8,100 per year

Hudson taxes: $10,800 per year

That’s a difference of $2,700 annually, or about $225 per month—just based on how taxes vary by town. These are rough examples, but they show how much impact local taxes can have on your budget.

It’s easy to think that lower taxes are always better but that’s not always true.

Towns with higher tax rates often use that money for better services, schools, and infrastructure. If you have kids, a strong school system might be worth the added cost. You might also enjoy extras like better maintained parks, community programs, or faster emergency response times.

When you look at Southern NH houses for sale, think about how each town’s services fit your lifestyle. A slightly higher tax bill could bring better long-term value and quality of life.

On the other hand, lower taxes can make a home more affordable month to month. If you’re a first-time buyer or on a tighter budget, that can be a big advantage.

However, lower taxes sometimes mean fewer town services. You might need to hire private trash pickup, pay for a recreation membership, or travel farther for certain amenities.

Again, this is why knowing how taxes vary by town helps you balance cost and convenience. It’s about finding what matters most to you and your family.

When you start browsing Southern NH houses for sale, keep a few smart strategies in mind:

Check tax rates early. Don’t wait until closing to find out how much you’ll owe each year.

Ask your REALTOR® for comparisons. Local agents know which towns have higher or lower taxes and why.

Look beyond the number. Sometimes a higher rate supports strong schools or great community resources.

Consider your full budget. Add taxes, utilities, and insurance to your monthly costs before setting your price range.

This kind of preparation keeps your finances steady and helps you make confident decisions.

There are a few myths that can trip up buyers when trying to understand how taxes vary by town:

Myth #1: New homes always mean higher taxes.

Not necessarily. Sometimes new builds are more energy-efficient and valued lower than expected.

Myth #2: Property taxes never go down.

Rates can decrease if property values rise or if towns reduce budgets.

Myth #3: A low tax rate always means a cheaper home.

A lower rate might be paired with a higher home value, balancing things out.

Understanding the truth behind these myths can make your home search much smoother.

Buyers often ask whether tax rates impact home prices. The short answer is yes, indirectly. Towns with higher taxes sometimes have slower appreciation because buyers factor in the ongoing cost. But if those taxes support great schools and amenities, they can actually boost demand and long-term value.

When comparing Southern NH houses for sale, look for areas where taxes are fair, services are strong, and property values are stable. That’s usually the sweet spot.

Even after you buy your home, it’s smart to stay proactive about your property taxes.

Review your annual assessment. Make sure your home’s value is accurate.

Attend local meetings. Town budget hearings often discuss proposed tax changes.

Set aside a little extra. Build a buffer in your budget for potential increases.

Knowing how taxes vary by town means you’ll always be ready for whatever changes come your way.

Your REALTOR® can be a huge help in understanding property taxes. They can explain how rates differ, what local services you’re paying for, and how taxes fit into your overall affordability.

When shopping Southern NH houses for sale, a knowledgeable agent can show you how to weigh taxes against other factors, like commute times, school ratings, or neighborhood trends. A good agent knows the numbers, but they also know how those numbers affect your life.

At the end of the day, how taxes vary by town is just one piece of the puzzle. Your perfect home isn’t only about the rate. It’s about the community, the comfort, and the long-term fit for your lifestyle.

If you’re exploring Southern NH houses for sale, take time to compare both home prices and tax rates. With a bit of research and guidance, you can find a home that feels right for your heart and your wallet. Property taxes may not be the most exciting part of buying a home, but understanding them helps you make decisions that truly pay off in the long run.

If you need more tips on how how taxes vary by town, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

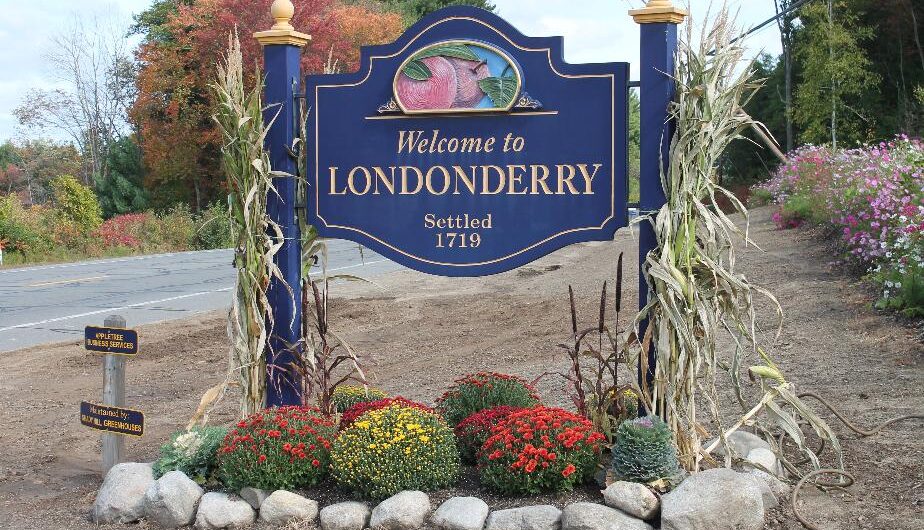

If you’re exploring Southern NH towns, the history of Londonderry NH is worth knowing. This town blends deep roots with modern living. From its early settlers to today’s thriving neighborhoods, Londonderry has a story that adds value to every home.

Whether you're browsing Londonderry houses for sale or Southern NH houses for sale, understanding the town’s past helps you appreciate its present.

Early Beginnings: From Nutfield to Londonderry

Early Beginnings: From Nutfield to LondonderryLondonderry started as Nutfield in 1719. A group of Scotch-Irish immigrants, led by Rev. James MacGregor, settled here after leaving Ireland. They were seeking peace, farmland, and religious freedom.

Nutfield was rich in nut trees and fertile land.

In 1722, the town was renamed Londonderry, honoring their Irish roots.

It became one of the first inland settlements in the Merrimack Valley.

This early foundation shaped the town’s strong community spirit and love for the land.

Colonial Growth and Farming Roots

Colonial Growth and Farming RootsLondonderry grew quickly. Families built homes, farms, and churches. The town became known for its agriculture, especially flax and linen production.

Londonderry Linen was famous across New England.

Apple orchards like Mack’s Apples date back to the 1700s.

Stone walls and open commons defined early neighborhoods.

These traditions still influence the town’s layout and real estate appeal today.

Expansion and New Towns

Expansion and New TownsAs Londonderry grew, parts of it became new towns. Derry, Windham, and Manchester all started as pieces of Londonderry.

Windham and Hudson split off in 1741.

Derryfield (now Manchester) was formed in 1751.

Derry became its own town in 1828.

Despite these changes, Londonderry kept its identity and continued to thrive.

Industry and Innovation

Industry and InnovationIn the 1800s, Londonderry saw growth in trade and manufacturing. Sawmills, tanneries, and railroads boosted the local economy.

This mix of progress and tradition still attracts buyers looking for homes with character.

Modern Londonderry: A Blend of Old and New

Modern Londonderry: A Blend of Old and NewToday, Londonderry is one of Southern NH’s most desirable towns. It offers a mix of historic charm and modern convenience.

If you’re browsing Londonderry houses for sale, you’ll find everything from Colonial homes to New Builds.

Landmarks That Tell the Story

Landmarks That Tell the StoryLondonderry’s landmarks reflect its rich history. They also add emotional value to nearby homes.

These places make Londonderry feel like home, and boost real estate appeal.

Community Events That Celebrate History

Community Events That Celebrate HistoryLondonderry loves its traditions. Annual events bring neighbors together and celebrate the town’s roots.

These events create a strong sense of community, something buyers look for when choosing a home.

Why History Matters in Real Estate

Why History Matters in Real EstateThe history of Londonderry NH adds depth to every home. Buyers feel connected to the town’s story, and that emotional pull can influence decisions.

Whether you're listing or buying, Londonderry’s history is a selling point.

Londonderry Real Estate Snapshot

Londonderry Real Estate SnapshotLondonderry continues to grow while honoring its past. The town offers a strong market for families, retirees, and professionals.

Median home price: around $560,000

Homes sell quickly, often with multiple offers

New developments blend with historic neighborhoods

If you’re exploring Southern NH houses for sale, Londonderry should be on your list.

The History of Londonderry NH – Roots, Growth & Real Estate Charm

The History of Londonderry NH – Roots, Growth & Real Estate CharmThe history of Londonderry NH isn’t just about dates and names. It’s about people, progress, and pride. It’s about how a small farming town became a vibrant place to live, work, and grow.

Whether you're buying or selling in Londonderry, knowing the town’s story adds meaning to your move. It helps you connect with the community and feel at home.

So next time you drive through Londonderry, take a moment to appreciate its roots. You’re not just looking at houses, you’re stepping into history.

If you need more info on the History of Londonderry NH, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Nashua, New Hampshire, often called the Gate City, has a story that stretches back nearly 350 years. What began as a small colonial settlement along the Merrimack River grew into a powerhouse of industry, innovation, and community. Today, Nashua blends its historic roots with modern growth, making it one of Southern New Hampshire’s most dynamic cities.

Nashua’s story began in 1673, when settlers established the town of Dunstable, which spanned parts of modern-day New Hampshire and Massachusetts. The fertile riverbanks provided farmland and a strong foundation for the community.

In 1746, the northern portion officially became part of New Hampshire. As the population grew, so did the need for identity—leading to the city we now know as Nashua.

By the early 19th century, the Nashua Manufacturing Company transformed the region. Powered by the Nashua and Merrimack Rivers, its textile mills made the city a hub of production. Brick factories and mill housing shaped much of the downtown architecture that still stands today.

The arrival of the Nashua and Lowell Railroad in 1838 only fueled the city’s boom. Goods, people, and ideas flowed through Nashua, strengthening its reputation as an industrial powerhouse.

As prosperity grew, Nashua became known as the “Gate City”, thanks to its key location at the gateway between Massachusetts and New Hampshire. It was a crossroads of trade, manufacturing, and community life.

Immigrant workers from Ireland, Canada, and Europe arrived to fuel the mills and create a diverse cultural fabric that remains part of the city’s character.

When the textile industry declined in the mid-20th century, Nashua reinvented itself. High-tech companies, healthcare systems, and retail centers replaced the mills as economic drivers.

Today, Nashua is home to thriving businesses, vibrant arts and culture, and one of New England’s most celebrated downtowns. Twice named Best Place to Live in America by Money Magazine, Nashua balances rich history with a forward-looking spirit.

Understanding Nashua’s past helps us appreciate its present. From its Dunstable beginnings to its mill-town boom, from immigrant neighborhoods to modern technology centers—every chapter shaped the Nashua we know.

Whether you’re walking past historic mill buildings, enjoying a show at the Nashua Center for the Arts, or living in one of its growing neighborhoods, you’re part of a city built on resilience and reinvention.

Curious about the History of Nashua, NH?

Whether you're a longtime resident, a newcomer, or just someone intrigued by local stories, this blog has something for you. Ready to dive deeper—or curious what your home might be worth here?

Call me at (603) 883-8840 or use the form below to connect with one of our agents. We'd love to help you write your own chapter in Nashua’s ongoing story.

Let’s explore this city’s past—and plan your future.

You’ve served your country—now it’s time to settle down and build your future. Whether you’re retiring from the military or transitioning back to civilian life, homeownership can be a smart next step.

There’s a lot to learn, but don’t worry—we’re going to keep this simple. This guide breaks down veterans buying a home in a clear, easy-to-understand way. From VA loans to local housing options like South Nashua houses for sale and Southern NH houses for sale, we’ll walk you through everything.

Let’s get started—this is your next mission.

After years of moving around, the idea of “home” hits differently. You want stability. You want space. And most of all—you want something of your own.

Buying a home means:

No more base housing

No more landlords

A place to call your own

An investment in your future

And thanks to VA loan benefits, veterans buying a home have more support than most buyers.

One of the biggest perks for veterans buying a home is the VA loan. If you’ve served, you may qualify for this powerful mortgage option backed by the U.S. Department of Veterans Affairs.

Here’s why VA loans are a game-changer:

Yep, you read that right. Most loan programs require 3% to 20% down. But with a VA loan, you can buy a home with zero down. That means you don’t have to save up for years to make a move.

Other low-down-payment loans charge PMI each month. VA loans don’t. That saves you hundreds of dollars a year.

VA loans often come with lower rates than traditional loans. Over time, that can save you thousands.

Had a few bumps in the road? The VA loan program is more forgiving than others when it comes to credit scores.

So if you're searching South Nashua houses for sale or eyeing Southern NH houses for sale, know this—you've got an edge.

You might be wondering: do I qualify?

Here’s a quick look at who usually qualifies for a VA loan:

Veterans with an honorable discharge

Active-duty service members

Some reservists and National Guard members

Surviving spouses (in some cases)

Still not sure? Ask your lender or a VA-approved REALTOR®. They can check your eligibility and help you get your Certificate of Eligibility (COE)—you’ll need it to apply.

Good news! The VA loan works in all 50 states, including right here in New Hampshire.

Whether you're looking at a small home in the woods or something closer to downtown South Nashua, you can use a VA loan to buy:

A single-family home

A condo in a VA-approved complex

A new construction home

A home you plan to fix up (some rules apply)

You can even reuse the loan down the road or use it again if you’ve paid off a previous VA loan.

Let’s break it down. Here’s what veterans buying a home need to do:

Talk to a VA-approved lender. They’ll help you figure out how much home you can afford and what your payments might look like.

Your lender can help you with this. It proves you're eligible for VA loan benefits.

Find a REALTOR® who understands VA loans and the local market. Especially in places like Southern NH and South Nashua, where homes can move fast.

Look at homes that fit your budget, lifestyle, and needs. Want a backyard? A garage? An open kitchen? Let your agent know.

Once you find the one, your agent will help you make a strong offer and negotiate the best deal.

The VA requires a special appraisal to make sure the home is safe and worth the price. You’ll also want a regular inspection to spot any issues.

Sign your paperwork, get your keys, and celebrate—you’re a homeowner!

Yes! With a VA loan, you can buy a home with up to 4 units—as long as you live in one of them. This can be a smart way to invest and earn rental income.

Yes again. You can use your benefit multiple times, even if you’ve used it before. Certain conditions apply, but it’s very possible.

It’s a one-time cost most buyers pay at closing. It helps keep the program going. Good news—if you have a service-related disability, you may be exempt from this fee.

If you’re a veteran thinking about buying a home in South Nashua or Southern NH, here’s why now makes sense.

Believe it or not, while some towns are hot, others still have hidden gems. Southern NH offers a mix of quiet suburbs, scenic spots, and commuter-friendly neighborhoods. There’s something for everyone.

New Hampshire loves its vets. From property tax relief in some towns to veteran programs and community support, this state has your back.

Ask your REALTOR® about towns that offer local benefits and special assistance for vets.

Not every agent understands VA loans. You’ll want someone who:

Knows how to write strong offers using VA financing

Can guide you through the VA appraisal process

Knows local lenders who specialize in VA loans

Understands the emotional side of the process too

Whether you're just starting your home search or ready to tour South Nashua houses for sale today, a trusted, VA-savvy agent makes all the difference.

Let’s wrap up with some simple advice that can really make a difference.

Even though the VA appraisal checks safety, it’s not the same as a full home inspection. Always get one—it’s worth it.

While VA loans cover a lot, you’ll still need some cash for things like moving costs, furniture, or small repairs.

Are you planning to stay in the area? Grow your family? Work from home? Pick a home that fits your next chapter—not just today.

Many sellers in Southern NH are open to helping with closing costs. Your agent can ask for this during negotiations.

If you're a veteran ready to put down roots, we’re here to help.

Let’s tour some South Nashua houses for sale or explore peaceful neighborhoods in Southern NH together. With the right agent by your side, you’ll feel confident every step of the way.

Buying a home is more than a transaction—it’s a life milestone. And as a veteran, you’ve earned every bit of support and guidance available to you.

So whether you're just curious or ready to move in, remember this:

✅ VA loans give you an edge

✅ Homeownership builds stability and wealth

✅ New Hampshire has great options and benefits for veterans

Veterans buying a home have more power than ever. Let’s use it to build your future.

If you need more tips on info on what veterans need to know to buy a home, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Welcome to 79 Glencliff Rd Roslindale ! This charming 3-bedroom, 1 1/2-bath Colonial home in Boston MA is full of potential and waiting for you to make it your own. Located in one of Roslindale’s most desirable neighborhoods, this property offers a fantastic opportunity to create the perfect space for you and your family. Let's take a closer look at what makes this home so special.

The living room at 79 Glencliff Rd Roslindale is the heart of the home, offering plenty of space to relax and unwind. With beautiful hardwood floors and a cozy wood fireplace, it’s the perfect spot for cozy nights in or entertaining guests. The bright, welcoming space offers a warm and inviting atmosphere. When exploring Roslindale homes for sale, this living room stands out for its charm and comfort.

Upstairs, you’ll find 3 spacious bedrooms, each with hardwood floors and ample closet space. Whether you need room for your growing family, a guest room, or a home office, these bedrooms provide flexibility and comfort. The thoughtful design and generous closet space are standout features of homes in Roslindale, making 79 Glencliff Rd a fantastic option for families looking for room to grow.

The home features a convenient 1 1/2 bath layout. The half bath is located on the main level, offering easy access for guests and everyday convenience. The full bath upstairs serves the 3 bedrooms and is ready for your personal touch to update it to your style. This functional bathroom layout is highly desirable in Roslindale homes for sale, combining practicality and ease.

The partially finished basement at 79 Glencliff Rd Roslindale offers endless possibilities. With a little work, it can become the perfect space for a home office, playroom, extra living area, or a guest room. Many homes in Roslindale don’t offer this bonus space, which makes this home an incredible find. The basement also features laundry and storage areas, making it an incredibly functional space.

The backyard at 79 Glencliff Rd Roslindale is ideal for outdoor entertaining or gardening. Whether you love to host summer barbecues or want to cultivate a beautiful garden, the patio and outdoor space provide room for it all. This feature is highly sought after among Roslindale homes for sale, where outdoor living is key to the appeal of a property.

One of the biggest advantages of 79 Glencliff Rd Roslindale is its location. Situated near parks, schools, and Roslindale Square, this home offers easy access to local shops, restaurants, public transportation, and highways. With everything you need just a short walk or drive away, this location offers the perfect balance of convenience and community.

If you’re looking for a home with potential in a fantastic neighborhood, 79 Glencliff Rd Roslindale is the perfect choice. With hardwood floors, spacious living areas, a partially finished basement, and a backyard perfect for outdoor activities, this property has all the ingredients to become your dream home. Don’t miss out on this opportunity—contact a local agent today to schedule a viewing and explore all the possibilities 79 Glencliff Rd Roslindale: Boston MA has to offer!

If you're searching for Roslindale homes for sale, 79 Glencliff Rd stands out as an excellent choice with its spacious layout and potential. Don’t miss out on this amazing opportunity – contact Ken Ziehm today to schedule a viewing and make 79 Glencliff Rd Roslindale: Boston MA your new home!