Category Archives for "Litchfield homes for sale"

Winter in New Hampshire is beautiful. It’s also messy, cold, and sometimes expensive. Every year, homeowners learn the hard way why winter snow home safety matters. Ice builds up. Roofs leak. Heating bills soar. Sound familiar? If you own a home or are shopping in Litchfield houses for sale or South Hudson houses for sale, this topic hits close to home.

Snow does not just sit quietly on your property. It melts. It refreezes. It sneaks into small cracks. Then it causes big problems. The good news is that most winter damage can be prevented with smart planning and simple habits. You do not need fancy tools or superhero strength. You just need to know what to watch for and when to act.

As New Hampshire REALTORS, we hear the same winter stories every year. A roof leak that started as an ice dam. A frozen window that would not open in spring. A heating system that worked overtime because heat escaped through unseen gaps. Let’s talk about how to avoid those headaches while keeping your home safe, warm, and market ready.

Snow removal seems simple. Grab a shovel. Clear the driveway. Done. Not quite. Snow clearing plays a major role in winter snow home safety, especially around entryways, foundations, and roofs.

Start with your walkways and steps. Ice loves to hide under fresh snow. One wrong step and winter wins. Use ice melt early and often. Sand also helps when temperatures drop too low for salt to work. Clear snow away from doors so they open easily during emergencies.

Next, think about your foundation. Piled snow melts and seeps into small cracks. That water refreezes and expands. Over time, this causes foundation damage. Try to push snow away from the house instead of stacking it along the walls. Your future self will thank you.

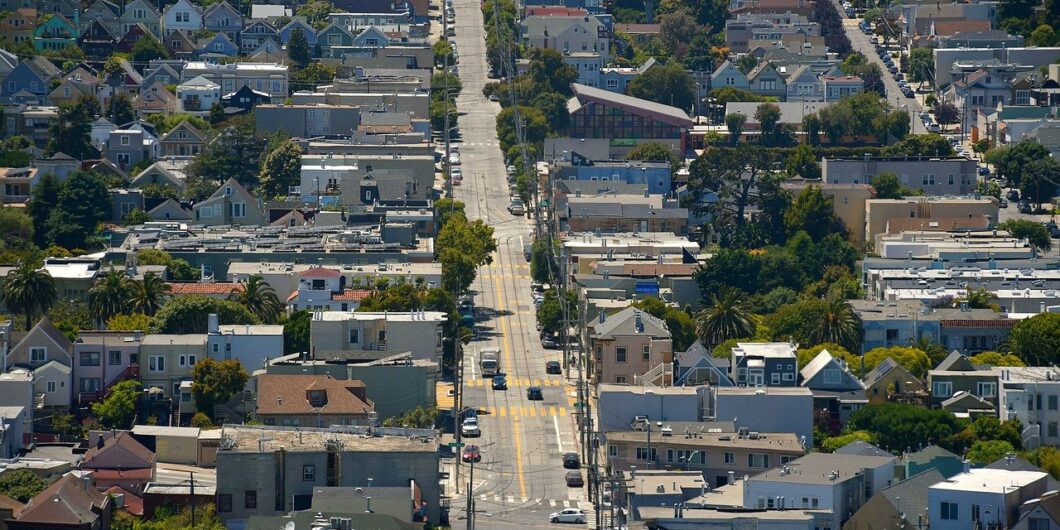

Buyers touring South Nashua houses for sale in winter often notice snow management right away. A well cleared property feels cared for. It signals pride of ownership. That matters more than many sellers realize.

Roofs carry a lot in winter. Snow may look fluffy, but it adds weight fast. Wet snow weighs even more. Too much snow can stress roof structures, especially older homes common in Southern NH Houses for sale.

Watch for sagging gutters or creaking sounds after heavy storms. These are warning signs. Roof rakes are your friend here. Use them safely from the ground to remove excess snow. Never climb onto an icy roof. That story rarely ends well.

Ice dams form when warm air escapes through the attic. Snow melts. Water runs down. Then it refreezes at the edge. That ice traps more water behind it. Eventually, water sneaks under shingles and into your home.

Stopping ice dams is a major part of winter snow home safety. Proper insulation and ventilation matter more than people think. Sealing attic air leaks can make a huge difference.

Icicles are pretty. They also signal heat loss. Big icicles mean warm air is escaping and melting snow unevenly. That usually leads to ice dams.

They can also be dangerous. Falling icicles can damage siding, windows, or worse, someone’s head. Keep gutters clear before winter starts. Clogged gutters hold water and speed up ice buildup.

Londonderry houses for sale often show these winter patterns clearly because many have longer rooflines. If you see heavy icicles, it is time to investigate insulation and attic airflow.

Removing icicles safely helps protect your roof edge, gutters, and anyone walking below. Never knock them down while standing under them. Gravity is not forgiving.

Cold drafts make rooms uncomfortable and heating bills higher. Windows play a big role in winter snow home safety and energy efficiency.

Check for drafts by feeling around window frames on cold days. If you feel air moving, heat is escaping. Simple weather stripping or caulking can fix many issues. Plastic window film kits are affordable and effective. They may not look fancy, but they work.

Condensation on windows also tells a story. A little is normal. Heavy moisture or frost means indoor humidity is too high or insulation is lacking. That moisture can lead to mold or rot over time.

Buyers looking at houses for sale often comment on window comfort during showings. Warm rooms feel welcoming. Cold drafts do not.

Doors get overlooked. They should not. Gaps under doors let cold air rush in and warm air escape. Door sweeps are inexpensive and easy to install.

Check door frames for cracked seals. Replace worn weather stripping. Make sure storm doors close tightly. These small steps improve comfort quickly.

In winter, doors also deal with snow buildup. Clear snow away from door thresholds. Melting snow can refreeze overnight and trap doors shut. That is never fun at six in the morning.

Strong doors and seals matter when showing houses for sale during winter months. First impressions start at the front door.

Your heating system is the hero of winter snow home safety. Treat it well. Schedule annual maintenance before cold weather hits. A tuned system runs more efficiently and breaks down less often.

Change filters regularly. Dirty filters restrict airflow and make systems work harder. That leads to higher bills and shorter equipment life.

Listen for unusual noises. Smells matter too. Burning odors or frequent cycling should be checked by a professional.

Homes across Southern NH Houses for sale vary widely in heating systems. Some use oil. Others use gas, propane, or heat pumps. Each system needs proper care to perform well in winter.

Frozen pipes cause major damage. They often freeze overnight when temperatures drop suddenly. Exterior walls, basements, and crawl spaces are high risk areas.

Insulate exposed pipes. Let faucets drip slightly during extreme cold. Keep cabinet doors open under sinks to allow warm air to circulate.

If you leave town, never turn heat off completely. Set thermostats to at least fifty five degrees, possibly higher if the temps plan to get really cold. It costs less than repairing burst pipes.

Winter snow home safety includes protecting what you cannot see. Pipes fall into that category.

Attics play a huge role in ice dams and heat loss. Poor insulation allows heat to escape upward. That warms the roof surface unevenly.

Proper insulation keeps heat inside the home where it belongs. Ventilation allows cold air to flow and keep roof temperatures stable.

Many homes in South Nashua were built before modern insulation standards. Upgrading attic insulation improves comfort and resale value.

If you notice uneven snow melt on your roof, your attic may be sending signals. It is worth investigating.

Winter pushes animals to seek warmth. Snow piled near foundations gives pests easy access to entry points.

Clear snow away from vents and openings. Check for gaps around utility lines. Seal small holes before winter sets in.

Rodents inside walls create damage and noise. No one wants surprise attic guests in January.

Maintaining winter snow home safety means thinking beyond snow and ice. It includes protecting the entire structure.

Every winter brings new stories. One homeowner ignored ice dams for years. One warm spell later, water poured through a ceiling light. Another skipped window sealing. Heating bills doubled during a cold snap.

Then there are the smart ones. The family who raked their roof after every storm. The seller who sealed drafts before listing. The buyer who spotted good insulation and felt confident making an offer.

These small choices add up. Winter rewards preparation and punishes neglect.

Winter condition tells buyers a lot. A well maintained home in winter signals year round care. It builds trust.

Homes shown during winter often sell faster when they feel warm, dry, and safe. Buyers notice snow management, roof condition, and heating comfort immediately.

That is why winter snow home safety is also a marketing advantage. Especially in competitive areas like Londonderry and South Hudson.

Winter damage often reveals itself in spring. Leaks, stains, warped wood, and mold appear once snow melts.

Preventing problems now saves repair costs later. It also protects property value.

Spring buyers touring Litchfield houses for sale appreciate homes that came through winter strong.

Winter in New Hampshire will always bring snow, ice, and cold. You cannot control the weather. You can control how your home handles it.

By focusing on winter snow home safety, you protect your roof, windows, heating system, and investment. You also reduce stress and surprises.

Whether you live in South Nashua houses for sale, Londonderry houses for sale, South Hudson houses for sale, Litchfield houses for sale, or are exploring Southern NH Houses for sale, smart winter care makes every season easier.

If you ever have questions about winter prep, home value, or buying and selling during snow season, I’m always happy to talk. Winter may be long, but it does not have to be painful.

If you need more information on winter snow home safety, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Learning how to remove wallpaper can feel overwhelming at first. Many homeowners worry about time, mess, and wall damage. Yet this task often brings big rewards in home value and buyer appeal. This topic comes up often when preparing Litchfield houses for sale and Southern NH Houses for sale. Because wallpaper dates a space quickly, removing it helps homes feel fresh and inviting.

Wallpaper removal does not need to cause stress. With the right plan, patience, and tools, it becomes manageable. Homeowners often feel proud once the walls are clean. Buyers then see potential instead of distraction. That shift can change how a home shows and sells.

Wallpaper reflects the style of another time. While some patterns feel charming, many buyers see them as work. This reaction affects emotion during showings. When buyers feel unsure, they hesitate.

Neutral walls help buyers imagine their own style. Clean surfaces also photograph better for listings. Because online views matter so much, walls play a key role.

In competitive New Hampshire markets, small details count. Removing wallpaper helps homes stand out. This effort often leads to faster sales and stronger offers.

Why would you remove wallpaper? Not every wallpaper needs removal. Some newer designs still appeal. However, busy or dark patterns often limit buyer interest.

If wallpaper peels or bubbles, removal feels urgent. Damage sends the wrong message. Buyers may worry about hidden issues.

When preparing Litchfield houses for sale, sellers often remove wallpaper in main rooms. This choice creates a clean slate. It helps buyers focus on layout and light.

Many homeowners feel anxious before starting. Wallpaper removal has a bad reputation. Stories of torn walls and long hours scare people.

However, preparation reduces stress. Knowing what to expect helps calm nerves. Each step forward builds confidence.

Once finished, homeowners often feel relief and pride. That emotional lift matters. It turns a dreaded task into a win.

Good tools make the job easier. A scoring tool helps break the wallpaper surface. This allows moisture to reach the glue.

A spray bottle or pump sprayer works well. Warm water often does the trick. Some people add mild soap or vinegar.

Plastic scrapers protect walls better than metal ones. Drop cloths keep floors safe. Preparation saves time later.

Always test a small area first. Wallpaper types vary widely. Some peel easily, while others fight back.

Testing shows how much moisture helps. It also reveals wall condition underneath. This step prevents surprises.

If the paper comes off clean, the rest will follow. If not, adjust your approach early.

The peel and spray method works for many homes. Start by lifting a corner of the paper. Peel slowly and evenly.

Once the top layer comes off, spray the backing. Let moisture soak in for several minutes. Patience helps here.

Then scrape gently from top to bottom. Avoid rushing. Slow progress protects the wall surface.

Some wallpaper resists water alone. Steam adds heat and moisture together. This softens tough glue.

Steamers work well in older homes. Many New Hampshire houses fall into this category. The heat loosens layers faster.

However, steam requires care. Too much heat can damage drywall. Short passes work best for control.

Wall damage worries many homeowners. Gentle tools and patience reduce risk. Avoid sharp blades when possible.

Work in small sections. Let moisture do the work. Forcing the paper causes tears and gouges.

If damage happens, repairs remain manageable. Minor patches fix easily before painting. Do not panic if walls look rough at first.

After removal, glue residue often remains. This sticky film affects paint adhesion. Cleaning matters.

Warm water and a sponge usually remove residue. Some people use mild cleaners. Rinse walls well afterward.

Let walls dry fully before moving on. Dry surfaces reveal any missed spots. This step prepares walls for the next phase.

Small holes or tears happen sometimes. Joint compound fills these areas easily. Smooth with a putty knife.

Once dry, sand lightly for a flat finish. Wipe dust away before priming. Clean prep leads to smooth paint.

Primer seals repaired areas. It also blocks old patterns from bleeding through. This step ensures a fresh look.

Paint color influences buyer emotion. Neutral tones appeal to more people. Soft whites and light grays work well.

These colors reflect light and make rooms feel larger. Buyers appreciate bright and open spaces.

In Southern NH Houses for sale, neutral paint helps homes compete. It creates a move in ready feel.

Wallpaper removal takes time. A small room may take a day. Larger spaces may need more.

Costs remain low if done yourself. Tools cost little compared to professional services. Sweat equity pays off.

Professional removal helps for tough jobs. Sellers should weigh time versus cost. Both paths add value.

Some wallpaper proves very stubborn. Multiple layers increase difficulty. Plaster walls need special care.

Professionals bring experience and tools. They reduce risk of damage. This option suits tight timelines.

Before listing a home, timing matters. Hiring help may speed preparation. Faster listings often attract more buyers.

When you remove wallpaper you can refresh a space instantly. Buyers see clean walls and imagine furniture placement.

Homes feel more modern and cared for. This impression influences perceived value. Buyers often respond with stronger interest.

In markets with Litchfield houses for sale, updated interiors stand out. Small updates make a big difference.

REALTORS often suggest that you remove wallpaper, especially if it’s dated. They know buyer reactions well. Their advice comes from experience.

During walkthroughs, agents point out areas to update. Wallpaper often tops the list. Simple changes improve marketability.

Working together helps sellers prioritize tasks. Wallpaper removal often delivers strong returns for effort.

Wallpaper in kitchens and baths raises concerns. Moisture causes peeling and stains. Buyers notice these flaws quickly.

Buyers prefer the seller to remove wallpaper from these rooms. It makes them feel more neutral and move-in ready. Clean walls signal care and maintenance.

Paint or tile replacements feel fresh. Buyers feel confident about upkeep. This confidence supports offers.

Wallpaper affects light reflection. Dark patterns absorb light. Rooms feel smaller and dimmer.

After removal and painting, light spreads better. Spaces feel larger and more inviting. This change feels dramatic.

Good lighting supports listing photos. Better photos lead to more showings. This chain reaction starts with clean walls.

Many homeowners feel surprised by relief afterward. The task feels less painful than expected. Accomplishment replaces dread.

This positive energy carries into other projects. Sellers feel motivated to finish preparation. Momentum builds.

Buyers sense this care during showings. Homes feel loved and ready.

Take breaks often. Hydrate and stretch. Small pauses prevent frustration.

Work room by room instead of all at once. Progress feels clearer that way. Celebrate small wins.

Music or podcasts help pass time. Keeping a relaxed mindset matters. Stress shows in rushed work.

Skipping wall testing leads to surprises. Always test first. This saves time later.

Using sharp tools risks damage. Gentle methods work better. Patience protects walls.

Skipping cleaning and priming causes paint issues. Do not rush this step. Preparation ensures lasting results.

Older homes often have multiple wallpaper layers. Each layer tells a story. Removal takes extra care that buyers prefer not to tackle. They prefer a move-in ready home where they don’t have to remove wallpaper themselves.

Plaster walls differ from drywall. Moisture levels must stay controlled. Gentle scraping matters even more.

Many Southern NH Houses for sale fall into this category. Thoughtful removal preserves charm while modernizing style.

When buyers see fresh walls, they relax. They feel less work lies ahead. This comfort matters.

Sellers can share before and after stories. Buyers appreciate the effort invested. Transparency builds trust.

Updated walls signal readiness. Homes feel closer to move in ready status.

Some wallpaper styles remain tasteful. Subtle patterns may work in small spaces. However, broad appeal matters most.

If unsure, neutral paint usually wins. Buyers prefer flexibility. Paint offers a blank canvas.

REALTORS often guide this decision. Their market insight helps sellers choose wisely.

Removing wallpaper feels challenging but rewarding. Clean walls improve emotion, style, and value. In New Hampshire, these updates help homes shine in competitive markets. Sellers preparing Litchfield houses for sale often see strong results from this effort. The same holds true for Southern NH Houses for sale where buyers value move in ready spaces. With patience and the right approach, this project becomes a smart and satisfying step forward.

If you need more tips on how to remove wallpaper, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Looking for the perfect place to settle down in New Hampshire? You are in luck. Southern NH neighborhoods offer a mix of charm, convenience, and lifestyle that keeps buyers coming back. From vibrant Nashua to cozy Londonderry, these areas have something for everyone. Whether you are searching for Southern NH houses for sale or just exploring your options, understanding which neighborhoods stand out can make your home search easier and even a bit more fun.

Buying a home is more than just walls and a roof. It is about community, schools, and access to daily conveniences. That is why Southern NH neighborhoods are so desirable. They strike a perfect balance between suburban peace and city accessibility. Want to live somewhere that is close to shopping, restaurants, and good schools but still feels like a retreat after a long day? Then these neighborhoods should be on your radar.

Nashua often takes the top spot when people think of Southern NH neighborhoods. It is the second largest city in the state but still feels welcoming and approachable. People love Nashua for its vibrant downtown, excellent schools, and family-friendly parks. If you are looking for Southern NH houses for sale, Nashua offers a wide variety. From charming older homes to modern new constructions, there is something for every taste and budget.

Downtown Nashua has a surprising mix of restaurants, coffee shops, and local boutiques. You can enjoy a quick walk along the Nashua River and still be minutes from highways for commuting. Families especially like the school options here. The public schools consistently score above average, and there are several private schools that offer unique programs for students.

Neighborhoods have a mix of historic charm and modern convenience. You might even find yourself chatting with neighbors at local farmers markets or community events. That sense of connection is part of what makes Nashua one of the most desirable Southern NH neighborhoods.

Hudson is another top choice for buyers searching Southern NH houses for sale. Why? It offers suburban tranquility with easy access to Massachusetts. Many residents commute to Boston for work but come home to spacious yards, quiet streets, and a strong sense of community.

Schools in Hudson are consistently well rated, which makes this area popular with families. The town also has a number of parks, recreational areas, and local shops that make life enjoyable. Plus, Hudson’s neighborhood streets have that “friendly neighbor” vibe that you can feel as soon as you take a walk in the morning.

Neighborhoods stand out for their family-friendly layouts. Streets lined with trees, sidewalks for walking, and homes with spacious backyards make it a place where kids can run around safely. It’s also great for buyers who want a mix of older charm and modern homes. Hudson remains a favorite among those looking to combine lifestyle, comfort, and Southern NH real estate value.

Merrimack is often overlooked, but it deserves a spot on the list of most desirable Southern NH neighborhoods. It is quietly nestled between Nashua and Manchester, giving residents easy access to both cities while maintaining a suburban feel. Many people choose Merrimack because it offers affordable Southern NH houses for sale without compromising on quality of life.

The town is filled with parks, walking trails, and family-friendly activities. Schools are excellent, making it perfect for growing families. Merrimack also boasts a strong sense of community. Neighbors know each other, and local events bring everyone together. If you want a peaceful place to raise a family while still being close to city amenities, Merrimack should be on your list.

If you like more space, Londonderry is worth a serious look. This town is known for its larger lots, newer developments, and quiet streets. It is ideal for buyers who want Southern NH houses for sale with room to grow, maybe even a backyard big enough for a pool or garden.

Londonderry schools are excellent and highly regarded throughout the state. Families are drawn to this area because it feels like a safe haven while still being within reach of Manchester and Boston. Neighborhoods offer modern homes, well-kept streets, and a sense of exclusivity. It is one of those areas where you immediately feel like you have found home.

Looking for Southern NH neighborhoods with character? Amherst and Hollis are perfect examples. These towns are smaller but packed with appeal. Amherst offers historic homes, quiet streets, and top-rated schools. Hollis feels like stepping back in time with its scenic landscapes, farmland, and community events.

These areas are not just pretty. They also provide strong investment potential. Homes here tend to hold value because the demand for Southern NH neighborhoods with charm, good schools, and convenient commuting options stays high. If you love that classic New England feel with modern conveniences, you will want to explore Amherst and Hollis when looking at Southern NH houses for sale.

So why are these neighborhoods so popular? First, they offer a perfect mix of lifestyle benefits. Families get safety, excellent schools, and recreational opportunities. Professionals enjoy commuting options and access to dining and shopping. Retirees appreciate the quiet streets, community feel, and quality healthcare nearby.

Second, Southern NH neighborhoods are diverse. There are older, character-filled homes, newer constructions, and everything in between. That variety makes it easier for buyers to find a home that fits their style and budget.

Typical peaceful town with friendly neighbors will help you decide to own a property for sale in South NH

Finally, these neighborhoods are growing. Local economies are strong, property values are solid, and the communities continue to improve. That means when you invest in Southern NH houses for sale, you are buying more than just a home—you are buying a lifestyle that pays off in happiness, convenience, and long-term value.

If you are considering moving to Southern NH, spend time exploring each neighborhood. Visit local parks, walk the streets, and talk to residents. See how traffic feels during rush hour and check out local businesses. Southern NH neighborhoods offer a lot of options, but the right one depends on your lifestyle, family needs, and budget.

Remember, the most desirable neighborhoods are often the ones that combine strong schools, convenient location, and a sense of community. That is why Nashua, Hudson, Merrimack, Londonderry, Amherst, and Hollis remain at the top of buyers’ lists.

Whether you are a first-time buyer or looking to upgrade, Southern NH houses for sale provide opportunities to find a home that fits your vision. From bustling downtowns to quiet streets, there is a neighborhood waiting to welcome you.

Southern NH neighborhoods continue to be some of the most sought-after areas in the state. From the vibrant city life of Nashua to the peaceful streets of Londonderry, there is something for every buyer. Families, professionals, and retirees all find their perfect fit here. Exploring Southern NH houses for sale will show you why these communities are more than just places to live. They are places to thrive.

If you need more tips on Southern NH Neighborhoods, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Choosing the right home often goes beyond price or style. Families prioritizing education understand that schools shape daily life and long-term value. Parents want safe neighborhoods, strong academic programs, and a sense of community.

Southern New Hampshire offers many options for families seeking the best combination of education and lifestyle. When exploring Southern NH Houses for sale, it is essential to consider the schools in addition to home features. Homes located in strong districts often maintain value and appeal over time.

Understanding local schools gives families confidence. Knowledge ensures children thrive both academically and socially.

School quality drives decisions for families prioritizing education. Strong districts often feature low student-to-teacher ratios and highly trained staff. Extracurricular programs and advanced courses also matter.

Researching performance metrics, standardized test scores, and graduation rates can help families compare districts. Towns like Bedford, Amherst, and Hollis consistently earn high marks for academic achievement.

Families should also visit schools in person. Seeing classrooms, facilities, and community programs provides a real sense of each district's quality.

Education needs vary by age. Families prioritizing education must consider every stage. Elementary schools focus on foundational skills and social development. Middle schools introduce specialized learning. High schools prepare students for college and career paths.

In addition to academics, families should consider extracurricular activities. Sports, music, arts, and clubs enhance growth. These opportunities often define the overall experience for children.

Towns that support all levels of education attract long-term residents. Homes near these schools often hold strong value for years.

Smaller class sizes allow for individual attention. Families prioritizing education often prioritize districts that maintain these ratios. Teachers with advanced degrees and certifications further support learning outcomes.

Many New Hampshire towns offer detailed staff profiles online. Families can learn about experience levels, certifications, and teaching styles. This information helps families gauge the quality of education available.

Smaller classes and dedicated teachers create a nurturing environment that encourages children to thrive.

Specialized programs often differentiate districts. Advanced placement courses, STEM initiatives, and language immersion programs provide extra opportunities.

Families prioritizing education should also consider gifted programs or special education services. Access to these resources ensures children with varying needs succeed.

Schools with strong enrichment programs often reflect overall community investment in learning.

Education goes beyond textbooks. Families prioritizing education recognize the value of sports, arts, and clubs. These programs build confidence, teamwork, and leadership skills.

When visiting schools, families should explore gyms, performance spaces, and club offerings. A well-rounded program often complements strong academics.

Towns with active school programs attract families seeking both education and community engagement.

School ratings influence property values. Homes in highly rated districts often command higher prices but maintain long-term value.

Families prioritizing education must balance budget with desired school quality. Comparing Southern NH Houses for sale across different districts helps families make informed decisions.

Understanding school impact helps buyers avoid surprises and make confident offers.

Proximity to schools affects daily routines. Shorter commutes provide convenience and safety for children.

Families prioritizing education often look for homes within walking distance or a short drive to schools. This factor influences lifestyle and stress levels.

Towns that prioritize walkable neighborhoods and safe routes to schools remain popular among buyers.

Education is intertwined with neighborhood safety. Families prioritizing education value low crime rates, safe streets, and active community involvement.

Local events, parent organizations, and volunteer programs strengthen the connection between schools and neighborhoods. These ties enhance overall quality of life.

Communities that support both education and safety often attract long-term residents.

Growth impacts schools and neighborhoods. Families prioritizing education consider future development plans.

New housing projects can affect class sizes, school funding, and resources. Town planning boards often share upcoming developments.

Researching these plans ensures families choose areas that will continue to support quality education over time.

High-quality schools often come with higher property prices. Families prioritizing education must balance budgets with educational priorities.

Some towns may offer strong academics at a more reasonable price. Exploring Southern NH Houses for sale in multiple communities helps families find ideal combinations.

Financial planning and understanding property tax implications help families make smart, long-term choices.

On-site visits reveal more than statistics. Families prioritizing education benefit from touring schools, meeting teachers, and speaking with local parents.

Parent insights often reveal school culture, teacher engagement, and community involvement.

This information complements research data and helps families feel confident in their choices.

Local agents provide valuable insight for families prioritizing education. They know neighborhoods, school reputations, and property trends.

Realtors can guide families to homes that align with academic priorities while staying within budget.

Working with a knowledgeable agent reduces stress and ensures families do not miss valuable opportunities.

Many communities offer supplemental learning. Libraries, tutoring centers, and enrichment programs enhance education.

Families prioritizing education should explore these resources when evaluating towns.

Access to additional learning options supports children’s growth and provides flexibility for different learning styles.

Education needs change over time. Families prioritizing education think ahead to middle and high school transitions.

Considering future school performance, extracurricular opportunities, and community programs ensures children continue to thrive.

Homes in strong districts often attract families for decades, creating stable communities.

When searching Southern NH Houses for sale, families prioritizing education must consider proximity to top schools.

Homes near highly rated districts often sell faster but provide long-term value.

Balancing location, size, and budget ensures families find homes that support both lifestyle and learning.

Education and Community Values Align

Towns with strong schools often foster family-friendly communities. Families prioritizing education value supportive neighbors and local involvement.

Town activities, sports leagues, and school events enhance social engagement.

Communities that value learning often attract like-minded families, creating lasting bonds.

Education-focused home searches require careful planning. Families prioritizing education gather data, visit schools, and weigh options.

Balancing school quality with affordability and community fit ensures smart decisions.

Patience and research lead to homes where children can grow and families can thrive.

Families prioritizing education face many choices, but knowledge builds confidence. Schools, neighborhoods, and amenities all influence long-term satisfaction.

Southern NH Houses for sale near strong districts provide both lifestyle and educational value. Families can find homes that support growth, comfort, and opportunity.

By understanding school ratings, programs, and community resources, families prioritize education effectively and make informed decisions for the future.

If you need more info on families prioritizing education, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Buying a home brings many questions. Taxes often create the most confusion. Southern NH property taxes play a big role in monthly costs and long term planning. Buyers should understand them early.

When reviewing Southern NH Houses for sale, taxes should always be part of the conversation. They affect affordability more than many expect. This guide explains how taxes work in clear and simple terms.

The goal is confidence. With the right knowledge, buyers can plan wisely and avoid surprises.

Property taxes support daily life in each town. They fund schools, roads, and public safety. Libraries, parks, and town services also rely on tax dollars.

Unlike some states, New Hampshire does not have a broad income tax. Property taxes carry more weight instead. This structure makes local tax rates important.

Buyers should view taxes as part of community investment. Strong services often reflect thoughtful spending.

Southern NH property taxes start with assessed value. Each town assesses homes based on market value. Assessments usually occur every few years.

The town then applies a tax rate. This rate is set annually. It reflects the town budget and total assessed value.

Taxes equal assessed value multiplied by the tax rate. Knowing both numbers helps buyers estimate costs.

Every town sets its own budget. School costs, staffing, and services differ. These choices shape tax rates.

Some towns have higher home values. Others rely more on residential taxes. Business presence can also impact rates.

Buyers comparing Southern NH Houses for sale should review town tax histories. Patterns often matter more than one year.

Tax rates are shown as dollars per thousand. A rate of twenty means twenty dollars per thousand of value.

For example, a three hundred thousand dollar home would owe six thousand dollars at that rate. This math helps buyers plan.

Agents often help explain this step. It turns confusion into clarity quickly.

Assessed value may differ from purchase price. Some towns assess below market. Others stay close to current values.

Buyers should not assume taxes will match the seller’s bill. New purchase prices can trigger reassessment.

Understanding this gap helps avoid surprises after closing.

Towns reassess properties periodically. This process updates values across the board. Reassessments do not always raise taxes. They often adjust values evenly. Individual tax bills depend on the new rate.

Buyers should ask when the last reassessment occurred. Timing matters for planning.

Schools represent the largest tax expense. Education quality often links directly to tax levels. Towns with strong schools may have higher rates. Many buyers see this as a fair trade.

When reviewing Southern NH property taxes, school budgets deserve attention. They shape both cost and value.

Fire departments, police, and public works cost money. Town size and layout influence expenses.

Rural towns may spend more per home on roads. Dense towns spread costs across more properties.

Buyers should match lifestyle preferences with service levels. Taxes often reflect those choices.

Comparing taxes requires context. A lower rate does not always mean lower cost. Higher home values can offset savings.

Buyers should compare total tax bills, not just rates. This approach paints a clearer picture.

A local agent can help analyze these differences quickly.

Many southern towns fall into predictable ranges. Suburban towns often sit in the middle. Commuter friendly towns may have slightly higher rates. Access and demand influence budgets.

Understanding these patterns helps buyers set expectations early.

Property taxes usually roll into escrow payments. Lenders collect taxes monthly. This system spreads costs evenly across the year. Buyers should review escrow estimates carefully.

Accurate tax estimates prevent payment shocks later.

Escrow accounts adjust annually. Changes reflect actual tax bills. If taxes rise, payments increase slightly. If taxes drop, buyers may see refunds.

Understanding this cycle reduces stress and confusion.

New Hampshire offers limited exemptions. Seniors and veterans may qualify. Income and residency rules apply. Buyers should ask town offices directly.

Even small exemptions help long term budgets.

Homeowners can appeal assessments. Towns provide clear timelines. If a value seems too high, evidence helps. Comparable sales often support appeals.

Buyers should know this option exists. It empowers homeowners.

Taxes influence buyer demand. Extremely high taxes can slow sales. Balanced taxes paired with strong services attract steady interest.

Southern NH property taxes often support long term value when managed well.

New homes often start with land assessments. Taxes rise after completion. Buyers should plan for higher bills in year two. This step surprises many first time buyers.

Builders and agents can estimate future taxes accurately.

Condos often have lower taxes than single family homes. Shared land lowers assessed value. Buyers should still review association fees. Total costs matter more than one number.

Taxes and fees together shape affordability.

Multi family homes carry higher values. Taxes reflect income potential. Buyers should factor rent into planning. Taxes often remain manageable with cash flow.

Investors watch Southern NH property taxes closely for this reason.

Rural homes may have larger lots. Land value adds to assessment.

However, services may be fewer. Rates sometimes balance out.

Buyers should review full tax bills before deciding.

New Hampshire lacks broad income tax. Property taxes fill the gap. Buyers moving from other states may notice the shift.

Overall cost of living often balances out with careful planning.

Smart buyers plan taxes early. They review town budgets and trends. They also ask questions before making offers. Knowledge builds confidence.

This approach leads to better decisions and smoother closings.

Local agents understand tax nuances. They track changes and patterns. They also explain how taxes affect offers. Guidance saves time and stress.

A trusted agent becomes a key resource.

Listings often show current tax bills. Buyers should read them carefully. Taxes help shape monthly comfort. They deserve equal attention as price.

Southern NH Houses for sale offer variety across many tax ranges.

Every buyer values different things. Some prioritize schools. Others want privacy.

Taxes often reflect these priorities. Balance matters most.

Buyers should choose what fits their life best.

Some buyers ignore taxes until closing. Others assume they will stay flat. Both mistakes create stress. Early review prevents problems.

Asking questions always helps.

Tax rates change yearly. However, trends matter more than spikes. Southern New Hampshire remains stable overall. Growth often spreads costs.

This stability supports confident buying decisions.

Southern NH property taxes may feel complex at first. With clear guidance, they become manageable. Knowledge turns concern into control.

When exploring Southern NH Houses for sale, taxes deserve careful review. They shape comfort, value, and long term plans.

With the right support, buyers can move forward with confidence and peace of mind.

If you need more tips on Southern NH Property taxes, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Many people ask the same question today. Is it cheaper to rent or buy a home? For many buyers, the answer may surprise you. In several markets, it is Cheaper to pay a mortgage than rent. This shift has changed how people think about home ownership, especially in Southern New Hampshire.

Rents continue to rise fast. Meanwhile, home prices have stabilized in many towns. Because of this, monthly mortgage payments now compete with rent costs. In some cases, owning costs less each month than renting. This reality has opened new doors for buyers who once felt priced out.

Let us explore why this is happening, where it applies, and how it affects your next move.

Rent prices have increased year after year. This trend shows no sign of slowing. Landlords face higher taxes, insurance, and maintenance costs. As a result, renters absorb these increases through higher monthly payments.

Also, rental demand remains strong. Many people delayed buying during recent years. Others relocated for work or family reasons. This demand keeps pressure on rental prices across New Hampshire.

In many towns, renters pay more each year but gain no equity. That money leaves their pocket forever. This reality causes many renters to rethink their plans.

At the same time, buying a home looks more attractive. Mortgage rates remain higher than past lows, yet prices have leveled in many areas. Sellers now offer more flexibility. Buyers gain more options and stronger negotiating power.

Also, fixed rate mortgages bring stability. Your monthly payment stays steady over time. Rent, on the other hand, often rises each year. This difference creates long term peace of mind for homeowners.

Because of this shift, it can feel Cheaper to pay a mortgage than rent in many markets today.

Southern New Hampshire stands out in this discussion. The region offers strong schools, convenient highways, and vibrant communities. It also provides better value compared to nearby states.

Many buyers compare rent costs to mortgage payments in towns like Hudson, Litchfield, Merrimack, and Londonderry. In many cases, owning costs the same or less per month.

Litchfield houses for sale attract buyers seeking space, quiet streets, and long term value. Southern NH houses for sale appeal to commuters who want more home for their money.

This combination makes ownership feel attainable again.

Let us break this down in simple terms. A typical rental may cost several thousand dollars each month. That payment covers housing only. It builds no wealth.

Now compare that to a mortgage payment. While the payment includes interest, part of it builds equity. Over time, that equity grows. It becomes a powerful financial tool.

In many cases, the total monthly mortgage payment equals or beats rent. When that happens, the choice becomes clearer for many families.

Equity sets homeowners apart from renters. Each payment moves you closer to full ownership. Over time, equity can fund renovations, future purchases, or retirement goals.

Renters miss this benefit. Each rent payment supports someone else’s investment.

Because of equity growth, it often feels Cheaper to pay a mortgage than rent when looking beyond the monthly number.

Homeownership also brings tax advantages. Many homeowners deduct mortgage interest and property taxes. These benefits can lower your overall cost of ownership.

Renters do not receive these benefits. Their payments offer no financial return.

When you consider these factors together, ownership often wins in the long run.

Renters face uncertainty. Lease renewals bring rent increases. Some renters face non renewals. Others deal with sudden changes.

Homeowners enjoy stability. Fixed payments provide predictability. This stability helps families plan their future with confidence.

That emotional benefit matters as much as the financial one.

First time buyers often assume renting costs less. Today, that assumption no longer holds true.

Many first time buyers qualify for low down payment programs. Some loans require as little as three percent down. Others offer reduced mortgage insurance.

These programs help buyers enter the market sooner. When combined with stable home prices, buying becomes realistic.

As a result, Cheaper to pay a mortgage than rent becomes a real option for new buyers.

Southern NH houses for sale remain strong investments. The area attracts steady demand from buyers and renters alike. This demand supports long term value growth.

Towns across the region continue to improve infrastructure, schools, and services. These improvements protect property values over time.

Buying now allows you to benefit from future appreciation.

Litchfield offers a unique balance. Buyers enjoy a quiet setting with access to nearby cities. Homes often provide larger lots and peaceful neighborhoods.

Many buyers find Litchfield houses for sale priced competitively compared to rental costs. This balance makes ownership appealing.

Families appreciate the sense of community and long term stability.

Homeownership brings freedom. You can paint, renovate, and personalize your space. You can plant gardens or build patios.

Renters face limits. Landlords set rules. Changes often require approval.

This freedom adds value beyond dollars and cents.

Owning a home builds connection. Homeowners invest in their neighborhood. They support local schools, businesses, and events.

This sense of belonging improves quality of life. It also creates lasting memories for families.

Renting often feels temporary. Owning feels permanent.

Short term costs matter. Long term outcomes matter more.

Rent increases over time. Mortgage payments stay steady. Over ten or twenty years, the gap widens.

Eventually, homeowners pay off their loan. Renters never reach that finish line.

This reality highlights why Cheaper to pay a mortgage than rent becomes clearer with time.

While ownership looks appealing, timing still matters. Buyers should understand local market conditions. Prices vary by town and neighborhood.

Working with a local REALTOR helps buyers choose wisely. Professional guidance ensures smart decisions.

Local expertise protects your investment.

Buying includes more than the mortgage payment. Owners pay taxes, insurance, and maintenance. These costs require planning.

However, renters also face hidden costs. Rent increases, moving costs, and lack of stability add up.

When viewed fully, ownership remains competitive.

A REALTOR guides buyers through every step. From pre approval to closing, support matters.

Agents analyze market data, negotiate terms, and explain options. This guidance reduces stress and saves time.

With the right help, buying feels manageable.

Confidence drives good decisions. When buyers understand the numbers, fear fades.

Knowledge empowers action. Buyers move forward with clarity.

That confidence leads to better outcomes.

Many people grew up hearing that renting costs less. Today, that belief no longer fits reality.

Markets change. Conditions shift. Smart buyers adapt.

This mindset shift opens new opportunities.

Southern New Hampshire continues to attract buyers. Proximity to jobs, strong schools, and quality of life drive demand.

Homes here hold value well. Ownership provides security and growth.

That combination appeals to buyers at every stage.

For many families, their home becomes their largest asset. Equity grows steadily. Appreciation adds strength.

This wealth supports future goals. College funding, retirement planning, and lifestyle choices benefit.

Renting does not offer this advantage.

Every situation differs. Some buyers need flexibility. Others seek stability.

Understanding the numbers helps clarify your path. When ownership costs align with rent, the choice becomes easier.

That clarity brings peace of mind.

In many markets today, it truly is Cheaper to pay a mortgage than rent. Rising rents and stable prices support this shift.

Southern New Hampshire offers strong opportunities for buyers. Litchfield houses for sale and Southern NH houses for sale continue to attract smart buyers.

With guidance and planning, ownership becomes both affordable and rewarding.

If you need more info on whether it is cheaper to pay amortgage than rent, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

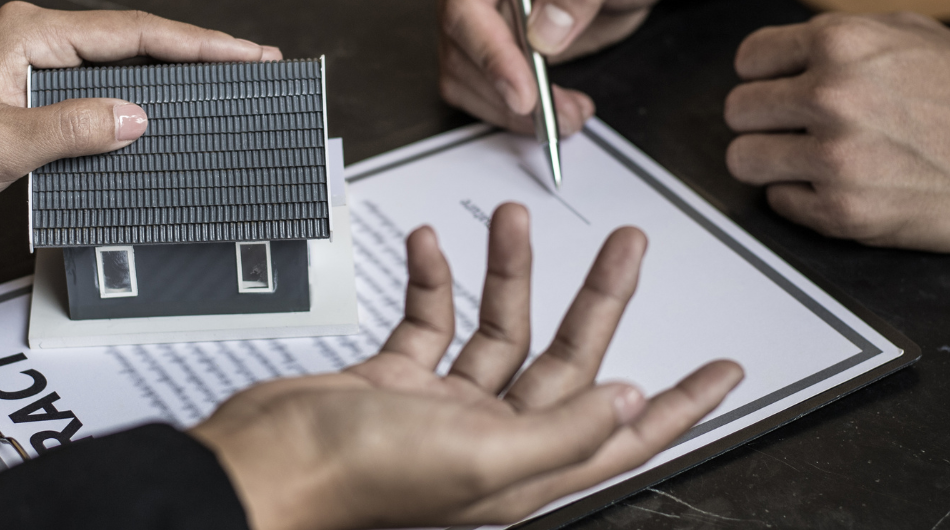

Buying or selling a home should feel exciting. Yet problems can appear when ownership questions arise. Property disputes can create stress, delays, and extra costs. Knowing the risks early helps buyers and sellers feel prepared. This guide explains the most common issues seen in New Hampshire real estate.

When people understand property disputes, they make smarter choices. They ask better questions. They avoid surprises. This knowledge is helpful whether you are buying your first home or selling after many years.

If you are exploring Litchfield houses for sale or Southern NH Houses for sale, these insights can help protect your investment.

Property disputes affect value and peace of mind. They can delay closings. They can even stop a sale.

Buyers want clear ownership. Sellers want smooth transactions. Lenders want certainty. When disputes appear, everyone feels the pressure.

Most disputes can be avoided with good planning. A knowledgeable REALTOR helps spot warning signs early.

New Hampshire has many older homes. It also has rural land and changing boundaries. These factors increase the chance of disputes.

Records may be old. Boundaries may be unclear. Easements may surprise buyers.

Understanding local patterns helps buyers stay confident. Local experience matters.

Boundary issues are very common. Neighbors may disagree on where one yard ends and another begins.

Fences often cause confusion. Driveways may cross property lines. Sheds may sit too close to boundaries.

Surveys help prevent these disputes. A current survey shows exact lot lines.

Before buying, review the survey carefully. Ask questions early.

Boundary property disputes can escalate fast. Clear records reduce risk.

Buyers may inherit disputes from past owners. This creates stress after closing.

A disputed boundary can affect use and value. It may limit future plans.

Lenders may hesitate if boundaries are unclear.

Proper review protects your future enjoyment.

Easements allow others to use part of your property. Common examples include shared driveways and utility access.

Some easements benefit neighbors. Others benefit towns or utility companies.

Problems arise when buyers do not understand these rights.

Easement property disputes often involve access or maintenance.

Easements appear in deeds and plans. They may not be obvious during a showing.

A REALTOR helps explain what easements mean for daily use.

Ask how access works. Ask who maintains shared areas.

Clear understanding prevents future frustration.

Title disputes are serious. They question who truly owns the property.

Old liens or unpaid debts can create problems. Past ownership errors may surface.

Title searches protect buyers. Title insurance adds security.

These steps reduce risk and support confident ownership.

Title problems can delay closing. They can require legal action.

Buyers may feel anxious waiting for resolution.

Strong preparation limits these risks.

This is where professional guidance matters most.

Shared driveways are common in New Hampshire. They work well when agreements are clear.

Problems arise when maintenance expectations differ.

One neighbor may block access. Another may avoid repairs.

These property disputes often strain relationships.

Ask for written agreements. Review maintenance terms.

Understand snow removal duties. Clarify repair costs.

Clear expectations support peaceful living.

Local REALTORS see these issues often.

Disclosure disputes occur after closing. Buyers may feel issues were hidden.

Water problems are common. Septic concerns also arise.

Sellers must disclose known issues honestly.

Inspections protect buyers and sellers.

Trust supports smooth transactions.

Clear disclosures reduce conflict.

Buyers should read reports carefully.

Questions should be asked before closing.

Inspections reveal visible problems.

They support informed decisions.

Buyers can negotiate repairs or credits.

This step builds confidence and clarity.

Surveys show boundaries and easements.

They reveal encroachments early.

Buyers gain peace of mind.

This is especially helpful with Litchfield houses for sale and rural lots.

Some disputes need legal advice.

Attorneys review deeds and agreements.

They help resolve complex issues.

Early review saves time and money.

REALTORS guide buyers through details.

They coordinate with lenders and attorneys.

They explain risks clearly.

Local knowledge makes a difference.

Typical peaceful town with friendly neighbors will help you decide to own a property for sale in South NH

Fast markets create pressure.

Buyers may rush decisions.

Rushing increases risk.

Preparation protects buyers.

Disputes cause stress and worry.

They affect enjoyment of the home.

Clear planning reduces anxiety.

Confidence improves decisions.

Unresolved disputes affect resale.

Future buyers may hesitate.

Value may decline.

Resolution protects investment.

Ask questions early.

Review documents carefully.

Trust professional guidance.

Preparation matters.

Each town has unique records.

Older homes need careful review.

Southern NH Houses for sale vary widely.

Local insight adds value.

Experienced agents spot red flags.

They slow the process when needed.

They protect client interests.

This support builds trust.

Some disputes cannot be resolved quickly.

Walking away may be wise.

Your agent helps evaluate risk.

Your peace matters.

Property ownership should feel secure.

Knowledge reduces risk.

Professional support adds confidence.

With preparation, buyers feel empowered.

If you need more information on property disputes, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Buying a home is exciting. It can also feel overwhelming. Many buyers focus on the down payment first. That makes sense. Yet closing costs savings often surprise buyers at the finish line. Knowing what to expect helps you plan with less stress.

In New Hampshire real estate, closing costs are part of every purchase. They are normal. They are predictable. With the right guidance, they are manageable. This article explains what closing costs are, how much to save, and how to feel prepared.

If you are searching for Litchfield houses for sale or Southern NH Houses for sale, this knowledge will help you move forward with confidence.

Closing costs are the fees paid to complete a real estate transaction. They cover services required to transfer ownership. These costs protect both buyers and lenders.

Closing costs are separate from your down payment. They are due at closing. Buyers should plan for them early.

Common closing costs include lender fees, title services, and prepaid expenses. Each cost has a purpose. Each supports a smooth closing.

Understanding these basics is the first step toward strong closing costs savings.

Closing costs affect your total cash needed. Buyers who plan ahead feel calmer. Buyers who do not plan may feel rushed.

Sellers and lenders expect buyers to be prepared. When funds are ready, deals move forward smoothly.

In competitive New Hampshire real estate markets, preparation matters. Strong planning can make your offer feel more confident.

Closing costs savings are not just numbers. They bring peace of mind.

Every transaction is unique. Still, many costs are common across the state.

Buyers often pay lender origination fees. These cover loan processing. Appraisal fees are also common. They confirm home value.

Title search and title insurance protect ownership rights. Recording fees register the sale with the town.

Prepaid items may include taxes and insurance. These are collected upfront.

Knowing these categories helps buyers plan realistic closing costs savings.

Most buyers ask this question early. That is smart.

In New Hampshire, closing costs often range from two to five percent of the purchase price. The exact amount depends on the loan and property.

A $400,000 home may have $8,000 to $20,000 in closing costs. This range sounds wide. A local REALTOR can narrow it.

Planning ahead helps buyers feel in control. Closing costs savings start with clear estimates.

Loan programs affect closing costs.

Conventional loans may have different fees than FHA or VA loans. Some loans allow lower upfront costs. Others include insurance premiums.

Your lender will explain each fee. Ask questions. Clear answers reduce stress.

Choosing the right loan supports long term comfort and healthy closing costs savings.

Prepaid costs confuse many buyers. They are not extra fees. They are future expenses paid early.

Prepaid items often include homeowners insurance and property taxes. Lenders collect them to ensure payments stay current.

These funds often go into an escrow account. The account pays bills on your behalf.

Knowing this helps buyers understand where their money goes.

Title services protect buyers. They confirm clear ownership.

Title insurance guards against past issues. It protects your investment.

Attorney fees may apply depending on the transaction. Legal review adds another layer of security.

These costs support peace of mind. They also support smart closing costs savings planning.

Lender fees cover loan setup and review.

The appraisal confirms value. It protects buyers and lenders.

Appraisal gaps can create challenges. Knowing this early helps buyers plan.

Strong communication with your lender keeps expectations clear.

Early estimates reduce surprises.

Your lender provides a loan estimate. Review it carefully.

Your REALTOR adds local insight. They explain town specific fees.

Together, these tools guide realistic closing costs savings.

Yes, sometimes.

Seller concessions allow sellers to cover part of the buyer’s costs. This depends on the market and loan type.

In balanced markets, concessions are more common. In hot markets, they are less common.

Your agent will advise what is realistic for Litchfield houses for sale and Southern NH Houses for sale.

Strong offers balance price and terms.

Requesting help with closing costs may affect offer strength. Strategy matters.

Your REALTOR will guide timing and language. Smart negotiation protects your goals.

This planning supports successful closing costs savings.

Many buyers qualify for help.

State and local programs offer assistance. Grants and credits may apply.

Eligibility depends on income and location.

Exploring these options early supports strong financial planning.

Saving feels easier with a plan.

Start with a clear target. Break it into monthly goals.

Automate savings when possible. Small steps add up.

Confidence grows as your account grows.

Some buyers spend savings too early.

Large purchases before closing can cause issues. Lenders review finances carefully.

Keep funds stable. Avoid new debt.

Discipline protects your closing.

Markets move quickly.

Buyers who prepare early feel ready when the right home appears.

Preparation matters in New Hampshire real estate.

Closing costs savings give you flexibility.

Money creates emotion.

Stress fades with preparation.

Confidence replaces worry when plans are clear.

This calm helps buyers make better decisions.

A REALTOR explains costs clearly.

They coordinate with lenders and attorneys.

They help avoid surprises.

Local experience matters.

Every town is different.

Fees vary by location.

Litchfield houses for sale may differ from nearby towns.

Southern NH Houses for sale reflect many micro markets.

Closing day feels exciting.

Final numbers match earlier estimates.

Questions get answered.

Preparation leads to celebration.

Buying a home is a big step.

Preparation builds confidence.

Closing costs savings protect your peace of mind.

With the right plan, buying feels rewarding.

If you need more information on closing costs savings, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Saving money on energy bills is a priority for many homeowners. People who enjoy low energy bills often follow simple strategies that make a big difference. This article explores 10 secrets to help you reduce energy costs, improve efficiency, and maintain comfort in your home. These tips are especially helpful for homeowners in Litchfield and other areas with Southern NH houses for sale.

Energy efficiency is not just about saving money. It also increases your home’s value and comfort. Homes that are energy efficient are appealing to buyers. If you are looking for Litchfield houses for sale or Southern NH houses for sale, energy-saving features can make a property stand out. Let’s explore how homeowners keep their energy bills low.

One of the biggest secrets of people with low energy bills is using a smart thermostat. Smart thermostats automatically adjust temperature settings to save energy. You can program them for heating in winter and cooling in summer.

Homeowners can set the thermostat lower in winter when they are sleeping or away. In summer, you can raise it slightly while you are not home. This saves money without sacrificing comfort. Smart thermostats are easy to install and work in most homes in Southern NH houses for sale.

Insulation plays a major role in maintaining energy efficiency. People with low energy bills make sure their walls, attics, and basements are well insulated.

Insulation reduces heat loss in winter and keeps homes cool in summer. It prevents drafts and ensures the heating and cooling system works efficiently. Litchfield houses for sale with updated insulation are often more appealing to buyers. Proper insulation is a long-term investment that pays off with lower energy bills.

Air leaks can increase energy costs significantly. Homeowners with low energy bills often check windows and doors for drafts.

Sealing gaps with weatherstripping or caulking keeps warm or cool air inside. Double-pane or energy-efficient windows also reduce heat transfer. These upgrades are especially useful for Southern NH houses for sale, where winters can be harsh and summers warm. A sealed home is not only comfortable but also saves money year-round.

People with low energy bills never ignore their heating and cooling systems. Regular maintenance is key.

Changing filters, cleaning ducts, and scheduling professional tune-ups ensures HVAC systems work efficiently. Dirty or clogged systems use more energy to heat or cool your home. Litchfield houses for sale with well-maintained HVAC systems are more attractive to buyers. Preventive maintenance reduces the chance of costly repairs and helps keep bills low.

Lighting can contribute to energy bills more than most homeowners realize. People with low energy bills often replace traditional bulbs with LED lights.

LED bulbs use less electricity and last longer than incandescent or fluorescent bulbs. They are available in warm or cool tones and can enhance the ambiance of your home. For Southern NH houses for sale, modern LED lighting can be a selling point. Simple swaps like these save money and make your home more energy efficient.

Another secret is how homeowners use appliances. People with low energy bills make sure to use energy-efficient appliances and operate them wisely.

Run dishwashers and washing machines with full loads. Avoid using appliances during peak energy hours if possible. Look for Energy Star-rated appliances when buying or upgrading. In Litchfield houses for sale and other Southern NH homes, energy-efficient appliances add value and reduce monthly costs.

Water heating is one of the largest energy expenses. Homeowners with low energy bills often lower their water heater temperature.

Most families do not need water hotter than 120 degrees Fahrenheit. Insulating water heaters and pipes reduces heat loss. Tankless water heaters or high-efficiency models also save energy. Energy-conscious homes in Southern NH houses for sale often highlight water-saving features to buyers.

Proper ventilation helps maintain a comfortable home while keeping energy costs low. People with low energy bills use ventilation to balance airflow and humidity.

Exhaust fans in bathrooms and kitchens prevent moisture buildup, which can make heating or cooling less efficient. In Southern NH houses for sale, homes with proper ventilation feel fresher and healthier. Ventilation, combined with insulation and sealed windows, ensures energy efficiency year-round.

Strategic landscaping can help reduce energy bills. Homeowners with low energy bills often plant trees and shrubs to provide shade in summer.

Deciduous trees block sunlight in summer but allow sun in winter. Shrubs around the foundation act as windbreaks, reducing heat loss. Litchfield houses for sale with well-planned landscaping benefit buyers by reducing utility costs and enhancing curb appeal. Thoughtful outdoor planning saves energy and increases home value.

Finally, behavior plays a key role. People with low energy bills are aware of their energy usage and make conscious decisions daily.

They turn off lights when leaving a room. They unplug devices not in use. They monitor energy bills and make adjustments when necessary. In Southern NH houses for sale, homes that are energy conscious attract buyers looking for long-term savings. Awareness and small lifestyle changes complement other energy-saving strategies.

Homeowners in Litchfield and other Southern NH areas face seasonal energy challenges. Winter heating is a major expense. Summer cooling can also add up. Here are a few additional tips to maintain low energy bills year-round:

Use programmable thermostats for seasonal adjustments.

Close curtains at night to retain heat.

Open curtains during the day in winter for natural warmth.

Use ceiling fans to circulate air in summer and winter.

Schedule energy audits for older homes.

These small actions, combined with the 10 secrets above, can significantly lower your energy bills. Homes with these features and practices often sell faster and for higher value.

Energy efficiency is a selling point. Buyers in Litchfield and across Southern NH often look for homes with low utility costs. Homes with updated insulation, HVAC, appliances, and lighting are more attractive.

Homes with low energy bills appeal to buyers who want long-term savings. Real estate agents often highlight energy-saving features in listings for Southern NH houses for sale. Buyers are willing to pay more for homes that reduce monthly expenses and offer modern comfort.

Saving energy is not complicated. People with low energy bills combine smart technology, proper maintenance, and thoughtful habits. They use smart thermostats, maintain HVAC systems, insulate their homes, seal drafts, and choose efficient appliances. They also decorate and landscape strategically, manage ventilation, and stay aware of their energy usage.

For homeowners in Litchfield and Southern NH, these strategies not only reduce costs but increase comfort. They make homes more appealing for buyers. Selling a home with energy-saving features can be faster and more profitable.

Whether you are buying or selling a home in Southern NH houses for sale or Litchfield houses for sale, energy efficiency is a key feature to consider. Implement these strategies to lower your bills, improve comfort, and increase your home’s value.

If you need more tips on low energy bills, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Buying a home can feel like chasing a dream, especially in competitive areas like Litchfield or Southern NH. But it doesn’t have to be just a dream. With the right plan, you can win your dream home and make it a reality.

Finding the perfect property is exciting, yet challenging. With so many buyers in the market, having a strategy can make the difference between missing out and getting your ideal home. Today, we’ll cover five ways to win your dream home, from smart preparation to making offers that stand out.

The first step to win your dream home is knowing what you can afford. Getting pre-approved for a mortgage gives you confidence and credibility.

Pre-approval shows sellers you are serious and financially ready. It also helps you avoid disappointment when you fall in love with a home outside your budget.

In markets like Southern NH, homes move quickly. Buyers who are not pre-approved risk losing out. By getting pre-approved, you can act fast when a property you love becomes available.

Real estate agents also recommend sharing your pre-approval with your agent. This allows them to present offers with confidence. You’ll know exactly which Litchfield houses for sale or Southern NH houses for sale fit your budget.

A knowledgeable local REALTOR® is invaluable when trying to win your dream home. They know the neighborhoods, the current market trends, and which homes are likely to sell fast.

A skilled agent can alert you to new listings before they hit the general market. They can also guide you on making competitive offers without overpaying.

When buying Litchfield houses for sale or exploring Southern NH houses for sale, a local agent helps you navigate bidding wars and negotiate terms that protect your interests.

Beyond just showing homes, your agent becomes your advocate. Their experience can prevent mistakes and help you win a home that matches your needs and lifestyle.

In a hot market, sellers often receive multiple offers. To win your dream home, your offer needs to stand out.

Consider offering a strong earnest money deposit. This shows your commitment and gives the seller confidence in your seriousness. Keep contingencies realistic but protective. A clean, straightforward offer often appeals to sellers more than a complex one.

Your agent can also advise on personal touches, like a heartfelt letter to the seller. Many sellers appreciate knowing the home will be loved and cared for. These small touches can tip the balance in your favor.

For buyers competing for Litchfield houses for sale or Southern NH houses for sale, making your offer stand out can be the difference between getting the home and losing it.

Timing is critical when you want to win your dream home. Once you find a property you love, hesitation can cost you the deal.

Be prepared to tour homes promptly and make offers without delay. Keep your documents ready and maintain open communication with your agent.

Homes in Southern NH and Litchfield often sell within days of listing. Acting quickly shows the seller that you are serious and organized.

Flexibility can also help. If possible, accommodate the seller’s preferred closing date or terms. This shows cooperation and can give your offer an edge over others.

While it might sound counterintuitive, knowing when to step back is crucial to win your dream home. Sometimes, a home isn’t the right fit financially, emotionally, or logistically.

Being prepared to walk away keeps you from overpaying or making compromises you’ll regret. Trust your agent’s guidance and your instincts.

The real estate market always presents new opportunities. If you miss one home, another one may soon meet all your criteria. Staying patient and focused is part of winning the home that truly fits your lifestyle.

Beyond these five core strategies, there are a few additional ways to increase your odds:

Know Your Neighborhood: Research schools, amenities, and commute times. Buyers looking at Southern NH houses for sale often prioritize location as much as the home itself.

Plan Your Finances: Keep credit and debt in check to ensure a smooth mortgage approval.

Inspect Wisely: Schedule inspections quickly but carefully. Addressing concerns upfront can prevent delays.

Leverage Your Agent’s Network: Your agent may know about off-market properties or upcoming listings.

Stay Calm: Buying a home can be emotional. Staying level-headed helps you make smart, confident decisions.

When trying to win your dream home, local knowledge makes a big difference. Neighborhoods in Litchfield and Southern NH each have unique characteristics. Knowing school districts, local parks, traffic patterns, and community culture can influence your decision.

Your agent can also advise on pricing trends and which homes are likely to attract multiple offers. This insider knowledge helps you prepare offers strategically and stay competitive in the market.

Buying your dream home is exciting and emotional. You’re not just purchasing a property; you’re investing in your lifestyle and future.

Take the time to visualize your life in each home. Picture morning routines, family gatherings, and weekend relaxation. Emotional connections often guide decision-making, but balance it with practical considerations like budget and location.

Being aware of your emotional priorities can help you focus on homes that truly match your needs while avoiding impulsive decisions.

To win your dream home, financial preparation is key. Here’s what to do:

Save for a Down Payment: The larger your down payment, the stronger your offer appears.

Keep Credit Healthy: Check your credit score and address any issues before house hunting.

Budget for Closing Costs: Don’t forget taxes, insurance, and other fees.

Consider Future Costs: Maintenance, utilities, and renovations are part of owning your dream home.

Being financially ready allows you to act confidently and submit competitive offers without hesitation.

Sometimes, it’s not just the numbers but the strategy that helps you win your dream home. Consider:

Offering a flexible closing date.

Avoiding unnecessary contingencies that could delay the sale.

Including a personal letter to the seller explaining why you love their home.

Being prepared with backup offers in case your first choice falls through.

Strategic offers show sellers you are organized, serious, and committed. In markets like Litchfield and Southern NH, that can make a big difference.

When trying to win your dream home, some mistakes can derail the process:

Overbidding beyond your budget.

Ignoring inspection reports.

Waiting too long to make an offer.

Failing to research the neighborhood.