Category Archives for "Londonderry NH"

Buying a home today can feel overwhelming. Interest rates are changing, inventory is limited, and competition is high. However, there are smart ways to get ahead. In this article, we will explore 4 ways home buyers can win in the current New Hampshire housing market. Whether you are searching for Londonderry houses for sale or Southern NH houses for sale, these strategies can help you save money, gain flexibility, and find the right property.

Renovation financing allows buyers to purchase a home and make upgrades with a single loan. This is especially helpful if a home needs repairs or updates before it feels like your perfect space. Instead of spending extra cash out-of-pocket, renovation loans let you roll costs into your mortgage.

Why it works: Homes that need updates often have less competition. With renovation financing, you can transform a fixer-upper into your dream home. Buyers can increase value while creating a home that fits their style and lifestyle.

Tip: Programs like FHA 203k and Fannie Mae HomeStyle loans are popular choices. Work with a mortgage professional to understand requirements, interest rates, and project limits.

Transition phrase: Furthermore, renovation financing gives buyers flexibility in choosing homes that other buyers might overlook.

A seller credit can help home buyers reduce monthly payments by negotiating closing costs and interest rate points. Many sellers are open to credits in a competitive market, especially if it helps close the deal faster. This approach is ideal for buyers who want to manage upfront costs while keeping payments manageable.

How it works: Buyers can ask sellers to contribute to mortgage points or closing costs. These contributions lower the effective interest rate and reduce monthly expenses.

Tip: Always work with a skilled real estate agent to calculate the long-term savings. Negotiating seller credits can make a significant difference when purchasing homes in Southern NH or Londonderry.

Transition phrase: In addition, seller credits can provide more financial breathing room for buyers who want to invest in renovations or furnishings.

Investing in a 2-4 unit property can be a smart strategy for home buyers. FHA loans allow buyers to purchase multi-family homes with just a 3.5 percent down payment. This can be a game-changer for first-time buyers who want to offset mortgage costs with rental income.

Benefits: Living in one unit while renting the others helps cover the mortgage. This approach builds equity faster and allows buyers to start generating income immediately.

Tip: Carefully evaluate rental potential, property condition, and local rental laws. Working with an agent familiar with Southern NH rental markets can help you make the right choice.

Transition phrase: Moreover, buying a multi-unit property gives buyers flexibility and the potential for long-term financial growth.

Down payment assistance programs help buyers who struggle to save for upfront costs. These programs can provide grants or low-interest loans to cover down payments or closing costs. First-time buyers, veterans, and low to moderate-income households often qualify.

How it works: Each program has eligibility requirements based on income, location, or home type. Using these programs can make the difference between qualifying for a home and continuing to rent.

Tip: Check local programs in New Hampshire. Some assistance is available for Londonderry houses for sale and other Southern NH towns. Combining down payment assistance with renovation financing or seller credits can maximize savings.

Transition phrase: Additionally, buyers using down payment assistance often gain the confidence to compete in a competitive market without compromising financial stability.

The current New Hampshire housing market requires creativity and knowledge. Buyers who use renovation financing, seller credits, multi-unit purchases, and down payment assistance can overcome challenges. These strategies provide financial leverage, reduce risk, and help buyers secure the home they want.

When exploring Londonderry houses for sale or Southern NH houses for sale, these tools allow buyers to act quickly and confidently. Rather than paying full retail or settling for a home that does not meet needs, strategic buyers can create opportunities to win.

Navigating financing, negotiations, and property options can be overwhelming. Partnering with an experienced real estate agent is critical. They can guide you through loan programs, negotiate seller credits, and identify properties with rental potential.

Tip: Choose an agent familiar with Southern NH and Londonderry real estate. Their knowledge of local markets, schools, and neighborhoods ensures buyers make informed decisions.

Buying a home today requires strategy, creativity, and expert guidance. Using renovation financing, seller credits, multi-unit properties with 3.5 percent down, and down payment assistance allows buyers to save money and gain long-term advantages.

These four strategies give buyers confidence in a competitive market. Whether you are looking at Londonderry houses for sale or Southern NH houses for sale, knowing your options makes a real difference. Act smart, leverage available resources, and position yourself to win.

Are you ready to explore NH homes with confidence? Contact a local real estate professional to learn more about financing options, down payment assistance, and strategies to win in today’s market.

If you need more tips on WAYS HOME BUYERS CAN WIN, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Are you thinking about tackling home renovations yourself? It can be tempting to save money by doing it yourself. However, some jobs are better left to the pros. Handling complex work without proper experience can cost more in the long run. In this guide, we will explore DIY projects better left to the pros to keep your home safe and maintain its value. This advice is especially useful if you are selling your home in New Hampshire, whether you are checking out Londonderry houses for sale or Southern NH houses for sale.

Electrical projects are one of the most dangerous DIY tasks. Even small mistakes can lead to fire hazards or serious injuries. Licensed electricians have the knowledge to handle wiring safely. They know local codes, which is essential if you plan to sell your home. Attempting electrical work on your own can also void your homeowner insurance in some cases. Instead of risking your safety and your home’s value, hire a professional.

Tip: Simple upgrades like changing light bulbs or swapping out fixtures are safe for homeowners. But rewiring, installing outlets, or working on the breaker box should always be left to a licensed electrician.

Plumbing may seem straightforward, but it can quickly become overwhelming. Mistakes in plumbing can lead to water damage, mold, and expensive repairs. Leaking pipes or improperly installed water heaters can ruin your home’s structure. Licensed plumbers have the tools and experience to fix complex plumbing issues correctly.

Tip: Homeowners can handle minor tasks such as replacing a faucet washer or unclogging drains. Anything beyond that, including pipe replacement or bathroom remodels, should be left to the pros.

Your roof protects your entire home from weather damage. Working on a roof is extremely risky and requires proper safety measures. Even small errors in installation can lead to leaks and costly repairs. Professional roofing contractors know how to select materials, apply them correctly, and meet local building codes.

Tip: Simple gutter cleaning or minor shingle replacements may be safe with caution. Full roof repairs or replacements require expert knowledge to avoid disasters.

Heating and cooling systems are complex and vital for home comfort. Incorrect installation or repair can reduce system efficiency or cause dangerous gas leaks. HVAC technicians are trained to handle furnaces, air conditioners, and ductwork safely. This ensures your system runs efficiently and protects your home’s air quality.

Tip: Homeowners can replace filters or clean vents, but do not attempt furnace or AC repairs. These systems are too complex and carry safety risks.

Making structural changes, such as removing walls or expanding rooms, requires careful planning. Even seemingly minor changes can affect your home’s foundation and overall stability. Structural mistakes can be very costly and dangerous. Licensed contractors and engineers can ensure that renovations are safe and compliant with building codes.

Tip: Cosmetic updates like painting, decorating, or minor flooring changes are safe for DIY. But never remove load-bearing walls or alter your home’s frame without professional guidance.

Installing floors can look simple, but mistakes can result in uneven surfaces, squeaks, or long-term damage. Professionals know how to prepare subfloors, choose the right materials, and install them efficiently. Proper installation increases durability and helps maintain your home’s value.

Tip: DIY-friendly flooring projects include laminate or vinyl click systems that are easier to manage. Hardwood or tile installation is best left to the pros to ensure longevity.

Attempting complex projects without experience can be risky, expensive, and stressful. Professionals bring safety, quality, and efficiency to renovations. Moreover, when selling your home, buyers notice quality workmanship. Poor DIY jobs can decrease home value and even deter potential buyers. If you are exploring Londonderry houses for sale or Southern NH houses for sale, keeping your home in top condition is crucial. Hiring the right contractors ensures your investment pays off.

Look for licensed and insured contractors with strong reviews and local experience. Ask for references and examples of previous work. Clear communication and written contracts protect both you and the contractor. It is worth spending time finding the right professional to save headaches later.

While DIY projects can be rewarding, some tasks are simply better left to the pros. Electrical work, plumbing renovations, roof repairs, HVAC maintenance, structural changes, and major flooring installation require expert skills. By leaving these projects to licensed professionals, you protect your home, your family, and your wallet.

Whether you are preparing to sell your home or simply want to maintain its value, professional help can make all the difference. Explore Londonderry houses for sale or Southern NH houses for sale with confidence, knowing your home is in excellent condition.

Are you ready to make smart, safe home upgrades? Contact local licensed contractors for guidance. Protect your home, improve its value, and make your living space comfortable and beautiful.

If you need more tips on DIY projects better left to the pros, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

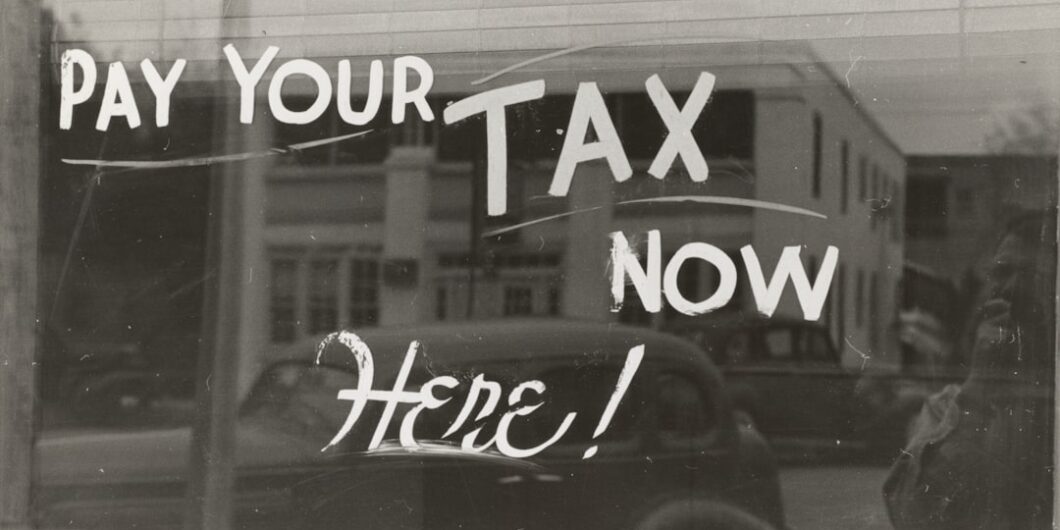

Property taxes can be stressful, especially if your bill feels too high. Many homeowners wonder, “How do you challenge a high property tax assessment?”

Whether you live in Londonderry or are looking at other Southern NH houses for sale, understanding the process can save you thousands. By following a few steps, you can ensure your home is fairly valued and your taxes are accurate.

Here’s a comprehensive guide to challenging your property tax assessment effectively.

Before you can challenge a high property tax assessment, you need to know how it works.

Property taxes are based on the assessed value of your home.

Local tax rates multiply your assessment to determine your annual bill.

Errors in square footage, property features, or comparable sales can increase assessments unfairly.

Knowing the details ensures your challenge is well-informed and effective.

Every homeowner receives an assessment notice. To challenge a high property tax assessment:

Check the recorded square footage and lot size.

Confirm details like number of bedrooms, bathrooms, and amenities.

Note discrepancies or errors that could lower the assessed value.

Accurate documentation makes your case stronger when speaking with your local assessor.

Comparable homes provide a benchmark. To challenge a high property tax assessment:

Look for recent sales of similar homes in Londonderry or Southern NH.

Compare features like square footage, age, and lot size.

Note if neighbors with similar homes pay less in property taxes.

This comparison proves whether your assessment is too high.

Strong evidence is critical when you challenge a high property tax assessment.

Take photos of your home, noting any wear or needed repairs.

Collect recent appraisals or market analyses.

Include comparable sales data and local property tax records.

Documenting facts ensures your appeal is persuasive and credible.

Start by speaking with your town or city assessor. To challenge a high property tax assessment effectively:

Request clarification on how your property was assessed.

Present your evidence politely and professionally.

Ask if informal adjustments are possible before filing a formal appeal.

Many assessment errors are corrected at this stage without going to a formal hearing.

If your informal approach doesn’t work, you can file an official appeal. Steps include:

Submit forms and supporting documents by your town’s deadline.

Attend a hearing to present your case.

Be concise, factual, and professional in your presentation.

Understanding the procedure ensures you don’t miss important deadlines.

During your appeal, organization is key. To challenge a high property tax assessment:

Start with the assessment facts and discrepancies.

Highlight comparable sales that show your home is overvalued.

Use photos, appraisals, and evidence to support your case.

A clear, logical presentation increases your chances of success.

Assessors or boards may ask questions. To challenge a high property tax assessment:

Be prepared to explain differences in property features.

Clarify repairs, maintenance issues, or neighborhood conditions.

Stay calm and factual during questioning.

Professionalism and preparation help you present a strong case.

Some homeowners hire property tax consultants or real estate agents. Benefits when you challenge a high property tax assessment:

Professionals know local procedures and deadlines.

They can gather and present evidence more efficiently.

Experienced agents understand market trends in Southern NH, including Londonderry houses for sale.

Professional guidance can make appeals faster and more successful.

Documentation matters. To challenge a high property tax assessment effectively:

Save copies of forms, emails, and correspondence.

Keep notes from conversations with assessors or consultants.

Record all deadlines and submissions.

Good records protect you in case of disputes or future appeals.

Every NH town has rules for property tax appeals. To challenge a high property tax assessment:

Review state and local property tax regulations.

Know deadlines for filing appeals.

Understand the appeals board process and hearing format.

Knowledge of laws gives homeowners confidence during the appeal process.

Condition affects value. When you challenge a high property tax assessment:

Show evidence of needed repairs or outdated systems.

Document exterior and interior maintenance issues.

Mention neighborhood factors that may lower property value.

Highlighting these issues supports a lower assessed value for your home.

Comparables are critical. To challenge a high property tax assessment:

Compare your home to similar nearby properties.

Focus on sales within the last year.

Include properties with similar size, age, and amenities.

This approach makes your appeal objective and data-driven.

Each town may have unique procedures. When you challenge a high property tax assessment:

Learn the board’s rules for submitting evidence.

Understand hearing formats and how to present your case.

Know the voting process and decision timeline.

Being informed avoids mistakes that could weaken your appeal.

A concise written summary strengthens your appeal. To challenge a high property tax assessment:

Summarize errors in your assessment.

Highlight supporting evidence like comparables and appraisals.

Keep the summary clear, factual, and persuasive.

This summary ensures the board understands your case quickly.

Your appearance matters. To challenge a high property tax assessment:

Dress professionally.

Bring all evidence organized.

Speak calmly and clearly.

Professional presentation can positively influence the outcome.

Sometimes, assessors offer compromises. To challenge a high property tax assessment:

Ask if adjustments can be made before a formal decision.

Negotiate using your evidence and comparable sales.

Accept reasonable reductions to avoid lengthy appeals.

Negotiation can save time and reduce stress for Southern NH homeowners.

Outcomes vary. When you challenge a high property tax assessment:

Full reduction to fair market value.

Partial reduction with some relief.

Denial of appeal, requiring payment as assessed.

Knowing possibilities helps set realistic expectations.

Even after an appeal, preparation matters. To challenge a high property tax assessment in the future:

Keep updated records of property improvements or damages.

Monitor sales of similar homes in your neighborhood.

Regularly review your assessment notice for accuracy.

Proactive planning reduces the risk of overpaying in the future.

A knowledgeable REALTOR can guide you. To challenge a high property tax assessment:

Use your agent’s market knowledge to gather comparables.

Get advice on timing and appeal strategy.

Leverage your agent’s experience with Southern NH and Londonderry houses for sale.

A REALTOR adds insight, professionalism, and local expertise to your appeal.

Property taxes can feel overwhelming, but homeowners have tools to protect themselves. To challenge a high property tax assessment:

Review your notice carefully.

Gather strong evidence, including comparables and appraisals.

Contact your assessor and consider a formal appeal.

Attend hearings professionally and consider professional guidance.

Whether you own Londonderry houses for sale or other Southern NH properties, these steps ensure your taxes are fair, accurate, and reflective of your home’s true value.

If you need more information on how to challenge a high property tax assessment, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Technology is changing how we buy and sell homes. As a REALTOR in New Hampshire, it’s essential to know the tech trends you should be watching.

From virtual tours to smart home devices, these trends are reshaping the Southern NH housing market. Whether you’re listing Londonderry houses for sale or exploring other local properties, staying informed helps you attract buyers and close deals faster.

Here’s a deep dive into four tech trends that are making a big impact in real estate today.

Virtual tours have become more than a luxury. They’re essential. To stay ahead, you need to embrace the tech trends you should be watching.

3D walkthroughs: Allow buyers to explore homes from their devices.

Interactive floor plans: Show room sizes and layouts clearly.

360-degree photos: Let viewers see every angle of a space.

For Southern NH houses for sale, virtual tours make listings accessible to remote buyers. People relocating to Londonderry or nearby towns can explore homes without leaving their current city.

Virtual experiences create excitement, save time, and reduce unnecessary in-person visits, making it easier to close deals.

Homebuyers increasingly expect tech ready homes. Among the tech trends you should be watching are smart devices that enhance safety, comfort, and convenience.

Smart thermostats: Control heating and cooling remotely.

Security systems: Video doorbells and cameras improve peace of mind.

Smart lighting and appliances: Offer energy savings and modern appeal.

Highlighting these features can make Londonderry houses for sale stand out in listings. Buyers, especially younger generations, value homes that integrate technology seamlessly into daily life.

Smart homes aren’t just cool—they increase perceived value and attract tech-savvy buyers.

AI isn’t just for tech companies. It’s shaping real estate too. To understand the tech trends you should be watching, consider how AI helps:

Predict market trends and property values

Match buyers with homes based on preferences

Streamline lead generation for REALTORS

For sellers of Southern NH houses for sale, AI tools provide insights into the best listing strategies. Buyers get personalized recommendations, making the search faster and more accurate.

AI improves efficiency, marketing effectiveness, and decision-making in today’s competitive housing market.

Online marketing has never been more critical. Among the tech trends you should be watching are advanced digital tools for listing promotion.

Targeted social media ads: Reach the right buyers for specific homes.

Email campaigns and newsletters: Keep prospects engaged with updates.

SEO-optimized listings: Ensure your home shows up in search results.

Using these tools for Londonderry houses for sale and other Southern NH properties boosts visibility and attracts motivated buyers.

Digital marketing not only showcases homes but also strengthens your reputation as a tech-savvy REALTOR.

Understanding these four trends helps sellers and REALTORS in multiple ways:

Faster sales: Tech increases exposure and engagement.

Better buyer experiences: Virtual and smart home tools improve satisfaction.

Higher offers: Homes that appear modern and convenient often command more interest.

Efficient marketing: AI and digital tools save time and target the right audience.

For Southern NH homeowners, integrating these technologies can transform a standard listing into a standout property.

To apply the tech trends you should be watching effectively:

Include virtual tours in your MLS listings.

Highlight smart home features in marketing materials.

Use AI tools to identify potential buyers.

Promote homes through social media campaigns and SEO-optimized posts.

By combining these trends, REALTORS make Londonderry houses for sale more attractive and competitive in a crowded market.

Visual content remains king. Even with AI and virtual tours, professional photos and videos are essential.

High-resolution images capture details buyers love.

Drone footage showcases property size, yard, and neighborhood.

Short video walkthroughs engage social media audiences effectively.

These tools complement other tech trends you should be watching, making every listing more compelling.

Millennials and Gen Z buyers search on smartphones first. To leverage tech trends you should be watching:

Ensure websites and listings are mobile friendly.

Enable easy contact forms and click-to-call buttons.

Optimize photos and videos for smaller screens.

For Southern NH houses for sale, mobile accessibility ensures you don’t miss a single buyer browsing online.

The pandemic accelerated virtual events, and they remain popular. To embrace tech trends you should be watching:

Schedule live stream open houses via social media.

Engage viewers with Q&A sessions.

Offer recorded tours for those who cannot attend live.

Virtual open houses attract out-of-state buyers and busy locals looking at Londonderry houses for sale.

Energy-conscious buyers are drawn to homes that save money and reduce environmental impact.

Smart thermostats, lighting, and water systems improve efficiency.

Solar panel integration appeals to eco-minded buyers.

Energy monitoring apps track usage and costs.

These features align with modern expectations and are part of the tech trends you should be watching for Southern NH real estate.

AI tools help agents price homes accurately and attract offers faster.

Predictive analytics provide competitive market insights.

Automated valuation models estimate fair market value.

AI helps identify trends in buyer preferences.

Sellers of Londonderry houses for sale can use these insights to adjust pricing strategy confidently.

Technology enables buyers to research agents and neighborhoods thoroughly.

Collect reviews on Google, Zillow, and social platforms.

Showcase testimonials in listing promotions.

Highlight positive buyer experiences in email campaigns.

Online credibility complements other tech trends you should be watching.

VR and AR tools are increasingly used for home tours.

AR apps let buyers visualize furniture placement.

VR headsets provide immersive property walkthroughs.

Both tools enhance buyer engagement and excitement.

These tools are particularly effective for remote buyers interested in Southern NH houses for sale.

Emerging technology in real estate isn’t just marketing.

Blockchain improves security in transactions.

Digital contracts streamline offers and closings.

Transparency increases buyer trust and speeds up processes.

Understanding these tech trends you should be watching keeps REALTORS ahead in efficiency and innovation.

To fully leverage these tech trends:

Stay updated with new tools and apps.

Train staff and clients on how to use tech features.

Incorporate tech highlights into every listing description.

Use analytics to measure marketing effectiveness.

By adopting these strategies, REALTORS selling Londonderry houses for sale and Southern NH properties can outperform competitors.

Technology will continue evolving in real estate. To stay competitive, focus on:

Integrating AI and VR seamlessly into buyer experiences.

Highlighting smart home capabilities in every listing.

Using predictive analytics for pricing and marketing strategy.

Embracing mobile first and social media trends.

Keeping up with tech trends you should be watching ensures your listings stay relevant and attractive.

The real estate market is changing fast. Understanding the tech trends you should be watching helps REALTORS sell homes efficiently and attract motivated buyers.

Virtual tours and 3D experiences engage buyers anywhere.

Smart home technology enhances value and appeal.

AI and predictive analytics optimize marketing and pricing.

Digital marketing, social media, and VR bring listings to life.

Whether you’re selling Londonderry houses for sale or other Southern NH homes, adopting these trends gives your listings a competitive edge.

If you need more tips on real estate tech trends you should be watching, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Winter in New Hampshire can get harsh. If your heating system fails, it’s important to know what to do if your heat stops working.

A non-working heater isn’t just uncomfortable—it can be dangerous, especially for children, pets, or elderly residents. Homeowners in Southern NH, whether looking at Londonderry houses for sale or managing their current property, need clear steps to stay safe and warm.

This guide walks you through quick fixes, emergency solutions, and preventive tips to handle heating problems effectively.

The first step in handling a heating failure is staying calm. To know what to do if your heat stops working, do this:

Check if the thermostat is on and set to heat.

Confirm the circuit breaker hasn’t tripped.

Look for pilot light issues on older furnaces.

Sometimes, the solution is simple, but early assessment prevents panic.

Many heating issues are caused by thermostat problems. To understand what to do if your heat stops working, examine:

Temperature setting: make sure it’s higher than room temperature.

Mode selection: set to “heat,” not “cool.”

Batteries: replace if necessary.

Correcting a thermostat issue is a fast way to restore warmth without calling a technician.

Your heating system itself might need attention. Steps include:

Checking filters for clogs that block airflow.

Ensuring vents and registers are open and unobstructed.

Resetting the system if a reset button is available.

Regular maintenance helps prevent future issues, especially in Southern NH houses for sale where winter can be long and cold.

If your heater still isn’t working, check power sources. To know what to do if your heat stops working:

Confirm breakers haven’t tripped.

Check fuses or switch settings.

Ensure the system is plugged in and receiving electricity.

Power interruptions are common causes of heating failure.

While waiting for repair, temporary solutions keep you warm. Options include:

Space heaters with safety certifications.

Layered clothing and blankets.

Closing unused rooms to focus heat where it’s needed.

Always supervise portable heaters and follow manufacturer safety instructions.

For gas or oil systems:

Confirm the gas supply is active.

Make sure oil tanks are full.

Inspect pilot lights and ignition systems.

Understanding fuel status is essential when deciding what to do if your heat stops working safely.

If basic checks don’t work, call a professional. Consider:

Licensed HVAC technicians in Southern NH.

Booking service promptly to avoid prolonged exposure to cold.

Asking for emergency or same-day service if temperatures are low.

Technicians can diagnose issues you can’t fix safely on your own.

A heating outage risks frozen pipes. To know what to do if your heat stops working, take these steps:

Keep water dripping in faucets to prevent freezing.

Open cabinet doors near plumbing to allow heat circulation.

Use insulated covers for vulnerable pipes.

Preventive actions save costly repairs later.

Smart thermostats and remote monitoring can help. For what to do if your heat stops working:

Check smart apps for error messages.

Reset systems remotely if supported.

Receive alerts if temperatures drop dangerously low.

Smart home technology makes winter safety more manageable.

Being prepared helps during heating failures. Supplies include:

Flashlights and extra batteries.

Blankets, sleeping bags, and warm clothing.

Non-electric food and water options.

Homeowners in Londonderry houses for sale or other Southern NH homes benefit from preplanning for winter emergencies.

If you rent or have others at home:

Inform tenants or family immediately.

Discuss temporary safety measures.

Coordinate to keep everyone warm and safe.

Communication is key when deciding what to do if your heat stops working.

Proper maintenance prevents future outages. To avoid repeating issues:

Schedule annual furnace or boiler inspections.

Replace air filters every 1–3 months.

Clean ducts and vents to improve airflow.

Proactive care ensures Southern NH homes stay comfortable all winter.

Before a complete failure, your system may show symptoms. Watch for:

Unusual noises like banging, whistling, or rattling.

Weak airflow or inconsistent temperature.

Strange smells such as burning or gas odors.

Catching problems early reduces the risk of emergencies.

For older homes or large spaces:

Radiant floor heaters or baseboard systems add comfort.

Pellet stoves or electric fireplaces provide safe alternative heat.

Space heaters for specific rooms help manage energy costs.

Supplemental heat keeps homes livable until your main system is restored.

Unexpected outages can cause damage. To know what to do if your heat stops working:

Review homeowner insurance for heating-related damages.

Understand liability if you rent your property.

Keep contact info for emergency HVAC and plumbing services.

Preparation prevents stress during unexpected winter problems.

Children, elderly, or pets are more at risk. To manage what to do if your heat stops working:

Keep warm blankets and clothing accessible.

Ensure pets stay indoors and warm.

Use safe temporary heaters in rooms where vulnerable people spend time.

Safety and comfort come first.

Even during outages, efficiency matters. Tips include:

Close doors and windows to trap heat.

Use thick curtains to insulate rooms.

Avoid opening unneeded rooms to save energy.

Energy awareness helps Southern NH homeowners maintain comfort.

Local resources assist during winter heating emergencies. Consider:

Utility company support for power or gas outages.

Town or state emergency shelters in Southern NH.

HVAC companies offering 24/7 emergency service.

Being informed reduces panic when deciding what to do if your heat stops working.

Repeated heating issues signal it may be time to upgrade. Steps include:

Evaluate energy-efficient furnaces or boilers.

Consider smart thermostats and zoning systems.

Inspect insulation and ductwork for improvements.

Upgrades increase comfort, safety, and home value, useful for Londonderry houses for sale.

Knowing what to do if your heat stops working helps Southern NH homeowners stay safe, warm, and prepared.

Start with thermostat and power checks.

Use temporary heat safely while calling professionals.

Protect pipes, vulnerable residents, and your property.

Consider long-term maintenance and future upgrades.

Whether you live in Londonderry houses for sale or other Southern NH homes, winter readiness and quick action prevent stress, costly damage, and safety risks.

If you need more tips on what to do if your heat stops working, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Many homeowners think selling in the spring is the best move. While spring is popular, it’s not always ideal. Sellers often miss opportunities if they shouldn’t wait until spring to sell.

Right now, demand for homes in Southern NH is strong. Buyers are actively looking, motivated by low inventory and competitive mortgage rates. Waiting months can mean losing serious buyers or facing more competition later. Whether you’re considering Londonderry houses for sale or other Southern NH properties, acting now can give you an advantage.

Many sellers believe buyers only shop in spring. That’s a misconception. To shouldn’t wait until spring to sell, consider that motivated buyers shop throughout the year.

Serious buyers look during fall and winter to settle before holidays.

Less competition means your home stands out more.

Homes in towns like Londonderry and surrounding Southern NH areas attract consistent interest.

Listing now can give you a head start on buyers before spring flooding the market with homes.

Spring often brings a surge of listings. By contrast, selling now means fewer competing homes. To shouldn’t wait until spring to sell means you can:

Capture attention of buyers eager to act.

Potentially sell faster.

Avoid the bidding wars that may appear in spring.

For Londonderry houses for sale, limited listings often make your home more attractive and desirable.

Fall and winter buyers are usually more serious. They aren’t just browsing. They are ready to buy. To shouldn’t wait until spring to sell, remember:

This is ideal for Southern NH sellers seeking an efficient sale.

Many homeowners delay listing because they worry about curb appeal in colder months. To shouldn’t wait until spring to sell, understand that:

With a good REALTOR, Londonderry houses for sale can shine any time of year.

Mortgage rates fluctuate. Waiting for spring may not be wise. To shouldn’t wait until spring to sell, consider:

Listing now ensures you access buyers before rates possibly increase.

Southern NH’s market often favors sellers in fall and winter. To shouldn’t wait until spring to sell, note that:

Homes in Londonderry and nearby towns may sell faster before spring’s influx of new listings.

Selling during fall and early winter has hidden benefits. To shouldn’t wait until spring to sell, remember:

Buyers who search during holidays are often motivated to close quickly.

Homes that show well with seasonal touches can feel warm and inviting.

Agents often have more time to focus on fewer listings.

A timely listing can create urgency and appeal to buyers who want to move before the year ends.

Waiting until spring can cost you more. To shouldn’t wait until spring to sell, consider:

Maintaining your home through winter adds costs for heating, insurance, and maintenance.

Quick sales save money on utilities and property upkeep.

You can reinvest proceeds sooner into your next home.

For sellers exploring Southern NH houses for sale, acting now can provide financial relief.

Marketing your home in the fall or winter allows it to shine. To shouldn’t wait until spring to sell, note:

Your listing gets more visibility because fewer homes compete online.

Professional photography, virtual tours, and social media reach buyers effectively year round.

Highlight unique features, such as cozy living spaces or winter-ready utilities.

Homes like Londonderry houses for sale gain attention quickly when marketed correctly.

In spring, buyers often juggle multiple listings. Off-season, they focus more. To shouldn’t wait until spring to sell, remember:

Fewer listings mean buyers can devote more attention to your home.

Serious buyers often plan visits in advance and are committed to the process.

Personalized showings increase your chances of getting an offer.

Focused buyers lead to faster negotiations and stronger offers.

Property values can fluctuate. To shouldn’t wait until spring to sell, consider:

Listing now secures value based on current market conditions.

Delaying may expose your home to seasonal changes in pricing.

Early action ensures you capture maximum interest before spring pricing shifts.

For Southern NH houses for sale, proactive listing can protect your investment.

Real estate agents often juggle fewer listings in the fall and winter. To shouldn’t wait until spring to sell, take advantage:

Personalized marketing strategies tailored to your home.

Dedicated communication with buyers.

Time to stage, photograph, and promote effectively.

This level of attention can speed up your sale and improve your bottom line.

Staging works year-round. To shouldn’t wait until spring to sell, note that:

Interior staging makes spaces feel larger, warm, and inviting.

Seasonal décor can highlight comfort and charm.

Buyers respond emotionally to well staged homes, leading to faster offers.

Londonderry houses for sale can attract buyers year-round with effective staging.

Buyers search for homes all year. To shouldn’t wait until spring to sell, understand that:

Digital listings capture buyers immediately.

High quality photos and virtual tours boost engagement.

SEO optimized descriptions attract motivated buyers in Southern NH.

Even in winter, homes can gain maximum online exposure.

Listing now allows negotiation options. To shouldn’t wait until spring to sell, consider:

Receiving early offers allows time to choose the best.

Less competition strengthens your bargaining position.

You can plan your next move without pressure.

Sellers of Southern NH houses for sale benefit from added flexibility in timing and terms.

Homes can shine in any season. To shouldn’t wait until spring to sell, showcase:

Warm interiors during fall and winter

Cozy fireplaces or energy efficient heating

Holiday friendly kitchens and dining areas

Highlighting seasonal features resonates with buyers emotionally.

Markets can change quickly. To shouldn’t wait until spring to sell, remember:

Interest rates may rise.

Buyer demand may shift.

Inventory may increase, reducing your competitive advantage.

Selling now ensures you control timing and market conditions.

Southern NH homes are desirable. To shouldn’t wait until spring to sell, know that:

Towns like Londonderry maintain consistent buyer interest.

Commuter access to Boston and nearby amenities draws year-round buyers.

Limited inventory keeps homes selling quickly.

Acting now positions your home as a prime opportunity.

Selling sooner has rewards beyond market conditions. To shouldn’t wait until spring to sell, consider:

Less stress knowing your home is listed and selling

Reduced financial burden from carrying costs

Early start toward your next home or investment

Listing now benefits both your wallet and peace of mind.

Even during fall and winter, buyers are ready. To shouldn’t wait until spring to sell, remember:

Many buyers want to close before the new year.

Serious buyers seek well priced, move-in ready homes.

Effective marketing captures attention immediately.

Homes like Londonderry houses for sale can attract buyers who act quickly.

Homeowners often hesitate, thinking spring is the perfect time. However, reasons abound why you shouldn’t wait until spring to sell. Strong buyer demand, lower competition, serious buyers, and consistent online search make now an ideal time.

By marketing effectively, highlighting key home features, and leveraging the advantages of off season selling, Southern NH homeowners can attract motivated buyers and achieve successful sales. Whether considering Londonderry houses for sale or other Southern NH properties, acting today ensures better positioning, faster offers, and a smoother process.

If you need more information on why you shouldn’t wait until spring to sell, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Buying your first home is exciting, but choosing the right town can be overwhelming. Understanding the top 5 towns in Southern NH for first-time homebuyers helps you narrow your search and find the perfect fit.

Southern NH offers a mix of suburban comfort, strong communities, and good schools. Whether you’re searching for Southern NH houses for sale in Nashua, Londonderry, or Milford, knowing the best towns for first-time buyers will save time, reduce stress, and help you make smart financial decisions. Let’s explore what makes each town great for new homeowners.

Buying a home isn’t just about the house. The town impacts your lifestyle, commute, and long term investment.

Good towns for first-time buyers offer:

Affordable home prices

Safe, welcoming communities

Strong schools for families

Access to amenities like parks, shopping, and restaurants

By focusing on the top 5 towns in Southern NH for first-time homebuyers, you can find a balance between budget, convenience, and quality of life.

Nashua is a city with a strong job market, affordable homes, and great community programs.

**Why **Nashua works for first-time buyers:

Median home prices are reasonable compared to nearby towns.

Top-rated schools make it ideal for families.

Plenty of shopping, dining, and entertainment options.

Neighborhood vibe: Friendly, walkable, and safe, with parks and community events.

Housing options: Single family homes, townhouses, and condos for every budget. Nashua’s combination of affordability and amenities makes it a top choice for first-time homeowners searching Southern NH houses for sale.

Londonderry is known for its suburban charm, friendly neighborhoods, and good schools.

**Why **Londonderry is ideal:

Homes are affordable but spacious, perfect for growing families.

Schools consistently receive high ratings.

Easy access to highways makes commuting simple.

Neighborhood vibe: Quiet, safe, and community-focused with local events and parks.

Housing options: Single-family homes, new construction, and townhouses.

If you’re looking for a balance of space, school quality, and community, Londonderry is a top contender among the top 5 towns in Southern NH for first-time homebuyers.

Milford is a smaller town with a charming downtown and strong community involvement.

Why Milford stands out:

Home prices are lower, making it accessible for first-time buyers.

Schools are small but strong, with close knit communities.

Recreational activities and local events enrich family life.

Neighborhood vibe: Friendly, welcoming, and ideal for families seeking a small-town feel.

Housing options: Single-family homes, starter homes, and affordable condos.

For buyers prioritizing budget, safety, and community, Milford is a strong pick in the top 5 towns in Southern NH for first-time homebuyers.

Enter your text here...

Merrimack offers a mix of suburban convenience and friendly neighborhoods.

Why Merrimack works well:

Homes are affordable with good space and modern features.

Excellent schools support family growth and education.

Plenty of shopping, dining, and outdoor activities.

Neighborhood vibe: Quiet, organized, and family oriented with parks and walking trails.

Housing options: Single-family homes, new builds, and townhouses.

Merrimack combines accessibility, amenities, and strong schools, making it a top choice among the top 5 towns in Southern NH for first-time homebuyers.

Hudson balances small town charm with access to larger cities nearby.

**Why **Hudson is appealing:

Home prices are moderate and competitive for first-time buyers.

Schools are well-regarded and community oriented.

Parks, recreation, and local businesses enhance daily life.

Neighborhood vibe: Friendly, and child focused with events and community spaces.

Housing options: Single family homes, starter homes, and townhouses.

Hudson is a strong pick for buyers seeking community, convenience, and affordability among the top 5 towns in Southern NH for first-time homebuyers.

Even with the best towns identified, first-time buyers should consider a few additional factors:

Commute and location: How long will you travel to work or school?

Budget and property taxes: Factor in both purchase price and local taxes.

Community amenities: Parks, libraries, shops, and recreational options matter for lifestyle.

School quality: Evaluate both public and private school options.

Future resale value: Homes in strong communities often appreciate faster.

Considering these factors ensures your home purchase supports both your lifestyle and financial goals.

Working with a REALTOR® is critical for first-time buyers. They can:

Show homes in towns that match your budget and needs

Provide insight into schools, neighborhoods, and local amenities

Guide negotiations to get the best deal

Offer advice on property taxes and future value

A REALTOR® who knows Southern NH is invaluable when navigating the top 5 towns in Southern NH for first-time homebuyers.

Affordability: Starter homes are available without overspending.

Community: Supportive neighborhoods welcome new owners.

Education: Schools are highly rated and accessible.

Amenities: Convenient access to shopping, dining, and outdoor activities.

Investment potential: Homes maintain value and offer long term growth.

These benefits make these towns ideal for first-time buyers exploring Southern NH houses for sale.

Following these tips simplifies the buying process and ensures a smooth experience.

Get pre-approved for a mortgage before house hunting.

Set a realistic budget including taxes, utilities, and maintenance.

Visit neighborhoods at different times of day to gauge safety and noise.

Research schools and local services for your family’s needs.

Work closely with a REALTOR® for insights and support.

Southern NH offers a variety of towns with affordable homes, strong schools, and welcoming communities. Whether you prefer city life in Nashua, suburban charm in Londonderry, or small-town appeal in Milford, there’s a perfect fit.

Exploring the top 5 towns in Southern NH for first-time homebuyers ensures you find a home that balances price, location, and lifestyle. Start by identifying your priorities: budget, school quality, and community feel. Then explore homes in the towns listed above.

Visiting homes and neighborhoods, researching schools, and consulting a REALTOR® will help you make a confident decision. Your first home should feel right for your family, your budget, and your long term goals.

Buying your first home is a major milestone. By focusing on the top 5 towns in Southern NH for first-time homebuyers, you’re setting yourself up for success.

Affordable homes, strong communities, and good schools make these towns perfect for new homeowners.

With careful research, guidance from a REALTOR®, and a clear understanding of your priorities, you can find the ideal first home in Southern NH.

If you need more info on the top 5 towns in Southern NH, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

When it comes to buying a home, there’s one thing many people forget to factor into their plans, property taxes. Understanding how taxes vary by town can help you make smarter decisions and avoid surprises down the road.

Property taxes can have a big impact on your monthly payments, your long-term costs, and even your home search strategy. In Southern New Hampshire, every town sets its own tax rate, and those differences can really add up.

Whether you’re exploring Southern NH houses for sale or comparing communities for your next move, knowing how each town’s taxes affect your budget will help you stay informed and confident as a buyer. Let’s break it all down in simple terms.

Property taxes aren’t just another line on your mortgage statement. They’re an ongoing cost of homeownership. These taxes help fund local services like schools, police and fire departments, libraries, and road maintenance.

When you understand how taxes vary by town, you can see why some areas cost more than others. A town with top-rated schools and well maintained parks may have higher tax rates to support those services. Meanwhile, smaller towns with fewer services might have lower rates but may not offer as many amenities.

The key is balance. You want a community that fits both your lifestyle and your budget.

Before diving into how different towns compare, it helps to understand how the math works. Property taxes are based on two main things:

The assessed value of your home – what the town believes your property is worth.

The local tax rate – how much the town charges per $1,000 of assessed value.

For example, if your home is assessed at $400,000 and the town’s tax rate is $20 per $1,000, your annual property tax would be $8,000. So even if two homes cost the same, your yearly costs could differ depending on how taxes vary by town.

Now let’s look at what this means in real life. Southern New Hampshire includes a mix of cities, suburbs, and small towns—all with different tax rates and services.

In general:

Cities like Nashua or Manchester tend to have higher tax rates because they offer more public services and larger school systems.

Towns like Windham, Bedford, or Hollis often have higher home values but lower tax rates, which balance out the total bill.

Smaller towns like Brookline or Lyndeborough may offer lower rates but fewer public amenities.

This is why it’s important to research each area before deciding where to buy. When looking at Southern NH houses for sale, take a few minutes to compare tax rates. It could affect your monthly budget more than you expect.

Tax rates aren’t set in stone. They can shift from one year to the next based on town budgets, property assessments, and local spending decisions.

Here are a few common reasons rates change:

Town budgets increase. If a town needs more money for schools, roads, or emergency services, rates can go up.

Property values rise. When property values increase across a town, the rate may go down—but you might still pay more overall because your assessment is higher.

New development. Growth can sometimes lower taxes, as new businesses or homes expand the tax base.

This is why it’s smart to keep an eye on how taxes vary by town each year, especially if you’re budgeting for long-term costs.

When you take out a mortgage, your property taxes are usually included in your monthly payment through an escrow account.

That means if your town’s taxes increase, your monthly payment could go up even if your mortgage rate stays the same.

For example, let’s say you find a home among Southern NH houses for sale that fits your $2,500 monthly budget. If that includes property taxes, and those taxes rise by $1,200 a year, your new payment could increase by $100 per month. That’s why understanding how taxes vary by town can help you plan ahead and avoid being caught off guard.

Let’s say you’re deciding between two homes—one in Londonderry and one in Hudson.

Londonderry: Tax rate of about $18 per $1,000 of assessed value.

Hudson: Tax rate of about $24 per $1,000 of assessed value.

If both homes are valued at $450,000, here’s how the math plays out:

Londonderry taxes: $8,100 per year

Hudson taxes: $10,800 per year

That’s a difference of $2,700 annually, or about $225 per month—just based on how taxes vary by town. These are rough examples, but they show how much impact local taxes can have on your budget.

It’s easy to think that lower taxes are always better but that’s not always true.

Towns with higher tax rates often use that money for better services, schools, and infrastructure. If you have kids, a strong school system might be worth the added cost. You might also enjoy extras like better maintained parks, community programs, or faster emergency response times.

When you look at Southern NH houses for sale, think about how each town’s services fit your lifestyle. A slightly higher tax bill could bring better long-term value and quality of life.

On the other hand, lower taxes can make a home more affordable month to month. If you’re a first-time buyer or on a tighter budget, that can be a big advantage.

However, lower taxes sometimes mean fewer town services. You might need to hire private trash pickup, pay for a recreation membership, or travel farther for certain amenities.

Again, this is why knowing how taxes vary by town helps you balance cost and convenience. It’s about finding what matters most to you and your family.

When you start browsing Southern NH houses for sale, keep a few smart strategies in mind:

Check tax rates early. Don’t wait until closing to find out how much you’ll owe each year.

Ask your REALTOR® for comparisons. Local agents know which towns have higher or lower taxes and why.

Look beyond the number. Sometimes a higher rate supports strong schools or great community resources.

Consider your full budget. Add taxes, utilities, and insurance to your monthly costs before setting your price range.

This kind of preparation keeps your finances steady and helps you make confident decisions.

There are a few myths that can trip up buyers when trying to understand how taxes vary by town:

Myth #1: New homes always mean higher taxes.

Not necessarily. Sometimes new builds are more energy-efficient and valued lower than expected.

Myth #2: Property taxes never go down.

Rates can decrease if property values rise or if towns reduce budgets.

Myth #3: A low tax rate always means a cheaper home.

A lower rate might be paired with a higher home value, balancing things out.

Understanding the truth behind these myths can make your home search much smoother.

Buyers often ask whether tax rates impact home prices. The short answer is yes, indirectly. Towns with higher taxes sometimes have slower appreciation because buyers factor in the ongoing cost. But if those taxes support great schools and amenities, they can actually boost demand and long-term value.

When comparing Southern NH houses for sale, look for areas where taxes are fair, services are strong, and property values are stable. That’s usually the sweet spot.

Even after you buy your home, it’s smart to stay proactive about your property taxes.

Review your annual assessment. Make sure your home’s value is accurate.

Attend local meetings. Town budget hearings often discuss proposed tax changes.

Set aside a little extra. Build a buffer in your budget for potential increases.

Knowing how taxes vary by town means you’ll always be ready for whatever changes come your way.

Your REALTOR® can be a huge help in understanding property taxes. They can explain how rates differ, what local services you’re paying for, and how taxes fit into your overall affordability.

When shopping Southern NH houses for sale, a knowledgeable agent can show you how to weigh taxes against other factors, like commute times, school ratings, or neighborhood trends. A good agent knows the numbers, but they also know how those numbers affect your life.

At the end of the day, how taxes vary by town is just one piece of the puzzle. Your perfect home isn’t only about the rate. It’s about the community, the comfort, and the long-term fit for your lifestyle.

If you’re exploring Southern NH houses for sale, take time to compare both home prices and tax rates. With a bit of research and guidance, you can find a home that feels right for your heart and your wallet. Property taxes may not be the most exciting part of buying a home, but understanding them helps you make decisions that truly pay off in the long run.

If you need more tips on how how taxes vary by town, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Buying a home is exciting, but it can also feel overwhelming. Many buyers ask, “How do I know you’ve found the right home?” It’s a mix of emotional and practical signs.

If you’re searching for Londonderry houses for sale or other Southern NH houses for sale, recognizing the right home early can save time, money, and stress. The right home feels comfortable, meets your needs, and aligns with your lifestyle.

Let’s explore clear signs, practical steps, and helpful tips to make sure you’re choosing a home with confidence.

The first sign you know you’ve found the right home is how it feels when you walk in.

Does it feel natural? Can you see yourself living there? Comfort is emotional. It doesn’t come from furniture or decor—it’s the home’s energy.

Even small things, like natural light, room flow, or how quiet it is, matter. Buyers often feel this immediately in homes for sale in Southern NH towns.

The right home matches your family’s lifestyle. Consider these:

Bedrooms and bathrooms are enough for everyone.

Kitchen layout supports your cooking and entertaining needs.

Living spaces match your daily habits, like working from home or relaxing with family.

If the home allows your routine to feel easy, you know you’ve found the right home.

Location is key. A great home in the wrong spot won’t feel like home.

Check proximity to work, schools, shopping, and recreation.

Neighborhood vibe matters too. Are people friendly? Streets quiet and safe? These factors help your long-term satisfaction and resale value.

For buyers considering Londonderry houses for sale, location often tips the scale.

A big sign you know you’ve found the right home is imagining your future there.

Picture family dinners, holiday gatherings, or relaxing evenings. If the space supports your dreams, it’s a strong indicator.

Also, think about storage, closets, and outdoor areas. Can they handle your lifestyle five or ten years from now? Homes in Southern NH houses for sale often have extra space, which helps with future planning.

Even the most perfect home won’t feel right if it stresses your budget.

You should feel comfortable with your mortgage, taxes, and maintenance costs. Avoid overextending—financial stress can ruin the joy of your new home.

When numbers align, it’s easier to emotionally connect and know you’ve found the right home.

Every home has trade-offs, but too many compromises are a red flag.

Make a list of must-haves vs. nice-to-haves. Does this home check the most important boxes?

For example, if a buyer prioritizes a spacious backyard or modern kitchen, and the home meets those needs, it’s a good match.

Being realistic helps you avoid second-guessing later and strengthens your confidence.

The best homes balance heart and logic.

It’s normal to feel excited walking in, but practical details matter too: plumbing, roof condition, HVAC systems, and energy efficiency.

Inspecting and asking questions ensures you know you’ve found the right home both emotionally and practically.

Sometimes the right home isn’t perfect—it has potential.

Maybe paint needs updating or landscaping could improve. Small DIY projects can increase value and make it feel like yours.

For buyers looking at Londonderry houses for sale, seeing potential often outweighs cosmetic flaws.

You aren’t just buying a home—you’re joining a community.

Check schools, parks, walkability, and commute times. Friendly neighbors and nearby amenities matter too.

Homes in Southern NH often offer a strong sense of community, which makes settling in easier.

Trust your instincts. Many buyers report that a “gut feeling” tells them when a home is right.

If you feel happy, comfortable, and excited, that’s a strong sign.

Combine that feeling with practical checks like inspection reports, budget considerations, and future needs.

Even if you plan to stay long-term, think about resale value.

Does the home maintain appeal for future buyers? Does it fit the trends for Southern NH houses for sale?

A home with good resale potential protects your investment. When your emotional connection aligns with smart investment sense, you know you’ve found the right home.

A right-fit home has enough space for everyone.

Bedrooms, bathrooms, storage, and living spaces should suit your household now and in the future.

If your family can live comfortably, host guests, and store belongings, it’s a strong indicator that this is the right choice.

Do you enjoy gardening, entertaining, or kids playing outside?

Backyards, patios, or decks should feel functional and enjoyable.

Even small spaces can work with creative landscaping or outdoor seating. Homes in Southern NH often provide versatile yards that enhance lifestyle satisfaction.

A home should feel comfortable year-round. Check heating, cooling, insulation, and windows.

Energy-efficient homes reduce bills and improve comfort. This practical check ensures your joy isn’t overshadowed by high costs.

When comfort and efficiency align, you can confidently know you’ve found the right home.

High-maintenance homes can become stressful.

Look for durable flooring, updated appliances, and solid roofing.

A low-maintenance home allows you to enjoy life instead of constant repairs. Combining emotional appeal with low upkeep is a big win.

Even a great home needs your touch.

Paint, decor, and minor renovations make it yours. Feeling excited to customize shows the home resonates with your taste and personality.

When buyers see themselves thriving there, it confirms they know they’ve found the right home.

Hosting events can reveal a home’s practicality.

Open kitchens, dining areas, and living spaces allow for gatherings.

Visualizing celebrations and casual moments strengthens your emotional connection. Buyers often look for homes that feel welcoming and social.

Ultimately, a home should bring joy.

If you wake up happy, excited, and comfortable, it’s a strong indicator that this is the right choice.

Joy, combined with smart practical checks, ensures a confident purchase decision in Southern NH houses for sale.

A trusted Realtor can help you evaluate whether you know you’ve found the right home.

They provide insight on market trends, property conditions, and resale potential.

For buyers looking at Londonderry houses for sale, expert advice ensures your choice is informed and secure.

Knowing you’ve found the right home blends heart and logic.

Emotional comfort, practical needs, location, budget, and future potential all matter.

By checking these signs and trusting your instincts, you’ll confidently choose a home that fits your lifestyle and your family.

Whether you’re exploring Londonderry houses for sale or other Southern NH houses for sale, paying attention to both feelings and facts ensures a happy, successful home purchase. Take your time, stay organized, and enjoy the process. It’s not just a home; it’s your future.

If you need more info on how to know you’ve found the right home, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

If you’re wondering when the best time to sell in Southern NH is, fall might surprise you. Many homeowners think spring or summer is ideal. But the fall season has unique advantages that buyers love. The leaves change, the air is crisp, and homes feel warm and inviting. These factors can make your property irresistible.

Especially for buyers searching for Londonderry houses for sale or Southern NH houses for sale, a cozy, well-decorated home during fall stands out. With the right approach, selling in autumn can be faster and even more profitable than other seasons.

Let’s explore why fall is a perfect selling season and how to use foliage and fall decor to make your home shine.

One of the biggest perks of selling in fall is the vibrant foliage. Red, orange, and yellow leaves make your home pop.

Buyers are naturally drawn to beautiful exteriors. A well-kept lawn with autumn leaves adds charm without extra effort.

Consider adding seasonal decorations like pumpkins or a wreath on the door. These small touches enhance curb appeal and create a warm, inviting atmosphere.

Because first impressions matter, fall colors can make your home more memorable than other listings in the area.

People shopping in fall often have a strong motivation to buy. Families want to settle before the holidays or the new school year.

This urgency can make the selling process smoother and quicker. Buyers who look in September and October often have financing ready.

You can attract these buyers by highlighting features that matter in fall, such as cozy living rooms, fireplaces, and energy-efficient windows.

Homes staged for fall feel welcoming and can encourage buyers to make faster decisions, which helps your sale in Southern NH houses for sale stand out.

Fall is the perfect season to show off a home’s cozy spots. Living rooms, dens, and kitchens become focal points.

Simple changes like adding soft throws, warm lighting, and scented candles make rooms feel inviting.

Buyers imagine themselves relaxing in these spaces, which creates an emotional connection. Emotional appeal can increase the perceived value of your home.

Even small touches, like a basket of fresh apples or a tray of hot cocoa, make your home feel lived-in but welcoming.

Decorating your home for fall can give it personality without overwhelming buyers.

Use neutral or warm-toned decor to complement your home’s features. Think subtle pumpkins, autumn leaves, and seasonal table settings.

Avoid clutter or personal items. Buyers should picture their own family enjoying the space.

Decor like a cozy entryway rug or a fall centerpiece in the dining room helps create memorable first impressions.

Strategically placed decor can highlight your home’s best features, which helps listings in Londonderry houses for sale look extra appealing.

Even as temperatures drop, outdoor spaces still matter. Decks, patios, and porches look inviting when staged properly.

Add seasonal touches like a small fire pit, outdoor lanterns, or a warm throw on a chair.

Buyers can envision entertaining or relaxing outside, even in autumn. Well-staged outdoor areas make your home feel larger and more functional.

This is especially helpful for Southern NH homes, where buyers often value outdoor lifestyle and backyard space.

Fall offers soft, natural light that makes homes look beautiful in photos and showings.

Take photos during the “golden hour” in the afternoon. The warm sunlight enhances your home’s colors and makes spaces feel cozy.

Keep blinds open to let in as much light as possible. Light-filled rooms appear larger and more inviting to buyers.

Great photos can make a huge difference for your listing online, helping you attract buyers from search results for Southern NH houses for sale.

Autumn is the perfect time to showcase a home’s heating system, insulation, and fireplace.

Buyers notice when homes are comfortable and efficient. Highlight energy-efficient windows, programmable thermostats, or a freshly serviced furnace.

Even small touches like plush blankets or a crackling fireplace add a sense of warmth and comfort.

A home that feels cozy and energy-smart can sell faster and for a better price, especially in colder months.

Fall typically has fewer homes for sale than spring or summer. Less competition can make your listing more noticeable.

Serious buyers searching for Londonderry houses for sale or Southern NH houses for sale are more likely to focus on your property.

Pricing competitively and staging for fall makes your home shine. You can often sell faster and avoid the delays of crowded spring markets.

Families often prefer to move before the new school year or the winter holidays. Selling in fall targets buyers motivated by timing.

Highlight proximity to local schools, parks, and community activities.

Homes in Southern NH communities, like Londonderry, attract buyers looking for convenience and family-friendly amenities.

Timing your listing for fall helps ensure buyers act quickly, which can shorten your selling timeline.

Before showing your home, perform simple maintenance tasks.

Rake leaves, clean gutters, and trim shrubs to create a neat appearance.

Touch up paint, clean windows, and power wash your home’s exterior.

Small efforts show buyers that the home is well-cared-for, which can justify your asking price and improve its perceived value.

Highlight fall in your marketing materials. Use terms like “cozy,” “fall-ready,” and “autumn charm.”

Photos featuring fall foliage, pumpkins, and seasonal decor make your home stand out online.

Even simple captions mentioning “best time to sell in Southern NH” or “autumn-ready homes” attract motivated buyers.

Creative, seasonal marketing can help your listing compete in the Southern NH houses for sale market.

Fall may not be spring, but it has unique selling advantages. Beautiful foliage, cozy vibes, and motivated buyers make it the best time to sell in Southern NH.

By using seasonal decor, highlighting indoor and outdoor spaces, and leveraging lighting and warmth, your home can stand out.

Even small updates and staging for autumn make a significant impact on buyers’ perception.

If you’re ready to list, fall can be your secret weapon for a faster sale at a great price. Buyers searching for Londonderry houses for sale or Southern NH houses for sale will notice your home’s charm immediately.

So embrace the season, add cozy touches, and show your home at its absolute best. Fall may just be your most profitable selling season yet.

If you need more info on the best time to sell in Southern NH, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.