Category Archives for "Pat Pasquale Nappo"

The real estate world changes fast and interest rates shift often. Many buyers struggle to keep up with rising payments. When a seller offers an assumable FHA, VA, or USDA mortgage, buyers get something rare. They get a chance to step into a loan with a lower rate than they can find in the current market.

This creates instant emotional impact. Buyers feel relief when they hear the words lower payment. They feel hopeful when they realize they can afford more home than expected. Financial stress fades and excitement grows. Sellers with assumable mortgages hold an incredible advantage because they are offering something powerful and uncommon.

Assumable mortgages allow buyers to take over the seller’s current loan. The interest rate remains the same. The remaining loan term stays the same. The monthly payment remains the same. The buyer simply continues where the seller left off.

This works only with certain types of loans. FHA, VA, and USDA loans are commonly assumable when rules are followed. Many homeowners in Southern NH have one of these loans. That means more homes in Hudson, Londonderry, and Nashua offer hidden benefits that buyers do not always realize.

The key is education. Buyers need to understand that this is not a new loan. It is a financial gift already wrapped and ready. For sellers, this becomes a golden selling point.

There are many reasons buyers feel drawn to assumable mortgages. Many buyers enter the market feeling overwhelmed. They see rising prices and rising rates. They see their buying power shrinking. Then they discover a home with an assumable mortgage and everything shifts.

Buyers enjoy the chance to save money. They appreciate the chance to avoid high interest rates. They feel secure knowing the loan has a proven track record. The payment is predictable and already established. This creates emotional comfort. Buyers want predictability and assumable mortgages offer exactly that.

Buyers also love the idea of stepping into a ready made financial structure. They feel like they are being handed a key to a rare savings opportunity. Many buyers even become more flexible with other terms because of this benefit. That can speed up negotiations and create smoother deals for everyone.

Sellers with assumable mortgages hold a quiet superpower. Not every seller has it and not every buyer knows to look for it. When the seller proudly says please take my mortgage they are offering something extremely valuable. It gives their home more attention and more offers. It makes their home feel special in a crowded market.

A home with an assumable loan becomes easier to market. It can attract buyers who were previously priced out. It can attract buyers who planned to wait but now feel ready to move. It can attract cash buyers who want lower payments and stronger long term plans.

Sellers love that their home becomes more competitive. They love that buyers feel happier and more confident. They also appreciate that their home might sell faster because assumable loans feel like a bonus feature that other homes do not offer.

Marketing is about emotion and value. When you include assumable mortgage information in your listing package, you are giving buyers a reason to stop and look. You can highlight lower payments and long term savings. You can share examples of possible monthly differences if a buyer keeps the seller’s rate instead of starting fresh.

Homes with assumable loans can be advertised proudly. A smart REALTOR knows how to present it in a simple and friendly way. You can share this information in open houses, online listings, social media posts, and printed marketing materials. When you do this clearly, buyers respond quickly.

Your listing becomes powerful. Your listing becomes shareable. Buyers tell their friends that this home is different. That builds energy and increases demand.

Buyers need to qualify with the lender who holds the current mortgage. This helps protect both buyer and seller. The lender reviews the buyer’s income, credit, and financial history. This part is similar to getting a traditional loan, but everything moves into an existing loan instead of a brand new one.

If the buyer approves, the remaining steps are simple. The buyer pays the seller for any equity if needed. Closing takes place and the buyer steps into the existing mortgage. They continue making the payments as usual.

The process feels smooth because the loan already exists. The buyer gains a predictable payment and a future filled with savings. The seller moves forward knowing they offered something truly helpful.

One question that often comes up involves equity. When a seller has built equity over time, the buyer may need to cover the difference between the loan balance and the home value. Buyers can use cash, a second loan, or creative financing options to cover this.

This still benefits buyers because the first mortgage has such a good interest rate. Even if a buyer takes a small second loan, the blended payment often remains lower than a brand new single mortgage at today’s higher rates.

This creates strong motivation for buyers to move quickly. They see real savings and they feel more in control of their purchase.

Southern New Hampshire remains one of the most popular areas for homebuyers. The communities offer strong schools, great commuter access, and beautiful neighborhoods. Homes in areas like Hudson, Nashua, and Londonderry stay in demand because they provide comfort and convenience.

Many homes in Southern NH were purchased in years when rates were very low. That means many sellers here already have FHA, VA, or USDA loans that come with attractive interest rates. Buyers moving into the region appreciate any opportunity to lock in lower costs. This gives sellers a real edge.

Homes with assumable mortgages in South Hudson and surrounding communities can become some of the most desirable properties on the market.

Real estate is emotional. Buyers fall in love with homes that feel comforting and secure. When a seller says please take my mortgage they are not only offering a loan. They are offering peace of mind. They are offering a path to a future that feels stable and predictable.

Buyers appreciate anything that reduces stress. They appreciate saving money. They appreciate fairness and transparency. A loan assumption checks all of these emotional boxes. A buyer feels good about moving forward because they know they are stepping into something proven and trustworthy.

Sellers feel emotional satisfaction because they know they helped the buyer. They created a moment of relief and hope. This often creates smoother cooperation during the rest of the transaction.

Imagine a seller with a three percent FHA loan. The current rate for a new loan might be seven percent. If a buyer assumes the seller’s loan, the payment could be much lower.

This difference adds up quickly. A buyer might save several hundred dollars each month. Over the life of the loan, that could mean tens of thousands of dollars saved. These savings can change a family’s financial future.

This is why assumable mortgages hold so much power in your marketing plan. They are real benefits that buyers can feel and understand.

Sellers should work closely with a REALTOR who understands how to promote this feature. Strong marketing helps buyers understand the value right away. Sellers should have their loan details ready and available. They should also confirm with their lender that the loan can be assumed.

Once everything is confirmed, this benefit should be shared in every part of the marketing package. It should be highlighted in online listings, open house discussions, and printed flyers. Buyers should see it instantly and feel encouraged to learn more.

Buyers should ask questions early in the process. They should explore the current loan balance, interest rate, and remaining years. They should also speak with a qualified lender to understand the steps involved.

Buyers should work with a REALTOR who knows how to negotiate assumable mortgage terms. They should also prepare to move quickly because homes with assumable mortgages often receive extra attention.

Assumable mortgages create real excitement in the current housing market. When a seller proudly says please take my mortgage it transforms the entire conversation. The listing feels more valuable and more attractive. Buyers feel hopeful and ready to take action. Southern NH buyers especially appreciate any advantage that makes ownership easier.

When used correctly, this feature becomes a true superpower for your listing. It adds confidence, clarity, and emotional appeal. Sellers feel empowered and buyers feel supported. It is a win for everyone. As you explore South Hudson houses for sale or other Southern NH houses for sale, keep an eye out for this benefit. It may shape your future in ways you never expected. The idea of assumable loans brings new energy to modern real estate and helps many people move forward with joy and confidence.

If you need more tips on how a buyer can take my mortgage, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

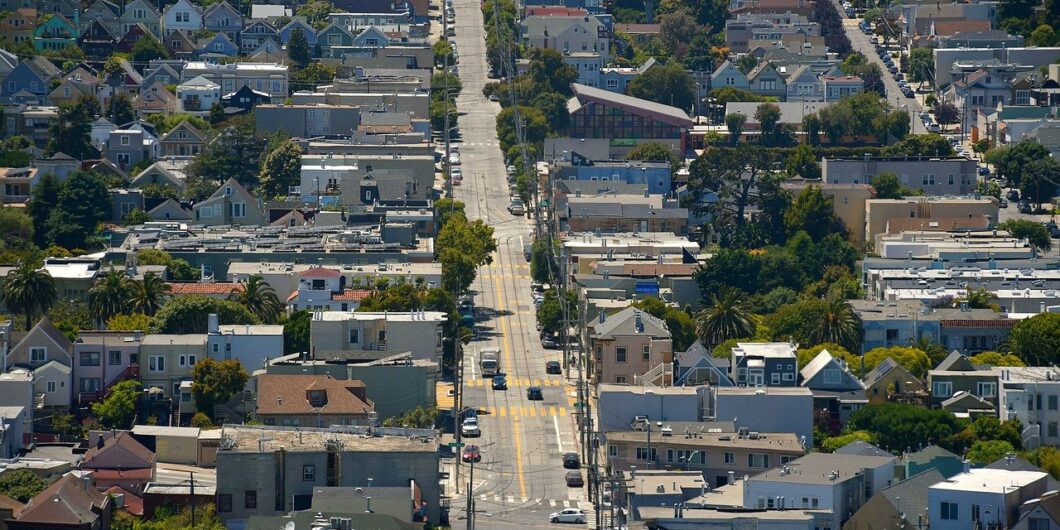

Looking for the perfect place to settle down in New Hampshire? You are in luck. Southern NH neighborhoods offer a mix of charm, convenience, and lifestyle that keeps buyers coming back. From vibrant Nashua to cozy Londonderry, these areas have something for everyone. Whether you are searching for Southern NH houses for sale or just exploring your options, understanding which neighborhoods stand out can make your home search easier and even a bit more fun.

Buying a home is more than just walls and a roof. It is about community, schools, and access to daily conveniences. That is why Southern NH neighborhoods are so desirable. They strike a perfect balance between suburban peace and city accessibility. Want to live somewhere that is close to shopping, restaurants, and good schools but still feels like a retreat after a long day? Then these neighborhoods should be on your radar.

Nashua often takes the top spot when people think of Southern NH neighborhoods. It is the second largest city in the state but still feels welcoming and approachable. People love Nashua for its vibrant downtown, excellent schools, and family-friendly parks. If you are looking for Southern NH houses for sale, Nashua offers a wide variety. From charming older homes to modern new constructions, there is something for every taste and budget.

Downtown Nashua has a surprising mix of restaurants, coffee shops, and local boutiques. You can enjoy a quick walk along the Nashua River and still be minutes from highways for commuting. Families especially like the school options here. The public schools consistently score above average, and there are several private schools that offer unique programs for students.

Neighborhoods have a mix of historic charm and modern convenience. You might even find yourself chatting with neighbors at local farmers markets or community events. That sense of connection is part of what makes Nashua one of the most desirable Southern NH neighborhoods.

Hudson is another top choice for buyers searching Southern NH houses for sale. Why? It offers suburban tranquility with easy access to Massachusetts. Many residents commute to Boston for work but come home to spacious yards, quiet streets, and a strong sense of community.

Schools in Hudson are consistently well rated, which makes this area popular with families. The town also has a number of parks, recreational areas, and local shops that make life enjoyable. Plus, Hudson’s neighborhood streets have that “friendly neighbor” vibe that you can feel as soon as you take a walk in the morning.

Neighborhoods stand out for their family-friendly layouts. Streets lined with trees, sidewalks for walking, and homes with spacious backyards make it a place where kids can run around safely. It’s also great for buyers who want a mix of older charm and modern homes. Hudson remains a favorite among those looking to combine lifestyle, comfort, and Southern NH real estate value.

Merrimack is often overlooked, but it deserves a spot on the list of most desirable Southern NH neighborhoods. It is quietly nestled between Nashua and Manchester, giving residents easy access to both cities while maintaining a suburban feel. Many people choose Merrimack because it offers affordable Southern NH houses for sale without compromising on quality of life.

The town is filled with parks, walking trails, and family-friendly activities. Schools are excellent, making it perfect for growing families. Merrimack also boasts a strong sense of community. Neighbors know each other, and local events bring everyone together. If you want a peaceful place to raise a family while still being close to city amenities, Merrimack should be on your list.

If you like more space, Londonderry is worth a serious look. This town is known for its larger lots, newer developments, and quiet streets. It is ideal for buyers who want Southern NH houses for sale with room to grow, maybe even a backyard big enough for a pool or garden.

Londonderry schools are excellent and highly regarded throughout the state. Families are drawn to this area because it feels like a safe haven while still being within reach of Manchester and Boston. Neighborhoods offer modern homes, well-kept streets, and a sense of exclusivity. It is one of those areas where you immediately feel like you have found home.

Looking for Southern NH neighborhoods with character? Amherst and Hollis are perfect examples. These towns are smaller but packed with appeal. Amherst offers historic homes, quiet streets, and top-rated schools. Hollis feels like stepping back in time with its scenic landscapes, farmland, and community events.

These areas are not just pretty. They also provide strong investment potential. Homes here tend to hold value because the demand for Southern NH neighborhoods with charm, good schools, and convenient commuting options stays high. If you love that classic New England feel with modern conveniences, you will want to explore Amherst and Hollis when looking at Southern NH houses for sale.

So why are these neighborhoods so popular? First, they offer a perfect mix of lifestyle benefits. Families get safety, excellent schools, and recreational opportunities. Professionals enjoy commuting options and access to dining and shopping. Retirees appreciate the quiet streets, community feel, and quality healthcare nearby.

Second, Southern NH neighborhoods are diverse. There are older, character-filled homes, newer constructions, and everything in between. That variety makes it easier for buyers to find a home that fits their style and budget.

Typical peaceful town with friendly neighbors will help you decide to own a property for sale in South NH

Finally, these neighborhoods are growing. Local economies are strong, property values are solid, and the communities continue to improve. That means when you invest in Southern NH houses for sale, you are buying more than just a home—you are buying a lifestyle that pays off in happiness, convenience, and long-term value.

If you are considering moving to Southern NH, spend time exploring each neighborhood. Visit local parks, walk the streets, and talk to residents. See how traffic feels during rush hour and check out local businesses. Southern NH neighborhoods offer a lot of options, but the right one depends on your lifestyle, family needs, and budget.

Remember, the most desirable neighborhoods are often the ones that combine strong schools, convenient location, and a sense of community. That is why Nashua, Hudson, Merrimack, Londonderry, Amherst, and Hollis remain at the top of buyers’ lists.

Whether you are a first-time buyer or looking to upgrade, Southern NH houses for sale provide opportunities to find a home that fits your vision. From bustling downtowns to quiet streets, there is a neighborhood waiting to welcome you.

Southern NH neighborhoods continue to be some of the most sought-after areas in the state. From the vibrant city life of Nashua to the peaceful streets of Londonderry, there is something for every buyer. Families, professionals, and retirees all find their perfect fit here. Exploring Southern NH houses for sale will show you why these communities are more than just places to live. They are places to thrive.

If you need more tips on Southern NH Neighborhoods, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Choosing the right home often goes beyond price or style. Families prioritizing education understand that schools shape daily life and long-term value. Parents want safe neighborhoods, strong academic programs, and a sense of community.

Southern New Hampshire offers many options for families seeking the best combination of education and lifestyle. When exploring Southern NH Houses for sale, it is essential to consider the schools in addition to home features. Homes located in strong districts often maintain value and appeal over time.

Understanding local schools gives families confidence. Knowledge ensures children thrive both academically and socially.

School quality drives decisions for families prioritizing education. Strong districts often feature low student-to-teacher ratios and highly trained staff. Extracurricular programs and advanced courses also matter.

Researching performance metrics, standardized test scores, and graduation rates can help families compare districts. Towns like Bedford, Amherst, and Hollis consistently earn high marks for academic achievement.

Families should also visit schools in person. Seeing classrooms, facilities, and community programs provides a real sense of each district's quality.

Education needs vary by age. Families prioritizing education must consider every stage. Elementary schools focus on foundational skills and social development. Middle schools introduce specialized learning. High schools prepare students for college and career paths.

In addition to academics, families should consider extracurricular activities. Sports, music, arts, and clubs enhance growth. These opportunities often define the overall experience for children.

Towns that support all levels of education attract long-term residents. Homes near these schools often hold strong value for years.

Smaller class sizes allow for individual attention. Families prioritizing education often prioritize districts that maintain these ratios. Teachers with advanced degrees and certifications further support learning outcomes.

Many New Hampshire towns offer detailed staff profiles online. Families can learn about experience levels, certifications, and teaching styles. This information helps families gauge the quality of education available.

Smaller classes and dedicated teachers create a nurturing environment that encourages children to thrive.

Specialized programs often differentiate districts. Advanced placement courses, STEM initiatives, and language immersion programs provide extra opportunities.

Families prioritizing education should also consider gifted programs or special education services. Access to these resources ensures children with varying needs succeed.

Schools with strong enrichment programs often reflect overall community investment in learning.

Education goes beyond textbooks. Families prioritizing education recognize the value of sports, arts, and clubs. These programs build confidence, teamwork, and leadership skills.

When visiting schools, families should explore gyms, performance spaces, and club offerings. A well-rounded program often complements strong academics.

Towns with active school programs attract families seeking both education and community engagement.

School ratings influence property values. Homes in highly rated districts often command higher prices but maintain long-term value.

Families prioritizing education must balance budget with desired school quality. Comparing Southern NH Houses for sale across different districts helps families make informed decisions.

Understanding school impact helps buyers avoid surprises and make confident offers.

Proximity to schools affects daily routines. Shorter commutes provide convenience and safety for children.

Families prioritizing education often look for homes within walking distance or a short drive to schools. This factor influences lifestyle and stress levels.

Towns that prioritize walkable neighborhoods and safe routes to schools remain popular among buyers.

Education is intertwined with neighborhood safety. Families prioritizing education value low crime rates, safe streets, and active community involvement.

Local events, parent organizations, and volunteer programs strengthen the connection between schools and neighborhoods. These ties enhance overall quality of life.

Communities that support both education and safety often attract long-term residents.

Growth impacts schools and neighborhoods. Families prioritizing education consider future development plans.

New housing projects can affect class sizes, school funding, and resources. Town planning boards often share upcoming developments.

Researching these plans ensures families choose areas that will continue to support quality education over time.

High-quality schools often come with higher property prices. Families prioritizing education must balance budgets with educational priorities.

Some towns may offer strong academics at a more reasonable price. Exploring Southern NH Houses for sale in multiple communities helps families find ideal combinations.

Financial planning and understanding property tax implications help families make smart, long-term choices.

On-site visits reveal more than statistics. Families prioritizing education benefit from touring schools, meeting teachers, and speaking with local parents.

Parent insights often reveal school culture, teacher engagement, and community involvement.

This information complements research data and helps families feel confident in their choices.

Local agents provide valuable insight for families prioritizing education. They know neighborhoods, school reputations, and property trends.

Realtors can guide families to homes that align with academic priorities while staying within budget.

Working with a knowledgeable agent reduces stress and ensures families do not miss valuable opportunities.

Many communities offer supplemental learning. Libraries, tutoring centers, and enrichment programs enhance education.

Families prioritizing education should explore these resources when evaluating towns.

Access to additional learning options supports children’s growth and provides flexibility for different learning styles.

Education needs change over time. Families prioritizing education think ahead to middle and high school transitions.

Considering future school performance, extracurricular opportunities, and community programs ensures children continue to thrive.

Homes in strong districts often attract families for decades, creating stable communities.

When searching Southern NH Houses for sale, families prioritizing education must consider proximity to top schools.

Homes near highly rated districts often sell faster but provide long-term value.

Balancing location, size, and budget ensures families find homes that support both lifestyle and learning.

Education and Community Values Align

Towns with strong schools often foster family-friendly communities. Families prioritizing education value supportive neighbors and local involvement.

Town activities, sports leagues, and school events enhance social engagement.

Communities that value learning often attract like-minded families, creating lasting bonds.

Education-focused home searches require careful planning. Families prioritizing education gather data, visit schools, and weigh options.

Balancing school quality with affordability and community fit ensures smart decisions.

Patience and research lead to homes where children can grow and families can thrive.

Families prioritizing education face many choices, but knowledge builds confidence. Schools, neighborhoods, and amenities all influence long-term satisfaction.

Southern NH Houses for sale near strong districts provide both lifestyle and educational value. Families can find homes that support growth, comfort, and opportunity.

By understanding school ratings, programs, and community resources, families prioritize education effectively and make informed decisions for the future.

If you need more info on families prioritizing education, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

The housing market keeps changing. Buyers and sellers want to know what comes next. The Southern NH future of real estate already shows clear signs of growth and adjustment. These changes matter for anyone watching Southern NH Houses for sale today.

Southern New Hampshire continues to attract buyers from nearby states. Lifestyle, space, and value drive demand. This article explains the trends shaping the market through 2026 in a clear and friendly way.

Southern New Hampshire offers location and balance. It sits close to Boston while feeling calm and open. Many buyers want that mix.

Low crime rates, strong schools, and outdoor access help fuel interest. Buyers also like the lack of broad income tax. These factors keep demand steady.

As a result, the Southern NH future of real estate looks active rather than slow.

Population trends influence housing demand. Many buyers move north for space and value. Others stay local but move within the region.

Young families seek good schools and yards. Retirees look for manageable homes near services. These shifts create varied demand.

Builders and sellers will respond with more diverse housing options.

Remote and hybrid work changed how people live. That shift will not fade soon. Buyers now prioritize home offices and flexible spaces.

Southern New Hampshire fits this lifestyle well. Commutes matter less for many workers. Space and comfort matter more.

This trend strongly supports the Southern NH real estate future.

Rapid price growth cannot last forever. Many experts expect slower appreciation in 2026. That shift may help buyers.

Prices may level out rather than drop. Inventory still remains limited. Demand continues to support values.

This balance creates a healthier market for long term planning.

Housing supply remains tight today. New construction takes time. Zoning and land limits also slow growth.

However, inventory should rise gradually. More homeowners may list as rates stabilize. Builders will also add homes.

Buyers watching Southern NH Houses for sale may see more options ahead.

Buyers now explore beyond major towns. Lesser known communities offer value and space. This trend will continue through 2026.

Towns like Candia, Raymond, and Chester see growing interest. Buyers appreciate quieter settings and larger lots.

As demand spreads, these towns may see steady price growth.

Lifestyle now drives many decisions. Buyers want comfort and flexibility. Homes that support daily life will stand out.

Features like outdoor space, energy efficiency, and updated layouts matter more. Buyers value function over flash.

Sellers who adapt to this trend will attract stronger offers.

Energy costs influence budgets. Buyers pay closer attention to efficiency. Insulation, windows, and heating systems matter.

Homes with upgrades often sell faster. Buyers see savings and comfort. This trend will continue to grow stronger.

Energy smart homes support long term value.

Builders are adjusting plans. New homes feature open layouts and flexible rooms. Storage and light matter more.

Smaller footprints with smart design will grow popular. Buyers want ease without wasted space.

This approach fits both families and downsizers.

Rates affect affordability. Even small changes impact monthly payments. Buyers will continue to watch rates closely.

However, many buyers now accept higher rates as normal. They focus more on lifestyle and timing.

This shift supports steady activity in the Southern NH real estate future.

First time buyers still face hurdles. Prices and rates create pressure. Creative solutions will help.

Programs, grants, and flexible loan options matter. Education also plays a role.

Agents who guide buyers carefully will stand out.

Many homeowners plan to downsize. They want less upkeep and more freedom. Southern New Hampshire offers many options.

Single level homes and condos will see strong demand. Walkable locations also matter more.

This trend adds variety to the housing market.

Families often combine households. Cost savings and support drive this choice.

Homes with in law layouts attract attention. Buyers plan for long term needs.

Builders and sellers who offer flexibility will benefit.

Technology continues to improve the process. Virtual tours and digital paperwork save time. Buyers expect convenience.

Agents who embrace tech gain trust. Clear communication still matters most.

The blend of tech and service defines modern real estate.

Investors watch stable markets. Southern New Hampshire offers consistent demand. Rental needs remain strong.

Multi family and single family rentals attract interest. Location and condition matter most.

This activity supports pricing and inventory movement.

Not all residents buy. Many rent by choice or need. Job growth supports rental demand.

Towns near highways and employers see steady interest. This trend supports investors and builders.

Rental stability adds strength to the overall market.

Employment drives housing demand. Southern New Hampshire benefits from diverse industries. Health care, tech, and trades all play roles.

Economic balance supports steady growth. It reduces sharp swings.

This stability boosts confidence among buyers and sellers.

School quality remains a top factor. Families plan carefully. Towns with strong schools stay popular.

Buyers often accept higher prices for education. That pattern will continue in 2026.

Schools remain tied closely to home values.

Roads, utilities, and broadband matter. Towns investing in infrastructure attract buyers.

Remote work increases the need for fast internet. Towns that improve access gain advantage.

Infrastructure supports the Southern NH real estate future.

Sellers should prepare for informed buyers. Pricing must reflect condition and market reality.

Homes that show well will still sell. Overpriced homes may sit longer.

Professional guidance helps sellers succeed.

Buyers should watch trends early. Preparation builds confidence.

Working with a local agent helps spot opportunity. Timing and knowledge matter.

Patience and planning lead to better outcomes.

Listings will reflect buyer needs. Homes with updates and flexibility will stand out.

Southern NH Houses for sale will show more variety over time. Buyers gain choice and clarity.

This evolution supports a healthier market.

Southern New Hampshire remains resilient. Demand stays steady. Growth feels balanced rather than rushed.

The Southern NH future of real estate looks positive and stable. Lifestyle, value, and location continue to attract buyers.

Those exploring Southern NH Houses for sale in 2026 can move forward with confidence and optimism.

If you need more tips on Southern NH future of real estate in 2026, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

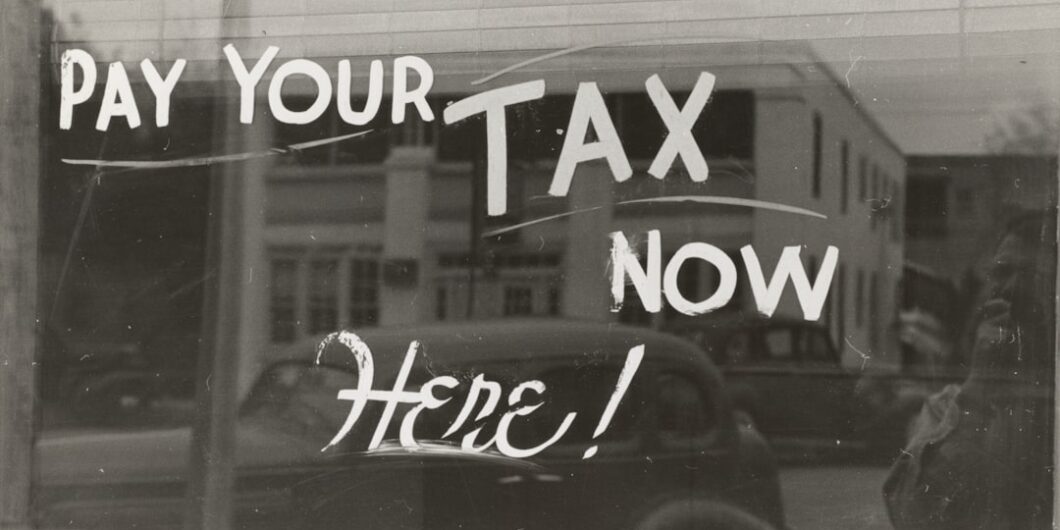

When it comes to buying a home, there’s one thing many people forget to factor into their plans, property taxes. Understanding how taxes vary by town can help you make smarter decisions and avoid surprises down the road.

Property taxes can have a big impact on your monthly payments, your long-term costs, and even your home search strategy. In Southern New Hampshire, every town sets its own tax rate, and those differences can really add up.

Whether you’re exploring Southern NH houses for sale or comparing communities for your next move, knowing how each town’s taxes affect your budget will help you stay informed and confident as a buyer. Let’s break it all down in simple terms.

Property taxes aren’t just another line on your mortgage statement. They’re an ongoing cost of homeownership. These taxes help fund local services like schools, police and fire departments, libraries, and road maintenance.

When you understand how taxes vary by town, you can see why some areas cost more than others. A town with top-rated schools and well maintained parks may have higher tax rates to support those services. Meanwhile, smaller towns with fewer services might have lower rates but may not offer as many amenities.

The key is balance. You want a community that fits both your lifestyle and your budget.

Before diving into how different towns compare, it helps to understand how the math works. Property taxes are based on two main things:

The assessed value of your home – what the town believes your property is worth.

The local tax rate – how much the town charges per $1,000 of assessed value.

For example, if your home is assessed at $400,000 and the town’s tax rate is $20 per $1,000, your annual property tax would be $8,000. So even if two homes cost the same, your yearly costs could differ depending on how taxes vary by town.

Now let’s look at what this means in real life. Southern New Hampshire includes a mix of cities, suburbs, and small towns—all with different tax rates and services.

In general:

Cities like Nashua or Manchester tend to have higher tax rates because they offer more public services and larger school systems.

Towns like Windham, Bedford, or Hollis often have higher home values but lower tax rates, which balance out the total bill.

Smaller towns like Brookline or Lyndeborough may offer lower rates but fewer public amenities.

This is why it’s important to research each area before deciding where to buy. When looking at Southern NH houses for sale, take a few minutes to compare tax rates. It could affect your monthly budget more than you expect.

Tax rates aren’t set in stone. They can shift from one year to the next based on town budgets, property assessments, and local spending decisions.

Here are a few common reasons rates change:

Town budgets increase. If a town needs more money for schools, roads, or emergency services, rates can go up.

Property values rise. When property values increase across a town, the rate may go down—but you might still pay more overall because your assessment is higher.

New development. Growth can sometimes lower taxes, as new businesses or homes expand the tax base.

This is why it’s smart to keep an eye on how taxes vary by town each year, especially if you’re budgeting for long-term costs.

When you take out a mortgage, your property taxes are usually included in your monthly payment through an escrow account.

That means if your town’s taxes increase, your monthly payment could go up even if your mortgage rate stays the same.

For example, let’s say you find a home among Southern NH houses for sale that fits your $2,500 monthly budget. If that includes property taxes, and those taxes rise by $1,200 a year, your new payment could increase by $100 per month. That’s why understanding how taxes vary by town can help you plan ahead and avoid being caught off guard.

Let’s say you’re deciding between two homes—one in Londonderry and one in Hudson.

Londonderry: Tax rate of about $18 per $1,000 of assessed value.

Hudson: Tax rate of about $24 per $1,000 of assessed value.

If both homes are valued at $450,000, here’s how the math plays out:

Londonderry taxes: $8,100 per year

Hudson taxes: $10,800 per year

That’s a difference of $2,700 annually, or about $225 per month—just based on how taxes vary by town. These are rough examples, but they show how much impact local taxes can have on your budget.

It’s easy to think that lower taxes are always better but that’s not always true.

Towns with higher tax rates often use that money for better services, schools, and infrastructure. If you have kids, a strong school system might be worth the added cost. You might also enjoy extras like better maintained parks, community programs, or faster emergency response times.

When you look at Southern NH houses for sale, think about how each town’s services fit your lifestyle. A slightly higher tax bill could bring better long-term value and quality of life.

On the other hand, lower taxes can make a home more affordable month to month. If you’re a first-time buyer or on a tighter budget, that can be a big advantage.

However, lower taxes sometimes mean fewer town services. You might need to hire private trash pickup, pay for a recreation membership, or travel farther for certain amenities.

Again, this is why knowing how taxes vary by town helps you balance cost and convenience. It’s about finding what matters most to you and your family.

When you start browsing Southern NH houses for sale, keep a few smart strategies in mind:

Check tax rates early. Don’t wait until closing to find out how much you’ll owe each year.

Ask your REALTOR® for comparisons. Local agents know which towns have higher or lower taxes and why.

Look beyond the number. Sometimes a higher rate supports strong schools or great community resources.

Consider your full budget. Add taxes, utilities, and insurance to your monthly costs before setting your price range.

This kind of preparation keeps your finances steady and helps you make confident decisions.

There are a few myths that can trip up buyers when trying to understand how taxes vary by town:

Myth #1: New homes always mean higher taxes.

Not necessarily. Sometimes new builds are more energy-efficient and valued lower than expected.

Myth #2: Property taxes never go down.

Rates can decrease if property values rise or if towns reduce budgets.

Myth #3: A low tax rate always means a cheaper home.

A lower rate might be paired with a higher home value, balancing things out.

Understanding the truth behind these myths can make your home search much smoother.

Buyers often ask whether tax rates impact home prices. The short answer is yes, indirectly. Towns with higher taxes sometimes have slower appreciation because buyers factor in the ongoing cost. But if those taxes support great schools and amenities, they can actually boost demand and long-term value.

When comparing Southern NH houses for sale, look for areas where taxes are fair, services are strong, and property values are stable. That’s usually the sweet spot.

Even after you buy your home, it’s smart to stay proactive about your property taxes.

Review your annual assessment. Make sure your home’s value is accurate.

Attend local meetings. Town budget hearings often discuss proposed tax changes.

Set aside a little extra. Build a buffer in your budget for potential increases.

Knowing how taxes vary by town means you’ll always be ready for whatever changes come your way.

Your REALTOR® can be a huge help in understanding property taxes. They can explain how rates differ, what local services you’re paying for, and how taxes fit into your overall affordability.

When shopping Southern NH houses for sale, a knowledgeable agent can show you how to weigh taxes against other factors, like commute times, school ratings, or neighborhood trends. A good agent knows the numbers, but they also know how those numbers affect your life.

At the end of the day, how taxes vary by town is just one piece of the puzzle. Your perfect home isn’t only about the rate. It’s about the community, the comfort, and the long-term fit for your lifestyle.

If you’re exploring Southern NH houses for sale, take time to compare both home prices and tax rates. With a bit of research and guidance, you can find a home that feels right for your heart and your wallet. Property taxes may not be the most exciting part of buying a home, but understanding them helps you make decisions that truly pay off in the long run.

If you need more tips on how how taxes vary by town, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Welcome to 149 Highland St Hudson NH 03051! This beautifully updated 5 bedroom, 3 bath Garrison-style home offers space, flexibility, and comfort for modern living. Perfect for multi-generational households or those needing room to grow, this home features a fully finished in-law suite, an above-ground pool, and a private backyard oasis—all set in a highly desirable Hudson neighborhood.

The main living room at 149 Highland St welcomes you with natural light from large windows and a charming wood-burning fireplace, creating a warm and cozy atmosphere. The open-concept family room stretches front to back and includes a stunning bow window and direct access to a large deck—ideal for entertaining or enjoying quiet mornings with coffee. Split A/C units keep the space comfortable all summer long.

The heart of the home is the updated kitchen, featuring granite countertops, sleek cabinetry, and a functional layout ideal for everyday living or hosting friends. Whether you're cooking dinner for the family or prepping for a summer party, this kitchen delivers both style and practicality.

One of the standout features of this property is the fully finished lower-level in-law apartment. Complete with a private bedroom, 3/4 bath, living area, and dining nook, it offers a separate space with endless possibilities—ideal for aging parents, college-age kids, or even rental income.

Step outside and you’ll find a backyard designed for relaxation and fun. Enjoy the above-ground pool on hot summer days, gather around the patio for cookouts, or create your dream garden in the expansive yard. With plenty of green space and privacy, this backyard is truly your own retreat—perfect for both play and peaceful downtime.

Recent upgrades include a newer metal roof (2021), a repaved driveway (2019), seamless gutters, and double-pane windows, providing peace of mind and long-term value. A 2-car garage adds convenience and storage, while the home’s curb appeal shines with well-kept landscaping and a welcoming front entry.

149 Highland St is tucked into a quiet, established neighborhood just minutes from schools, parks, shopping, and major commuting routes. With easy access to everything Hudson and the surrounding areas have to offer, this home combines suburban comfort with everyday convenience.

If you're looking for a spacious, move-in-ready home with in-law potential, updated features, and an unbeatable backyard, 149 Highland St Hudson NH 030351 is the one you’ve been waiting for. Don’t miss your chance to make it yours—showings begin at the Open House on Sunday, July 20, 2025, from 1–3 PM!

If you're searching for Hudson NH homes for sale, 149 Highland St Hudson NH 03051 stands out as an excellent choice with its spacious layout and potential. Don’t miss out on this amazing opportunity – contact Pat Nappo today to schedule a viewing and make 149 Highland St Hudson NH 03051 your new home!