- in Bedford NH , Best Real Estate Agents in Southern NH , Blog , Harmony Real Estate , Hudson NH , Investment , Litchfield homes for sale , Litchfield NH , Londonderry homes for sale , Londonderry NH , Nashua NH , South Hudson homes for sale , Southern Hudson NH , Southern Nashua NH , Southern NH homes for sale , Top Real Estate Agent in Southern NH , Virginia Kazlouskas Gregory by Virginia Kazlouskas

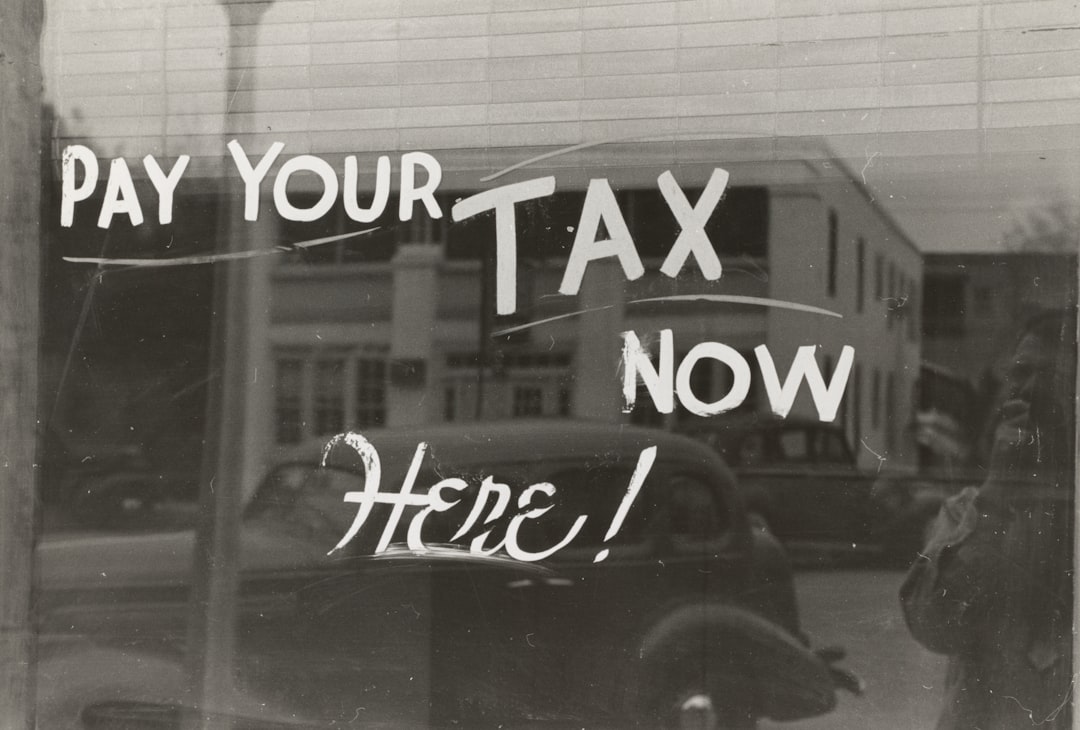

Southern New Hampshire Property Taxes Explained

Buying a home brings many questions. Taxes often create the most confusion. Southern NH property taxes play a big role in monthly costs and long term planning. Buyers should understand them early.

When reviewing Southern NH Houses for sale, taxes should always be part of the conversation. They affect affordability more than many expect. This guide explains how taxes work in clear and simple terms.

The goal is confidence. With the right knowledge, buyers can plan wisely and avoid surprises.

What Property Taxes Pay For in Southern New Hampshire

Property taxes support daily life in each town. They fund schools, roads, and public safety. Libraries, parks, and town services also rely on tax dollars.

Unlike some states, New Hampshire does not have a broad income tax. Property taxes carry more weight instead. This structure makes local tax rates important.

Buyers should view taxes as part of community investment. Strong services often reflect thoughtful spending.

How Southern NH Property Taxes Are Calculated

Southern NH property taxes start with assessed value. Each town assesses homes based on market value. Assessments usually occur every few years.

The town then applies a tax rate. This rate is set annually. It reflects the town budget and total assessed value.

Taxes equal assessed value multiplied by the tax rate. Knowing both numbers helps buyers estimate costs.

Why Tax Rates Vary by Town

Every town sets its own budget. School costs, staffing, and services differ. These choices shape tax rates.

Some towns have higher home values. Others rely more on residential taxes. Business presence can also impact rates.

Buyers comparing Southern NH Houses for sale should review town tax histories. Patterns often matter more than one year.

Understanding the Tax Rate Number

Tax rates are shown as dollars per thousand. A rate of twenty means twenty dollars per thousand of value.

For example, a three hundred thousand dollar home would owe six thousand dollars at that rate. This math helps buyers plan.

Agents often help explain this step. It turns confusion into clarity quickly.

Assessed Value Versus Purchase Price

Assessed value may differ from purchase price. Some towns assess below market. Others stay close to current values.

Buyers should not assume taxes will match the seller’s bill. New purchase prices can trigger reassessment.

Understanding this gap helps avoid surprises after closing.

Reassessments and Their Impact

Towns reassess properties periodically. This process updates values across the board. Reassessments do not always raise taxes. They often adjust values evenly. Individual tax bills depend on the new rate.

Buyers should ask when the last reassessment occurred. Timing matters for planning.

School Spending and Southern NH Property Taxes

Schools represent the largest tax expense. Education quality often links directly to tax levels. Towns with strong schools may have higher rates. Many buyers see this as a fair trade.

When reviewing Southern NH property taxes, school budgets deserve attention. They shape both cost and value.

How Local Services Affect Taxes

Fire departments, police, and public works cost money. Town size and layout influence expenses.

Rural towns may spend more per home on roads. Dense towns spread costs across more properties.

Buyers should match lifestyle preferences with service levels. Taxes often reflect those choices.

Comparing Southern NH Property Taxes Between Towns

Comparing taxes requires context. A lower rate does not always mean lower cost. Higher home values can offset savings.

Buyers should compare total tax bills, not just rates. This approach paints a clearer picture.

A local agent can help analyze these differences quickly.

Common Southern NH Town Tax Patterns

Many southern towns fall into predictable ranges. Suburban towns often sit in the middle. Commuter friendly towns may have slightly higher rates. Access and demand influence budgets.

Understanding these patterns helps buyers set expectations early.

Property Taxes and Monthly Mortgage Payments

Property taxes usually roll into escrow payments. Lenders collect taxes monthly. This system spreads costs evenly across the year. Buyers should review escrow estimates carefully.

Accurate tax estimates prevent payment shocks later.

Escrow Adjustments After Closing

Escrow accounts adjust annually. Changes reflect actual tax bills. If taxes rise, payments increase slightly. If taxes drop, buyers may see refunds.

Understanding this cycle reduces stress and confusion.

Exemptions That May Lower Taxes

New Hampshire offers limited exemptions. Seniors and veterans may qualify. Income and residency rules apply. Buyers should ask town offices directly.

Even small exemptions help long term budgets.

Tax Abatements and Appeals

Homeowners can appeal assessments. Towns provide clear timelines. If a value seems too high, evidence helps. Comparable sales often support appeals.

Buyers should know this option exists. It empowers homeowners.

How Property Taxes Affect Resale Value

Taxes influence buyer demand. Extremely high taxes can slow sales. Balanced taxes paired with strong services attract steady interest.

Southern NH property taxes often support long term value when managed well.

New Construction and Property Taxes

New homes often start with land assessments. Taxes rise after completion. Buyers should plan for higher bills in year two. This step surprises many first time buyers.

Builders and agents can estimate future taxes accurately.

Condos and Property Taxes

Condos often have lower taxes than single family homes. Shared land lowers assessed value. Buyers should still review association fees. Total costs matter more than one number.

Taxes and fees together shape affordability.

Multi Family Homes and Taxes

Multi family homes carry higher values. Taxes reflect income potential. Buyers should factor rent into planning. Taxes often remain manageable with cash flow.

Investors watch Southern NH property taxes closely for this reason.

Property Taxes and Rural Homes

Rural homes may have larger lots. Land value adds to assessment.

However, services may be fewer. Rates sometimes balance out.

Buyers should review full tax bills before deciding.

How Southern NH Property Taxes Compare to Other States

New Hampshire lacks broad income tax. Property taxes fill the gap. Buyers moving from other states may notice the shift.

Overall cost of living often balances out with careful planning.

Planning Ahead as a Buyer

Smart buyers plan taxes early. They review town budgets and trends. They also ask questions before making offers. Knowledge builds confidence.

This approach leads to better decisions and smoother closings.

Working With a Local REALTOR Matters

Local agents understand tax nuances. They track changes and patterns. They also explain how taxes affect offers. Guidance saves time and stress.

A trusted agent becomes a key resource.

Reviewing Southern NH Houses for sale With Taxes in Mind

Listings often show current tax bills. Buyers should read them carefully. Taxes help shape monthly comfort. They deserve equal attention as price.

Southern NH Houses for sale offer variety across many tax ranges.

Balancing Taxes With Lifestyle Goals

Every buyer values different things. Some prioritize schools. Others want privacy.

Taxes often reflect these priorities. Balance matters most.

Buyers should choose what fits their life best.

Common Buyer Mistakes Around Taxes

Some buyers ignore taxes until closing. Others assume they will stay flat. Both mistakes create stress. Early review prevents problems.

Asking questions always helps.

Long Term Outlook for Southern NH Property Taxes

Tax rates change yearly. However, trends matter more than spikes. Southern New Hampshire remains stable overall. Growth often spreads costs.

This stability supports confident buying decisions.

Understanding Southern NH Property Taxes Before You Buy

Southern NH property taxes may feel complex at first. With clear guidance, they become manageable. Knowledge turns concern into control.

When exploring Southern NH Houses for sale, taxes deserve careful review. They shape comfort, value, and long term plans.

With the right support, buyers can move forward with confidence and peace of mind.

If you need more tips on Southern NH Property taxes, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.