Tag Archives for " buying "

Luxury home design trends 2025 are changing how buyers see high-end homes. From sleek exteriors to cozy interiors, today’s luxury homes are all about comfort, style, and smart living. If you're checking out Londonderry Houses for Sale or browsing Southern NH houses for sale, these trends will help you spot the best features. Let’s dive into what’s hot this year in luxury real estate.

Luxury homes design trends 2025 now come with tech that makes life easier. Smart thermostats, lighting, and security systems are standard. Voice control and mobile apps let homeowners manage everything from anywhere.

Buyers love homes that feel modern and connected. If you're selling, adding smart features can boost your home's value.

Wood, stone, and clay are trending again. These materials add warmth and texture to both interiors and exteriors. Think stone fireplaces, wood beams, and clay tile roofs.

Natural finishes help homes blend with the landscape. In Southern NH, where nature is part of the charm, this trend fits perfectly.

Open floor plans are still popular, but now they come with zones. Instead of one big room, designers create areas for cooking, relaxing, and working. This makes homes feel organized and cozy.

Buyers want homes that flow well but still offer privacy. If you're listing a home, highlight these zones in your photos and descriptions.

Luxury homes now treat outdoor spaces like indoor rooms. Covered patios, outdoor kitchens, and fire pits are must-haves. Some homes even have outdoor theaters or spa areas.

In Londonderry houses for sale, outdoor living is a big selling point. Buyers want to enjoy all four seasons in style.

Neutral tones are still around, but bold colors are making waves. Deep blues, forest greens, and rich terracotta are showing up in kitchens and bathrooms. Textured walls and patterned tiles add depth.

These touches make homes feel unique and high-end. They also photograph well, which helps listings stand out online.

Eco-friendly features are no longer optional. Solar panels, energy-efficient windows, and recycled materials are key in luxury homes. Buyers care about the planet and want homes that reflect that.

Southern NH houses for sale with green features often sell faster and for more. It’s a win-win for buyers and sellers.

Bathrooms are turning into personal retreats. Think soaking tubs, rainfall showers, and heated floors. Natural light and calming colors make these spaces feel like a spa.

Luxury buyers want bathrooms that help them relax. If you're staging a home, add soft towels and candles to set the mood.

Kitchens are the heart of the home, and luxury buyers want them to shine. Double islands, smart appliances, and custom cabinets are top features. Open shelving and statement lighting add style.

In Londonderry houses for sale, a stunning kitchen can seal the deal. Make sure your listing photos show off every detail.

Ceilings and floors are getting more attention. Coffered ceilings, wood inlays, and bold tile patterns add drama. These features make homes feel custom and high-end.

Buyers notice these details, especially in Southern NH houses for sale. They add character and charm that stands out.

Luxury homes now include rooms that can change with your needs. Home offices, gyms, and media rooms are popular. Some homes even have hidden nooks for reading or meditation.

Flex spaces make homes more livable. They also appeal to buyers with busy lifestyles.

Art is playing a bigger role in home design. Custom pieces, gallery walls, and sculptures add personality. Buyers want homes that feel unique and reflect their style.

If you're selling, consider staging with local art. It adds emotion and helps buyers connect with the space.

Designers are mixing classic styles with modern touches. Think traditional moldings with sleek furniture. This blend creates homes that feel fresh but still familiar.

Luxury buyers love homes that balance old and new. It makes the space feel curated and thoughtful.

From door handles to drawer pulls, every detail matters. High-end homes use quality materials and thoughtful design. Even small upgrades can make a big impact.

If you're prepping a listing, don’t skip the little things. They help your home feel polished and complete.

If you need more information on luxury home design trends 2025, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Today’s buyers care about more than square footage and curb appeal. They want homes that support sustainable living practices. Eco-friendly upgrades not only help the planet—they also boost home value and attract environmentally conscious buyers.

Whether you're listing Londonderry houses for sale or Southern NH houses for sale, these tips can make your home stand out.

Why Sustainable Living Matters in Real Estate

Why Sustainable Living Matters in Real EstateSustainable homes are in demand. Buyers want energy savings, healthier spaces, and smart technology. These features make homes more comfortable and cost-effective.

Lower utility bills

Healthier indoor air

Smart energy tracking

Eco-conscious lifestyle

Homes with sustainable living practices sell faster and often for more money. Let’s explore how to make your home greener and more appealing.

Energy-Efficient Upgrades That Make a Big Impact

Energy-Efficient Upgrades That Make a Big ImpactEnergy efficiency is a top priority for eco-minded buyers. These upgrades are simple, powerful, and budget-friendly.

Use less energy and last longer.

Brighten rooms while saving money.

Control heating and cooling from your phone.

Save energy with automated settings.

Use less water and electricity.

Buyers love modern, efficient kitchens and laundry rooms.

Keep warm air in during winter.

Reduce cooling costs in summer.

These upgrades show buyers your home is smart, efficient, and ready for modern living.

Solar Power: Clean Energy That Sells

Solar Power: Clean Energy That SellsSolar panels are a bold step toward sustainability. They also add serious value to your home.

Lower electric bills

Tax incentives and rebates

Increased home value

Long-term savings

If you’re selling in Londonderry or Southern NH, solar panels can be a major selling point. Buyers love homes that offer clean energy and independence from rising utility costs.

Water-Saving Features Buyers Appreciate

Water-Saving Features Buyers AppreciateWater conservation is another key part of sustainable living practices. These upgrades are easy and effective.

Use less water without losing pressure.

Save money and help the environment.

Collect rainwater for gardens.

Reduce water bills and support healthy landscaping.

Use native plants that need less water.

Create beautiful, low-maintenance yards.

These features are especially helpful in Southern NH, where seasonal changes affect water use.

Eco-Friendly Building Materials That Buyers Notice

Eco-Friendly Building Materials That Buyers NoticeMaterials matter. Buyers want homes built with care and sustainability in mind.

Durable, stylish, and renewable.

Adds warmth and charm to any room.

Made from glass, paper, or concrete.

Unique and environmentally friendly.

Improve indoor air quality.

Safe for kids and pets.

Adds character and reduces waste.

Perfect for accent walls or furniture.

These materials show buyers your home is thoughtful and eco-conscious.

Indoor Air Quality: A Hidden Selling Point

Indoor Air Quality: A Hidden Selling PointClean air is essential. Buyers care about health and comfort, especially in family homes.

Remove allergens and pollutants.

Create a healthier living space.

Bring in fresh air and reduce humidity.

Prevent mold and improve comfort.

Natural air filters that add beauty.

Easy way to boost indoor air quality.

Homes with good air quality feel fresh and inviting. That’s a big win for buyers.

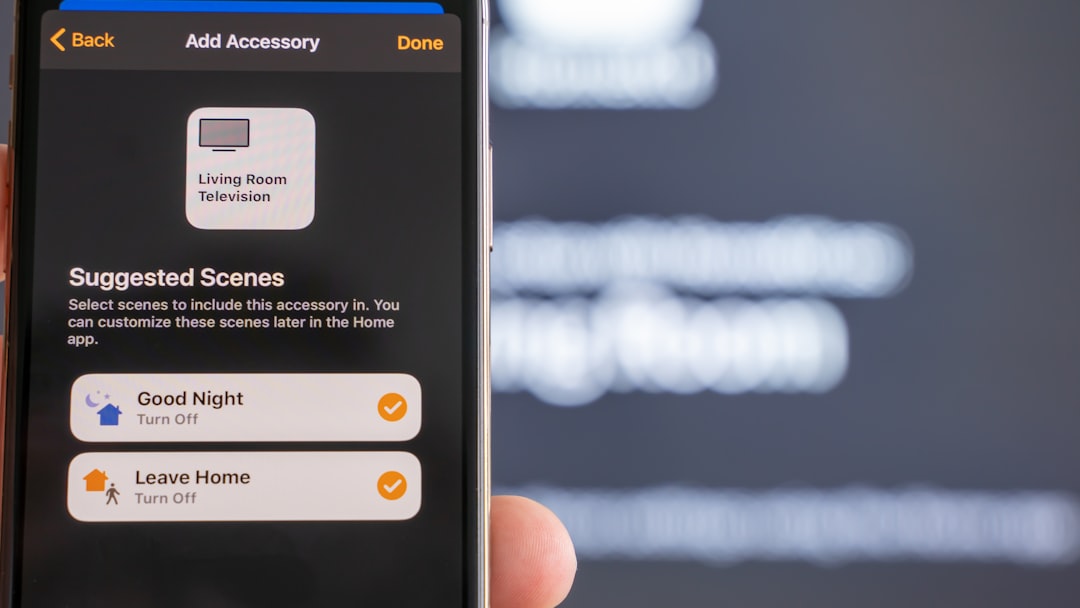

Smart Home Tech That Supports Sustainability

Smart Home Tech That Supports SustainabilitySmart homes are not just cool—they’re efficient. Tech helps buyers manage energy and live greener.

Cut off power to unused devices.

Save energy without effort.

Track usage and find savings.

Buyers love seeing real-time data.

Adjust settings based on time or activity.

Reduce waste and increase comfort.

Smart tech makes sustainable living practices easy and attractive.

Eco-Friendly Habits That Buyers Value

Eco-Friendly Habits That Buyers ValueSustainability isn’t just about upgrades—it’s also about lifestyle. Buyers notice how a home supports green living.

Make it easy to sort and store recyclables.

Show buyers your home supports eco habits.

Reduce waste and feed gardens.

Great for buyers who love gardening.

Save energy by skipping the dryer.

Simple, old-school, and effective.

These habits help buyers picture themselves living sustainably in your home.

Neighborhood Sustainability: A Community That Cares

Neighborhood Sustainability: A Community That CaresBuyers want more than a green home—they want a green neighborhood. Highlight local efforts and amenities.

Support local food and reduce packaging.

Great for families and food lovers.

Grow fresh produce and build connections.

Show buyers the town values sustainability.

Encourage outdoor activity and reduce driving.

Popular in Londonderry and Southern NH.

Neighborhood features add emotional value and help buyers feel connected.

Make Your Home a Green Dream

Make Your Home a Green DreamEco-friendly homes are more than a trend—they’re the future. By adding sustainable living practices, you attract buyers who care about the planet and their lifestyle.

Whether you're listing Londonderry houses for sale or Southern NH houses for sale, these tips help your home shine. From solar panels to smart thermostats, every upgrade adds value and appeal.

So take a look around your home. What can you improve? What habits can you highlight? Your next buyer might be looking for exactly what you have.

If you need more tips on sustainable living practices, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

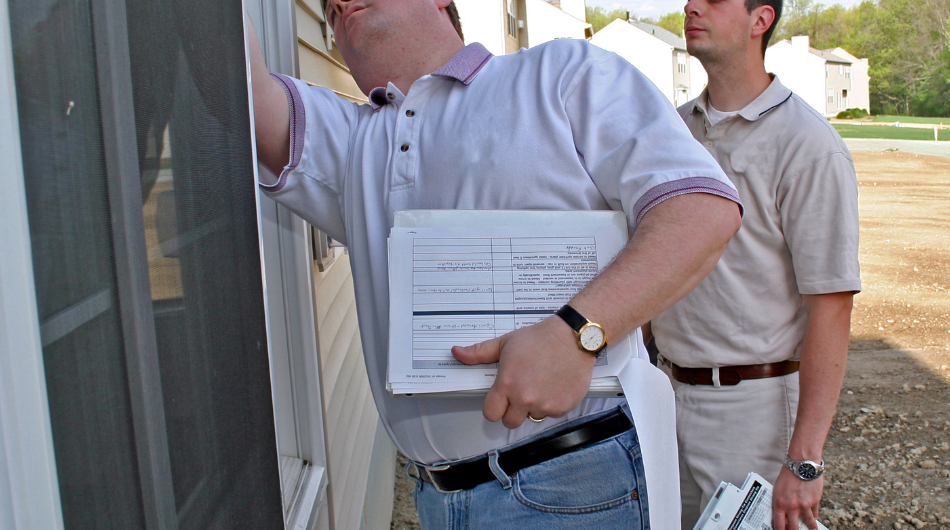

Buying a home is exciting, but it can also feel overwhelming. Two important steps—home inspection vs appraisal—often confuse buyers. They sound similar, but they serve very different purposes.

If you're shopping South Hudson houses for sale or Southern NH houses for sale, knowing the difference helps you make smart decisions. Let’s break it down in simple terms.

What Is a Home Inspection?

What Is a Home Inspection?A home inspection is a deep look at the home’s condition. It’s usually done after your offer is accepted.

A licensed home inspector checks the house.

They look at structure, systems, and safety.

Roof, foundation, plumbing, electrical, HVAC, and more.

They also check for leaks, mold, and pests.

To find problems before you buy.

You can ask the seller to fix issues or lower the price.

The buyer usually pays.

It costs a few hundred dollars but can save thousands.

A home inspection gives peace of mind. It helps buyers feel confident about their purchase.

What Is an Appraisal?

What Is an Appraisal?An appraisal is a professional estimate of the home’s value. It’s required by lenders before they approve your loan.

A licensed appraiser visits the home.

They compare it to similar homes nearby.

Size, location, condition, and upgrades.

They also look at recent sales in the area.

To make sure the home is worth the loan amount.

Lenders don’t want to lend more than the home is worth.

The buyer usually pays.

It’s often included in closing costs.

An appraisal protects both the buyer and the lender. It helps avoid overpaying for a home.

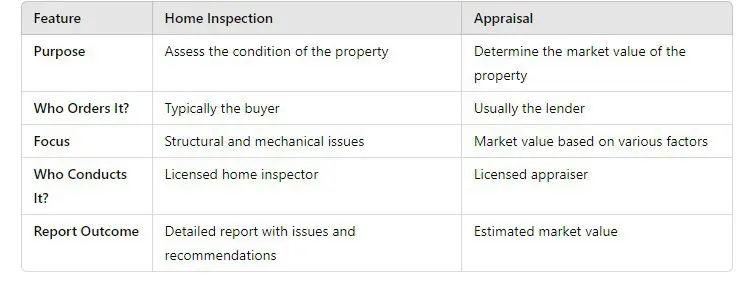

Key Differences Between Home Inspection vs Appraisal

Key Differences Between Home Inspection vs AppraisalLet’s compare the two side by side:

Why Both Matter in Southern NH Real Estate

Why Both Matter in Southern NH Real EstateWhether you're buying South Hudson houses for sale or Southern NH houses for sale, both steps are important.

Inspections catch hidden problems.

Appraisals confirm fair pricing.

No one wants to find a leaky roof after moving in.

No one wants to pay more than a home is worth.

Inspection results can lead to price changes.

Appraisal results can affect loan terms.

Smart buyers use both tools to make informed choices.

Common Questions About Home Inspection vs Appraisal

Common Questions About Home Inspection vs AppraisalYes. They serve different purposes and protect you in different ways.

You can, but it’s risky. You might miss costly problems.

You may need to renegotiate or bring more cash to closing.

You can choose your inspector. The lender picks the appraiser.

Tips for Buyers and Sellers

Tips for Buyers and SellersAlways get a home inspection.

Review the report carefully.

Ask questions and don’t be afraid to negotiate.

Consider a pre-listing inspection.

Fix issues before listing.

Price your home based on recent appraisals.

These tips help make the process smoother and less stressful.

South Hudson and Southern NH Market Insights

South Hudson and Southern NH Market InsightsIn areas like South Hudson and Southern NH, buyers are smart and cautious. Homes with clean inspection reports and fair appraisals sell faster.

Homes move quickly.

Buyers want confidence in their purchase.

Appraisals help set realistic prices.

Inspections help avoid surprises.

Buyers trust homes with full transparency.

Sellers who prepare well earn better offers.

If you're listing South Hudson houses for sale or Southern NH houses for sale, understanding home inspection vs appraisal helps you succeed.

Checklist: What to Do and When

Checklist: What to Do and WhenHire a trusted inspector.

Be present if possible.

Ask questions during the walk-through.

Review the report.

Decide if repairs or price changes are needed.

Clean and stage your home.

List upgrades and improvements.

Review the value.

Talk to your lender if it’s lower than expected.

This checklist keeps you on track and informed.

Be Smart, Be Prepared

Be Smart, Be PreparedBuying or selling a home is a big deal. Knowing the difference between home inspection vs appraisal helps you feel confident and in control.

Both steps protect your money, your future, and your peace of mind. Whether you're buying South Hudson houses for sale or Southern NH houses for sale, these tools are your best friends.

So take your time, ask questions, and work with a trusted REALTOR®. You’ve got this!

If you need more information on home inspection vs appraisal, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Today’s buyers are looking for more than just a pretty kitchen or a big backyard. They want smart home features that make life easier, safer, and more efficient. If you're selling South Hudson houses for sale or Southern NH houses for sale, adding smart upgrades can boost your home's value and attract serious buyers.

Let’s explore the top features buyers love and how you can use them to make your home stand out.

Security Systems: Peace of Mind Sells Homes

Security Systems: Peace of Mind Sells HomesSafety is a top priority for buyers. A smart security system is a great smart home feature. It adds comfort and confidence.

Video doorbells let buyers see who’s at the door.

Popular brands include Ring and Nest.

Lights that turn on when someone walks by are a big plus.

They add safety and save energy.

Keyless entry is convenient and secure.

Buyers love being able to unlock doors from their phones.

Systems with cameras, alarms, and mobile apps are in demand.

Monthly monitoring adds extra value.

Adding these smart home features shows buyers you care about safety and modern living.

Smart Thermostats: Comfort and Savings

Smart Thermostats: Comfort and SavingsBuyers want homes that feel good and save money. Smart home features like smart thermostats do both.

Set temperatures for different times of day.

Save energy while staying comfortable.

Control the heat or AC from your phone.

Great for vacations or busy schedules.

Some thermostats learn your habits.

They adjust automatically to save energy.

See how much energy you use.

Buyers love tracking savings.

Homes with smart thermostats feel modern and efficient. That’s a win for buyers and sellers.

Energy Tracking: Smart and Sustainable

Energy Tracking: Smart and SustainableEnergy efficiency is more than a trend—it’s a must-have. Buyers want homes that help them save money and protect the planet.

Track energy use in real time.

Spot patterns and reduce waste.

If you have solar panels, show buyers how they perform.

Apps make it easy to share data.

Some systems track energy use by device.

Buyers love knowing where their money goes.

Some smart systems connect with local utilities.

They offer tips and rebates for saving energy.

These smart home features make your listing stand out, especially in Southern NH where energy costs matter.

Lighting That Works Smarter

Lighting That Works SmarterLighting sets the mood and saves money. Smart lighting is a simple upgrade with big impact.

Use Alexa or Google to turn lights on and off.

Buyers love the convenience.

Set lights to turn on at sunset or off at bedtime.

Adds security and comfort.

Adjust brightness for any mood.

Great for staging open houses.

Save money and last longer.

Buyers appreciate long-term savings.

Smart lighting is easy to install and makes your home feel high-tech and cozy.

Smart Entertainment: Fun That Sells

Smart Entertainment: Fun That SellsBuyers want homes that fit their lifestyle. Smart entertainment systems add fun and function.

Play music in every room.

Great for parties or relaxing.

Connect to streaming apps and voice assistants.

Buyers love easy access to entertainment.

A dedicated media room adds wow factor.

Include smart controls for lights and sound.

Smart homes can support gaming setups.

Younger buyers especially love this feature.

Entertainment upgrades make your home memorable and exciting.

Smart Assistants: The Brain of the Home

Smart Assistants: The Brain of the HomeSmart assistants tie everything together. They make your home feel connected and easy to manage.

Control lights, locks, and thermostats with your voice.

Buyers love hands-free living.

Set morning or bedtime routines.

Automate tasks for comfort and savings.

Connect with security, lighting, and entertainment.

A seamless experience adds major value.

Smart assistants are a small upgrade with a big impact.

Smart Appliances: Modern and Efficient

Smart Appliances: Modern and EfficientAppliances are a big part of daily life. Smart versions make chores easier and homes more appealing.

Track groceries and suggest recipes.

Buyers love the tech and convenience.

Get alerts when laundry is done.

Save energy with efficient cycles.

Preheat from your phone.

Cook smarter and safer.

Monitor water use and cycle times.

Eco-friendly and easy to use.

Smart appliances show buyers your home is ready for modern living.

Smart Features That Boost Market Value

Smart Features That Boost Market ValueAdding smart home features can increase your home’s value. Buyers see them as upgrades worth paying for.

Homes with smart features sell quicker.

Buyers feel more confident and excited.

Smart upgrades can lead to better offers.

Buyers see long-term savings and comfort.

Use smart features in your listing photos and descriptions.

Highlight them during showings and open houses.

If you're listing South Hudson houses for sale or Southern NH houses for sale, smart features help your home stand out.

Make Your Home Smarter and More Sellable

Make Your Home Smarter and More SellableSmart home features are no longer just nice to have. They’re expected. Buyers want homes that are safe, efficient, and fun to live in. From security systems to smart thermostats and energy tracking, these upgrades make a big difference.

Whether you're selling in South Hudson or anywhere in Southern NH, adding smart features can help your home sell faster and for more money. So take a look around your home, pick a few upgrades, and get ready to impress today’s tech-savvy buyers.

If you need more tips on smart home features, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Want to sell your home faster and for more money? Start with the outside! These seasonal curb appeal tips help your home shine all year long. Whether you're listing South Hudson Houses for Sale or Southern NH houses for sale, first impressions matter.

Buyers often decide how they feel about a home before they even walk in. That’s why curb appeal is key. Let’s break it down season by season with easy, powerful tips that make your home pop.

Spring: Fresh Starts and Bright Colors

Spring: Fresh Starts and Bright ColorsSpring is the season of new beginnings. Buyers are out and ready to fall in love with homes. Use these seasonal curb appeal tips to make yours stand out:

Rake leaves, pick up sticks, and clear out winter debris.

Edge the lawn for a crisp, clean look.

Use bright annuals like pansies, tulips, and daffodils.

Add flower boxes or hanging baskets for charm.

Wash siding, walkways, and driveways.

Clean windows until they sparkle.

Choose a bold color that pops but fits your home’s style.

Red, navy, or teal are great choices.

Make sure they’re easy to read from the street.

Try modern metal or bold black numbers.

Summer: Lush Lawns and Outdoor Living

Summer: Lush Lawns and Outdoor LivingSummer brings long days and lots of showings with these seasonal curb appeal tips. Buyers want to see a home that feels alive and welcoming.

Water regularly and mow often.

Use fertilizer to keep it lush.

Cut back overgrowth to show off the house.

Keep walkways clear and safe.

A cozy bench or bistro set adds charm.

Stage patios and decks like outdoor rooms.

Fresh mulch makes flower beds pop.

Choose dark brown or black for contrast.

Add solar lights along paths and driveways.

Use lanterns or string lights for evening showings.

Fall: Warm Colors and Cozy Vibes

Fall: Warm Colors and Cozy VibesFall is a great time to sell. The air is crisp, and buyers are serious. Use these seasonal curb appeal tips to make your home feel warm and inviting.

Use pumpkins, mums, and hay bales.

Keep it simple and tasteful.

Don’t let them pile up on the lawn or walkways.

A clean yard shows care.

Remove leaves and debris.

Make sure everything looks solid and well-kept.

Choose one with warm colors like orange, red, and gold.

Hang it on the freshly painted front door.

Swap bulbs for soft white or amber tones.

Highlight the porch and entryway.

Winter: Clean, Safe, and Cheerful

Winter: Clean, Safe, and CheerfulWinter can be tough, but homes still sell with these seasonal curb appeal tips! Buyers want to see a home that’s safe, cozy, and well cared for.

Keep paths clear of snow and ice.

Safety is a top priority.

Use wreaths, garlands, and potted evergreens.

Keep it festive but not overdone.

Use bright, warm lights to welcome buyers.

Make sure fixtures are clean and working.

Remove snow and frost from windows.

Let in as much natural light as possible.

Add a cozy bench with pillows.

Use lanterns or battery candles for glow.

Year-Round Tips That Always Work

Year-Round Tips That Always WorkNo matter the season, these curb appeal tips help boost your home’s market value:

Repair fences, steps, and railings.

Buyers notice the little things.

Sweep porches, wash windows, and tidy up.

A clean home feels loved.

Paint trim and siding in soft, classic tones.

Avoid anything too bold or trendy.

Use plants, furniture, and decor to add depth.

Make the space feel full but not cluttered.

Stand across the street and look at your home.

What stands out? What needs work?

Make Your Home Irresistible

Make Your Home IrresistibleBoosting curb appeal doesn’t have to be hard. These seasonal curb appeal tips are simple, affordable, and powerful. They help your home look its best and sell faster.

Whether you're listing South Hudson Houses for Sale or Southern NH houses for sale, these tips work. Buyers want homes that feel loved, cared for, and ready to move in.

So grab your checklist, pick a season, and start boosting your curb appeal today. Your future buyer is already out there—make sure your home is the one they fall in love with.

If you need more information on seasonal curb appeal, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

When buyers pull up to a home, their first impression happens fast. Often, it's within just a few seconds. That’s why the power of curb appeal is so important. It can be the difference between a quick sale and a long wait.

In Southern NH, where charming homes are everywhere, your home’s exterior needs to stand out. Whether you’re listing South Hudson Houses for Sale or Southern NH houses for sale, these tips will help make your home shine.

Let’s explore some simple, powerful ways to improve your home’s curb appeal and make a lasting impression.

First things first—curb appeal is not just about looks. It’s about value, emotion, and attraction. Buyers want to fall in love with a home at first sight.

When a house looks neat, clean, and inviting on the outside, it suggests the inside is just as well cared for. That feeling builds trust—and trust helps close deals.

Studies show homes with strong curb appeal sell faster and for more money. And that’s what every seller wants, right?

You don’t need to hire a fancy landscaping crew to boost your home’s marketability. A little sweat and some smart choices can go a long way.

Before adding anything, clean up what’s already there.

Trim overgrown bushes and trees.

Remove weeds.

Mow the lawn and edge the walkways.

Rake up leaves and clear away clutter.

A clean yard feels fresh and well-maintained. It also makes your home easier to see and appreciate.

Lush grass adds life to any yard. If your lawn is patchy or brown, give it some love.

Water it regularly.

Use a slow-release fertilizer.

Seed bare spots.

In South Hudson or anywhere in Southern NH, a green lawn can help your house stand out in the neighborhood.

Colorful flowers can brighten up any yard.

Plant in garden beds, window boxes, or hanging baskets.

Choose bold, seasonal blooms.

Mix perennials and annuals for year-round color.

Even a small flower bed by the front door makes a cheerful, inviting statement.

Too much going on can feel messy. Stick to clean lines and balanced shapes.

Symmetry looks tidy and pleasing.

Use mulch to define beds and paths.

Pick 2-3 main colors for flowers and pots.

Simple landscaping feels high-end and easy to care for.

The outside of your house tells buyers what to expect inside. Make it feel loved, updated, and move-in ready.

One of the fastest ways to refresh your home’s look? Paint the front door.

Pick a color that pops but still fits the style of your home. Think navy, red, forest green, or even black for a classy look.

A clean, bold door says “welcome home.”

These small details can make a big difference. Swap out old house numbers for modern ones. Clean or replace your mailbox, too.

They may seem tiny, but these updates show buyers you care about the details.

Grime, mildew, and dirt can make a home look tired. Pressure wash:

Siding

Walkways

Driveways

Fences

Decks

A clean surface gives everything a bright, fresh look.

Before listing, fix what’s worn out or broken.

Replace cracked steps.

Patch peeling paint.

Repair loose railings or siding.

These fixes build buyer confidence and protect your home’s value.

Don’t forget the power of lighting. A well-lit home feels safer and more welcoming—day or night.

Swap out old light fixtures for stylish, energy-saving ones. Look for:

Porch lights

Garage lights

Pathway lighting

Choose warm-toned bulbs that feel cozy and inviting.

Solar lights are a budget-friendly way to add charm. They guide visitors and highlight your landscaping.

Plus, buyers love low-maintenance features.

In Southern NH, a cozy front porch is a huge plus. Make it shine!

A bench or two chairs with cushions

A pretty welcome mat

Seasonal décor like a wreath or potted plants

Keep it simple, neat, and charming.

Buyers want to picture themselves relaxing on your porch. Too much stuff gets in the way. Keep it open and easy to walk through.

Looking to really impress? These ideas bring high emotional impact:

Window boxes add instant beauty. Fill them with colorful flowers or trailing vines. They’re easy to install and make windows pop.

A wreath on the front door adds warmth. Pick one that fits the season. It gives your entrance a welcoming, personal touch.

Trash bins, hoses, or old tools should be tucked out of sight. Use fencing, small sheds, or screens to keep your yard looking tidy.

If you're listing South Hudson houses for sale, buyers may expect a more classic New England look. Think:

Brick walkways

Traditional shutters

Cozy porches

Meanwhile, for Southern NH houses for sale, you might want to highlight rustic charm or modern updates. Either way, the power of curb appeal helps your home stand out in a competitive market.

Talk with a local REALTOR® who knows what buyers in your area want to see. A little expert advice can help you spend smart and get top dollar.

Here’s a fast list you can use before showings:

Just a few of these can make a huge impact on how buyers feel.

When buyers see a home that’s clean, colorful, and well cared for, they feel hopeful and excited. That emotion can lead to faster offers—and better ones, too.

The power of curb appeal is real. And it’s one of the most affordable, high-impact ways to improve your home’s marketability.

If you're preparing to sell your home in Southern NH, don’t overlook the outside. A great first impression can be the start of something amazing.

Need more advice? Reach out today for help with staging, pricing, or listing South Hudson houses for sale or Southern NH houses for sale. Let’s make your home unforgettable!

If you need more information on the power of curb appeal, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Looking to buy or sell a home in Southern NH houses for sale or Londonderry Houses for Sale? Knowing how to maintain, test, and inspect is a smart move. Whether you're prepping a home for sale or making an offer, maintenance and inspection steps can save money, avoid surprises, and build buyer confidence.

In this guide, you’ll learn:

Key maintenance routines

Essential systems and tests

What data shows about inspections

Top questions to ask during inspection

Use this info to make your home shine—or to shop confidently for your next one.

Keeping your home in great shape doesn’t require daily effort. Instead, focus on seasonal and annual to-dos.

Spring

SpringClean gutters and downspouts to prevent water damage

Check foundation for cracks

Service HVAC before summer

Inspect roof for winter harm

Summer

SummerTrim trees and shrubs

Test smoke alarms and carbon monoxide detectors

Inspect outdoor faucets and hoses

Fall

FallDrain outdoor pipes and irrigation

Clean and inspect furnace

Seal gaps to reduce heating costs

Winter

WinterMonitor attic insulation

Protect pipes from freezing

Remove ice dams from roofs

Regular service not only keeps comfort high—it boosts your home's curb appeal and value if you're selling.

Beyond maintenance, strategic testing gives buyers confidence—and helps when you're negotiating.

Radon test: Radon is common in New England. Testing protects safety and aids mortgage approval.

Well water test: If your home has a private well, screening for bacteria and chemicals is vital.

Mold and moisture checks: Data shows 22% of inspections find mold, and 65% find grading issues causing leaks.

Pest inspection: Termites or carpenter ants appear in about 30% of homes.

Electrical safety: Faulty wiring shows up in 28% of inspection failures, with 25% having outdated wiring.

HVAC check: HVAC issues show up in 39% of inspections.

Foundation review: Cracks appear in 12–15% of inspections .

Installing a sump pump, insulating pipes, and adding downspout extensions protects your home and builds trust with buyers.

Most buyers—about 85%—find at least one issue during inspections. These findings often lead to negotiation, with 75% requesting fixes or credits.

Here’s what identifies as common issues:

Electrical problems: 25–28%

HVAC issues: ~39%

Roof defects: missing shingles and flashing

Plumbing issues: 33%

Grading and drainage: 65%

Mold: 22%

Foundation cracks: 12–50%

A clean inspection report gives buyers peace of mind—and keeps your sale on track.

When attending an home inspection, speaking up matters. Here are essential home inspection questions to ask your home inspector:

“Are cracks in the foundation cosmetic or structural?”

“Is water draining away from the home as it should?”

“How old is the roof and any visible damage?”

“What type of pipes does this home use?” (PEX, copper, polybutylene)

“Any signs of leaks or drainage issues?”

“Where is the main water shutoff?”

“Is the wiring up to code?”

“Where’s the main breaker or fuse panel?”

“Any outlets not working or missing GFCI in wet areas?”

“How old is the HVAC? Any mold or R‑22 refrigerant?”

“Did you turn on heating and cooling? Do they work well?”

“Is attic insulation enough? Any ventilation issues?”

“Any signs of termites or other pests?”

“Is there mold or moisture, especially in attics or basements?”

“Can you show me how systems work, like boiler or sump pump?”

“What maintenance should I plan for each system?”

“Should we bring in specialists—for structural, HVAC, or pest issues?”

Inspection findings are evidence—and give you options:

Request repairs or credits for big issues.

Renegotiate price if costs are high.

Walk away safely if inspection contingency allows and major issues appear.

Budget for future care, like replacing the roof or servicing HVAC.

Inspectors act all around 2–3 hours typically , and cost $300–500 .

Sellers can also do inspections early. Why?

Identify issues before buyers do

Sell confidently with documentation

Increase resale value by prepping fixes

Data shows a 3% boost in resale value comes from pre-listing inspections.

Buyers searching Southern NH houses for sale and Londonderry Houses for Sale want turnkey homes. A clean home inspection report boosts buyer interest and may reduce time on market. When homes are move-in-ready, buyers feel safer and offers get stronger. So ask any home inspection questions you may have while the time is right.

Maintenance, testing, and asking the right home inspection questions keeps homes safer, sales smoother, and value stronger.

85% of homes show defects

Electrical, HVAC, plumbing, and mold are top issues

Spending on maintenance and pre-list inspections pays off

Smart home inspection questions reveal value—so ask them all!

If you're selling in Southern NH or Londonderry, invest in solid home systems, clean testing, and a full inspection report. Buyers, ask all the home inspection questions above. That’s how you make smart decisions and enjoy your next move.

If you need more info on asking the right home inspection questions, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

The real estate market is always changing. Sometimes it's hot and fast, and other times, buyers have more room to breathe. In today's shifting market, we're seeing more seller concessions—and that’s good news for buyers.

So, what are seller concessions, and how can they help you when you're buying a home? Whether you're checking out Southern NH houses for sale or diving into Litchfield Houses for Sale, this blog will break it all down for you—in simple terms.

Let’s start with the basics. Seller concessions are things the seller agrees to pay for to help close the deal. These can include:

Closing costs

Home repair credits

Interest rate buy-downs

HOA fees for a few months

Home warranties

They’re like little bonuses that make buying a home easier and more affordable.

Here’s the deal: when the market shifts, sellers must work a bit harder to attract buyers. Homes may sit longer. There may be more competition.

So, sellers sweeten the pot. That’s where seller concessions come in. They make buyers feel supported—and often, more willing to make an offer.

In a hot market, sellers had the upper hand. But now, in many parts of Southern NH, the playing field is leveling out.

Covering Closing Costs

These are the fees buyers usually pay when the deal wraps up—like loan fees, taxes, and title insurance. Sellers may cover a portion or even all of it.

Repair Credits

Instead of fixing items before closing, sellers give the buyer money to handle the repairs later. It’s easier for both sides.

Interest Rate Buy-Downs

Sellers may offer to pay points on the buyer’s loan to reduce the interest rate. This lowers the monthly payment.

HOA or Tax Payments

Sellers may offer to pay the first few months of homeowners association dues or property taxes to help ease the buyer’s start.

Home Warranties

These are service plans that cover repairs on appliances and systems for a year after closing. Peace of mind is always welcome.

Now that seller concessions are more common, how can you, the buyer, benefit?

Lower Your Upfront Costs

Buying a home can get expensive. With concessions, you might not need to bring as much cash to the closing table. That’s huge for first-time buyers!

Handle Repairs on Your Schedule

With a repair credit, you get to choose who does the work, and when. That can save time and reduce stress.

Keep Your Monthly Payments Lower

If a seller helps buy down your interest rate, your monthly cost drops. That makes your budget go further.

Make a Stronger Offer with Less Risk

Sometimes, asking for a concession allows you to offer the full price and still stay within budget. It can be a win-win.

Some buyers worry about asking for too much. But the truth is, in today’s market, many sellers expect these conversations.

Here’s how to keep it smooth:

Lean on your REALTOR® to handle the ask

Know what’s reasonable based on the home and location

Be clear, but kind

Stay flexible—negotiation is a two-way street

In towns like Litchfield, where demand and inventory are shifting, there’s room to negotiate. Don’t be afraid to speak up!

Let’s say you’re buying a $450,000 home in Southern NH. You’ve got a solid offer, but the interest rate feels too high.

Your REALTOR® suggests asking the seller for a $5,000 credit to buy down the loan rate. The seller agrees—because your offer is fair, and they’re motivated.

Now, your monthly payment drops by $100 or more. That’s real money, every single month.

This is the power of seller concessions when used smartly.

If you're house-hunting in Litchfield, Hudson, Pelham, or Windham, the market is shifting—just like everywhere else.

We’re seeing more:

Price reductions

Extended listings

Willing sellers open to creative deals

That means buyers looking at Litchfield houses for sale have more tools at their disposal—including seller concessions.

This blog’s mainly for buyers—but if you’re selling, listen up.

Offering a concession isn’t a loss. It’s a strategy.

Sometimes it helps sell the home faster. It can attract more buyers. It might even keep your price firm while still meeting buyer needs.

Your REALTOR® can guide you on when and how to offer concessions that make sense.

“Only weak offers need concessions.”

Not true. Smart buyers use all the tools available—even strong ones.

“Sellers will say no if I ask.”

Maybe. But in this market? You’ll be surprised how often they say yes.

“It’s greedy to ask.”

It’s not. It’s just part of today’s real estate conversation.

Your REALTOR® is your guide through this entire process. They know what sellers are offering. They know what’s fair. They can read between the lines on listings.

A skilled agent will:

Suggest where and when to ask for concessions

Write strong offers that balance price and perks

Help you stand out—even while negotiating

If you’re a first-time homebuyer, concessions are your friend.

They can:

Offset your closing costs

Help with moving expenses

Keep your budget intact

And homes in Southern NH are full of potential for first-time buyers—especially now that the market is shifting.

Here’s a quick cheat sheet:

Start with a fair offer

Don’t ask for everything under the sun

Pick one or two helpful concessions

Be ready to give a little too

Keep the tone friendly and open

A positive attitude and a clear plan go a long way in any negotiation.

Sometimes sellers signal that they’re open to concessions. Look for these words in home listings:

“Seller offering credit”

“Flexible closing”

“Price improvement”

“Motivated seller”

“Will consider buyer assistance”

If you’re browsing Southern NH houses for sale, keep these terms in mind. They might mean more wiggle room for concessions.

One note to keep in mind: the home still needs to appraise.

If a seller offers concessions, the total package still must match the home’s appraised value. Your REALTOR® and lender will guide you through this part to make sure it all works.

In this shifting market, seller concessions give buyers a unique advantage.

You don’t have to overextend your budget. You don’t have to give up everything on your wish list. With the right strategy, you can save money and get a great home.

Whether you’re searching Litchfield Houses for Sale or eyeing Southern NH houses for sale, now is the time to explore your options.

Ask questions. Be bold. And let your REALTOR® help you win with confidence.

If you need more info on seller concessions, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Your friendly step-by-step guide for buying a home in Southern NH

Buying your first home is exciting—but it can also feel a little overwhelming. Don’t worry. You’re not alone. Many people have questions, especially when it’s their first time. That’s why we’ve created this easy guide to help you through understanding the buying process.

We’ll walk you through each step—from getting pre-approved to closing the deal—so you can feel confident every step of the way. Whether you're exploring Londonderry Houses for Sale or shopping around Southern NH houses for sale, this guide is your roadmap to success.

The first step is a personal one. You have to feel ready to buy. Ask yourself:

Do I have a steady income?

Have I saved up for a down payment?

Am I planning to stay in the area for a while?

If you said yes, that’s a great sign!

Your credit score plays a big role in the loan you can get. A higher score may mean a lower interest rate.

Here’s how to check it:

Use a free credit site like Credit Karma or Annual Credit Report .

Fix any mistakes you see.

Try to pay off small debts before applying for a loan.

Lenders will use this score to decide if they’ll approve you—and what terms they’ll offer.

Getting pre-approved helps you:

Know how much home you can afford

Show sellers you’re a serious buyer

Speed up the buying process

You’ll need:

Proof of income (pay stubs or tax returns)

Bank statements

Credit info

Once you’re pre-approved, you’ll get a letter showing your budget. That’s your golden ticket!

Buying a home is easier when you have a great REALTOR® by your side. Look for someone who:

Knows the local market

Understands first-time buyers

Answers your questions patiently

A good agent will help you:

Spot great listings

Negotiate prices

Handle paperwork

Avoid common mistakes

If you’re looking for Southern NH houses for sale, working with a local expert is a huge advantage.

Now the fun begins—house hunting!

Here’s how to make the most of it:

Make a list of must-haves (like 3 bedrooms or a big backyard).

Pick a location that fits your lifestyle.

Don’t forget about the commute, schools, and community vibe.

Check out Londonderry houses for sale and homes in other popular Southern NH towns. Many offer great schools, beautiful parks, and friendly neighborhoods.

Take notes during showings and trust your instincts.

You found the one! Now it’s time to make an offer.

Your REALTOR® will help you:

Decide on a fair price

Include any special requests (like closing cost help)

Set deadlines for the seller to reply

Sellers might say yes, no, or come back with a counteroffer. That’s normal! Your agent will guide you through the negotiation.

This is a must-do step in understanding the buying process.

A professional home inspector will:

Check the home’s structure, roof, plumbing, and more

Give you a report on what’s in good shape (and what’s not)

If big problems show up, you can:

Ask the seller to fix them

Ask for a credit

Walk away if needed

Your agent will help you weigh your options.

Your lender wants to make sure the home is worth the price you agreed to pay. So, they’ll order an appraisal.

If the value comes back lower than your offer:

You might need to renegotiate the price

Or cover the difference out-of-pocket

Your REALTOR® and loan officer will help you figure out the best plan.

Time to dot the i’s and cross the t’s!

During this step, your lender will:

Review your financial documents again

Set your mortgage terms

Lock in your interest rate

Tip: Avoid big purchases or new credit cards during this time. It could delay or change your loan!

A day or two before closing, you’ll walk through the home one more time.

Check that:

Repairs were completed

The home is clean and empty

Nothing is damaged or missing

If everything looks good, you’re ready for closing!

Closing is the big day! You’ll sign a bunch of paperwork and officially become a homeowner.

At closing, you’ll:

Pay your down payment and closing costs

Sign mortgage papers

Get the keys to your new home

Congratulations—you did it!

Here are some extra things to keep in mind as you’re understanding the buying process:

Save for More Than Just the Down Payment

Save for More Than Just the Down PaymentYou’ll need money for:

Closing costs (2–5% of the home’s price)

Inspections

Moving expenses

Future repairs

Know What You Can Afford

Know What You Can AffordYour monthly mortgage should fit comfortably in your budget. Include taxes, insurance, and any HOA fees.

Think Long-Term

Think Long-TermIs this a home you’ll love for years? Does it have room to grow? These are smart things to consider.

Buying in Southern New Hampshire comes with amazing perks. Whether you're eyeing Londonderry houses for sale or homes closer to the Massachusetts border, you’ll find:

Lower property taxes than MA

Beautiful scenery and small-town charm

Easy access to highways, shopping, and nature

This area is perfect for first-time homebuyers who want community, value, and peace of mind.

The best tip for understanding the buying process? Work with a REALTOR® who’s on your side. I love helping first-time buyers feel informed and excited—not overwhelmed.

I’ll guide you through:

Getting pre-approved

Touring homes

Making smart offers

Navigating the inspection and loan process

And I’ll be right there with you on closing day, cheering you on!

Decide you're ready

Check your credit

Get pre-approved

Choose a great REALTOR®

Start house hunting

Make an offer

Schedule a home inspection

Get an appraisal

Finalize your loan

Do a final walkthrough

Close and celebrate!

Buying a home might seem big, but you don’t have to do it alone. With the right guide, clear steps, and a little planning, you’ll be holding the keys before you know it.

If you're ready to start—or just want to ask questions about Londonderry Houses for Sale or other Southern NH houses for sale—reach out today. I’m here to help every step of the way.

If you need more information on understanding the buying process, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

If you’re thinking about listing your house, summer is one of the best times to do it. Warm weather, longer days, and blooming yards make everything look better. Buyers are out in full force. But before the “For Sale” sign goes up, there’s a bit of prep to do.

In this guide, we’ll walk you through how to get your Southern NH home ready for a summer sale. Whether you’re selling in South Hudson or anywhere in Southern NH, these tips will help you make a great first impression, stand out from the crowd, and maybe even score a few extra offers. Let’s get started!

Buyers love summer. School’s out, schedules are flexible, and moving is easier in warm weather. In Southern NH, homes shine in the summer light, and buyers are more motivated to close quickly.

But competition can be fierce. That’s why it’s important to take the time to prepare your home.

Your home’s first impression starts from the street. If buyers pull up and see a messy yard or peeling paint, it could turn them off—fast.

Mow the lawn and trim the edges.

Add fresh mulch to flower beds.

Plant colorful summer flowers.

Wash siding, steps, and railings.

Repaint your front door (go bold!).

Replace broken lights and numbers.

Pro Tip: A clean, cheerful front porch says “welcome home” before they even open the door.

Less stuff makes your home feel bigger and more open. When it comes to selling, less really is more.

Clear countertops, tables, and windowsills.

Pack away off-season clothes and decorations.

Remove bulky or unused furniture.

Organize closets to show off space.

Think of it like pre-packing—you’re getting a head start on moving while helping buyers imagine their own stuff in the home.

Summer light shows everything—dust, smudges, and stains. A spotless home shines in photos and in person.

Windows (inside and out)

Floors and baseboards

Bathrooms (yes, even the grout!)

Kitchen appliances and cabinets

Ceiling fans and vents

Pro Tip: Don’t forget to clean pet areas. A fresh smell makes a huge difference during showings.

Buyers love move-in-ready homes. Small issues can make your home feel poorly maintained, even if they’re minor.

Leaky faucets or running toilets

Loose handles, knobs, or hinges

Squeaky doors or floors

Cracked tiles or chipped paint

Burned-out bulbs or broken fixtures

Not sure where to start? A pre-listing inspection can help you find hidden issues before buyers do.

Summer showings can heat up—literally. You want buyers to feel relaxed, not sweaty.

Set the thermostat to a cool, consistent temperature.

Turn on ceiling fans for airflow.

Close blinds during the hottest part of the day.

Offer cold water at open houses.

The goal? Create a space where buyers want to stay awhile.

Staging helps buyers picture themselves living in your home. And it doesn’t have to cost a fortune.

Use light-colored linens and curtains.

Add pops of color with throw pillows or flowers.

Remove personal photos and items.

Create cozy, welcoming spaces.

Set the dining table for two or four.

Less clutter + smart furniture placement = more buyer love.

Summer buyers love outdoor areas. A clean, pretty yard can seal the deal.

Power wash the patio or deck.

Set up seating with cushions or a fire pit.

Hang string lights or add solar path lights.

Add fresh potted plants by the entry.

Keep the yard tidy and toys out of sight.

In Southern NH, we love spending time outside—make sure your yard invites buyers to picture summer BBQs and relaxing evenings.

Your home has summer perks—show them off!

Do you have central air? Mention it!

Is there a pool? Make it sparkle.

Big windows with natural light? Let it shine.

Shade trees or garden beds? Clean them up and label them.

You want to highlight the features that make your home enjoyable this season.

Great pictures can make all the difference online. Summer listings with bright, clear photos attract more clicks—and more showings.

Hire a real estate photographer who knows how to capture:

Natural light

Wide shots of rooms

Outdoor beauty

Clean, clutter-free rooms

Don’t forget drone shots if you’ve got a nice yard or scenic views!

Summer buyers are serious. If your home is priced too high, they’ll move on.

Your REALTOR® will help you:

Analyze the local market

Compare similar homes

Set a competitive price

Attract strong offers quickly

And don’t forget to look at homes in your area. Check out South Hudson houses for sale or similar Southern NH houses for sale to see what buyers are paying right now.

Summer buyers are often on tight timelines. They want to close before the new school year or a job starts.

That means you should:

Be flexible with showings

Respond quickly to offers

Have your next steps planned

Work closely with your REALTOR® so you’re never caught off guard.

The little things matter. A few finishing touches can give buyers that emotional “wow” moment.

Fresh flowers on the counter

Lemon slices in a pitcher of water

Soft background music

Light, clean scents (think citrus or linen)

Open windows for a fresh breeze (if weather allows)

These tiny details leave a big impression.

If you're selling in Southern NH, remember this area’s unique charm. Here’s how to use it to your advantage:

Mention nearby lakes, trails, and mountains.

Highlight commuter access to Boston or Manchester.

Talk about great school systems and small-town vibes.

Feature local farmers’ markets or summer events.

And don’t forget to include “Southern NH houses for sale” in your online listings and social posts to reach more local buyers!

Even in a hot market, sellers make mistakes. Let’s help you avoid them:

Don’t skip cleaning and staging.

Don’t overprice your home “just to try.”

Don’t ignore curb appeal.

Don’t wait until the last minute to prep.

Don’t go it alone—work with a local REALTOR®!

Here’s a quick checklist of what to do to get your Southern NH home ready for a summer sale:

Selling your home doesn’t have to be stressful. With the right strategy and a local REALTOR® who knows the market, you can enjoy the process.

We’re here to help you:

Prep your home step-by-step

Market it with pro photos and smart pricing

Reach qualified buyers

Sell for top dollar this summer

Thinking about listing? Let’s chat about how to get your home ready for a successful Southern NH summer sale.

If you need to know more about how to get the best Southern NH summer sale, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.