Tag Archives for " for sale "

Retirement is an exciting time. You’ve worked hard, and now it’s time to enjoy the good life. That next big step? Finding the perfect Southern NH home for retirees. Whether you're looking to downsize, stay near family, or find peace in a quiet neighborhood, this guide has you covered.

The good news is that Southern NH houses for sale offer all kinds of choices. From cozy condos to low-maintenance ranch homes, there’s something for everyone. And if you’re checking out South Hudson Houses for Sale, you’ll find lovely communities, parks, and easy access to shopping and healthcare.

Let’s dive into what matters most when finding that dream retirement home.

As we get older, stairs can become more of a hassle. That’s why many retirees love single-story homes. One-level homes are easier to navigate and safer too.

Look for homes with:

All bedrooms on the main floor

Wide doorways and open floor plans

Minimal or no steps at the entry

Many Southern NH homes for retirees feature ranch-style layouts or single-level condos that offer comfort and style.

The location of your home matters more than ever. You want peace and quiet, but also access to things you enjoy.

Retirees often look for:

Nearby doctors and hospitals

Parks and walking trails

Grocery stores and shops

A friendly, safe neighborhood

If you’ve looked into South Hudson houses for sale, you know this area checks a lot of boxes. It’s close to Nashua for shopping but still offers a quiet, small-town feel.

In retirement, the goal is more play and less work. So, look for homes that make life easier—not harder.

Helpful features include:

Vinyl siding or brick exteriors

Simple landscaping

Newer roofs and heating systems

HOA services like snow removal or lawn care

In many Southern NH houses for sale, you’ll find move-in-ready homes with updates already done. That means less stress and more time for hobbies.

As you look for your forever home, it helps to think ahead.

Look for safety-friendly features like:

Walk-in showers

Grab bars (or space to add them)

Non-slip flooring

Good lighting in all rooms

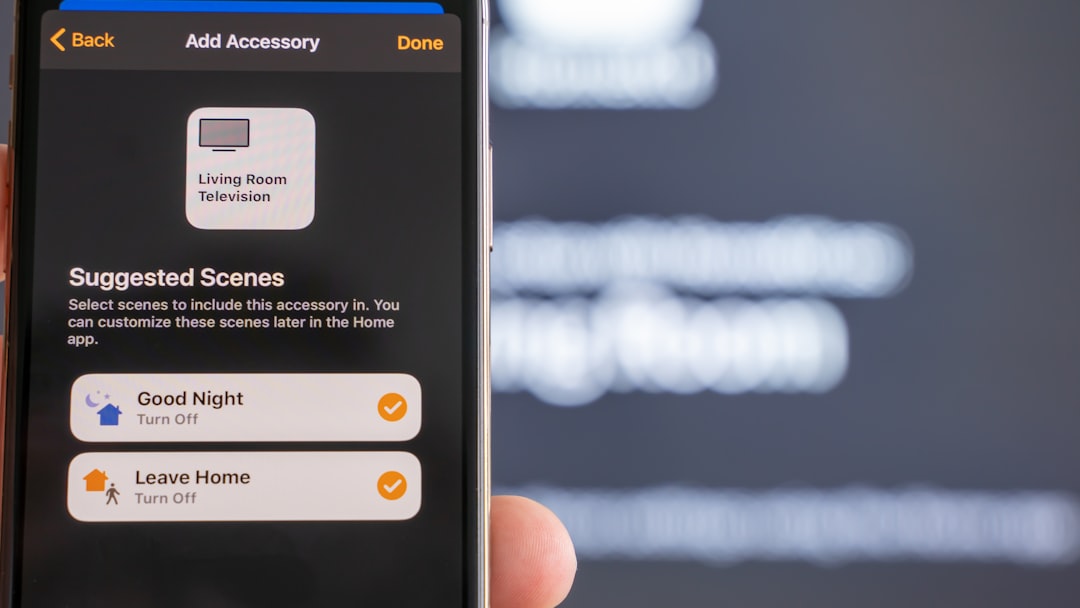

Smart home systems for security and convenience

Some Southern NH homes for retirees come with these already. Others may just need small updates to be perfect.

Even if you’re downsizing, you don’t want to feel cramped. Many retirees want room for:

Grandkids to visit

A hobby or craft room

A guest bedroom

A cozy den or reading nook

You don’t need a mansion, but a thoughtful layout helps a lot. Some homes in South Hudson offer finished basements or bonus rooms—just what you need for visiting family or relaxing projects.

Are you looking for a quiet retirement or an active one? Either way, the neighborhood should match your lifestyle.

Some retirees love 55+ communities. These often include:

Clubhouses

Social events

Fitness rooms

Maintenance services

Others prefer non-age-restricted neighborhoods near walking trails, coffee shops, or libraries.

The great part about shopping for a Southern NH home for retirees is the variety. Whether you’re social or love solitude, there’s a fit for you.

Downsizing doesn’t mean downgrading. You just want a home that suits your life now.

A few tips on sizing:

Don’t go too small—you’ll want storage and space to host

Don’t go too big—extra rooms mean more to clean and heat

Look for open layouts and natural light

If you’re checking out South Hudson houses for sale, you’ll find smartly designed homes that hit the sweet spot.

Sticking to a budget is key in retirement. Southern NH is often more affordable than surrounding states, like Massachusetts. Plus, New Hampshire has:

No income tax

No tax on Social Security benefits

No sales tax

That makes a Southern NH home for retirees not just comfortable—but smart financially.

Don’t rule out condos or townhomes! They can be perfect for retirees who want even less to maintain.

Look for:

Low HOA fees

Good reserves and well-managed associations

First-floor master suites

Quiet neighbors

There are great condo options in Southern NH, especially in spots like South Hudson, Litchfield, and Londonderry.

You may want a little yard for gardening—or none at all. Either way, it’s nice to have an outdoor area that feels like your own.

Consider:

Patios or decks for relaxing

Small, fenced yards for pets

Community green spaces

Some homes come with lovely views of trees, rivers, or even golf courses. Imagine sipping coffee outside on a peaceful morning. That’s retirement done right.

Saving money on monthly bills? Yes, please!

Look for homes with:

Updated windows and doors

Modern heating and cooling

Energy-efficient appliances

Insulation upgrades

These small things add up over time and make a Southern NH home for retirees even more affordable.

You may not need it now, but being near good medical care brings peace of mind. Luckily, Southern NH is packed with top-rated hospitals, clinics, and specialists.

Nearby areas like Nashua and Manchester offer everything from basic checkups to full medical centers. It’s another reason South Hudson houses for sale are so appealing.

Finding the right home in retirement shouldn’t be stressful. With the right REALTOR®, it’s actually fun.

Your agent can help you:

Focus on what really matters

Navigate paperwork and inspections

Negotiate for a fair price

Spot homes with smart upgrades

Understand local market trends

They’ll also know the ins and outs of Southern NH neighborhoods, including hidden gems and peaceful pockets.

When you’re out touring homes, keep a simple checklist in mind:

Are there steps to enter the home?

Is the layout easy to move around in?

Does the lighting feel bright and cheerful?

Will you need to do any major repairs soon?

How far is it from stores, doctors, and fun things to do?

Bring a notebook or use your phone to take pictures and notes. This helps you compare after a long day of tours.

Maybe you’re still a year or two away from retiring. That’s okay!

Now is the perfect time to:

Research neighborhoods

Explore homes online

Chat with a local REALTOR®

Get your current home ready to sell

Think about your wants and needs

Early planning helps you feel more prepared and confident when the time comes.

Retirement should feel relaxing and joyful. And your home should reflect that. With a little planning and the right support, you’ll find the perfect Southern NH home** for retirees**.

Whether you're checking out South Hudson Houses for Sale or exploring other charming New Hampshire towns, the right fit is out there. And when you find it, you’ll know—you’re home.

If you need more ideas on what retirees should look for in a home, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

When looking at houses, it’s easy to get distracted by the kitchen or the backyard. But one important part of the home is often forgotten—the basement. Let’s be real—ignore the basement, and you might miss out on a lot.

Whether you're browsing Southern NH houses for sale or checking out Litchfield Houses for Sale, taking a closer look downstairs could reveal hidden value, comfort, and opportunity.

Let’s talk about why this space matters, and how it can be a game-changer in your home search.

We all know the typical basement scene—boxes, holiday decorations, and old furniture. But today’s basements can be so much more.

Finished or unfinished, basements hold major potential. Some become cozy family rooms. Others turn into home gyms, play areas, or even office space. Some folks even create rental units or in-law suites.

The space is already there—it just needs a vision.

In fact, many Litchfield houses for sale come with basements that are ready for your creative touch. Don’t overlook it!

This isn’t just about space—it’s about dollars.

A finished basement can seriously boost your home’s value. Buyers love extra living areas. And sellers love getting higher offers. It’s a win-win.

If you're comparing homes in Southern NH, two houses might look the same on paper—but one has a finished basement. Guess which one buyers rush to see?

When appraisers assess a home, basements often factor in. That extra square footage can make a big difference in what the home is worth.

Ignoring the basement means missing out on:

Extra storage

Additional living space

Future rental income

Hobby or office space

A safe, dry place during storms

Plus, you want to make sure the basement is in good shape. A quick peek during your home tour could uncover water issues, old systems, or signs of foundation trouble.

A strong home starts from the ground up. That’s why we say—don’t ignore the basement.

So what should you look for when checking out a basement?

Here are a few signs of a solid space:

Dry floors and walls

No musty smells

Insulated pipes

Clean sump pump area

Solid foundation walls

Updated electrical panels

These signs mean the space has been cared for and likely won’t cause you trouble later on.

In many Southern NH houses for sale, you’ll find basements that are move-in ready or halfway there.

Even if the basement isn’t finished, don’t write it off.

An unfinished basement is a blank canvas. It might need some love, but it gives you room to grow. That’s exciting!

Some buyers use it as a workshop or storage right away. Others finish it over time, adding equity with every upgrade.

And in towns like Litchfield, where land space can be limited, having a basement gives you options without building out.

Here’s something most people don’t think about—basements can help save on energy.

A properly sealed basement helps keep your whole home warmer in winter and cooler in summer. That saves money on energy bills.

Look for:

Insulated walls

Updated windows

Energy-efficient lighting

If you're checking out Southern NH homes, ask the seller or agent about the basement’s energy setup. Small upgrades down there can lead to big savings upstairs.

While basements can be awesome, they can also hide problems—especially if no one’s paying attention.

When touring a home, don’t ignore the basement just because it seems dark or boring. Look for red flags like:

Standing water

Cracks in the walls or floor

Rusty appliances

Mold or mildew

Smells that don’t belong

If anything feels off, ask questions or get a home inspector involved. That’s what they’re there for!

Dreaming of a cozy movie night space? A guest bedroom? A game room? Your basement can be all that—and more.

Buyers love homes that come with finished basements because they see the fun possibilities.

Some cool basement ideas include:

Home gym

Music or art studio

Playroom

Home office

Teen hangout zone

Craft room

Small guest apartment

In fact, buyers looking at Litchfield houses for sale often ask about basement potential right away. It’s that important.

If you’re selling, don’t forget the basement when staging your home.

Here are simple things that make a big impact:

Clean and declutter

Add soft lighting

Use cozy rugs or flooring

Paint the walls a neutral color

Set up furniture to show possible uses

Even if the basement isn’t fancy, showing how it can be used makes a difference.

A basement should be safe and easy to exit. Make sure you have proper egress windows if it’s being used as a bedroom or living space.

Also, check that:

There’s a working smoke detector

Stair rails are secure

Windows open easily

There’s no exposed wiring

These small things help buyers feel secure and confident when considering a home purchase.

We know New Hampshire weather isn’t always friendly. Basements play a big role here.

During storms, your basement can offer shelter. But it also needs protection from water.

When shopping for Southern NH houses for sale, ask if the basement has:

A sump pump

Drainage systems

Waterproofing

Backup generators

Homes in Litchfield often come with these systems already in place. That’s a bonus you don’t want to miss!

Thinking long-term? Consider turning the basement into an in-law suite or a rental unit.

If local zoning allows it, this can become a powerful investment. Rent it out for monthly income or offer it as space for family members.

It’s another reason not to ignore the basement—you could be walking past a paycheck.

The basement is the heart of the home’s foundation. It’s full of possibility. It holds storage, safety, and comfort. And it could be your secret weapon when buying or selling.

Next time you’re walking through a home in Southern NH or browsing Litchfield Houses for Sale, don’t skip the stairs.

Go down. Look around. Ask questions.

Because smart buyers and sellers know this one simple truth—you should never ignore the basement.

If you need more info on why you shouldn’t ignore the basement, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Let’s face it—single home buying sounds scary at first. It’s a big step. It can feel overwhelming. But here’s the truth: it doesn’t have to be hard.

Whether you’re starting fresh, recently divorced, or just ready for your own place, buying a home solo is totally doable. And in places like Southern NH, where charm meets convenience, it's a smart move too.

Many people are choosing to go solo these days. You’re not alone. And with the right plan, a great REALTOR®, and some know-how, you can make your dream home a reality.

Single home buying is becoming more common every year. People are waiting longer to get married, or choosing not to at all. Others are rebuilding after big life changes. Some just want a place that’s fully theirs.

There’s something powerful about owning your own home, decorating it how you want, and knowing you did it. That’s independence. That’s freedom. And it starts with a clear, simple plan.

If you’re looking at Southern NH houses for sale or checking out Litchfield Houses for Sale, you’ve got options—and support.

Before you look at homes, know what you can afford. A budget gives you power. It helps you stay focused and confident.

Start with these basics:

Check your credit score

List your income and monthly bills

Decide what you’re comfortable spending each month

Then, talk to a lender. Get pre-approved. This tells you how much house you can buy and helps when you’re ready to make an offer.

Remember, your loan doesn’t have to be huge. There are great starter homes in Southern NH that won’t break the bank.

One of the best parts of buying solo? You get to choose exactly where you want to live.

Do you want to be near work? Closer to friends? Near the gym or hiking trails?

Litchfield houses for sale are perfect for buyers who love peace, trees, and a strong community feel. Meanwhile, Southern NH houses for sale offer a wide mix—from downtown condos to country retreats.

Your lifestyle matters. Think about your daily routine. What’s most important to you? That’s your guide.

You don’t have to do this alone—even if you're buying alone.

Here’s who should be on your home-buying team:

A local, trustworthy REALTOR®

A friendly lender who explains things clearly

A good home inspector

A lawyer if needed (especially for contracts)

Your REALTOR® is your biggest cheerleader. They know the market. They know how to negotiate. They answer the questions you didn’t even know to ask.

Sure, you’d love a fireplace, walk-in closet, and a big yard—but what do you need?

Make a list. Separate the must-haves from the nice-to-haves. This will help you stay focused when you start touring homes.

Here are common solo-buyer must-haves:

Low-maintenance yard

Safe neighborhood

Affordable utilities

Space to work from home

Storage and good lighting

If you're looking in Litchfield or other Southern NH towns, many homes offer charm, space, and updates—all within budget.

When you buy alone, it’s good to plan for the future too.

Ask yourself:

Will I live here long-term?

Could I rent it out someday?

Is it close to schools or highways?

Will it need big repairs soon?

You want a home that fits your life now and gives you options later. This kind of thinking helps you avoid regrets and grow your investment.

Safety matters, especially when you’re living alone. Good news: many Southern NH houses for sale come with smart home tech already installed.

Look for:

Video doorbells

Smart locks

Motion lights

Security systems

Also, trust your gut. If something feels off, ask questions. And when touring homes, bring a friend or your agent.

Solo home buying can be smooth if you avoid a few common traps:

Buying too much house – Stick to your budget, not your wish list.

Skipping the inspection – Always get one, no matter what.

Letting emotions lead – Fall in love, yes—but double-check the facts.

Going it alone – Even strong, independent buyers need help.

Remember, buying a home is exciting—but it’s also a big deal. Take your time and make smart moves.

Want to stretch your dollar? Here’s how:

Shop for the best loan, not just the first one

Ask your REALTOR® about first-time buyer programs

Look into USDA or FHA loans

Ask sellers to cover some closing costs

Buy a smaller home and build equity

Homes in Southern NH often come with lower taxes and energy costs compared to big cities. That’s a bonus!

Now for the fun part—making it yours!

When you buy alone, you get to pick the paint, the furniture, the vibe. No debates. No compromises.

Want a purple front door? Go for it. Want a dog-friendly patio or a cozy reading nook? Do it.

This home is yours. It’s a fresh chapter, and your style gets to shine.

It’s okay to feel nervous. Buying a home is a huge step. But nervous doesn’t mean you’re not ready.

It just means you care. And that’s a good thing.

The key is to stay informed, ask questions, and trust your team. You don’t have to rush. Take your time. Tour a few homes. Think it through.

And if you ever feel stuck, your REALTOR® is here to help guide you.

Meet Sarah. She was 32, renting for years, and nervous about buying alone. But she did it—with the help of her REALTOR® and a little planning.

Now she owns a cozy two-bedroom home in Litchfield. She loves her garden and her friendly neighbors. Most of all, she’s proud of what she accomplished solo.

You can do it too.

There’s no “perfect” time to buy a home. But there’s a right time for you.

And right now, there are great Litchfield Houses for Sale and tons of Southern NH houses for sale ready for smart buyers like you.

Interest rates are still manageable. Inventory is growing. And more programs exist to help single buyers than ever before.

If you’ve been thinking about it, now might be your moment.

Single home buying may sound tough, but it doesn’t have to be. With the right plan, the right people, and the right attitude, you can do this.

You’ll have a home that’s truly yours. A place to grow, relax, and thrive.

So take that first step. Check out some homes. Talk to a REALTOR®. Ask questions. Dream big. And know you’re not alone. This is your story. And it starts at home.

If you need more tips on single home buying, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Let’s talk money—specifically mortgage money. The average size of mortgage loan has reached a record high across the country. That’s a big deal, especially if you’re buying, selling, or just keeping an eye on the real estate market.

Now more than ever, homebuyers in places like Southern New Hampshire and Litchfield are taking on larger loans. But what does that mean for you? Whether you're hunting for a cozy ranch or a modern colonial, this trend affects your next move. Let’s break it down in simple terms.

First off, homes are getting more expensive. That’s no surprise to anyone looking at Southern NH houses for sale. With demand staying high and supply staying tight, prices continue to rise.

Buyers now need larger mortgages to cover these rising prices. It’s not about people buying fancy homes—it’s about the cost of housing going up overall.

And let’s be honest—if you’ve searched Litchfield Houses for Sale lately, you’ve probably seen sticker shock. You're not alone.

According to recent reports, the average size of mortgage loan has hit an all-time high. In some areas, it's over $450,000. That’s a jump compared to previous years. And here in New Hampshire, it’s no different.

In Southern NH, homes in towns like Londonderry, Hudson, and Litchfield are selling fast—and for more money. That drives loan amounts higher, especially for first-time homebuyers.

Several factors are pushing mortgage sizes up:

Home prices are rising

Low inventory keeps demand high

Interest rates, while higher than before, are still manageable

Buyers are stretching budgets to get their dream homes

Many buyers are also choosing 30-year loans to keep monthly payments reasonable, even if the total loan amount is higher.

Let’s say you're looking at Southern NH houses for sale with a $500,000 price tag. A few years ago, that may have seemed high. Today, it's common.

With a bigger loan, your monthly mortgage payment also increases. That means budgeting becomes more important than ever.

You’ll want to:

Get pre-approved early

Know your monthly comfort zone

Explore down payment options

Work with a trusted local REALTOR®

In hot areas like Litchfield, where homes move quickly, buyers must act fast but smart.

Not necessarily. Higher mortgage amounts reflect current market trends, not mistakes.

Yes, you’ll borrow more. But real estate remains one of the most powerful investments out there. Plus, homes in New Hampshire tend to hold their value well, especially in sought-after towns like Litchfield and Windham.

If you’re buying in a solid market with steady job growth, you’re in a strong position—even if your mortgage is bigger than expected.

Here are a few helpful strategies for managing a larger loan:

Keep your credit score high – Better credit = better rates.

Shop for lenders – Don’t settle for the first offer.

Make a bigger down payment if you can – This lowers your monthly payment.

Budget with accuracy – Know your monthly limits before you fall in love with a home.

Factor in taxes and insurance – They add up quickly.

Working with a skilled REALTOR® who understands the local market helps you stay smart and secure throughout the process.

If you’re selling a home in Southern New Hampshire, this trend can work in your favor.

A higher average size of mortgage loan means buyers can afford more house. That helps sellers get top dollar for their property.

If your home is in a prime location—like Litchfield or Bedford—you may even spark a bidding war. But even outside the big-name towns, a well-staged, move-in-ready home sells fast.

Buyers want value, comfort, and convenience. And they're willing to pay more when they find it.

Buyers and sellers in New Hampshire are searching for:

Southern NH houses for sale

Litchfield houses for sale

Homes with large yards

Modern kitchens

Updated bathrooms

Energy-efficient upgrades

Smart home features

These keywords reflect what buyers want—and what helps homes sell faster.

There’s no sugarcoating it: Homes are more expensive than they used to be. But that doesn’t mean they’re not worth it.

A home is more than a place to sleep. It’s where memories are made. It’s where families grow. It’s an investment that builds wealth over time.

So even if the average size of mortgage loan is higher, you're still getting long-term value.

Interest rates play a big role in your loan amount. And yes, they’ve gone up since the record lows of 2020 and 2021.

But here’s the thing—rates are still historically moderate. And as long as buyers focus on monthly affordability, they can still find great homes in Southern NH.

A good lender and REALTOR® team can help you lock in a rate that works for your budget.

Let’s highlight Litchfield. This small town packs a big punch. It offers:

Peaceful neighborhoods

Excellent schools

Easy access to Nashua and Manchester

Beautiful parks and nature spots

And the homes? They’re in demand. Litchfield houses for sale often feature larger yards and modern upgrades. As prices rise, the average size of mortgage loan in Litchfield rises too.

But buyers still see the value. It’s one of those hidden gems that’s gaining popularity fast.

First home? Don’t worry—we’ve got you.

Yes, loans are larger today. But you can still find the right home for your budget.

Here’s how to start strong:

Talk to a local lender

Work with a knowledgeable REALTOR®

Look in multiple towns

Be flexible with your must-haves

Don’t panic over high numbers

Remember, everyone starts somewhere. You don’t need your dream home right away—you just need your first step.

If you need more tips on the average size of mortgage loan, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Technology is changing everything—even the homes we live in. These days, homes are filled with trailblazing technology that’s both smart and stylish. From talking mirrors that greet you in the morning to ceiling faucets that save space and splash, the future is knocking at your front door.

For anyone looking at Southern NH houses for sale or scrolling through Litchfield Houses for Sale, this blog will open your eyes to what’s possible. Whether you’re a buyer, a seller, or just dreaming, here’s how cool tech can make your home stand out.

Let’s be honest—homebuyers today want more than just a pretty kitchen. They want smart. They want connected. They want fun and useful. That’s where trailblazing technology comes in.

Think about it. You wake up and your mirror says, “Good morning, Sarah. It's 72 degrees and sunny.” That’s not a movie scene anymore—it’s real life. These small touches can turn an ordinary space into something magical.

Plus, high-tech features often raise the value of a home. In a market like Southern New Hampshire, that can be a serious advantage.

Let’s start with one of the most fun new gadgets—talking smart mirrors.

These mirrors do more than show your reflection. They tell you the weather, time, and traffic. Some even play music, display your calendar, or give you a morning pep talk.

Now imagine showing off a smart mirror during an open house. That’s an instant wow-factor. It tells buyers that this home isn’t just modern—it’s ahead of the curve.

Many smart mirrors are voice-activated and link to home assistants like Alexa or Google Home. Buyers love the convenience, and they’re willing to pay for it.

Now let’s talk about ceiling-mounted faucets. Yes, you heard that right—water coming straight from the ceiling into your sink or pot.

These are often used above stoves for filling pots. It’s a big space-saver and a conversation starter. When buyers see it, they usually say, “Whoa, that’s awesome!”

Ceiling faucets aren’t just cool—they’re practical. No more lugging heavy pots to the stove. That kind of convenience sells, especially in Litchfield houses for sale, where kitchens are a big deal for families and foodies alike.

With trailblazing technology, your voice is now your remote control.

You can turn on lights, lock doors, close blinds, or start your coffee machine—all by talking. How’s that for a power move?

Here are some popular voice-controlled upgrades:

Smart thermostats

Automated blinds

Smart lighting systems

Smart door locks

Buyers love walking into a house and saying, “Alexa, set the mood,” and watching the room respond. It’s exciting, modern, and downright cool.

These features are showing up more and more in Southern NH houses for sale. If you're a seller, these are the upgrades that catch eyes (and offers).

Okay, not the entire floor—but close!

Some homes now include robot vacuums that live under cabinets and come out on their own. Others have central vacuums built into the walls. Just sweep debris into a little wall slot and—poof!—gone.

These features may seem small, but they make a big difference in daily life. And when you’re listing a home, little things like this can push buyers from maybe to yes.

Don’t laugh! Bathrooms are one of the most important rooms for buyers. And now, they’re going high-tech.

Smart toilets have heated seats, built-in bidets, lights, and even music. Showers can start at a voice command and remember your favorite temperature. Some even change color with the water temp.

All of these techy touches make a home feel like a spa. And that’s a selling point. People fall in love with comfort—and they pay for it.

Yes, your fridge can text you now.

Some smart fridges have built-in cameras. If you’re at the store and forget if you need milk, just peek at your fridge from your phone.

Others let you write digital notes, track expiration dates, or create shopping lists.

High-end tech in the kitchen is a major draw. In fact, tech-savvy kitchens are now showing up more in Litchfield homes for sale as sellers look to stand out.

Home safety is always important. But with trailblazing technology, it’s also super sleek.

Modern systems include:

Video doorbells

Smart locks

Facial recognition

Motion-detected lighting

Remote monitoring

Buyers love the idea of seeing who’s at the door—even if they’re at work. And parents? They love being able to unlock the door for their kids from their phone.

Another unsung hero? Smart garages and storage.

Imagine this: You’re pulling into your driveway. Your garage senses your car and opens automatically. The lights come on inside. Your favorite music plays from a ceiling speaker.

Welcome home.

Some homes even feature smart storage units with climate control—great for wine, tools, or seasonal gear.

In Southern NH houses for sale, smart garages are becoming a top feature in new builds.

Today’s buyers don’t just want style—they want smart energy savings too.

Here’s what helps:

Solar panels

Smart thermostats

Insulated windows

Tankless water heaters

Motion-sensor lights

These upgrades can lower energy bills and attract eco-conscious buyers. That’s a win-win, especially for folks shopping Litchfield houses for sale who want a modern, money-smart move.

More people work from home now than ever before. So home office tech has boomed.

Features like smart lighting, noise-canceling walls, and fast fiber internet connections are in demand.

If you’re staging or buying a home, consider how tech can make a workspace better. It might just seal the deal.

Even outdoor spaces are getting high-tech makeovers.

Check out these cool ideas:

Smart sprinklers

Weather-sensitive lights

Outdoor speakers

Wi-Fi grills

Smart patio covers

Imagine grilling while the speakers play your favorite playlist and the lights adjust as the sun sets. That’s the kind of life buyers want.

All these upgrades may sound fancy—and they are! But many are surprisingly affordable.

And here’s the best part: they can add real value to your home. Not just in dollars, but in how fast it sells and how excited buyers get.

In a competitive market like Southern NH, standing out matters. And trailblazing technology is one powerful way to do that.

If you're house hunting, keep your eyes open for homes with:

Smart appliances

Updated lighting systems

Energy-saving tech

Voice-control features

Security and smart entry

Tech-enhanced bathrooms and kitchens

Ask your REALTOR® about these features when browsing Southern NH houses for sale or viewing Litchfield houses for sale. They might just make your life easier—and your home more fun.

If you're thinking of selling, even one or two tech upgrades can help your listing stand out.

Start small:

Add a smart thermostat

Install a video doorbell

Try voice-activated lights

These changes are low-cost but high-impact. Plus, they’ll look amazing in listing photos and walkthroughs.

Homes aren't what they used to be—and that’s a good thing.

With trailblazing technology, buyers get comfort, convenience, and a little bit of fun. Sellers get to show off something special. And REALTORS® have more reasons to say, “You’ve got to see this place!”

So whether you’re browsing Litchfield Houses for Sale, buying your first home in Southern NH, or getting ready to sell—keep tech in mind.

It’s not just the future of real estate—it’s the now.

If you need more tips on trailblazing technology, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

et’s be real. Home repairs can feel intimidating—especially if you’re not exactly “handy.” But here’s the truth: DIY home fixes don’t have to be hard, expensive, or scary.

In fact, there are simple things you can do today that make your home look better, feel cozier, and even boost its value. Whether you're getting ready to list your place or just moved into a fixer-upper, these easy fixes make a big difference.

These ideas work great if you’re browsing South Nashua Houses for Sale, looking at Southern NH Houses for Sale, or just wanting to freshen up your space.

Ready? Let’s roll up our sleeves and dive in!

Walls take a beating. Between picture hangers, furniture bumps, and kids playing rough, little holes and dents show up fast.

Fixing them is easier than you think.

Spackling paste or lightweight joint compound

Putty knife

Sandpaper

Paint to match your wall

Scoop a bit of spackle and press it into the hole.

Smooth it out with your putty knife.

Let it dry completely.

Lightly sand the area until smooth.

Paint over the patch.

Boom—like new! These little fixes are a must if you're planning to sell. Clean walls make your home shine in listing photos and open houses.

Old, cracked caulk looks gross. Worse? It can let water sneak behind walls and cause damage.

Good news: It’s a quick, cheap fix.

This quick DIY home fix makes your kitchen or bathroom look clean and updated—without spending big bucks.

Want a kitchen or bathroom glow-up without a remodel? Swap out your old knobs and pulls.

This simple trick works wonders in older homes across Southern NH houses for sale, especially in places like South Nashua where classic styles mix with modern.

New knobs or pulls

Screwdriver

Measuring tape (optional)

Remove the old hardware.

Check that the holes match your new ones (or drill new ones if needed).

Attach the new hardware.

Done! This small change packs a big visual punch. Plus, it’s renter-friendly if you're prepping a place to sell or stage.

Squeaks are annoying. But did you know they’re usually super easy to fix?

This is one of those DIY home fixes that takes just minutes—and makes your house feel more solid.

Spray a little WD-40 or rub petroleum jelly on the hinges.

Open and close the door a few times to work it in.

Sprinkle baby powder or baking soda into the cracks between boards.

Sweep the powder in, then walk over the area to work it in.

These tricks don’t cost much and take no time at all. But they help your home feel well-cared-for—especially important if you're selling!

Is your home drafty? Cold air sneaking in? You might be wasting money on heat or A/C.

Fixing weather stripping helps you save money and makes your home feel cozy.

New weather stripping (adhesive foam or rubber)

Scissors

Measuring tape

Peel off the old stripping.

Clean the area with soap and water.

Measure and cut the new strip.

Press it firmly into place.

Seal those doors and windows! This energy-saving trick is perfect for NH winters and adds value to any home—especially across the Southern NH houses for sale market.

Good lighting changes everything. Dim, outdated fixtures can make a great room feel gloomy or small.

Swapping in a new one is easier than you think.

New light fixture

Screwdriver

Voltage tester (safety first!)

Wire connectors (usually included with the fixture)

Turn off the power at the breaker.

Remove the old fixture.

Test wires to make sure there’s no power.

Connect the new wires using color codes (usually black to black, white to white).

Attach the new fixture and turn the power back on.

Bright, warm light can totally change how a space feels. This fix is perfect if you're updating a listing or preparing for an open house.

Want a few more easy ideas? These outdoor touches help any home stand out:

Paint or polish your front door

Add a cheerful welcome mat

Plant a few flowers

Trim overgrown bushes

Power wash your siding or walkway

Small touches like these help your home make a powerful first impression. That matters whether you’re showing it off or just pulling in the driveway after a long day.

Let’s face it—real estate is competitive. Buyers today are smart and picky. Whether you're buying, selling, or just nesting, these simple updates make your home feel fresh and well cared for.

If you’re looking at South Nashua houses for sale, or checking out other Southern NH houses for sale, these easy upgrades can make your home stand out from the pack. Even better? They boost value without draining your savings.

Seriously—you don’t need to be a pro. Most of these projects take under an hour. And the tools? Nothing fancy. Just a little effort, a bit of time, and the confidence to start.

You’ve got this.

Sometimes it just takes a small win to build momentum. Pick one project from this list and go for it.

Need help figuring out which ones will help you sell faster? Let’s chat. As a local NH REALTOR®, I know exactly what buyers are looking for. From Southern NH Houses for Sale to cozy nooks in South Nashua, I’ve seen firsthand how these little changes make a big difference.

You don’t need to knock down walls or spend a fortune to improve your home. Just a few easy DIY home fixes can freshen things up, add value, and make you feel more in control of your space.

Whether you’re staying put, getting ready to sell, or browsing South Nashua Houses for Sale, you’ve now got the power to tackle some real changes—one fix at a time.

And if you ever need help finding the right buyer or the perfect next place to call home? I’m just a call away.

Let’s fix it, list it, and love where you live.

If you need more info on DIY home fixes, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Let’s be honest—buying a home isn’t as easy as it used to be.

If you're house hunting, you’ve probably seen prices go up. Maybe mortgage rates have you scratching your head. It can feel like owning a home is just out of reach.

But here's the good news: with the right strategy, home affordability is still within your grasp. Whether you're buying your first home, moving up, or downsizing, there are ways to win in today’s real estate market.

Let’s break it down together in simple, real talk.

Home affordability means being able to buy a house that fits your budget—without stretching yourself too thin.

It’s all about what you can realistically pay for:

When all these pieces fit into your budget, that’s when home buying becomes truly affordable.

You're not imagining it—things are more expensive. Here’s why:

In places like South Nashua Houses for Sale and all across Southern NH Houses for Sale, prices have gone up fast.

A lot of folks want to move here, but there aren't enough homes for everyone. More buyers and fewer houses mean higher prices.

A few years ago, rates were around 3%. Now, they’re much higher. That means your monthly payment goes up—even if the price stays the same.

Groceries, gas, utilities—it all adds up. So the money you once saved for a home might now go to everyday stuff.

All of these together make home affordability more challenging than ever.

The good news? You’re not stuck. You just need the right tools and a bit of planning. Let’s look at the ways to beat the market.

Here’s how you can make homeownership possible—even in a tough market.

This one’s big. The better your credit, the better the mortgage rate you’ll get.

Here’s how to do it:

Pay bills on time

Don’t max out credit cards

Check your credit report for errors

Keep old accounts open

Even a small bump in your credit score can save you thousands over time.

New Hampshire offers amazing programs for first-time homebuyers:

Down payment help

Lower interest rates

Special loans with fewer fees

Ask your REALTOR® or lender to explain which ones you qualify for.

You might love one town, but just a few miles away, homes are more affordable.

For example, South Nashua houses for sale tend to be more budget-friendly than some neighboring towns. Southern NH houses for sale offer a wide range of options—from quiet country homes to downtown condos.

Stay flexible. You might find a hidden gem that fits your life and your wallet.

Sometimes the best way to start is small.

A condo or starter home might not be your dream house—but it gets you in the door. You can always move up later.

Plus, smaller homes often mean:

Lower monthly payments

Lower taxes

Less upkeep

That’s a win-win when you’re focused on home affordability.

You don’t always need 20% down.

Some loans allow as little as 3–5% down, especially for first-time buyers. Just make sure you still have money left over for closing costs and emergencies.

Talk to your lender about your options and what makes sense for your budget.

Not all loans are created equal. Get quotes from a few lenders. Compare:

Interest rates

Fees

Loan terms

Your REALTOR® can connect you with trusted local lenders who will help you understand your numbers clearly.

Here’s the thing: there’s no perfect time to buy.

But sometimes your time is the right time.

If you find the right home and you’re financially ready, waiting for the market to change could mean missing out.

Still unsure? A trusted REALTOR® will walk you through your options with zero pressure.

You don’t have to figure all this out alone.

A knowledgeable, caring REALTOR® can:

Help you understand the market

Show you homes that fit your budget

Explain the home buying process

Connect you with trusted lenders and home inspectors

Help you make a smart offer

In Southern NH, we know the market inside and out. Whether you're eyeing South Nashua houses for sale or looking across Southern NH houses for sale, we’re here to guide you every step.

Let’s avoid trouble. These are the most common home buying mistakes people make:

❌ Not getting pre-approved before house hunting

❌ Stretching the budget too far

❌ Forgetting about extra costs (taxes, insurance, repairs)

❌ Falling in love with a home that’s too pricey

❌ Skipping the home inspection

Stay smart. Ask questions. Slow and steady wins this race.

Here’s a super simple way to check your budget.

Rule of Thumb: Your total monthly home costs should be no more than 28–30% of your gross monthly income.

So if you make $5,000/month:

Keep home costs around $1,400–$1,500/month

That includes mortgage, taxes, insurance, and HOA fees

Use a mortgage calculator or talk to your lender to run the numbers.

Yes, buying a home right now can be tough. But you’re not alone. With patience and a solid plan, it’s totally possible.

Keep these tips in mind:

Stay realistic

Be flexible

Ask questions

Get help from a pro

Don’t give up

Your dream home might look a little different than you pictured—but it’s still out there.

The market might feel tricky, but home affordability isn’t out of reach. There’s a path forward—and we’ll help you find it.

With the right REALTOR®, smart planning, and some creative thinking, homeownership is possible. Even now. Especially now.

Whether you're checking out South Nashua Houses for Sale or browsing Southern NH Houses for Sale, we’re here to help you every step of the way.

Let’s work together to turn your home dreams into real life.

Ready to Start? Let’s Chat!

If you're wondering what homes you can afford, or where to begin, reach out anytime. We’ll guide you through your options and find a plan that works just for you.

Home affordability starts with smart choices—and we’re here to help you make them. 🏡💬

If you need more tips on navigating home affordability, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Let’s be honest—buying a home isn’t as easy as it used to be.

If you're house hunting, you’ve probably seen prices go up. Maybe mortgage rates have you scratching your head. It can feel like owning a home is just out of reach.

But here's the good news: with the right strategy, home affordability is still within your grasp. Whether you're buying your first home, moving up, or downsizing, there are ways to win in today’s real estate market.

Let’s break it down together in simple, real talk.

Home affordability means being able to buy a house that fits your budget—without stretching yourself too thin.

It’s all about what you can realistically pay for:

When all these pieces fit into your budget, that’s when home buying becomes truly affordable.

You're not imagining it—things are more expensive. Here’s why:

In places like South Nashua Houses for Sale and all across Southern NH Houses for Sale, prices have gone up fast.

A lot of folks want to move here, but there aren't enough homes for everyone. More buyers and fewer houses mean higher prices.

A few years ago, rates were around 3%. Now, they’re much higher. That means your monthly payment goes up—even if the price stays the same.

Groceries, gas, utilities—it all adds up. So the money you once saved for a home might now go to everyday stuff.

All of these together make home affordability more challenging than ever.

The good news? You’re not stuck. You just need the right tools and a bit of planning. Let’s look at the ways to beat the market.

Here’s how you can make homeownership possible—even in a tough market.

This one’s big. The better your credit, the better the mortgage rate you’ll get.

Here’s how to do it:

Pay bills on time

Don’t max out credit cards

Check your credit report for errors

Keep old accounts open

Even a small bump in your credit score can save you thousands over time.

New Hampshire offers amazing programs for first-time homebuyers:

Down payment help

Lower interest rates

Special loans with fewer fees

Ask your REALTOR® or lender to explain which ones you qualify for.

You might love one town, but just a few miles away, homes are more affordable.

For example, South Nashua houses for sale tend to be more budget-friendly than some neighboring towns. Southern NH houses for sale offer a wide range of options—from quiet country homes to downtown condos.

Stay flexible. You might find a hidden gem that fits your life and your wallet.

Sometimes the best way to start is small.

A condo or starter home might not be your dream house—but it gets you in the door. You can always move up later.

Plus, smaller homes often mean:

Lower monthly payments

Lower taxes

Less upkeep

You don’t always need 20% down.

Some loans allow as little as 3–5% down, especially for first-time buyers. Just make sure you still have money left over for closing costs and emergencies.

Talk to your lender about your options and what makes sense for your budget.

Not all loans are created equal. Get quotes from a few lenders. Compare:

Interest rates

Fees

Loan terms

Your REALTOR® can connect you with trusted local lenders who will help you understand your numbers clearly.

Here’s the thing: there’s no perfect time to buy.

But sometimes your time is the right time.

If you find the right home and you’re financially ready, waiting for the market to change could mean missing out.

Still unsure? A trusted REALTOR® will walk you through your options with zero pressure.

You don’t have to figure all this out alone.

A knowledgeable, caring REALTOR® can:

Help you understand the market

Show you homes that fit your budget

Explain the home buying process

Connect you with trusted lenders and home inspectors

Help you make a smart offer

In Southern NH, we know the market inside and out. Whether you're eyeing South Nashua houses for sale or looking across Southern NH houses for sale, we’re here to guide you every step.

Let’s avoid trouble. These are the most common home buying mistakes people make:

❌ Not getting pre-approved before house hunting

❌ Stretching the budget too far

❌ Forgetting about extra costs (taxes, insurance, repairs)

❌ Falling in love with a home that’s too pricey

❌ Skipping the home inspection

Stay smart. Ask questions. Slow and steady wins this race.

Here’s a super simple way to check your budget.

Rule of Thumb: Your total monthly home costs should be no more than 28–30% of your gross monthly income.

So if you make $5,000/month:

Keep home costs around $1,400–$1,500/month

That includes mortgage, taxes, insurance, and HOA fees

Use a mortgage calculator or talk to your lender to run the numbers.

Yes, buying a home right now can be tough. But you’re not alone. With patience and a solid plan, it’s totally possible.

Keep these tips in mind:

Stay realistic

Be flexible

Ask questions

Get help from a pro

Don’t give up

Your dream home might look a little different than you pictured—but it’s still out there.

The market might feel tricky, but home affordability isn’t out of reach. There’s a path forward—and we’ll help you find it.

With the right REALTOR®, smart planning, and some creative thinking, homeownership is possible. Even now. Especially now.

Whether you're checking out South Nashua Houses for Sale or browsing Southern NH Houses for Sale, we’re here to help you every step of the way.

Let’s work together to turn your home dreams into real life.

Ready to Start? Let’s Chat!

If you're wondering what homes you can afford, or where to begin, reach out anytime. We’ll guide you through your options and find a plan that works just for you.

Home affordability starts with smart choices—and we’re here to help you make them. 🏡💬

If you need more tips on navigating home affordability, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Helping someone move is always a big deal. But when it’s a boomer—maybe your parent, a friend, or even yourself—it takes a little extra care.

Boomers are in a unique stage of life. Many are thinking about downsizing, retiring, or just making life simpler. If you want to help boomers move, this guide is for you.

We’ll break it down in easy steps. And don’t worry, we’ll keep it simple, friendly, and full of heart.

A lot of boomers are choosing to move. Here’s why:

The house is too big now.

It’s hard to keep up with maintenance.

They want to live closer to family.

They want to travel more.

They’re looking for a one-level home.

In places like South Nashua Houses for Sale and across Southern NH Houses for Sale, there are lots of great options for this next chapter.

This might be the hardest part—starting the conversation.

If you’re helping someone else, try asking gentle questions like:

“Is the house feeling too big lately?”

“Would it be easier with fewer stairs?”

“Do you want to be closer to the grandkids?”

Listening is key here. This move is emotional. It’s not just about boxes. It’s about memories, routines, and comfort.

Start early. Talk often. Keep it positive.

One of the biggest tasks is sorting through stuff. Let’s be real—decades of stuff.

Here’s how to help:

Take one room at a time.

Use boxes labeled keep, donate, toss.

Keep the most meaningful items.

Take pictures of things that hold memories but aren’t needed.

Get help from family or hire a pro.

Don’t rush this part. It takes time to let go. Encourage, but never push.

A clean, tidy space makes it easier to get ready for showings. That matters if you’re planning to list the home in South Nashua houses for sale or other Southern NH houses for sale.

If the home needs some updates before selling, focus on the simple stuff. You don’t need a full remodel. Just a few small updates can help boost the home’s value.

Here’s what helps:

Fresh paint (think soft neutrals)

Bright lighting

Clean windows

Safe steps and walkways

Staged rooms that feel open and warm

A good REALTOR® can walk you through what’s worth doing and what’s not.

Boomers want comfort, ease, and location. That means homes that are:

One-level or with a main-floor bedroom

Low maintenance

Close to healthcare

In a walkable neighborhood

Near family or friends

There are wonderful options in Southern NH houses for sale. Think charming condos, townhomes, and ranch-style houses.

If you’re in the South Nashua area, you're in luck. There are many great listings in South Nashua houses for sale that fit the bill.

When it’s time to list the home, a trusted agent makes all the difference. Selling can feel overwhelming—but it doesn’t have to be.

Here’s what a great REALTOR® will help with:

Pricing the home right

Coordinating showings

Marketing the home online

Managing paperwork

Helping with offers and closing

And yes, if you're trying to help boomers move, your agent can also recommend movers, downsizers, or estate sale pros.

The best time to sell? Usually spring or summer. But that depends on the local market and the seller’s goals.

Sometimes waiting a few weeks makes a big difference. Other times, striking fast is smart. Talk with your agent about what’s best in your neighborhood.

A good REALTOR® knows what’s happening with Southern NH houses for sale, so you won’t be guessing.

Here’s how to make the actual move smooth and easy:

Hire movers who specialize in senior relocations.

Pack an overnight bag with meds, snacks, and clothes.

Label every box with the room and content.

Take breaks often.

Make sure new home utilities are set up in advance.

Celebrate the first night with something special—pizza, champagne, or a cozy blanket.

Moving can feel big, but little touches make it easier.

This move isn’t just about a house. It’s about life changes, letting go, and starting fresh. Always approach it with patience, empathy, and encouragement.

Use kind words. Offer to help without taking over. Celebrate small wins along the way.

And remember—it’s okay to feel a mix of emotions. Excitement, fear, sadness, and joy can all happen at once.

Here’s a simple checklist:

✅ Talk about the idea of moving

✅ Declutter one room at a time

✅ Freshen up the home

✅ Meet with a trusted REALTOR®

✅ Explore local homes (like in South Nashua!)

✅ Choose the right next home

✅ Sell the current home

✅ Schedule the move with help

✅ Get settled with comfort and care

✅ Celebrate the new beginning!

Helping boomers move doesn’t have to be overwhelming. With the right steps, the right people, and the right mindset, it can actually be a joyful, freeing time.

Whether it’s a cozy condo near family, a low-maintenance ranch in Southern NH, or simply something that feels “just right,” the next chapter is full of possibility.

Need help finding that perfect place? Thinking about selling a long-loved home? I’m here to make it all a little easier—with care, experience, and the local knowledge you can trust.

Let’s Talk!

Want more info about South Nashua Houses for Sale or other Southern NH Houses for Sale? Thinking about how to help someone downsize? Let’s chat. I’d love to guide you or your loved ones through this exciting next step.

If you need more info on how to help boomers move, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

If you're thinking about selling your home, there’s one easy trick that works like magic—top paint colors.

Yes, the color on your walls can actually help you sell your house faster. It can even help you get more money for it. Wild, right?

Whether you’re prepping a cozy condo or browsing South Nashua Houses for Sale, the right paint choices truly matter. Even small changes make a big impact. This blog walks you through the best colors, where to use them, and why they help so much.

Let’s dive into the paint bucket and get your home market-ready!

Color sets the mood. It makes rooms feel bigger, brighter, cleaner, and more welcoming. That’s exactly what buyers want.

Most folks start their search online. That first photo? It needs to pop! A fresh coat of paint with the right hue can make your listing stand out from the crowd.

That’s true whether you’re selling in a busy area or looking at Southern NH Houses for Sale. Buyers are drawn to homes that feel fresh, clean, and move-in ready.

Let’s start with the gold standard—neutrals.

Neutral colors work like a blank canvas. They let buyers picture their own stuff in the space. Plus, neutrals go with almost any décor. That’s why they show up in so many successful real estate photos.

Soft Gray: Cool, clean, and calm. Great for living rooms and bedrooms.

Warm Beige: Cozy and inviting. Perfect for family rooms and hallways.

Greige (Gray + Beige): The best of both worlds. Works in almost any space.

Pro Tip: Stick to soft tones with a matte or eggshell finish. They look clean without being too shiny.

Kitchens and bathrooms are major selling points. A great paint job can make them shine!

Soft White: Clean, fresh, and timeless.

Pale Blue: Adds a cheerful touch without being bold.

Light Sage Green: Earthy and modern at the same time.

Cool Gray: Spa-like and serene.

Light Taupe: Warm, but not dark. Looks elegant and clean.

Dusty Blue: Adds color without overwhelming the space.

Even in South Nashua houses for sale, kitchens and bathrooms with updated colors stand out to buyers—and often sell faster.

While neutral colors rule most rooms, bold pops of color can work wonders in small doses.

Try using rich or dramatic shades in places like:

An accent wall in the dining room

The inside of a front door

A small powder room

A home office wall

Navy Blue: Classy and strong.

Forest Green: Earthy and eye-catching.

Deep Charcoal: Modern and sleek.

These colors make a strong impression—without taking over the whole space.

Don’t forget the outside! The exterior of your home is the first thing buyers see. That first impression can make or break the sale.

Classic White: Clean and timeless.

Soft Gray: Neutral with a fresh, modern twist.

Slate Blue: A bit different but still welcoming.

Pair these with crisp white trim for a sharp, clean look. Updating your front door color can also help. A black, navy, or red door adds a touch of personality and charm.

In neighborhoods with lots of listings, like Southern NH houses for sale, a fresh exterior can set your home apart.

Now that we’ve covered the best colors, let’s look at what to skip.

Buyers tend to avoid:

Bright Reds or Oranges: Too loud and intense.

Dark Browns or Blacks (indoors): Can feel small or gloomy.

Neon Colors: Distracting and hard to decorate around.

Overly Personalized Colors: Like purple, hot pink, or bright yellow.

Remember, the goal is to help buyers picture themselves in your home. Stick with simple, soothing tones that feel fresh and inviting.

Use Quality Paint: It lasts longer and looks better.

Don’t Skip Prep Work: Clean, patch, and tape carefully.

Stick to One Color Per Room: Keeps things simple and clean.

Paint Trim and Doors Too: Fresh white trim goes a long way!

Keep It Light: Light colors make spaces feel bigger and brighter.

The right paint color makes a room feel brighter, larger, and more inviting. Buyers don’t want to do a lot of work after they move in.

When they walk into a home that looks finished and neutral, they get excited. They start picturing where their couch will go or how they’ll host dinner parties.

Paint is one of the least expensive upgrades you can make—and it often brings one of the biggest returns.

In areas like South Nashua Houses for Sale or other Southern NH Houses for Sale, buyers want easy, move-in-ready homes. The local market is still strong, but competition is real. If your house looks sharp and fresh, it’ll catch more eyes—and better offers.

That’s especially true for younger buyers or busy families. They don’t want to deal with big projects. They want a home that’s ready to go. Fresh paint is a signal that your home has been cared for and updated.

Selling a home doesn’t have to be hard. Little changes, like using the top paint colors, can have a big impact.

Whether you’re working with a REALTOR®, staging your own home, or just curious about upgrades, start with the walls. A weekend of painting could mean a faster sale—and a better price.

Want to chat about getting your home ready to sell? I'm here to help. Let’s make your home shine from the inside out!

If you need more info on top paint colors, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.