Tag Archives for " home buyer "

If you’re looking to boost your home’s value before selling, you don’t need a huge budget or a full renovation. With a few simple DIY projects, you can give your home a fresh, updated look that attracts more buyer, especially those searching for Londonderry houses for sale or Southern NH houses for sale.

These quick upgrades can make your home feel newer, cleaner, and more inviting. Best of all, most of these projects take just a weekend and a bit of elbow grease.

Let’s explore six easy DIY projects that add instant charm, style, and value to your home.

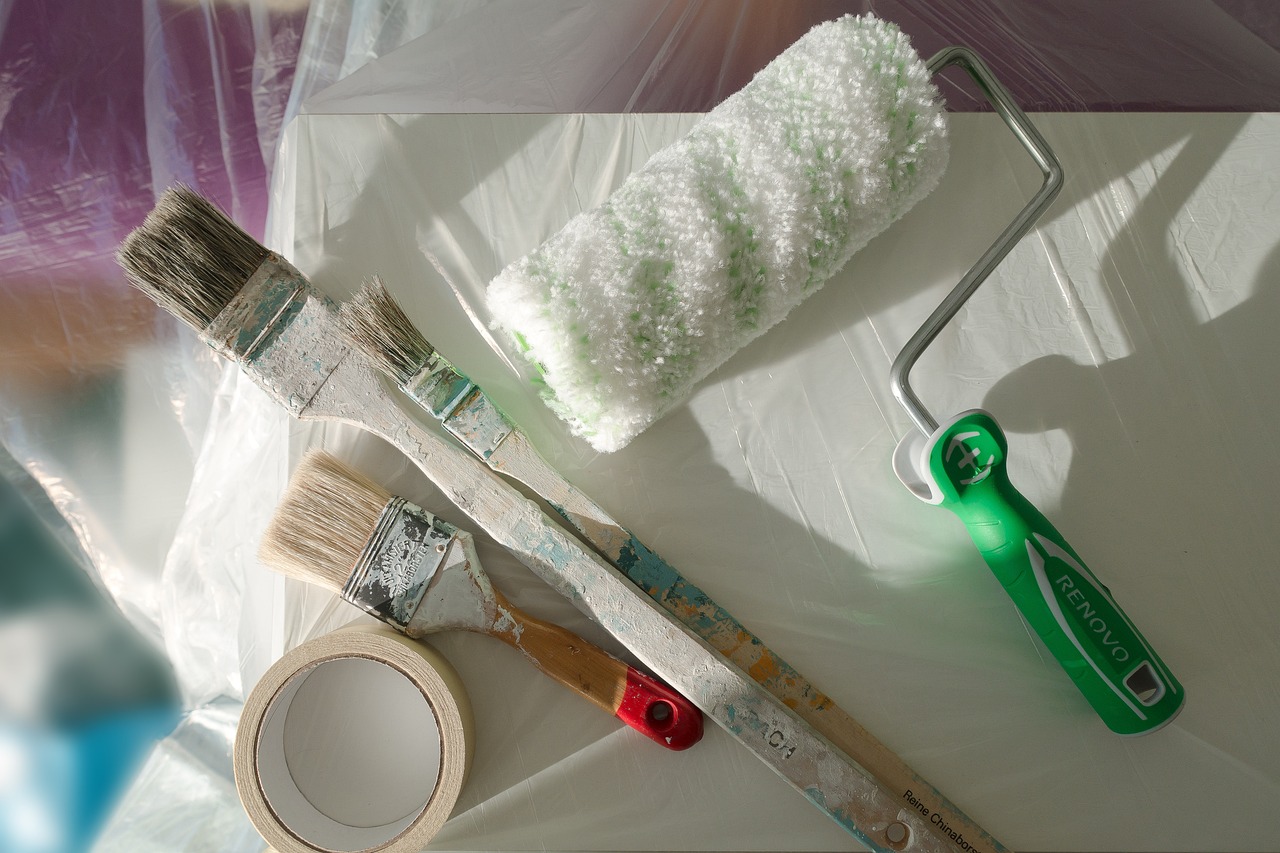

One of the easiest ways to boost your home's value is with a fresh coat of paint. Paint has power. It transforms the look and feel of a room almost instantly.

Neutral colors like light gray, beige, or soft white help rooms look bigger, brighter, and cleaner. They also appeal to a wide range of buyers. A gallon of quality paint costs around $30–$50, and you can paint a standard room in a day.

If you’re feeling bold, paint a single accent wall for a pop of color. It’s an easy way to create a focal point without overwhelming the space.

Before painting, fix any small wall dents or holes with spackle. A smooth finish helps the paint look professional, even if you’re a beginner.

Good lighting can change everything. Outdated fixtures can make your home feel dark and tired. Swapping them out for modern, energy-efficient ones is a simple project that adds real value.

Think about adding warm, soft lighting in living areas and bright white light in kitchens and bathrooms. These small choices create a welcoming vibe buyers notice right away.

Installing dimmer switches is another easy upgrade that adds flexibility and sophistication.

If you’re showing your home soon, open blinds, clean windows, and use daylight bulbs to make your home shine. Homes for sale in Southern NH often get lots of natural light, so highlight that feature whenever you can.

First impressions matter, especially when buyers pull up to your house. Improving curb appeal is one of the most cost-effective ways to boost your home's value.

Start with your front door. Paint it a bold, welcoming color like navy blue, red, or forest green. Add new hardware for a modern touch.

Next, tidy up your landscaping. Trim bushes, edge your lawn, and plant colorful flowers or low-maintenance shrubs. Fresh mulch gives garden beds a clean, finished look.

Don’t forget your mailbox and house numbers. Replacing old ones with stylish new options costs little but makes a big difference.

A few small touches outside tell buyers that your home is well cared for, which can make them feel more confident about the rest of the property.

You don’t need a full kitchen remodel to make a huge impact. Swapping out cabinet hardware, faucet fixtures, and lighting gives your kitchen a quick facelift.

Matte black, brushed nickel, or brass handles instantly modernize your space. If your cabinets are sturdy but outdated, consider painting them for a fresh, new look.

Add under-cabinet lighting to brighten counters and make your kitchen feel more high-end. Small changes like these help potential buyers picture themselves cooking and entertaining there.

Since kitchens are one of the most important selling points in any home, small upgrades can lead to a big return on investment.

Bathrooms are another top priority for buyers, but a full renovation can be pricey. Luckily, you can do a mini makeover for a fraction of the cost.

Replace old faucets and towel bars with sleek, modern designs. Update your mirror or add a frame around the existing one for a custom look.

Re-grouting tile or applying new caulk around the tub can make your bathroom feel cleaner and newer instantly.

For a spa-like touch, add floating shelves with rolled towels, a few plants, and some candles. These little touches make your space feel relaxing and luxurious.

When buyers see a bright, clean bathroom, it instantly adds emotional value, something that helps your home stand out from others in the Southern NH houses for sale market.

Every buyer loves storage, and most homes could use more of it. Creating extra storage is an easy way to boost your home’s value without major construction.

Start by adding shelving in your garage, laundry room, or basement. Use baskets and bins to keep things tidy.

Inside the home, add closet organizers to maximize space. A simple DIY shelf or built-in bench in an entryway can also double as extra storage and decor.

Even something as small as adding hooks or a pegboard in the mudroom shows buyers your home is functional and well organized.

When a home feels clean and clutter-free, buyers can better imagine living there, and that’s exactly what helps sell homes faster.

Before listing, take time to deep clean every corner of your home. A sparkling clean house looks newer and better cared for.

Declutter rooms by removing personal items and excess furniture. You want buyers to imagine their belongings in the space, not yours.

Homes that are clean and clutter-free photograph better too, which is key when marketing Londonderry houses for sale or promoting your property among other Southern NH houses for sale.

DIY projects aren’t just about saving money. They show pride in ownership. When buyers see small upgrades done with care, they assume the rest of the home has been maintained too.

Plus, these projects often give you one of the best returns for your time and money. Even if you’re not selling right away, improving your home makes it a happier, more beautiful place to live.

If you’re thinking about selling soon, completing a few of these projects can help your home stand out from the competition.

Buyers in areas like Londonderry, Hudson, and across Southern New Hampshire appreciate move-in-ready homes that feel updated and cared for.

With these six easy DIY projects, you’ll be well on your way to boosting your home’s value and attracting serious buyers faster.

You don’t need to spend thousands to make a big impact. Focus on small, simple updates that refresh your space and make buyers fall in love.

From a new coat of paint to stylish fixtures and tidy landscaping, every little improvement adds up.

So grab your tools, roll up your sleeves, and start one of these projects this weekend. You’ll be amazed at how much you can boost your home’s value and how much better your home will feel when you’re done.

If you need more tips on how to boost your home’s value, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Thinking about buying a home in Southern New Hampshire but still waiting? You’re not alone. Many buyers hesitate, hoping prices will drop or interest rates will improve. But the cost of waiting can be much higher than you think.

Whether you're browsing Southern NH houses for sale or just starting your search, it’s important to understand how small market changes can lead to big future costs. Let’s break it down in a simple, laid-back way.

Home Prices Keep Rising in Southern NH

Home Prices Keep Rising in Southern NHSouthern NH continues to be a hot market. Towns like Nashua, Hudson, Londonderry, and Litchfield are seeing steady price increases.

Even a small increase in home prices, say $10,000, can mean a much bigger cost over time.

How the Cost of Waiting Adds Up

How the Cost of Waiting Adds UpLet’s say you’re eyeing a home priced at $450,000. You decide to wait six months. The market shifts, and now that same home costs $465,000.

Even a 3% price increase can cost you thousands more over time. That’s the real cost of waiting.

Why Buying Now Makes Sense in Southern NH

Why Buying Now Makes Sense in Southern NHSouthern NH offers strong value, great schools, and easy access to Boston and Manchester. Homes here are in demand for good reason.

Lock in today’s prices

Start building equity sooner

Avoid rising interest rates

Get ahead of spring competition

If you’re browsing Southern NH houses for sale, now is the time to act.

Tips for Buyers Ready to Move Forward

Tips for Buyers Ready to Move ForwardKnow your budget

Show sellers you’re serious

They know the market

They’ll help you move quickly

Consider different towns or home styles

Focus on long-term value

Don’t just look at the price

Consider taxes, insurance, and utilities

Southern NH Market Snapshot

Southern NH Market SnapshotSouthern NH continues to attract buyers from all over New England. Here’s what’s happening:

Median home price: $525,000+

Homes sell in under 20 days

Inventory remains tight

Waiting could mean paying more or missing out entirely.

The Cost of Waiting to Buy in NH – Smart Moves Beat Market Shifts

The Cost of Waiting to Buy in NH – Smart Moves Beat Market ShiftsThe cost of waiting to buy in NH is real. Prices are rising, interest rates are unpredictable, and competition is fierce. If you’re ready to buy, now is the time to act.

Whether you're browsing Southern NH houses for sale or working with a REALTOR®, being proactive can save you thousands. Don’t wait for the perfect moment—make your move while the market is still in your favor.

If you need more information on the cost of waiting to buy, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

For many buyers, the idea of buying a fixer-upper sounds exciting. The thought of turning a worn-out house into a dream home has a certain appeal. You can picture the “after” photos. You can almost feel the pride that comes from doing it yourself. But is it always worth the effort?

The truth is, buying a fixer-upper has both benefits and challenges. It can save you money upfront, but it can also cost more than you expect. Sweat equity can add value, but it demands time, energy, and a flexible budget.

In Southern NH, where buyers are often searching for value in a competitive market, fixer-uppers can look tempting. Whether you’re checking out South Hudson houses for sale or browsing Southern NH houses for sale, you may come across listings that need some love. The key is knowing when a project makes sense and when it’s too risky.

This guide will walk you through the real pros and cons so you can decide if buying a fixer-upper fits your goals.

Fixer-uppers hold a lot of promise. Many buyers like the idea of customizing a home to match their personal style. Others hope to buy low, put in work, and gain equity fast. For some, it’s about entering a housing market that might otherwise feel out of reach.

In Southern NH, where homes can move quickly, fixer-uppers often look like hidden gems. They may not get the same level of interest as turnkey homes, which could mean more negotiating room for you.

One of the biggest draws is cost. Fixer-uppers often list for less than updated homes in the same neighborhood. That lower price can make buying possible in areas you thought were out of reach.

By putting in your own work, you build equity faster. The value of your improvements stacks up over time. Sweat equity not only saves money but also increases pride of ownership.

You can design the space exactly how you want. From flooring to cabinets, every choice can reflect your style.

Move-in ready homes attract more buyers. Fixer-uppers often have fewer offers, giving you room to negotiate.

If you plan to sell in the future, upgrades can raise the resale value. With the right improvements, you may see a strong return on investment.

Repairs often cost more than expected. What looks like a small issue could turn into a major project. Plumbing, electrical, or structural issues can eat into your budget fast.

Fixer-uppers require time. Even simple upgrades can stretch out for weeks or months. If you have a busy schedule, projects may drag on longer than planned.

Sweat equity sounds nice, but it means sweat—real effort, real time, and sometimes real frustration.

Not all lenders love fixer-uppers. You may need a renovation loan or higher down payment. These can come with extra rules and paperwork.

If you plan to live in the house while fixing it, be ready for dust, noise, and disruption. Not everyone enjoys living in a construction zone.

How much can I really spend on repairs?

Do I have the time and skills for DIY projects?

Will I need to hire contractors?

Does the home have major structural or system issues?

How long do I plan to stay in the home?

Being honest with yourself about these questions can prevent headaches later.

When considering buying a fixer-upper, budget planning is key. Always add 20–30% more to your repair budget to cover surprises.

For example, if you expect $30,000 in renovations, plan for at least $36,000–$40,000. That cushion keeps you safe if problems pop up.

Not every job can be DIY. Painting, landscaping, and cosmetic updates are usually safe for homeowners. But electrical, plumbing, and structural fixes require licensed professionals.

Knowing when to hire out work saves money and protects your safety. It also keeps projects up to code, which matters if you ever sell.

Southern NH has a mix of homes. Some are historic with charm but need updating. Others are mid-century or more modern homes that simply need cosmetic work.

When you look at South Hudson houses for sale, you might notice fixer-uppers priced lower than fully renovated homes. The same is true across Southern NH houses for sale. If you’re open to projects, these homes could offer great potential.

But remember, location still matters most. A fixer-upper in a desirable neighborhood will likely hold value better than a perfect home in a less popular area.

Buying a fixer-upper is more than a financial decision—it’s emotional. Some people thrive on creating their dream home step by step. They love the journey. Others may feel overwhelmed by the stress and delays.

It helps to be realistic. Projects will take longer and cost more than planned. But the reward of walking into a space you transformed can feel priceless.

Your timeline matters a lot. If you need to move in right away, a major fixer-upper may not be practical. But if you can live with work-in-progress spaces, you may be fine.

If your goal is to resell quickly, factor in the renovation timeline. A home sitting unfinished for months won’t bring profit.

So, is buying a fixer-upper the right move for you? The answer depends on three main factors:

Your budget: Do you have money set aside for repairs and surprises?

Your timeline: Can you handle delays and long projects?

Your personality: Do you enjoy hard work, or does it stress you out?

For some buyers, sweat equity is worth every ounce of effort. For others, the dream fades when faced with constant repairs.

Fixer-uppers in Southern NH can be incredible opportunities, but they aren’t for everyone. They require patience, planning, and a willingness to deal with the unexpected.

If you’re browsing South Hudson houses for sale or scanning Southern NH houses for sale, don’t rule out homes that need work. Just make sure you understand the true costs, both financial and emotional.

When done right, buying a fixer-upper can give you equity, personalization, and pride. When done wrong, it can drain your budget and your energy. The decision comes down to your goals, your budget, and your timeline.

If you need more info on buying a fixer-upper, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

If you're thinking about moving to Southern New Hampshire, Hudson NH schools should be on your radar—especially if you have kids. Families love Hudson for its welcoming neighborhoods, strong school system, and easy access to nearby cities.

Whether you're browsing Hudson houses for sale or Southern NH houses for sale, knowing which school zones to watch can help you make a smart move. Let’s explore the top school zones that make Hudson a great place to raise a family.

Why Hudson NH Schools Matter When Buying a Home

Why Hudson NH Schools Matter When Buying a HomeSchools affect more than just your child’s education. They also impact home value, resale potential, and neighborhood vibe.

Better education opportunities

Safer, more stable neighborhoods

Stronger property values

More community involvement

When you invest in Hudson NH schools, you’re also investing in your child’s future.

Top School Zones in Hudson NH

Top School Zones in Hudson NHHudson has several standout public schools that consistently rank well in New Hampshire. Here are the top zones to watch in 2025:

1. Nottingham West Elementary School Zone

1. Nottingham West Elementary School ZoneNottingham West Elementary serves grades 2–5 and is known for its strong academics and caring staff.

High reading and math scores

Active parent-teacher involvement

Safe and friendly environment

Homes range from $450,000 to $700,000

Mix of ranches, colonials, and split-levels

Close to parks and shopping

If you're looking at Hudson houses for sale, this zone is a favorite for families focused on Hudson NH schools.

2. Hills Garrison Elementary School Zone

2. Hills Garrison Elementary School ZoneHills Garrison Elementary also serves grades 2–5 and offers a nurturing learning environment.

Strong teacher support

Great enrichment programs

Inclusive and welcoming culture

Homes range from $475,000 to $725,000

Quiet streets and large yards

Near conservation land and trails

This zone is perfect for families who want space and school quality in Hudson NH schools.

3. Hudson Memorial School Zone

3. Hudson Memorial School ZoneHudson Memorial School serves grades 6–8 and prepares students for high school success.

Advanced math and science programs

Sports, clubs, and arts opportunities

Supportive staff and leadership

Homes range from $500,000 to $800,000

Near town center and recreation areas

Ideal for families with older kids

This zone is a great choice for long-term planning around Hudson NH schools.

4. Alvirne High School Zone

4. Alvirne High School ZoneAlvirne High School serves grades 9–12 and offers a wide range of academic and career programs.

Career and technical education options

AP courses and college prep

Strong sports and arts programs

Homes range from $550,000 to over $900,000

Larger homes with modern features

Great for families focused on education

This zone adds long-term value to your home investment and ties directly into Hudson NH schools.

Tips for Buying Near Top School Zones

Tips for Buying Near Top School ZonesUse sites like GreatSchools or Niche

Look at test scores, reviews, and programs

Drive through during school hours

Talk to neighbors and parents

They know the school zones and market trends

Ask about future development and zoning changes

Even if your kids are young, plan ahead

Good schools help with resale value

Hudson Real Estate Snapshot

Hudson Real Estate SnapshotHudson continues to attract families from all over Southern NH. Here’s why:

Multiple top-rated public schools

Great support for all learning styles

Low crime rates and friendly communities

Ideal for raising kids

Easy access to Nashua, Manchester, and Boston

Close to shopping, dining, and recreation

Whether you're looking at Hudson houses for sale or Southern NH houses for sale, Hudson NH schools should be part of your decision.

Smart Moves Start With Hudson NH Schools

Smart Moves Start With Hudson NH SchoolsChoosing the right home means choosing the right neighborhood—and that often starts with schools. Hudson NH schools offer families a chance to live in safe, welcoming communities with access to top education.

From elementary to high school, Hudson’s school zones are worth watching. So take your time, ask questions, and find the home that fits your family’s needs. Your next chapter starts here.

If you need more info on the top Hudson NH schools, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Selling your home can be exciting, but it also comes with one important consideration: how to avoid capital gains tax. Capital gains tax is the tax you pay on the profit from the sale of an asset like your house. While it can be a substantial sum, there are several ways to reduce or avoid it entirely. In this article, we’ll explore strategies that homeowners, especially in South Hudson houses for sale and Southern NH, can use to minimize their capital gains tax liability.

Whether you’re selling a single-family home, a vacation property, or an investment property, knowing how to navigate the rules and regulations can save you a lot of money. Let’s dive into how to avoid capital gains tax when selling your home.

Before we get into the strategies for avoiding capital gains tax, let’s first break down what it is. Capital gains tax is the tax you pay on the profit you make from selling an asset, such as a home, stock, or real estate. If you sell your home for more than you paid for it, the difference is considered a gain, and the IRS may tax that gain.

There are two types of capital gains: short-term and long-term. Short-term capital gains apply if you sell an asset within one year of owning it, and these are taxed at a higher rate. Long-term capital gains apply to assets held for more than a year and are typically taxed at a lower rate.

In real estate, the rules around capital gains tax can be a bit more complex. However, there are several ways you can avoid capital gains tax or reduce it significantly.

If you’re selling your primary residence, you have a significant advantage over other types of property sales. The IRS offers an exclusion that allows you to avoid capital gains tax on the sale of your home, as long as certain conditions are met.

One of the most important things to know is the 2-out-of-5-year rule. If you’ve lived in the home for at least 2 of the last 5 years before the sale, you can exclude up to $250,000 in capital gains if you're single, or $500,000 if you're married and file jointly.

For example, if you bought your home for $200,000 and sold it for $400,000, your gain would be $200,000. If you meet the 2-out-of-5-year rule, you wouldn’t have to pay any capital gains tax on the $200,000 gain.

If you’ve made any home improvements during your ownership, these costs can be added to the “basis” of your home, which will reduce your capital gain. For instance, if you bought your home for $250,000 and made $50,000 worth of improvements (like remodeling your kitchen or adding a new roof), your new basis would be $300,000. This would lower the capital gain you’d pay tax on when you sell.

Common home improvements that can increase your basis include:

Kitchen or bathroom remodels

New windows or doors

Adding a deck or patio

Finishing a basement or attic

Landscaping improvements

However, basic repairs or maintenance like fixing a leaky roof or replacing a broken appliance do not count as improvements. They don’t add to your home’s basis for tax purposes.

To qualify for the $250,000 or $500,000 exclusion, you need to meet the use and ownership requirements. This means that, during the 5 years before the sale, you must have lived in the home as your primary residence for at least 2 years. These 2 years do not have to be consecutive.

Moving can be time consuming, but it will help you use the capital gain to its fullest potential. The IRS sllows taxpayers to use the exclusion multiple times, but no more than once every two years. So, if you’ve claimed this exclusion on another home sale in the past two years, you won’t be able to use it again. This means you could sell multiple homes at a large gain and never pay a dime in taxes!

If you’re selling an investment property, things work a bit differently. Unfortunately, the IRS does not offer the same capital gains tax exclusion for investment properties as it does for primary residences. However, there are still ways to avoid or reduce capital gains tax on these types of properties.

A 1031 exchange allows you to defer capital gains taxes on an investment property sale if you use the proceeds to purchase another similar property. This strategy is popular among real estate investors because it allows them to defer paying taxes until the new property is sold, which could be many years down the line.

To qualify for a 1031 exchange, the following conditions must be met:

The property must be held for investment purposes or business use, not for personal use.

The replacement property must be of equal or greater value.

The exchange must occur within a specific time frame—typically 45 days to identify a new property and 180 days to complete the transaction.

By using a 1031 exchange, you can avoid paying capital gains tax on the sale of the investment property, keeping more money for your next real estate deal.

While depreciation is an excellent way to reduce your taxable income during the ownership of an investment property, when you sell, you may face depreciation recapture. This means that you will have to pay taxes on the depreciation deductions you’ve claimed over the years. However, even with depreciation recapture, it’s still possible to use strategies like a 1031 exchange to defer the tax.

Selling a vacation home is different from selling your primary residence. You don’t qualify for the $250,000 or $500,000 exclusion unless it meets the criteria of being your primary home for at least 2 out of the last 5 years. However, there are still strategies to reduce your capital gains tax liability.

If you’re considering selling a vacation home and want to take advantage of the primary residence exclusion, one strategy is to convert the vacation home into your primary residence. You can do this by living in the home for at least 2 years before you sell it. This would allow you to meet the 2-out-of-5-year rule and potentially avoid paying capital gains tax on the sale.

Keep in mind that this strategy requires careful planning and timing. You would also need to consider any potential state-specific tax rules in New Hampshire when deciding how to proceed.

While the strategies mentioned above are the most common ways to avoid capital gains tax on the sale of a home or investment property, there are a few additional tactics to consider.

If you’ve sold other investments at a loss, you can use those losses to offset your capital gains. This strategy is known as tax loss harvesting. For example, if you sold stocks at a loss, you can use that loss to offset your real estate capital gains, reducing your taxable income.

Another way to avoid capital gains taxes is to gift the property to a family member. However, the recipient may be liable for capital gains taxes when they sell the property, depending on their situation. It’s important to consult with a tax professional before pursuing this route.

When it comes to selling your home or investment property, understanding how to avoid capital gains tax can make a huge difference in your financial outcome. Whether you’re selling your primary residence and using the 2-out-of-5-year rule, considering a 1031 exchange for investment properties, or even converting a vacation home into a primary residence, there are strategies available to help you minimize or eliminate your tax liability.

If you’re planning to sell your home in South Hudson houses for sale or Southern New Hampshire, it’s always a good idea to consult with a real estate agent and a tax professional to ensure you’re taking full advantage of the available tax benefits.

By planning ahead and making informed decisions, you can keep more of your hard-earned money when it’s time to sell your property.

If you need more information on how to avoid capital gains, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Hudson is one of the most popular towns in Southern New Hampshire—and it’s easy to see why. It’s got great schools, friendly neighborhoods, and easy access to major highways. Whether you’re buying your first home or upgrading to something bigger, Hudson has a lot to offer.

In this post, we’ll walk you through the top Hudson NH neighborhoods to consider in 2025. We’ll talk about what makes each area special, what kinds of homes you’ll find, and why people love living there.

1. Whip-Poor-Will Estates

1. Whip-Poor-Will EstatesThis neighborhood is a favorite for families and anyone who wants peace and quiet. The streets are lined with trees, and the homes have big yards—perfect for kids and pets.

Why people love it: It’s quiet, safe, and close to Benson Park, one of Hudson’s best outdoor spots.

Home styles: Mostly Colonial-style homes with 3–4 bedrooms.

Nearby: Alvirne High School, Route 102 shopping, and South Hudson houses for sale listings.

If you’re looking for a calm place to settle down, Whip-Poor-Will Estates is a great choice.

2. Barretts Hill

2. Barretts HillBarretts Hill is known for its scenic views and newer homes. It’s a little elevated, so you get privacy and a peaceful vibe.

Why people love it: You’re surrounded by nature but still close to town. It’s perfect for buyers who want a modern home with space.

Home styles: Newer construction, ranches, and contemporary homes.

Nearby: Robinson Pond, Hudson Town Forest, and Southern NH houses for sale listings.

This area is ideal if you want a newer home and love the outdoors.

3. Greeley Park Area

3. Greeley Park AreaLocated near the Nashua border, this neighborhood is perfect for commuters. You get the benefits of Hudson living with quick access to Route 3 and all the shopping and dining in Nashua.

Why people love it: It’s super convenient for work and errands. Plus, it’s close to schools and parks.

Home styles: Mix of ranches, split-levels, and some townhomes.

Nearby: Route 3, Nashua shopping centers, and South Hudson houses for sale.

If you work in Nashua or Massachusetts, this area makes your daily drive easy.

4. Musquash Road Neighborhood

4. Musquash Road NeighborhoodThis part of town has a more rural feel, but you’re still just minutes from everything. It’s great for buyers who want space and privacy without being too far from town.

Why people love it: You get big lots, quiet roads, and access to conservation land. It’s like living in the country—but with all the perks of Hudson.

Home styles: Larger single-family homes, some with acreage.

Nearby: Musquash Conservation Area, Hudson Speedway, and Southern NH houses for sale.

This neighborhood is perfect for nature lovers and anyone who wants a little extra space.

5. Nottingham West

5. Nottingham WestNottingham West is one of Hudson’s most established neighborhoods. It’s got a strong sense of community and is close to schools, making it a top choice for families.

Why people love it: It’s walkable, friendly, and close to everything. Plus, the homes have character and charm.

Home styles: Traditional Colonials, ranches, and split-levels.

Nearby: Nottingham West Elementary, Hudson Library, and South Hudson houses for sale.

If you’re looking for a neighborhood with roots and a welcoming vibe, this is the one.

Bonus: South Hudson Highlights

Bonus: South Hudson HighlightsSouth Hudson is growing fast, and it’s full of great opportunities for buyers. You’ll find newer developments, easy access to Route 3, and plenty of listings under the “South Hudson houses for sale” category.

Whether you're looking for a starter home or something more luxurious, South Hudson has options.

Why Hudson NH Is a Great Place to Buy in 2025

Why Hudson NH Is a Great Place to Buy in 2025Hudson is one of the most desirable towns in Southern NH. Here’s why:

Great schools: Alvirne High School and Nottingham West Elementary are highly rated.

Commuter-friendly: Quick access to Route 3 and I-93.

Outdoor fun: Benson Park, Robinson Pond, and Musquash Conservation Area.

Community vibe: Friendly neighborhoods, local events, and a small-town feel.

Plus, with so many Southern NH houses for sale, you’ll have plenty of choices to find your perfect home.

Top 5 Hudson NH Neighborhoods to Buy a Home in 2025.

Top 5 Hudson NH Neighborhoods to Buy a Home in 2025.Buying a home is a big decision, and choosing the right neighborhood makes all the difference. These Hudson NH neighborhoods offer something for everyone—whether you want peace and quiet, easy commuting, or a strong sense of community.

Let’s chat! I’d love to help you find the perfect place. Contact me here or check out the latest listings for South Hudson houses for sale and Southern NH houses for sale.

If you need more information on the the top 5 Hudson NH Neighborhoods to buy a home, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

The New Hampshire housing market has been buzzing with change. If you’ve been watching trends, you know things aren’t standing still. Recently, we’ve seen a home prices and inventory shift that’s affecting nearly everyone — buyers, sellers, investors, and even renters.

Whether you’re exploring Litchfield houses for sale or shopping for Southern NH houses for sale, understanding these shifts will help you make smarter decisions. Let’s dig into what’s happening, why it matters, and who it impacts most.

In simple terms, home prices and inventory are the heartbeat of the real estate market.

Home prices show what buyers are willing to pay.

Inventory shows how many homes are available for sale.

When prices rise and inventory stays low, buyers face more competition. When inventory grows and prices balance out, sellers may need to adjust expectations.

Right now in NH, inventory is slowly increasing, but home prices remain strong. That mix has unique effects across the state.

Several factors drive the current shift.

Interest rates: Higher rates affect affordability for buyers.

Economic growth: Job markets and wages play a role in housing demand.

Lifestyle changes: More people are working from home and want larger spaces.

Seasonal patterns: Summer and fall often bring more listings to the market.

These combined forces push the market in new directions, and every group involved feels the impact differently.

For buyers, a home prices and inventory shift creates both opportunities and challenges.

More homes on the market means more choices.

Rising prices can still make affordability tough.

Competition is easing slightly, but desirable homes still move fast.

If you’re exploring Southern NH houses for sale, you may notice more listings compared to last year. That’s good news for choice, but you’ll still need to act quickly when the right home pops up.

Sellers also feel the shift in powerful ways.

More inventory means more competition.

Buyers have options, so pricing right is crucial.

Well-staged and updated homes still sell quickly.

If you’re listing your property against other Litchfield houses for sale, you’ll need to make sure your home stands out. Simple updates, curb appeal, and smart pricing strategies will keep your home attractive in a market with more supply.

Investors keep a close eye on these changes.

More inventory can mean more opportunities to buy.

Rising prices may impact rental yields and return on investment.

Demand for rentals often increases when buyers pause due to affordability.

Smart investors know timing matters. Watching the NH housing market closely can create opportunities to buy when inventory rises and hold when prices peak.

Even renters feel the ripple effects of home prices and inventory shift.

If fewer people can buy, rental demand increases.

Higher demand often pushes rental prices higher.

Some renters may finally see opportunities to purchase if inventory grows.

For many renters in NH, the dream of homeownership is linked directly to these shifts. More listings and stable prices may make stepping into the market possible.

Real estate isn’t just about numbers. It’s emotional too.

Buyers may feel excitement but also frustration.

Sellers may feel hopeful but also nervous about competition.

Families may feel pressure to move quickly when the right home appears.

This is where a trusted Realtor makes a huge difference. Guidance, clarity, and reassurance help clients navigate the ups and downs of market shifts.

Not every part of NH feels shifts in the same way.

Southern NH houses for sale tend to move quickly due to proximity to Massachusetts jobs.

Towns like Litchfield, Hudson, and Londonderry see steady demand from families.

Rural areas may see inventory sit longer, even as prices remain stable.

Knowing your specific local market is essential. What works in Litchfield might not work in northern NH.

Interest rates are one of the biggest drivers behind today’s home prices and inventory shift.

When rates climb, monthly payments rise. That reduces buying power for many families. Some buyers pause their search, which increases inventory.

But in places like Litchfield, where homes are still in demand, interest rates may not slow buyers as much. That’s why Litchfield houses for sale often remain competitive.

If you’re a buyer, here are smart moves:

Get pre-approved: Know your budget before shopping.

Act fast: Even with more inventory, great homes still sell quickly.

Be flexible: Widen your search to more towns for better opportunities.

Work with a Realtor: Local knowledge is your best advantage.

These steps will help you succeed in today’s changing NH market.

If you’re a seller, keep these tips in mind:

Price smart: Overpricing can cause your home to sit too long.

Boost curb appeal: First impressions are everything.

Stage wisely: Buyers connect emotionally with well-presented homes.

Be realistic: Understand how more inventory affects your competition.

By staying practical, you’ll compete strongly even with more Southern NH houses for sale nearby.

Transparency is crucial in shifting markets. Buyers and sellers both need clear guidance.

Buyers should know exactly how rising prices affect their budget.

Sellers should understand how inventory changes impact buyer demand.

An honest, upfront Realtor builds trust and ensures clients feel supported during the process.

So, where is the NH market heading?

Experts suggest inventory will continue to rise gradually, while prices may level out. That means less intense bidding wars, but steady demand.

In popular areas with Litchfield houses for sale, prices may hold firm. In other towns, sellers may need to be more flexible.

Picture this: A family shopping for Southern NH houses for sale sees five options in their price range. Last year, they may have had only one. This gives them more confidence, less stress, and better negotiating power.

Now imagine a seller in Litchfield. With more homes hitting the market, they can’t overprice. But by staging well and setting a smart list price, they attract eager buyers and close quickly.

These examples show how shifts create both challenges and opportunities.

The home prices and inventory shift in NH affects everyone. Buyers, sellers, renters, and investors all feel the changes in unique ways.

For buyers, it means more choice but careful budgeting. For sellers, it means staying competitive. For investors and renters, it creates both challenges and opportunities.

Whether you’re comparing Litchfield houses for sale or exploring Southern NH houses for sale, the key is knowledge. With the right Realtor by your side, you’ll make smart, confident moves in today’s market.

If you need more information on home prices and inventory shift in NH, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Buying or selling a home is a big move. The process can feel exciting but also overwhelming. One option you might hear about is dual agency.

This is when one Realtor represents both the buyer and the seller in the same transaction. For some people, it sounds unusual. For others, it’s a smart way to simplify the process.

But like any choice in real estate, dual agency has advantages and challenges. Let’s explore the benefits, potential conflicts, and the role of transparency in making this path work for everyone.

And if you’re exploring Litchfield houses for sale or browsing Southern NH houses for sale, understanding dual agency could help you decide if this option fits your needs.

Dual agency happens when one Realtor represents both sides of a real estate deal.

The Realtor helps the seller list and market the property.

The same Realtor also guides the buyer interested in purchasing it.

It’s legal in New Hampshire, as long as both sides agree in writing. The key here is full disclosure. Everyone must understand how the arrangement works before moving forward.

Dual agency can create unique advantages for buyers and sellers. Let’s break down the key benefits.

Working with one Realtor keeps things simple. Instead of messages bouncing between two agents, information flows through one source.

This can reduce delays, speed up negotiations, and avoid miscommunication. For busy buyers searching through Southern NH houses for sale, this simplicity can make the process less stressful.

Time is valuable in real estate. When one agent manages both sides, the process often moves faster.

Scheduling showings, handling paperwork, and arranging inspections can all be streamlined. Sellers love this efficiency when they want their home on the market to stand out against other Litchfield houses for sale.

A dual agent knows the property inside and out. Since they’re representing the seller, they already understand the home’s features.

When the same agent works with a buyer, they can answer detailed questions more quickly. This helps buyers feel confident about their choices.

Sometimes, sellers may negotiate a reduced commission with dual agency. Why? Because the Realtor is handling both sides of the deal.

This can save money and put more cash in the seller’s pocket, a benefit that can be appealing when preparing to purchase another home in the pool of Southern NH houses for sale.

While there are clear benefits, dual agency also has challenges. It’s important to understand them before deciding.

A Realtor in dual agency can’t fully advocate for one side over the other. Their role shifts to being a neutral guide.

That means the Realtor can’t push for the lowest price for the buyer or the highest price for the seller.

With both parties relying on the same agent, conflicts can happen. For example:

How much detail should the Realtor share about each side’s motivation?

Can they stay fair while balancing two different goals?

Transparency is key here. Both parties need to trust the process.

In dual agency, buyers and sellers may worry about privacy. Will the Realtor share too much with the other side?

The law requires the Realtor to stay neutral, but some clients prefer the comfort of having their own advocate.

Transparency is the backbone of successful dual agency. Everyone must know what to expect.

Disclosure forms: In New Hampshire, written consent is required from both parties.

Clear rules: The Realtor explains what they can and cannot do.

Trust: Both sides need to feel comfortable with the arrangement.

A Realtor who is upfront and clear will help ensure the process feels fair and professional.

For buyers, dual agency can mean easier access to homes and faster decisions.

You get quick answers about the property.

You may avoid bidding wars if you’re already working with the listing agent.

The process often feels smoother.

This can be a big deal when exploring competitive markets like Southern NH houses for sale.

For sellers, dual agency can mean a quicker sale and fewer headaches.

Showings and offers are managed by one person.

Negotiations may move faster.

Commission savings can be possible.

This makes your property stand out even more, especially if buyers are also looking at nearby Litchfield houses for sale.

The answer depends on your comfort level. Some people love the simplicity and speed. Others want their own dedicated advocate.

Ask yourself:

Do I trust the Realtor to stay neutral?

Am I comfortable with less advocacy?

Will transparency be strong enough for me to feel confident?

Your answers will guide your decision.

New Hampshire allows dual agency, but strict rules apply. Realtors must:

Disclose the arrangement clearly.

Obtain written consent.

Maintain fairness and neutrality throughout the process.

Working with an experienced Realtor in Southern NH can help you feel confident. They’ll guide you through the rules and ensure you’re protected.

Imagine this: You’re browsing Litchfield houses for sale and see one that grabs your heart. The listing agent offers to help you purchase it.

With dual agency, the process can move quickly. You might avoid competing offers, and you’ll get first-hand details about the property.

Or picture a seller eager to move and buy one of the many Southern NH houses for sale. Accepting dual agency could mean a faster closing and fewer commission costs.

These examples show how dual agency can benefit both sides when handled with care.

If you’re considering dual agency, here are some smart moves:

Ask Questions: Make sure you fully understand the arrangement.

Get Everything in Writing: Protect yourself with clear agreements.

Know Your Comfort Zone: If you feel uneasy, you can always request separate representation.

Choose Experience: Work with a Realtor who knows New Hampshire laws and markets well.

Dual agency can offer simplicity, speed, and even savings in real estate deals. But it also comes with limits and risks.

For some buyers and sellers, it’s a perfect fit. For others, separate agents feel safer.

The key is transparency. With clear communication and written agreements, dual agency can be a powerful option.

Whether you’re listing a property, checking out Litchfield houses for sale, or touring Southern NH houses for sale, understanding dual agency helps you make smart choices.

If you need more information on dual agency, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

When you know you won’t be in a home for long, every dollar matters. The goal is to make smart investments for short-term homeowners that improve your comfort and increase resale value, without wasting money on projects that won’t pay off.

If you’re already browsing Litchfield houses for sale or checking out Southern NH houses for sale, these tips can guide your upgrade decisions before you list your current home.

Owning a home for a short stay is not the same as settling in for decades. The upgrades you choose must serve two purposes:

They should make your time in the home more enjoyable.

They should increase buyer appeal when it’s time to sell.

That balance is the sweet spot. Spend wisely, and you’ll love your home while also protecting your bottom line.

When buyers are comparing Southern NH houses for sale, even small improvements can set your property apart from the rest.

Curb appeal sells homes. Buyers decide how they feel before stepping inside. A tidy yard, fresh paint, and clean entryways make a world of difference.

Paint the front door in a warm, welcoming color.

Add simple landscaping like mulch, seasonal flowers, or trimmed shrubs.

Replace worn house numbers and outdated light fixtures.

These small touches are low-cost but powerful. They send buyers the message that the home is cared for and move-in ready. And when you’re preparing to compete with other Litchfield houses for sale, that first impression is everything.

Short-term homeowners should focus on comfort upgrades that are noticeable, affordable, and practical. A few examples:

Lighting: Swap old bulbs for bright LED fixtures. Better lighting makes rooms feel bigger and cleaner.

Storage: Add shelving or closet organizers. Buyers love usable space.

Paint: Fresh neutral paint is one of the highest-return investments you can make.

These projects don’t cost much but create an emotional connection for buyers. They also make your stay far more enjoyable until you’re ready to shop for your next place in the lineup of Southern NH houses for sale.

Kitchens sell homes, but a full remodel can drain your wallet. Instead, focus on simple, smart investments:

Update cabinet hardware for a fresh, modern look.

Add a new faucet or sink with clean lines.

Paint cabinets instead of replacing them.

Install a new backsplash that pops but stays neutral.

These budget-friendly touches can transform a dated kitchen into one buyers admire without spending tens of thousands. That’s especially helpful when your home will be compared side by side with other Litchfield houses for sale.

Bathrooms are another selling hotspot. Skip the gut job, and do this instead:

Replace faucets, showerheads, and towel bars.

Add new lighting and mirrors for style and brightness.

Use caulk and grout to make tile look clean and fresh.

These updates keep your budget safe but still wow potential buyers.

Buyers today love homes that save money on energy. These upgrades make your home more attractive:

Add a smart thermostat for control and savings.

Install weatherstripping around doors and windows.

Upgrade to Energy Star appliances if yours are outdated.

Not only will you enjoy lower utility bills, but you’ll also give buyers a reason to choose your home over others in the Southern NH houses for sale market.

Worn carpets or dated vinyl can kill a sale. You don’t need luxury hardwood, but you should aim for fresh, clean flooring.

Replace carpet with affordable, durable laminate or vinyl plank.

Use area rugs to add warmth in living spaces.

Stick with neutral colors to appeal to more buyers.

A clean, modern floor plan invites buyers to imagine themselves in the space, which makes a big difference when they’re touring multiple Litchfield houses for sale in a single weekend.

Technology isn’t just for long-term homeowners. Smart features can impress buyers and make your stay easier.

Consider adding:

Smart door locks for convenience and security.

Video doorbells for peace of mind.

Smart lighting that can be voice-activated or app-controlled.

These upgrades are affordable and easily transferable if you move into one of the many available Southern NH houses for sale.

New Hampshire buyers love usable outdoor space. A deck, patio, or fire pit can be a powerful selling point.

Add a simple seating area with outdoor lighting.

Install a small fire pit or string lights for atmosphere.

Repair existing decks and railings for safety and appeal.

Even modest upgrades outside can create the lifestyle vibe buyers want when comparing Southern NH houses for sale.

Not every project adds value. Some may even hurt your bottom line when you’re planning a quick sale.

Think twice before you:

Add a swimming pool (expensive and high maintenance).

Build a home theater (too personal for most buyers).

Knock down walls to create open concepts (costly and risky).

Install luxury finishes that price you out of your neighborhood.

Short-term ownership means staying practical. Skip projects that only suit your personal style or require too much investment.

When it’s time to sell, staging is one of the smartest investments for short-term homeowners.

Remove clutter and personal items.

Arrange furniture to make rooms look bigger.

Add simple décor like throw pillows or plants.

Staging helps buyers picture their own lives in the space. It’s affordable, and it works—especially when your home is competing with nearby Litchfield houses for sale.

A trusted New Hampshire Realtor knows which upgrades matter most in your market. They’ll guide you toward cost-effective projects that boost value.

Markets change, and what works in one area may not in another. Don’t go it alone. A Realtor will help you avoid wasted money and maximize your return—whether you’re listing your home or shopping among the best Southern NH houses for sale.

For short-term homeowners, the smartest moves are often the simplest. Focus on projects that improve comfort now and attract buyers later.

Remember, the best smart investments for short-term homeowners are those that balance cost, enjoyment, and resale value. Paint, lighting, curb appeal, and small updates deliver results without draining your budget.

Skip the massive remodels. Stay practical, and when it’s time to move, your home will stand out among the many Litchfield houses for sale and Southern NH houses for sale.

If you need more information on smart investments for short-term homeowners, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

If you’re searching for a home in Southern New Hampshire, you’ll likely come across public water homes—especially in Nashua. These homes are connected to the city’s water supply, offering convenience and reliability.

Whether you're browsing South Nashua houses for sale or Southern NH houses for sale, understanding how public water works helps you make a smart, confident decision. Let’s break it down in a laid-back, easy-to-follow way.

What Are Public Water Homes?

What Are Public Water Homes?Public water homes get their water from a municipal system. The city treats and delivers water directly to your home.

Water is managed by the city

Monthly water bills apply

Water quality is regularly monitored

Most homes in Nashua are connected to public water. It’s common in urban and suburban neighborhoods across Southern NH.

Why Buyers Should Understand Public Water Systems

Why Buyers Should Understand Public Water SystemsPublic water is reliable and safe—but it’s not free. You’ll need to know how it works and what to expect.

Water bills are part of your monthly budget

Water quality is managed by the city

Maintenance is minimal but not your responsibility

Knowing the basics helps you plan ahead and avoid surprises.

Costs to Expect With Public Water Homes

Costs to Expect With Public Water HomesPublic water homes come with monthly bills. These costs vary based on usage and local rates.

Monthly water bill: $40–$100 depending on usage

Sewer fees may be included

Occasional rate increases by the city

Ask your REALTOR® for recent utility bills to estimate your monthly costs.

Water Quality and Safety

Water Quality and SafetyNashua’s public water is treated and tested regularly. The city follows strict guidelines to keep water safe.

Bacteria and viruses

Lead and copper levels

Chlorine and fluoride levels

pH and hardness

You can request a copy of the city’s water quality report. It’s usually available online or through the water department.

What Happens During a Water Issue?

What Happens During a Water Issue?If there’s a water issue, the city handles it. You’ll be notified if there’s a boil order or service disruption.

Temporary discoloration during pipe flushing

Low pressure during repairs

Rare boil advisories after storms

Public water homes offer peace of mind because you’re not responsible for fixing the system.

Water Treatment Options for Public Water Homes

Water Treatment Options for Public Water HomesEven with treated water, some buyers prefer extra filtration. It’s a personal choice based on taste or sensitivity.

Faucet filters for drinking water

Whole-house filtration systems

Water softeners for hard water

Ask your REALTOR® if the home already has any systems installed.

Pros of Buying a Public Water Home in Nashua NH

Pros of Buying a Public Water Home in Nashua NHPublic water homes offer convenience and reliability. Many buyers prefer them over private wells.

No need to test or maintain a well

Water is treated and monitored

Repairs are handled by the city

Consistent water pressure and supply

If you’re looking at South Nashua houses for sale, public water homes are a great option for busy families and first-time buyers.

Cons to Consider Before Buying

Cons to Consider Before BuyingPublic water homes aren’t perfect. You’ll need to budget for monthly bills and stay informed about local water updates.

Monthly costs can add up

Water taste may vary due to treatment

Limited control over water quality

Working with a knowledgeable REALTOR® helps you find homes with good water history and low utility costs.

Tips for Buying Public Water Homes in Southern NH

Tips for Buying Public Water Homes in Southern NHRequest recent statements

Compare costs with similar homes

Look for lead, chlorine, and pH levels

Ask your REALTOR® for help finding it

Some homes have filters or softeners

Ask about maintenance and warranties

Some homes use public water but have private septic

Know what systems are in place

They know the area and utility trends

They’ll guide you through inspections and paperwork

Public Water Homes in Nashua and Southern NH

Public Water Homes in Nashua and Southern NHNashua is known for its vibrant neighborhoods and reliable infrastructure. Most homes here use public water. It’s part of the city’s appeal.

Great schools and parks

Easy access to Manchester and Boston

Strong community and services

Southern NH towns like Merrimack, Hudson, and Salem also offer public water homes. If you’re looking for convenience and peace of mind, these areas are worth exploring.

What Every Buyer Should Know About Public Water Homes in Nashua NH

What Every Buyer Should Know About Public Water Homes in Nashua NHBuying a public water home in Nashua NH can be a great move—if you know what to expect. With proper planning, smart questions, and a little research, you’ll enjoy clean, reliable water and a home that fits your lifestyle.

Whether you're browsing South Nashua houses for sale or Southern NH houses for sale, don’t overlook the benefits of public water. Just be informed, ask questions, and work with a REALTOR® who knows the area.

If you need more info on a Nashua public water home, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.