Tag Archives for " Hudson "

Are you planning to upgrade to a larger home in Hudson, NH? It's an exciting move! But be careful; there are 6 costly errors when moving to your larger Hudson home that can turn your dream into a nightmare. Whether you’re searching for South Hudson houses for sale or browsing Southern NH houses for sale, it's essential to know what mistakes to avoid. Let’s dive into these common errors and learn how to make your move smooth and successful!

One of the most common costly errors when moving to your larger Hudson home is underestimating the costs involved. Moving isn't just about packing boxes and driving across town. It includes expenses like:

Hiring professional movers

Renting moving trucks

Purchasing packing supplies

Covering potential storage fees

You might find a dream property among South Hudson NH houses for sale, but if you don't budget for these costs, you could end up spending way more than expected. To avoid surprises:

Get Multiple Quotes: Compare prices from at least three moving companies.

Include Hidden Costs: Factor in insurance, tips, and extra services like packing or disassembling furniture.

Plan for Delays: Unexpected delays can lead to additional fees, especially if you need temporary storage.

By budgeting wisely, you'll avoid draining your savings and enjoy a stress-free transition to your new home.

Start gathering quotes and planning your move as soon as you decide to search for Southern NH houses for sale. Early preparation can save you both time and money.

It’s easy to get excited about a bigger space, but skipping the home inspection is a huge mistake. Even if a house looks perfect, hidden issues could cost you thousands of dollars down the line. Especially in competitive markets like South Hudson NH houses for sale, some buyers may be tempted to skip inspections to make their offer more appealing. But this can lead to costly repairs in the future.

Roof damage

Plumbing problems

Faulty electrical systems

Foundation cracks

Mold or pest infestations

How to Avoid This Error: Always schedule a home inspection before finalizing your purchase. Work with a reputable inspector who can give you a detailed report. This way, you know what you’re getting into and can negotiate repairs or a lower price if needed.

Timing is crucial when moving, especially if you’re upgrading to a larger home. Many people don’t realize that moving during peak seasons can be more expensive and stressful. In Hudson, NH, summer and early fall are popular times for moving, but this is also when prices for moving services tend to spike.

Peak Season Costs: Moving companies often charge higher rates from May to September.

Weather Concerns: Winter moves can be tricky due to snow and ice, which can cause delays and potential damage to your belongings.

School Schedules: If you have kids, moving during the school year can be disruptive.

Smart Move: If possible, plan your move during the off-season (late fall or winter). Not only can you save money, but moving companies may be more available to accommodate your schedule.

A common mistake many people make is not decluttering before moving to their larger Hudson home. You might think a bigger space means you can bring everything, but that’s not the case. Packing and moving things you no longer need can increase your costs and make the move more complicated.

Sort and Purge: Go through each room and decide what to keep, donate, or discard.

Host a Yard Sale: Sell items you no longer need. It’s a great way to lighten your load and make a little extra cash.

Use the 6-Month Rule: If you haven’t used an item in the last six months, it’s time to let it go.

Decluttering before you start looking at Southern NH houses for sale will make your life easier and your new space feel more organized and fresh.

Moving to a larger home doesn’t automatically solve all your storage problems. Sometimes, people assume they’ll have enough space without actually planning for it. A new house might have more rooms, but if it lacks storage features like closets, shelves, or a garage, you could find yourself struggling to fit everything.

Before committing to a purchase, check the layout of potential Southern NH houses for sale to ensure they meet your storage needs.

Buying a larger home in a different part of Hudson might seem exciting, but not researching the new neighborhood can lead to costly regrets. Each area has its unique vibe, amenities, and challenges. If you’re looking at South Hudson NH houses for sale, for example, you’ll want to know what the local traffic is like, the quality of schools, and what amenities are nearby.

Local Amenities: Check for nearby grocery stores, parks, and medical facilities.

School Districts: If you have children, research the quality of local schools.

Commute Times: Test the drive from your potential new home to your workplace during rush hour.

Spend time in the neighborhood during different times of the day to get a feel for the community. It’s one of the best ways to ensure you’re making the right choice.

Moving to a larger home in Hudson can be a wonderful experience if you plan it right. Here are a few extra tips to make the process even smoother:

Hire Professional Movers: While it’s an added expense, it can save you time and prevent damage to your belongings.

Label Everything: Clearly label your boxes to make unpacking easier.

Create a Moving Checklist: Write down all tasks you need to complete before, during, and after the move. This will keep you organized and reduce stress.

Upgrading to a larger home is a big step, but avoiding these 6 costly errors when moving to your larger Hudson home can make the journey much smoother. Whether you’re eyeing South Hudson NH houses for sale or exploring Southern NH houses for sale, careful planning and attention to detail can help you avoid pitfalls. Take your time, do your research, and make informed decisions to enjoy your beautiful new space without regrets.

Ready to find your dream home in Hudson? Let’s start your search today! Happy moving!

If you need more tips on errors to avoid when moving to your larger Hudson home or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

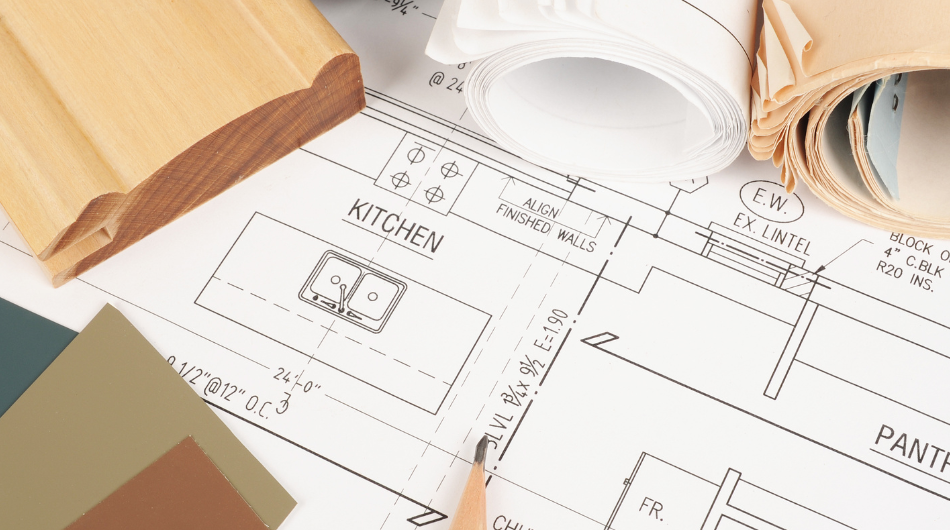

Selling your home can feel like a daunting task, especially in a competitive market. However, strategic updates can make all the difference. Whether you're listing South Hudson NH houses for sale or looking to sell in another area, the right improvements will boost your home’s value and appeal. This guide explores the most impactful home renovations to help homeowners maximize their sale potential.

Today’s buyers have high expectations, especially with so many Southern NH houses for sale. The right upgrades make your property stand out, attract more offers, and justify a higher asking price. A well-maintained home signals care and value, making it easier for buyers to envision their future.

The kitchen is the heart of any home, and buyers know it. Simple yet effective upgrades can make a lasting impression.

Cabinet Refinishing: Sand, repaint, or replace doors for a fresh, modern look.

New Countertops: Invest in quartz or granite to give your kitchen a luxury touch.

Energy-Efficient Appliances: Modern, energy-saving models appeal to eco-conscious buyers.

When buyers see a functional, beautiful kitchen, they’re more likely to make a strong offer.

Bathrooms are another space where details matter. Small upgrades can create a spa-like feel.

New Fixtures: Replace outdated faucets and showerheads with sleek, water-efficient options.

Fresh Tile or Grout: Brighten the room with clean, updated surfaces.

Vanity Upgrades: A new vanity with ample storage elevates the bathroom's appeal.

Even minor improvements make a significant impact on buyers.

Curb appeal sets the tone for the entire showing. Potential buyers decide in seconds whether to step inside.

Fresh Paint: Repaint your home’s exterior in neutral, inviting colors.

Landscaping: Trim hedges, plant flowers, and clean walkways for a polished look.

Lighting: Add outdoor lighting to highlight features and improve safety.

For homes like South Hudson NH houses for sale, strong curb appeal can attract a steady flow of potential buyers.

Eco-friendly homes are increasingly popular. Adding energy-efficient features reduces utility costs and increases property value.

Insulation: Proper insulation keeps homes warm in winter and cool in summer.

Windows: Energy-efficient windows add style and reduce heating costs.

Smart Thermostats: Devices like Nest or Ecobee appeal to tech-savvy buyers.

With sustainability trending, these upgrades make homes more attractive in markets like Southern NH houses for sale.

Old or damaged flooring is a turn-off for buyers. Updating floors creates an instant transformation.

Hardwood Floors: Buyers love the durability and timeless style of hardwood.

Luxury Vinyl Plank: Affordable and stylish, vinyl is a great option for budget-conscious sellers.

Carpet Replacement: Fresh carpets in neutral tones bring warmth to bedrooms.

Choose durable, low-maintenance options to get the most impactful home renovations and attract modern buyers.

Finished basements add usable space, making them a valuable selling point.

Family Room Conversion: Create a cozy space for movies and gatherings.

Home Office: With remote work on the rise, home offices are in demand.

Extra Bedroom: Adding a legal bedroom increases both function and value.

Homes in South Hudson and Southern NH are more appealing with versatile spaces like these.

Paint is one of the most cost-effective ways to refresh your home.

Neutral Colors: Shades like beige, gray, and soft whites appeal to a broad audience.

Accent Walls: Create visual interest with tasteful, bold colors.

Touch-Ups: Fix scuffs, chips, and worn areas for a flawless look.

A freshly painted home feels clean, modern, and ready for buyers to move in.

Outdoor spaces are highly desirable, especially in picturesque areas like South Hudson NH.

Deck or Patio Updates: Refinish or repair for a welcoming outdoor retreat.

Outdoor Kitchens: A grill, sink, and counter space add luxury to the backyard.

Fire Pits: Fire features extend usability into cooler months.

Functional outdoor spaces make homes stand out in competitive markets like Southern NH houses for sale.

Technology upgrades appeal to a wide range of buyers.

Security Systems: Install smart locks and cameras for peace of mind.

Automated Lighting: Offer convenience and energy savings with smart lighting.

Voice-Controlled Devices: Features like Amazon Alexa integration add a modern touch.

Tech-savvy buyers will appreciate a home equipped for the future.

Not every renovation has the same ROI. Focus on upgrades that align with buyer preferences in your area. Consult a local REALTOR® to identify improvements that are impactful home renovations and make the most sense for your South Hudson NH houses for sale.

Even with renovations, staging plays a key role. Arrange furniture, declutter, and use decor to highlight your home’s best features. A well-staged home sells faster and often for a higher price.

Selling a home in today’s competitive market requires strategy and effort. By focusing on impactful home renovations, you can stand out among Southern NH houses for sale. Kitchens, bathrooms, and curb appeal are just the beginning—energy-efficient upgrades, outdoor spaces, and smart features add even more value. With the right investments, you can attract buyers and maximize your sale price.

If you're ready to sell your house or need guidance, contact a local Our REALTORS® to help you navigate the process. South Hudson NH houses for sale are in high demand—make yours the one everyone wants! If you’re looking for a home, give us a call at (603) 883-8840 or sign up for your dream home search or reach out to for more information. We’d love to help you with your real estate needs.

Hudson, NH, is set for several significant Hudson NH infrastructure projects. See how new Hudson NH infrastructure will boost property values and the overall attractiveness of the town, making it a hot spot for potential home buyers. These developments are likely to draw attention to South Hudson NH houses for sale as well as Southern NH houses for sale, due to the area's growing amenities and improved connectivity.

The expansion of Route 111 has been a focal point for Hudson's traffic improvement efforts. The project aims to alleviate congestion by widening lanes and adding new traffic signals, which will streamline the daily commute. This enhancement is crucial for residents of South Hudson and nearby areas. As a result, properties along these routes are likely to see increased demand, given the improved travel efficiency.

With smoother traffic flow and reduced travel times, homes in this vicinity, particularly South Hudson NH houses for sale, are expected to become more appealing to potential buyers looking for easy access to major highways and nearby amenities. The broader goal is to make the town more accessible for those commuting to larger employment hubs like Nashua and Manchester, boosting the attractiveness of Southern NH houses for sale as well.

The Barretts Hill Road project is another notable infrastructure effort aimed at creating a sustainable living environment. The approved plan includes a 13-lot open space subdivision featuring net-zero emission homes. This focus on sustainable development aligns with broader trends in real estate where energy-efficient homes are becoming increasingly desirable. The project also includes improved road safety measures like traffic mirrors and fencing, making the area safer for pedestrians and drivers alike.

For potential homebuyers looking at South Hudson NH houses for sale, this eco-friendly development could be a significant draw. The emphasis on green living is likely to attract environmentally conscious buyers who value energy-efficient homes and the associated cost savings. Moreover, this kind of project adds to the overall appeal of Hudson as a forward-thinking, sustainable town, making it a compelling option for those seeking Southern NH houses for sale.

The planned repair and improvement of the Hudson-Nashua Bridge, also known as the Veterans Memorial Bridge, is expected to significantly impact Hudson's infrastructure and traffic flow. Currently, the bridge handles a large volume of daily traffic, which has remained steady at about 37,000 vehicles per day. However, traffic congestion has become a major issue, particularly during peak hours, due to limited capacity.

The proposed upgrades are part of a broader effort to address these bottlenecks and reduce the diversion of traffic to alternate routes like the Sagamore Bridge. By enhancing the bridge's capacity and overall efficiency, the project aims to alleviate delays, improve travel times, and support regional economic competitiveness. These changes are crucial, as traffic on the Veterans Memorial Bridge is projected to increase by 15% by 2041 if no improvements are made. This infrastructure upgrade is expected to support smoother traffic flow and reduce the strain on local roads, benefiting both daily commuters and businesses in the area.

For a more detailed overview, you can refer to the full project analysis provided by the Town of Hudson in their June 2024 newsletter.

The various infrastructure projects planned for Hudson NH infrastructure will boost property value, the town's overall attractiveness and livability. Here’s how they could influence the local real estate market:

Increased Demand - New commercial and residential developments often lead to increased demand for housing. As job opportunities rise, more people may move to Hudson, driving up demand for both South Hudson NH houses for sale and Southern NH houses for sale.

Improved Accessibility - Enhancements like the Route 111 expansion will make commuting easier, attracting buyers who prioritize convenience. Better roads can reduce travel time and make daily commutes less stressful, which can increase property desirability.

Enhanced Amenities - Projects like Hudson Logistics Center add valuable amenities that can make the town more appealing to families and outdoor enthusiasts. Proximity to parks and recreational areas is often a key consideration for homebuyers.

Economic Growth - Large-scale developments like the Hudson Logistics Center can spur economic growth, potentially leading to higher property values. As businesses thrive, the local economy benefits, which can positively impact the real estate market.

Sustainable Development Appeal - The focus on sustainable projects, such as the net-zero homes on Barretts Hill Road, aligns with the increasing buyer preference for eco-friendly homes. Energy-efficient properties can offer long-term cost savings, making them attractive investments.

Hudson NH infrastructure will boost property value while undergoing a transformation to the town. These changes promise to boost the town's appeal, making it a compelling option for those searching for Southern NH houses for sale. From improved roadways to eco-friendly developments and expanded commercial hubs, Hudson is positioning itself as a desirable place to live, work, and invest.

For potential buyers, this could be the perfect time to explore the market. With these infrastructure projects set to enhance property values, investing in South Hudson NH houses for sale could yield substantial returns. Whether you're looking for a new family home or considering an investment property, Hudson's evolving landscape offers exciting opportunities.

Stay tuned for more updates as these projects progress, and keep an eye on how these changes could impact the local real estate market. With a variety of enhancements underway, Hudson is shaping up to be one of Southern New Hampshire's most promising areas for real estate growth.

If you need more info on how Hudson NH infrastructure will boost property value, some real estate tips or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

The holidays are a magical time for family and festivities, but for sellers, it can also be stressful. Balancing showings with holiday prep is no small feat. Whether you're listing South Hudson NH houses for sale or showcasing Southern NH houses for sale, keeping your home market-ready during Thanksgiving is possible with some Holiday House Hacks. Here’s your ultimate guide to keeping buyers impressed while enjoying the holiday spirit.

A spotless home is key to attracting buyers. Here are simple Holiday House Hacks to keep your home sparkling:

Holiday décor can elevate your home, but it’s important to avoid overwhelming buyers with personal touches.

Balancing family time and showings can be tricky during Thanksgiving. Use these Holiday House Hacks to make it work:

During the holidays, kitchens take center stage for buyers imagining holiday meals. Make yours shine with these ideas:

Thanksgiving is all about togetherness, so create an inviting atmosphere that feels like home.

The exterior sets the stage for the entire showing experience. Keep it inviting:

Following these Holiday House Hacks can make your home stand out in South Hudson NH houses for sale or Southern NH houses for sale. Buyers in today’s competitive market are drawn to well-presented homes.

Once Thanksgiving wraps up, focus on maintaining momentum through the winter.

Swap Thanksgiving items for neutral winter decorations, avoiding anything too personal or bold.

Use programmable thermostats to maintain a comfortable temperature for showings.

Stay in touch with your real estate agent for feedback on showings and advice for adjustments.

By using these holiday house hacks, you can keep your home ready for buyers while enjoying the season. Whether you’re listing South Hudson NH houses for sale or looking at Southern NH houses for sale, these tips will keep your property ahead of the competition. Make this holiday season the one where you find success in selling your home!

If you're ready to sell your house or need guidance, contact a local Our REALTORS® to help you navigate the process. South Hudson NH houses for sale are in high demand—make yours the one everyone wants! If you’re looking for a home, give us a call at (603) 883-8840 or sign up for your dream home search or reach out to for more information. We’d love to help you with your real estate needs.

Looking for the best neighborhoods in Southern NH for young families? You’ve come to the right place! Southern New Hampshire offers a variety of communities that are perfect for families with kids. From excellent schools to beautiful parks and fun activities, this region has everything a young family could want. Let's explore some top neighborhoods where your family can thrive.

Bedford is often considered one of the best neighborhoods in Southern NH for young families. It’s known for its highly-rated public schools and safe, welcoming atmosphere. The town has a strong sense of community, making it an ideal place to raise kids.

Why Families Love Bedford:

Top-Rated Schools: Bedford High School and Memorial Elementary are among the best in the state.

Beautiful Parks: Families enjoy places like Bedford Village Common and Benedictine Park.

Safe Neighborhoods: Low crime rates make Bedford a secure place for raising children.

Bedford also offers plenty of Southern NH houses for sale, ranging from charming starter homes to spacious family houses. With its great amenities and friendly vibe, Bedford is a top pick for many young families.

Nashua, the second-largest city in New Hampshire, is an excellent choice for young families. It offers a mix of urban and suburban living, with many parks, playgrounds, and family-friendly activities.

Highlights of Nashua for Families:

Good School Options: Nashua School District has strong public and private school options.

Recreation Opportunities: Enjoy Mine Falls Park, playgrounds, and summer festivals.

Convenient Location: Easy access to shopping, dining, and Boston.

Nashua has many Southern NH houses for sale in various neighborhoods, giving you plenty of options to find the right fit for your family. Whether you want a quiet suburban home or a place close to city amenities, Nashua has it all.

If you prefer a quieter, more rural setting, Hollis might be the best neighborhood in Southern NH for your young family. Hollis is known for its excellent schools, beautiful landscapes, and tight-knit community.

Why Hollis is Great for Families:

Highly Rated Schools: Hollis-Brookline High School is one of the top public schools in NH.

Community Events: Enjoy seasonal events like the Hollis Strawberry Festival.

Outdoor Fun: Explore Silver Lake State Park and local farms.

Hollis offers Southern NH houses for sale that are perfect for families looking for larger lots and more privacy. It’s a wonderful place to enjoy a peaceful, country lifestyle while still being close to major towns.

Londonderry is a popular choice for young families due to its excellent schools, safe neighborhoods, and family-friendly activities. It’s a growing community with lots of new developments, making it easy to find Southern NH houses for sale that fit your needs.

Family-Friendly Features of Londonderry:

Great Schools: Londonderry High School and Matthew Thornton Elementary have high ratings.

Parks and Recreation: Enjoy the Londonderry Rail Trail and numerous playgrounds.

Convenient Shopping: The town has a variety of shops, restaurants, and local businesses.

Londonderry's vibrant community atmosphere and excellent amenities make it one of the best neighborhoods in Southern NH for young families looking to settle down.

Windham is another excellent choice for families who want a safe, suburban neighborhood with access to top-notch schools. It’s a bit quieter than some other Southern NH towns, but it offers a fantastic quality of life.

What Families Love About Windham:

Top Schools: Windham High School and Windham Center School are highly regarded.

Family-Friendly Activities: Visit Griffin Park, a favorite spot for kids and parents alike.

Community Events: Enjoy events like Windham’s Harvest Fest and summer concerts.

Windham has many beautiful Southern NH houses for sale, including new constructions and established homes. It’s a great place for families who want a peaceful, welcoming community.

Merrimack is an attractive option for families looking for an affordable yet family-friendly town. It’s a great place to find Southern NH houses for sale with good value.

Family Perks in Merrimack:

Quality Schools: Merrimack High School and Reeds Ferry Elementary offer great education options.

Recreational Spots: Wasserman Park and Twin Bridge Park are popular with families.

Community Activities: Enjoy local events like the Merrimack Fall Festival.

Merrimack provides a mix of suburban comfort and convenient access to nearby cities, making it one of the best neighborhoods in Southern NH for young families.

Amherst is a charming town with a mix of historic homes and modern developments. It’s known for its beautiful town center and strong community spirit.

Why Families Choose Amherst:

Excellent Schools: Souhegan High School is a top performer in the region.

Historic Charm: The Amherst Village Green is a picturesque spot for family outings.

Great Parks: Visit Baboosic Lake Town Beach for summer fun.

With its blend of history and new developments, Amherst offers plenty of Southern NH houses for sale that cater to young families looking for character and convenience.

Hudson is perfect for families seeking a budget-friendly option without sacrificing amenities. It’s a smaller town with a friendly feel and easy access to larger cities.

Highlights for Families in Hudson:

Good School Options: Alvirne High School and Nottingham West Elementary are well-rated.

Parks and Outdoor Fun: Benson Park is a hit with kids and parents.

Affordable Homes: Find Southern NH houses for sale that fit a variety of budgets.

Hudson is a great place for young families looking to stretch their dollar while still enjoying great amenities and a convenient location.

Milford is known for its charming downtown, family-friendly atmosphere, and growing community. It’s an excellent place for families looking for a mix of small-town charm and modern amenities.

Family-Friendly Features of Milford:

Good Schools: Milford High School and Heron Pond Elementary are popular choices.

Charming Downtown: The Milford Oval hosts events and local shops.

Recreational Options: Enjoy hiking at Tucker Brook Town Forest.

Milford offers a variety of Southern NH houses for sale, from historic homes near downtown to new developments in quieter areas.

Southern NH is filled with great neighborhoods perfect for young families. Whether you’re looking for top-rated schools, beautiful parks, or a strong sense of community, you’ll find it here. From bustling towns like Nashua and Bedford to quieter spots like Hollis and Windham, there’s a perfect fit for every family. As you explore Southern NH houses for sale, consider these wonderful neighborhoods where your family can grow and thrive.

If you are looking for the Best Neighborhoods in Southern NH for Young Families, you can sign up for your dream home search or reach out to Our Agents for more information. If you need to sell your house click the link or give us a call at (603) 883-8840. We’d love to help you with your real estate needs.

Selling a home in 2024 comes with its own set of challenges. With shifting market conditions, knowing how long it will take to sell your house is crucial. The home-selling timeline in 2024 can vary, influenced by factors like interest rates, inventory, and buyer demand. But with the right strategies, you can speed up the process and get top dollar for your home. Whether you're selling a charming property in South Hudson or one of the many Southern NH houses for sale, understanding the market and taking smart steps will ensure a smooth transaction.

In 2024, the average time it takes to sell a home varies depending on the market conditions. On average, homes are selling within 30 to 60 days of being listed. However, this timeline can be longer or shorter based on several factors, including the location, price, and condition of the home. For instance, South Hudson houses for sale may sell faster due to high demand in the area, while rural homes could take longer.

Homes priced competitively and located in areas with limited inventory tend to sell more quickly. Conversely, homes that are overpriced or in less desirable areas may sit on the market for months. In Southern NH, homes that are well-priced and move-in ready are typically snatched up in just a few weeks.

The home-selling timeline in 2024 is largely influenced by current market conditions. Here are a few key factors that are shaping the real estate market this year:

Rising or falling interest rates play a significant role in the home-buying and selling process. In 2024, interest rates have seen some fluctuations, and this can affect how quickly homes are sold. When rates are low, buyers are more motivated to purchase homes. On the other hand, when rates rise, it can slow down the process as fewer buyers may qualify for mortgages, elongating the timeline for sellers.

In many markets, there is still a shortage of homes for sale. Low inventory drives up competition, leading to faster sales. In areas like South Hudson and Southern NH, where the housing market remains competitive, well-maintained and well-priced homes sell quickly. Sellers in these areas may see multiple offers, which can shorten the time it takes to close.

Local economic conditions also play a big role. Areas with strong job markets tend to attract more buyers, which can shorten the home-selling timeline in 2024. In contrast, regions where job growth has slowed or the cost of living has risen may experience slower sales.

If you’re hoping to expedite your home sale, there are several proven strategies to shorten the home-selling timeline in 2024. From pricing your home right to making key improvements, here’s what you can do:

One of the biggest mistakes sellers make is overpricing their home. To sell your home faster, work with your REALTOR® to set a competitive price. Look at recent sales in your area and consider current market conditions. If your home is priced too high, it may sit on the market longer, which could lead to price cuts later on.

When pricing homes in South Hudson or Southern NH, your REALTOR® will look at local comparable sales and market trends to ensure your home is priced right.

First impressions matter, and your home’s exterior is the first thing buyers will see. Enhancing your curb appeal can attract more buyers and reduce your home-selling timeline in 2024. Simple upgrades like fresh paint, landscaping, and a well-maintained yard can make a big difference. Buyers are more likely to be interested in a home that looks well-cared for, both inside and out.

Home staging can significantly impact how quickly your home sells. Staging helps potential buyers visualize the space as their own, and it highlights your home’s best features. You don’t have to spend a fortune on staging. Simple steps like decluttering, rearranging furniture, and adding neutral décor can help your home appeal to a wider range of buyers.

For South Hudson houses for sale, staging can be particularly effective, as it sets your home apart from the competition in a competitive market.

Marketing is key to a quick sale. A strong marketing strategy will get your home in front of as many potential buyers as possible. This includes professional photos, virtual tours, and online listings. Most buyers start their home search online, so having high-quality images and a detailed description is essential.

Your REALTOR® will also help market your home through social media, open houses, and targeted ads. This will increase exposure and attract serious buyers, shortening your home-selling timeline in 2024.

Buyers often have tight schedules, and if you limit showings, you may miss out on potential offers. To sell your home faster, be flexible and allow showings at various times, including evenings and weekends. If possible, consider allowing your REALTOR® to show your home even when you’re not there.

Sometimes, offering small incentives can make a big difference in how quickly your home sells. Consider offering to cover some of the closing costs, providing a home warranty, or leaving certain appliances with the home. These perks can make your home more appealing to buyers who are looking for a great deal.

While the above tips can help you sell your home faster, there are also some common mistakes that can slow down the process. To ensure your home-selling timeline in 2024 is as short as possible, avoid these pitfalls:

Some sellers skip a pre-listing inspection, thinking it’s unnecessary. However, a pre-listing inspection can identify potential issues before buyers do. By addressing these problems upfront, you can avoid delays in negotiations and prevent buyers from backing out of the sale.

In a competitive market like Southern NH, buyers may come in with offers below asking price or request repairs after the inspection. If you’re not prepared to negotiate, it could delay the sale or even cause the deal to fall through. Stay flexible and work with your REALTOR® to navigate offers and counteroffers.

If there are any outstanding liens, legal issues, or unpaid taxes on your property, it could delay your sale. Be proactive and resolve any legal or financial matters before listing your home.

Timing can also impact how long it takes to sell your home. In general, spring and summer are the busiest seasons for real estate, as families prefer to move when school is out. However, the home-selling timeline in 2024 could be shorter or longer depending on local market conditions.

In South Hudson and Southern NH, the real estate market tends to be more active in the warmer months, making it a great time to list your home. However, homes that are priced right and in good condition can sell quickly year-round.

Selling a home in 2024 comes with its challenges, but by understanding the current home-selling timeline and taking proactive steps, you can speed up the process. Whether you're listing South Hudson houses for sale or Southern NH houses for sale, pricing your home competitively, improving curb appeal, and marketing it effectively are all crucial.

By avoiding common pitfalls and following these tips, you'll be well on your way to a smooth and successful home sale in 2024. If you're ready to sell, contact a local REALTOR® who can guide you through every step of the process and help you get the best possible outcome for your home sale.

If you need more tips on the Mistakes to Avoid or are ready to sell your home give us a call at (603) 883-8840. You can also reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Selling a house is a big decision, and one wrong move can cost you a lot of money. To help you navigate the process, it’s essential to be aware of the costly mistakes to avoid when selling your house. Whether you’re putting one of the beautiful South Hudson houses for sale or listing a property in Southern NH, avoiding these common pitfalls will help you maximize your profit and sell your home faster.

In this guide, we’ll explore the top mistakes homeowners make and how you can sidestep them. Let’s dive in and make sure your home sale goes off without a hitch.

One of the most common costly mistakes to avoid when selling your house is overpricing. Many sellers assume that setting a high price will leave room for negotiation, but this can backfire. Buyers today are savvy—they research comparable home prices in your area and won’t be interested in an overpriced property.

In fact, overpricing can lead to your house sitting on the market for too long. If buyers see that your home has been listed for a long time, they may assume there’s something wrong with it. When you’re ready to list your South Hudson house for sale, work with your REALTOR® to set a competitive price based on the current market.

Another major mistake is neglecting repairs before listing your home. Buyers want a property that feels move-in ready. If your home has visible issues—whether it’s a leaky roof, cracked walls, or broken appliances—it can turn off potential buyers. You might think it’s easier to leave repairs for the buyer to handle, but this could result in lower offers.

Imagine walking through a home you’re considering purchasing and noticing chipped paint, dripping faucets, and loose tiles. It doesn’t inspire confidence, right? To avoid this, make sure your house is in good shape before listing. A few minor repairs can go a long way, especially when competing with other Southern NH houses for sale.

Presentation is everything when selling your house. Many sellers underestimate the power of staging, which can be a costly mistake to avoid when selling your house. A well-staged home helps buyers envision themselves living there, while a cluttered or poorly presented home can leave a negative impression.

Take the time to declutter, deep clean, and stage your home properly. Highlight its best features, whether that’s natural light, spacious rooms, or a beautiful backyard. You don’t need to spend a fortune—sometimes rearranging furniture or adding a few decorative touches can make a huge difference.

When listing South Hudson houses for sale, professional photos are another key factor. High-quality images help attract online interest, making potential buyers more likely to schedule a showing.

First impressions matter, and your home’s curb appeal plays a huge role in that. One of the biggest costly mistakes to avoid when selling your house is neglecting the exterior. The outside of your home is the first thing buyers see, and if it doesn’t look inviting, they may not bother coming inside.

Simple updates like landscaping, painting the front door, and adding outdoor lighting can boost curb appeal. Even small touches, like planting fresh flowers or maintaining a tidy lawn, can create a warm and welcoming atmosphere. If you’re listing Southern NH houses for sale, make sure the exterior shines just as brightly as the interior.

Selling a home requires flexibility. One of the biggest costly mistakes to avoid when selling your house is being unavailable for showings. If you make it difficult for buyers to see your home, you risk losing potential offers. Remember, buyers have busy schedules too, and they may not wait around for a convenient time.

Consider allowing your REALTOR® to show your home even when you're not there. The more accessible your home is, the faster it will sell. This is especially true for properties in competitive markets like Southern NH, where buyers may be looking at several homes in a short period.

A pre-listing inspection is an investment that many sellers overlook, but it’s one that can save you time and money. Knowing the condition of your home before listing allows you to fix any issues that could derail a sale later. Plus, it gives buyers confidence that your home is in good shape.

While buyers often schedule their own inspection, having one done in advance can prevent unpleasant surprises. If you’re listing a South Hudson house for sale, consider this step to avoid last-minute repairs and negotiations that could slow down the sale.

Some homeowners think they can save money by selling their home on their own. However, this is a costly mistake to avoid when selling your house. Without professional help, you may miss out on important details, such as pricing your home correctly or marketing it effectively.

A REALTOR® brings experience, market knowledge, and negotiation skills to the table. They can guide you through the entire selling process, from staging to closing. Having a professional by your side ensures you get the best possible price for your home, whether it’s in South Hudson or anywhere in Southern NH.

Many sellers focus solely on the sale price and forget about the closing costs involved in selling a home. These costs can include agent commissions, title insurance, repairs, and more. Not factoring in these expenses can eat into your profits and leave you surprised at the closing table.

When planning to sell your home, make sure you understand all the costs involved. If you’re unsure, your REALTOR® can help break down the expenses so you know exactly what to expect.

What if your house doesn’t sell as quickly as you hope? Or what if the buyer’s financing falls through at the last minute? Not having a backup plan can be a costly mistake to avoid when selling your house.

While it’s important to stay optimistic, you also need to prepare for worst-case scenarios. Be ready to adjust your strategy if needed—whether that means lowering the price, offering incentives, or working with a different buyer.

If you’re listing Southern NH houses for sale, it’s crucial to be adaptable. The market can shift, and having a backup plan ensures you’re not caught off guard.

Selling a home can be an emotional process, especially if you’ve lived there for many years. But one of the biggest costly mistakes to avoid when selling your house is letting your emotions get in the way. Once you decide to sell, it’s important to approach the process as a business transaction.

This means being open to feedback, pricing your home competitively, and being willing to negotiate with buyers. It can be tough to detach from a place filled with memories, but keeping emotions in check will help you make smart decisions that benefit your sale.

Selling your home doesn’t have to be stressful or overwhelming. By understanding the costly mistakes to avoid when selling your house, you can navigate the process with confidence. Whether you’re listing a charming South Hudson houses for sale or Southern NH houses for sale, avoid these common pitfalls to maximize your profit and ensure a smooth sale.

From pricing your home correctly to staging it beautifully, following these tips will help you attract the right buyers and close the deal without any costly surprises. If you’re ready to sell your home, reach out to a local REALTOR® today for expert guidance and support.

If you need more tips on the Mistakes to Avoid or are ready to sell your home give us a call at (603) 883-8840. You can also reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Flipping houses can be a game-changer, but the trickiest part is finding great deals. Everyone wants that gem property at a low price. The secret lies in using strategies others overlook. In this guide, you’ll learn how to find deals to flip using creative methods that may surprise you. Let’s dive into these less obvious ways to spot hidden opportunities in the flipping world.

By the way, if you're looking for South Hudson houses for sale or Southern NH houses for sale, you might just find some hidden gems perfect for flipping right in your backyard.

Tax delinquent properties are goldmines waiting to be uncovered. When homeowners fall behind on property taxes, the government has the right to seize the property. Often, these properties are sold for much less than market value. To find these deals:

While it may require some patience and paperwork, this strategy offers incredible potential. If you're scouting Southern NH houses for sale, don't overlook tax-delinquent properties—they can be a great opportunity.

Probate properties are homes that have been inherited but are often sold off quickly by family members who don’t want the hassle of keeping the house. Many of these homes can be in great condition and priced below market value because the sellers are motivated to close fast.

Here’s how to tap into this opportunity:

Whether you’re looking for South Hudson houses for sale or properties across Southern NH, probate homes can be an ideal source for flippers.

Sometimes the best deals aren’t listed online but can be found by simply driving through neighborhoods. “Driving for dollars” means physically scouting homes that appear vacant, run-down, or neglected. These properties often signal motivated sellers.

How to do it effectively:

Next time you’re driving around looking at South Hudson houses for sale, keep an eye out for those neglected or vacant homes that might not be on the market yet.

Wholesalers are always on the lookout for properties to flip, and they often have deals that never make it to public listings. By building relationships with local wholesalers, you can access these off-market deals before anyone else.

Here’s how:

It’s not uncommon for wholesalers to have leads on Southern NH houses for sale that others haven’t even seen yet.

Pre-foreclosure homes are properties where the owner has fallen behind on payments but the foreclosure process hasn’t been completed yet. These homeowners are often motivated to sell quickly to avoid foreclosure, which can mean a better deal for you.

To find pre-foreclosures:

If you’re searching for South Hudson houses for sale or other Southern NH properties, pre-foreclosures could offer fantastic opportunities to find a deal before anyone else knows about it.

Online real estate auction platforms are becoming more popular. You can bid on distressed properties, foreclosures, or homes in tax delinquency without leaving your home.

Some popular auction sites include:

Be cautious though—some of these properties may require significant repairs, so factor that into your budget when looking for potential flips, even in places like South Hudson or Southern NH.

The real estate investment world is vast, and there’s no need to go it alone. Other investors can be a fantastic source of deals. Networking with seasoned investors can open doors to opportunities that aren’t listed anywhere.

Ways to build your network:

Building a strong network is essential, especially when hunting for Southern NH houses for sale that haven’t yet hit the broader market.

While most flippers look for homes, don’t overlook vacant lots or abandoned buildings. Many property owners of these spaces are eager to sell, and you can often get them for a fraction of the price of a traditional home.

How to approach:

When you’re driving around looking for South Hudson houses for sale, don’t forget to check out vacant lots—they could be your next big flip!

Technology is your friend when it comes to finding hidden deals. Several apps and websites are designed to help you identify properties that might be undervalued or under the radar.

Popular tools include:

These tools can save time and give you access to deals before they hit the broader market, especially when you’re focusing on Southern NH houses for sale.

Direct mail campaigns can still work wonders for finding deals, especially when targeting owners of distressed properties. Sending a letter or postcard to property owners can open doors to deals no one else knows about.

Tips for a successful campaign:

Whether you’re targeting South Hudson houses for sale or properties across the state, a well-executed mail campaign can help you uncover hidden opportunities.

When you’re looking for how to find deals to flip, thinking outside the box is essential. The best deals aren’t always in plain sight, and often, the less obvious opportunities bring the biggest rewards. From tax delinquent properties to networking with investors, the strategies above will give you an edge in the competitive world of flipping houses. The key is persistence and creativity—you never know where your next great deal will come from!

If you’re searching for South Hudson houses for sale or Southern NH houses for sale, applying these creative strategies can help you find that perfect flip opportunity. So, which method will you try first?

If you need more tips on how to find flips or are ready to start your dream home search give us a call at (603) 883-8840. You can also reach out to Our Agents for more information. We’d love to help you with your real estate needs.

When you’re thinking about buying a home—perhaps even one of those beautiful houses for sale in South Hudson—one of the most important factors that can influence your journey is your credit score. Your credit score not only determines whether you qualify for a mortgage but also affects the interest rates and terms you’ll be offered. So, how do buyers improve their credit scores and set themselves up for the best mortgage terms? Let’s dive into some easy-to-follow tips that can help you boost your credit score and secure favorable financing for your dream home.

Before we get into the steps to improve your credit score, let’s take a moment to understand why it matters so much, especially when you’re looking to buy a home. Your credit score is like a financial report card. It tells lenders how responsible you are with credit and how likely you are to repay a loan. The higher your credit score, the more confident lenders are in your ability to make payments on time.

Why a Good Credit Score Matters for Mortgage Terms

When you apply for a mortgage—whether it’s for a cozy family home in South Hudson or anywhere else—lenders use your credit score to decide whether to approve your loan and what interest rate to offer you. A higher credit score usually means a lower interest rate, which can save you thousands of dollars over the life of your mortgage. If you’re aiming for the best mortgage terms, improving your credit score is essential.

What’s a Good Credit Score?

Credit scores typically range from 300 to 850. Here’s a quick breakdown:

300-579: Poor

580-669: Fair

670-739: Good

740-799: Very Good

800-850: Excellent

To get the best mortgage terms—like for those attractive homes for sale in South Hudson—you’ll generally want a score of 740 or higher. But don’t worry if your score is lower—there are steps you can take to improve it.

The first step in improving your credit score for the best mortgage terms is to check your credit report for errors. Mistakes on your credit report can drag down your score, so it’s important to review your report carefully.

How to Get Your Credit Report

You’re entitled to a free credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—once a year. You can request your reports from Annual Credit Report . Take the time to go through each report line by line.

What to Look For

Common errors to look for include:

Incorrect personal information (like your name or address)

Accounts that don’t belong to you

Incorrect account statuses (like an account marked as delinquent when it’s not)

Duplicate accounts

Inaccurate credit limits

If you spot any errors, dispute them with the credit bureau. Correcting these mistakes can improve your credit score quickly and set you up for better mortgage terms—especially if you’ve got your eye on one of those inviting South Hudson houses for sale.

One of the most effective ways to improve your credit score is by reducing your credit card balances. This is because your credit utilization ratio—how much credit you’re using compared to your credit limit—accounts for about 30% of your credit score.

Keep Your Credit Utilization Low

To boost your credit score and make it easier to qualify for the best mortgage terms on that perfect South Hudson home, aim to keep your credit utilization below 30%. For example, if you have a credit card with a $10,000 limit, try to keep your balance below $3,000. The lower your utilization, the better.

Strategies to Pay Down Balances

If your balances are high, consider the following strategies:

Pay more than the minimum: Paying more than the minimum payment each month will help you reduce your balances faster.

Focus on high-interest debt first: If you have multiple credit cards, focus on paying off the one with the highest interest rate first. This will save you money in the long run.

Use windfalls: If you receive a tax refund, bonus, or other windfall, use it to pay down your credit card debt.

By paying down your balances, you’ll not only improve your credit score but also be in a better position to make an offer on a home in South Hudson when the perfect one comes along.

Your payment history is the most important factor in your credit score, accounting for about 35% of your total score. Late or missed payments can have a significant negative impact, so it’s crucial to make all of your payments on time.

Set Up Automatic Payments

To ensure you never miss a payment, consider setting up automatic payments for your bills. This way, your payments will be made on time every month, even if you forget.

Create a Budget

If you’re struggling to make payments, create a budget to help you manage your finances. Prioritize essential expenses like your mortgage, utilities, and groceries, and look for areas where you can cut back to free up money for debt payments.

What to Do If You Miss a Payment

If you do miss a payment, try to make it as soon as possible. The longer a payment is overdue, the more it will hurt your credit score. Additionally, consider reaching out to your creditor to see if they’re willing to remove the late payment from your credit report, especially if it’s a one-time mistake.

Making timely payments consistently will help you build a positive credit history, which is essential for securing the best mortgage terms—whether it’s for a home in South Hudson or anywhere else.

When you’re trying to improve your credit score for the best mortgage terms, it’s important to avoid opening new credit accounts. Each time you apply for credit, a hard inquiry is added to your credit report. Too many hard inquiries in a short period can lower your credit score.

Why You Should Avoid New Credit

Opening new credit accounts can also increase your credit utilization and make it harder to pay down existing balances. Plus, taking on new debt can raise red flags for lenders, who might see it as a sign that you’re overextending yourself financially.

Stick to Your Current Accounts

Focus on managing your current credit accounts responsibly instead of applying for new ones. By keeping your credit inquiries to a minimum and maintaining low balances, you’ll be better positioned to secure favorable mortgage terms—and take advantage of that charming South Hudson home for sale you’ve been eyeing.

If you’re just starting out or need to rebuild your credit, a secured credit card can be a useful tool. A secured credit card requires a cash deposit that serves as your credit limit. By using the card responsibly, you can build positive credit history over time.

How Secured Credit Cards Work

With a secured credit card, you’ll make a deposit (typically between $200 and $500) that serves as your credit limit. Use the card to make small purchases each month, and be sure to pay off the balance in full and on time. Over time, your responsible use of the card will be reported to the credit bureaus, helping to improve your credit score.

Transition to a Regular Credit Card

After several months of responsible use, your credit score should improve, and you may be able to qualify for a regular, unsecured credit card. Some secured card issuers even offer to upgrade you to an unsecured card once you’ve demonstrated good credit behavior. This can further help you improve your credit score and set yourself up for the best mortgage terms, making that South Hudson home more within reach.

The length of your credit history is another important factor in your credit score. The longer your accounts have been open, the better. Closing old accounts can shorten your credit history and lower your score, so it’s generally best to keep them open, even if you’re not using them.

Why Account Age Matters

Lenders like to see that you have a long history of managing credit responsibly. Closing an old account can reduce the average age of your accounts and negatively impact your score.

What to Do With Unused Accounts

If you have old credit cards that you don’t use, consider making a small purchase on each card every few months to keep the account active. Just be sure to pay off the balance in full each month to avoid interest charges. This strategy can help you maintain a longer credit history, which is beneficial when you’re aiming for the best mortgage terms—especially for homes in sought-after areas like South Hudson.

Your credit mix, or the variety of credit accounts you have, also plays a role in your credit score. Lenders like to see that you can manage different types of credit, such as credit cards, auto loans, and mortgages. If you only have one type of credit account, consider diversifying your credit mix.

Why a Diverse Credit Mix Matters

Having a mix of credit accounts shows lenders that you can handle different types of debt responsibly. This can boost your credit score and improve your chances of securing favorable mortgage terms.

How to Diversify Your Credit

If you currently only have credit card debt, consider adding an installment loan, like a personal loan or car loan, to your credit mix. Just be sure to manage the loan responsibly by making all of your payments on time. Over time, this can help improve your credit score and make you a more attractive candidate for a mortgage—whether it’s for a new home in South Hudson or elsewhere.

Improving your credit score can be challenging, especially if you have a lot of debt or negative marks on your credit report. If you’re struggling to improve your credit score on your own, consider seeking professional help. Credit counseling agencies can provide advice and assistance in managing your credit and finances. Just be sure to choose a reputable agency that offers legitimate services.

How Credit Counseling Works

Credit counseling agencies can help you create a budget, manage debt, and develop a plan to improve your credit score. Some agencies also offer debt management plans, where they work with your creditors to negotiate lower interest rates and payments.

Beware of Scams

Unfortunately, there are some unscrupulous companies out there that prey on people trying to improve their credit. Be wary of any company that promises to "fix" your credit overnight or charges high fees upfront. Instead, look for a nonprofit credit counseling agency that offers transparent, affordable services.

By getting professional help, you can develop a solid plan to improve your credit score and secure the best mortgage terms when you’re ready to buy a home—perhaps even one of the lovely houses for sale in South Hudson.

Improving your credit score takes time, so it’s important to plan ahead and be patient. Start working on your credit as early as possible, ideally at least six months to a year before you plan to apply for a mortgage. This will give you enough time to make meaningful improvements and increase your chances of qualifying for the best mortgage terms.

Set Realistic Goals

Set realistic goals for improving your credit score, such as paying down a certain amount of debt each month or making all of your payments on time. Celebrate your progress along the way, and remember that even small improvements can make a big difference in your mortgage terms.

Monitor Your Progress

Keep track of your credit score over time to see how your efforts are paying off. You can use free credit monitoring services to stay updated on any changes to your score and to catch any potential issues early.

Don’t Rush Into a Mortgage

While it’s tempting to buy a home as soon as possible, it’s worth waiting until your credit score is in the best possible shape. Rushing into a mortgage with a lower credit score can result in higher interest rates and less favorable terms, which can cost you more in the long run.

By planning ahead and being patient, you’ll be better positioned to secure the best mortgage terms and make your homeownership dreams a reality—whether that’s in South Hudson or another area.

Improving your credit score is one of the most important steps you can take to set yourself up for the best mortgage terms. By checking your credit report for errors, paying down balances, making timely payments, avoiding new credit, and following the other strategies outlined in this guide, you can boost your credit score and increase your chances of securing favorable financing for your home purchase.

If you’re ready to take the next step and start exploring homes for sale in South Hudson, don’t hesitate to Contact Harmony Real Estate for more information. We can help you find the perfect home and guide you through the mortgage process to ensure you get the best possible terms. Your dream home is waiting—let’s make it a reality!

Owning a home is a big decision, but it comes with many benefits. Here are seven great reasons to own a home, especially when you consider the South Hudson houses for sale.

One of the best reasons to own a home is building equity. Every mortgage payment you make helps you own more of your home. Over time, this can add up to significant wealth. For example, investing in one of the South Hudson houses for sale can help you build equity quickly due to the area's growing property values.

Owning a home provides stability and security. You don’t have to worry about rent increases or moving because the landlord decided to sell. Your home is your own safe haven. This is one of the top reasons to own a home, especially in a stable community like South Hudson. The South Hudson houses for sale offer the kind of long-term security that renters simply don't have.

When you own your home, you have the freedom to make it your own. Paint the walls your favorite color, plant a garden, or remodel the kitchen. This creative freedom is another great reason to own a home. The South Hudson houses for sale come with plenty of opportunities for customization, allowing you to create a space that truly reflects your personality and lifestyle.

Homeownership comes with tax benefits. You can deduct mortgage interest and property taxes from your income, saving you money each year. These tax breaks are compelling reasons to own a home. If you're looking at South Hudson houses for sale, consider the financial advantages these tax benefits provide, making homeownership even more attractive.

Your home can appreciate over time, making it a valuable investment. Real estate typically increases in value, providing a good return on your investment. This potential for appreciation is a solid reason to own a home. The South Hudson houses for sale are in a desirable area, which means they are likely to appreciate significantly over time.

Owning a home often means putting down roots and becoming part of a community. You get to know your neighbors, participate in local events, and feel a sense of belonging. This community connection is one of the emotional reasons to own a home. The South Hudson houses for sale are in friendly, welcoming neighborhoods where community spirit is strong.

Finally, owning a home brings a deep sense of personal satisfaction and pride. It’s a place where you can build memories, feel secure, and truly call your own. This personal fulfillment is perhaps the most rewarding reason to own a home. When you look at the South Hudson houses for sale, imagine the joy of owning a home in such a lovely area and making it your own.

In summary, there are many reasons to own a home: building equity, gaining stability, having the freedom to customize, enjoying tax benefits, investing in your future, connecting with a community, and experiencing personal satisfaction.

Homeownership is a smart and fulfilling choice for anyone looking to invest in their future. So, if you’re considering buying a house, remember these seven compelling reasons to own a home. And when you explore the South Hudson houses for sale, you’ll see how these benefits come to life in a wonderful community. Owning a home in South Hudson can provide you with not only a place to live but also a place to thrive. Contact Us to See how you Too can Own a Home!