Tag Archives for " rent "

The housing market is changing, and homebuilders are responding. More buyers are looking for affordable, efficient homes. That’s why builders are shifting focus to construct smaller homes. Whether you’re browsing Litchfield houses for sale or checking out Southern NH houses for sale, you’ll see this trend taking shape.

Many factors are driving this shift. Rising construction costs, high interest rates, and changing buyer preferences all play a role. People want homes that are easier to maintain, more energy-efficient, and fit their budget. For first-time buyers and downsizers, smaller homes make a lot of sense.

With home prices on the rise, many buyers need budget-friendly options. A smaller home often means a lower price, reduced property taxes, and lower utility bills. Builders recognize this demand and are designing compact homes that don’t sacrifice comfort.

Smaller homes are easier to heat and cool. This not only saves money but also helps the environment. Many new construction homes now include smart energy features like solar panels, high-efficiency windows, and better insulation. If you’re considering Southern NH houses for sale, you might notice these eco-friendly features becoming standard.

People are rethinking what they truly need in a home. Open floor plans, smart storage, and functional layouts are more important than sheer square footage. Many buyers prefer a cozy, well-designed space over a large, high-maintenance home.

If you’re looking at Litchfield houses for sale, you’ll likely find more compact, thoughtfully designed homes. Builders are responding to demand by creating smaller homes that still offer modern amenities like updated kitchens, home offices, and outdoor spaces.

A smaller home means less time spent on cleaning and maintenance. It also means fewer expenses on heating, cooling, and general upkeep. For first-time buyers and retirees, this can be a game-changer.

Because smaller homes are in demand, they often sell quickly. If you’re in the market for one, work with a real estate expert to stay ahead of the competition. This is especially true when looking at Southern NH houses for sale, where desirable properties get multiple offers fast.

A well-designed home makes the most of its space. Look for homes with built-in storage, multi-purpose rooms, and efficient layouts that maximize every square foot.

Smaller doesn’t mean settling. Many builders focus on high-quality materials and finishes in these homes. Hardwood floors, quartz countertops, and energy-efficient appliances are common in modern small homes.

Many new developments include parks, walking trails, and shared amenities to give homeowners more room to enjoy. If you love outdoor living, check for a patio, balcony, or nearby green spaces.

The trend toward smaller homes isn’t slowing down. Homebuilders are responding to changing buyer needs with well-designed, energy-efficient, and affordable options. Whether you’re exploring Litchfield houses for sale or searching for Southern NH houses for sale, this shift means more opportunities to find a home that fits your lifestyle. With careful planning and the right real estate expert by your side, you can find the perfect small home that meets your needs.

If you need more info on homebuilders shifting toward smaller homes, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

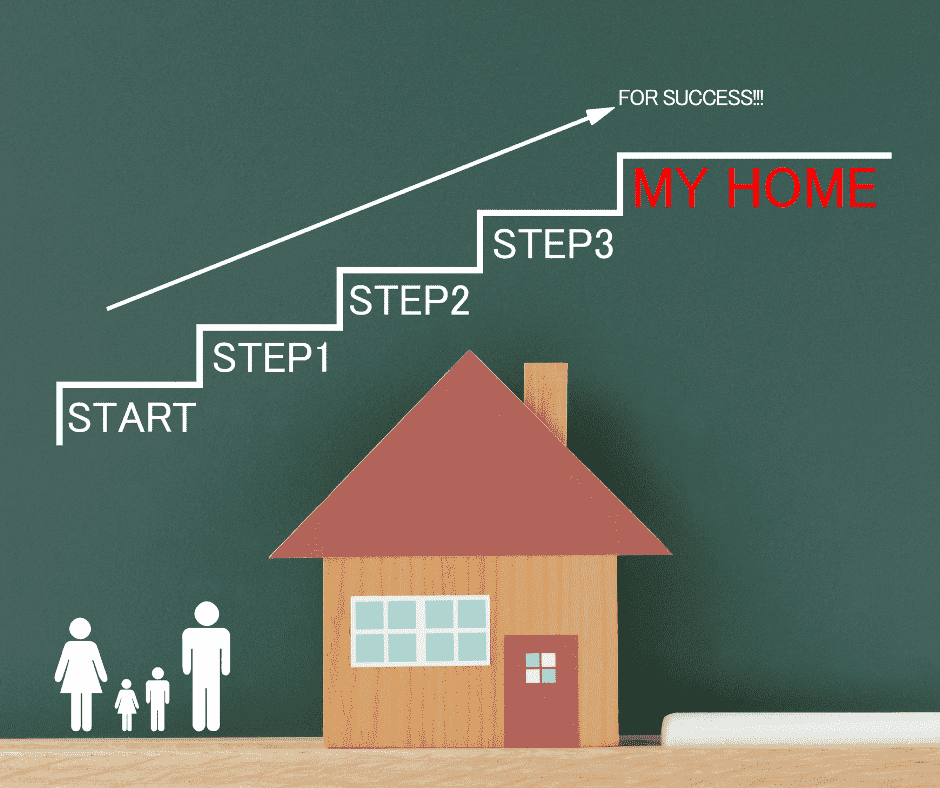

Buying Your First Home is exciting, but it can also feel overwhelming. There’s a lot to learn, from mortgages to closing costs. That’s why having the right guidance is key. Whether you’re looking at Litchfield houses for sale or checking out Southern NH houses for sale, this guide will help you navigate the process with confidence.

As someone buying your first home, you might not know where to start. The process is full of financial decisions, paperwork, and sometimes tough market conditions. Many buyers face challenges like tight budgets, bidding wars, and financing roadblocks. But with the right knowledge and support, you can overcome these hurdles and land the home of your dreams.

Before you start looking at homes, figure out what you can afford. Lenders look at your income, debt, and credit score to determine how much they’ll lend you. Getting pre-approved for a mortgage shows sellers that you’re serious and financially ready.

Location matters just as much as the house itself. Think about your daily commute, schools, amenities, and overall vibe. If you’re considering Southern NH houses for sale, explore different towns and neighborhoods to see which one fits your lifestyle best.

There are different types of loans, like FHA, VA, USDA, and conventional loans. Some offer low down payment options, which can be helpful if you don’t have 20% saved. Look into first-time homebuyer programs that might offer grants or down payment assistance.

What features do you need in a home? Do you want a big backyard, a garage, or an updated kitchen? Prioritize your list so you don’t get distracted by homes that don’t truly fit your needs.

If you’re buying your first home and searching for Litchfield houses for sale, you might face bidding wars, especially on desirable homes. Work with your real estate agent to craft strong, competitive offers that keep you within budget.

A home inspection helps uncover any hidden issues. If there are major problems, you may be able to negotiate repairs or even walk away from a bad deal. This step is crucial to avoiding costly surprises down the road.

Closing costs include lender fees, property taxes, homeowners insurance, and more. Your lender should provide an estimate upfront so you can budget accordingly.

Before closing day, do a last check of the home to ensure everything is in order. This is your chance to confirm that any agreed-upon repairs were completed and that the home is move-in ready.

Closing day is a big deal! Once the paperwork is signed and you get the keys, it’s time to celebrate. Buying your first home is a major milestone, and you’ve made it happen!

Buying your first home is a huge milestone, and the right knowledge makes all the difference. Whether you’re exploring Southern NH houses for sale or finding your dream home in Litchfield, being prepared will help you navigate the process with confidence. Work with a trusted real estate expert, stay informed, and before you know it, you’ll be settling into your perfect home!

If you need more tips on buying your first home, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Finding the right tenant can make or break your rental experience. Good resident screening helps landlords avoid bad tenants, costly repairs, and legal headaches. The right process protects your investment and keeps your property in great shape. Whether you own one rental or several, screening matters.

If you're managing rentals in South Nashua houses for sale or Southern NH houses for sale, strong tenant screening is even more critical. A good tenant means fewer issues and a steady rental income.

Skipping proper screening can lead to serious problems. Here’s what could go wrong:

Missed rent payments – Unreliable tenants might struggle to pay on time.

Property damage – Bad tenants can leave behind expensive repairs.

Evictions – A nightmare process that costs time and money.

Legal troubles – Violating fair housing laws can bring lawsuits.

A strong good resident screening process helps prevent these risks.

Decide what makes an ideal tenant. Consider credit score, income level, rental history, and references. This helps filter out unqualified applicants early.

Make sure applicants provide:

Personal details

Employment and income verification

Rental history and landlord references

Consent for background and credit checks

A credit report shows financial responsibility. A background check reveals past evictions, criminal records, or fraud. Always review these reports carefully.

Ensure the applicant earns enough to cover rent. Most landlords require tenants to make at least three times the monthly rent. Call employers to confirm job stability.

Contact previous landlords. Ask about payment history, property care, and any past issues. A tenant with multiple evictions is a red flag.

Stay compliant with federal and state fair housing rules. Avoid discrimination based on race, gender, religion, disability, or family status.

Some warning signs may indicate future trouble:

Eviction history – Frequent evictions suggest financial instability.

Poor credit score – A low score can mean late payments or unpaid debts.

Gaps in rental history – Unexplained periods without a rental may hide past problems.

Refusal to provide references – A good tenant should have no issue giving contact info.

If you spot these red flags, think carefully before moving forward.

Good tenants bring peace of mind. They pay rent on time, respect your property, and follow lease rules. A smart good resident screening process keeps your rental business stress-free.

If you're a landlord in South Nashua houses for sale or Southern NH houses for sale, these tips will help you find great tenants and avoid costly mistakes. Screening isn't just important—it’s essential!

Strong good resident screening protects your property, income, and sanity. Take the time to screen properly, and you’ll enjoy a smoother rental experience. Need expert advice? Connect with a local real estate pro today!

If you need more tips why good resident screening matters, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Squatters' rights might sound odd, but they are real. If someone lives in a property long enough without permission, they could gain legal ownership. Yes, that means someone staying in a home they don’t own could eventually claim it.

Understanding squatters rights is important for homeowners, especially if you own vacant property. Laws vary by state, but knowing the basics can help protect your investment. Whether you're selling South Nashua houses for sale or just securing your home, this information is crucial.

Squatters rights come from a legal concept called adverse possession. If a squatter meets certain conditions, they may claim ownership of a property. These conditions often include:

Continuous possession – Living in the home for a set period, often between 10-20 years in NH.

Open and notorious use – Using the property as if they own it, without hiding their presence.

Exclusive possession – Not sharing control of the home with others, including the owner.

Hostile possession – Living there without permission from the actual owner.

In New Hampshire, the period for adverse possession is 20 years. That’s a long time, but it’s important to stay aware, especially with Southern NH houses for sale sitting vacant.

A trespasser is someone who enters private property without permission. They can be removed by the police immediately. A squatter, on the other hand, might claim legal rights if they stay long enough. That’s why homeowners need to act fast if they notice unwanted occupants.

Preventing squatting is easier than dealing with it after the fact. Here are some steps to protect your property:

Make sure all doors and windows are locked. If your home is vacant, consider security cameras and alarms. This is especially important for vacant South Nashua houses for sale.

Clear signs make it obvious that no one should be on your property. This can also help in legal cases.

Check on your property often. If you’re an investor with multiple Southern NH houses for sale, hiring a property manager may be a smart move.

Ask neighbors to keep an eye out for strange activity. A strong community helps prevent squatters from taking over.

If a squatter has moved in, act quickly. Here’s what to do:

Call the police – If they are trespassing, law enforcement may remove them immediately.

Serve a formal eviction notice – If they have been there for a while, legal eviction may be necessary.

Take legal action – If they claim squatters' rights, you may need a court order to remove them.

Delays can make things harder. If you’re dealing with this issue in Southern NH houses for sale, consult a real estate attorney right away.

It’s rare, but if a squatter meets all the conditions of adverse possession, they could legally claim the home. This means the original owner could lose their property for good. Staying proactive is the best way to avoid this nightmare.

Understanding squatters rights is essential for homeowners, especially in the competitive South Nashua houses for sale market. The best defense is a good offense—secure your home, stay vigilant, and take action fast if you spot unauthorized occupants.

If you're thinking about buying or selling property in Southern NH, working with a trusted real estate agent can help you avoid legal headaches. Stay informed, stay prepared, and protect your investment!

If you need more tips on squatters rights, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Selling your home can feel overwhelming. Many homeowners in Hudson, Nashua, Londonderry, and Litchfield hesitate to list their homes because of common worries. Concerns about timing, pricing, and finding a new place to live are real. But with the right approach, selling can be smooth and rewarding.

If you’re thinking about selling but feeling unsure, you’re not alone. Let’s break down these worries and how to overcome them. With strong demand for Southern NH Houses for Sale, now could be the perfect time to take the leap!

One of the biggest fears sellers have is that their home will sit on the market too long. However, the right pricing, marketing, and presentation can attract buyers quickly.

How to Overcome It:

✅ Price It Right – A competitive listing price attracts serious buyers. Your real estate agent will analyze local home values to find the best price.

✅ Market Aggressively – Professional photos, online listings, and open houses make a big difference. A well-marketed home gets more attention.

✅ Stage Your Home – Small updates, decluttering, and staging help buyers picture themselves living in your space.

Homes in Southern NH sell fast, especially when priced correctly and well-presented!

Many sellers worry about selling before they secure a new home. With the competitive market, finding your next home takes planning.

How to Overcome It:

🔹 Work With a Real Estate Pro – A skilled agent helps coordinate both transactions smoothly.

🔹 Use Contingencies – You can make your sale contingent on finding a new home.

🔹 Explore Temporary Housing – Renting for a few months might be an option if needed.

Southern NH houses for sale are available in different price ranges and styles. With the right guidance, you’ll find a great next home!

Home inspections often uncover issues, making sellers nervous about repair costs. But you don’t need to fix everything!

How to Overcome It:

💡 Pre-List Inspection – This can give you a heads-up on potential issues.

💡 Focus on Major Concerns – Buyers expect minor wear and tear, but big problems (like a leaking roof) may need attention.

💡 Offer Repair Credits – Instead of fixing everything, you can negotiate a credit to the buyer.

Buyers looking for Southern NH houses for sale expect homes in various conditions. Being upfront about repairs helps keep the process smooth.

Low appraisals can be stressful, but they don’t always mean a deal will fall apart.

How to Overcome It:

✔ Challenge the Appraisal – Your agent can provide recent comparable sales to dispute a low value.

✔ Negotiate with the Buyer – A buyer may agree to cover the difference or split the cost.

✔ Reevaluate the Price – If needed, adjusting the price can keep the deal moving.

A trusted real estate agent will help navigate appraisal concerns and keep your sale on track.

The housing market fluctuates, and many sellers worry about timing.

How to Overcome It:

🏡 Sell When It’s Right for You – Trying to predict the "perfect time" can be stressful. If you’re ready to move, list your home!

🏡 Understand Market Trends – Your agent can provide insights into Southern NH real estate trends to help you make informed decisions.

🏡 Stay Flexible – Being open to negotiation can help in any market condition.

Londonderry, Hudson, Nashua, and Litchfield continue to attract buyers. A well-prepared home will always have interest!

It’s normal to feel nervous about selling, but the right preparation makes all the difference. Southern NH Houses for Sale are in demand, and with a strategic plan, you can sell successfully.

Are you ready to make your move? Let’s talk about your home’s value and the best way to sell with confidence!

If you need more tips on selling your home without worries, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Mortgage rates are always changing, and that can be stressful. But instead of worrying about things out of your hands, focus on what you can control. Whether you’re buying or selling a home in New Hampshire, there are steps you can take to stay ahead.

Looking to buy or sell? Check out Southern NH Houses for Sale and take the next step with confidence!

Instead of fixating on rates, start by knowing your budget. Work with a lender to determine how much home you can afford.

Review your credit score and debt-to-income ratio.

Get pre-approved to understand your buying power.

Factor in taxes, insurance, and maintenance costs.

If you find a rate that works for you, lock it in! Mortgage rates fluctuate, so securing a good one gives you peace of mind.

Ask your lender about rate lock options.

Consider shorter loan terms for lower interest rates.

A higher credit score can lead to better loan terms. Even small improvements can make a big difference.

Pay down high credit card balances.

Avoid new debt before applying for a mortgage.

Make all payments on time.

Not all lenders offer the same rates or loan programs. Compare different lenders to find the best deal for your situation.

What loan options are available?

Are there any special programs for first-time buyers?

What are the fees and closing costs?

Mortgage rates are just one piece of the puzzle. The right home, location, and market conditions matter too.

Market trends in Southern NH houses for sale.

How long you plan to stay in the home.

Your overall financial goals.

If you’re selling, be flexible and strategic. Buyers are watching rates too, so price your home competitively.

Offer incentives like rate buy-downs.

Work with an experienced REALTOR® to market your home well.

When you find the right home, don’t hesitate. A good property won’t stay on the market long.

Get your financing in order early.

Stay updated on new listings in Southern NH houses for sale.

Work closely with your agent to submit strong offers.

Mortgage rates will always change, but you have control over your choices. Stay informed, work with professionals, and focus on your financial goals. Ready to buy or sell? Explore Southern NH Houses for Sale today and take the next step with confidence!

If you need more information on mortgage rates, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Buying your home is an exciting journey, but it can also feel overwhelming. With the right guidance, the process is smooth and stress-free. Whether you're a first-time buyer or upgrading, knowing what to expect helps you move forward with confidence.

Thinking about buying? Check out Londonderry Houses for Sale and Southern NH Houses for Sale for great options!

The first step in buying your home is meeting with a trusted REALTOR®. They’ll discuss your needs, explain the process, and help you set a budget.

A discussion about your goals and must-haves.

An overview of the local market.

A strategy to find your ideal home.

To move forward, you’ll sign a Buyer Agency Agreement. This document ensures your REALTOR® represents you and works in your best interest.

Defines agent responsibilities.

Outlines commission details (typically covered by the seller).

Establishes the working relationship.

Before making an offer, you’ll need to research neighborhoods, compare homes, and get pre-approved for a mortgage.

Pro Tip: Looking in New Hampshire? Check out Southern NH houses for sale for amazing opportunities!

Get pre-approved by a lender.

Tour homes and compare features.

Research school districts, amenities, and commute times.

Once you find the perfect home, it’s time to make an offer. Your REALTOR® will help draft a competitive offer based on market conditions.

Offer price compared to market value.

Contingencies (inspection, financing, appraisal).

Closing timeline and terms.

After your offer is accepted, you’ll schedule a home inspection to uncover any issues with the property.

No issues: Move forward to closing.

Minor repairs: Negotiate fixes with the seller.

Major problems: Decide whether to proceed or walk away.

If you're using a mortgage, your lender will require an appraisal to confirm the home's value.

If the appraisal matches or exceeds the offer price, you’re good to go!

If it comes in lower, renegotiations may be needed.

Just before closing, you’ll do a final walk-through to ensure everything is as agreed upon.

Confirm all repairs are completed.

Check that appliances and fixtures are in working order.

Make sure the home is in the expected condition.

Closing day is when you officially become a homeowner! You’ll sign final documents, make payments, and get the keys to your new home.

Bring ID and necessary documents.

Review the final loan details.

Celebrate your new home!

Buying your home doesn’t have to be complicated. With the right team, you’ll have a seamless experience. If you’re searching for a home, check out Londonderry Houses for Sale and Southern NH Houses for Sale to find the perfect place!

Now that you know the process of buying your home, you can move forward with confidence. A trusted REALTOR® will guide you every step of the way. Whether you’re just starting your search or ready to make an offer, looking at Southern NH houses for sale is a great place to begin!

If you need more tips on buying your home, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Are you stuck in the rental rut? You’re not alone. Many people dream of owning a home, but they don’t know where to start or if it’s even possible. The good news is, buying a home may be easier than you think, especially in Southern NH. In this blog, we’ll walk through why it’s time to buy a home, how it can get you out of the rental rut, and the benefits of owning a house instead of renting. Plus, we’ll show you how South Hudson Houses for Sale and Southern NH Houses for Sale can be the perfect solution for you.

Renting may feel comfortable, but it’s not an investment. When you pay rent, you’re simply giving money to someone else. Each month, your money disappears with no return. In contrast, when you buy a home, your monthly payments are building equity. Equity is like owning part of your home—eventually, you can sell it and make a profit.

Besides, renting limits your freedom. You can’t make changes to the place. You can’t paint the walls the color you want, put in a garden, or remodel the kitchen. When you own a home, all those changes are possible, and they add value to your property.

Buying a home provides stability. You no longer have to worry about rent increases, unpredictable lease renewals, or landlords deciding to sell. Homeownership brings a sense of security. When you buy a house, your monthly mortgage payment stays consistent (unless you have an adjustable-rate mortgage). You’re in control.

On top of that, owning a home builds long-term wealth. Over time, as your property value increases, so does your equity. It’s a great investment for your future. When you rent, the money you spend each month isn’t going toward building any financial future.

So, what does it take to break free from the rental rut? Here are the key steps to making the leap from renting to owning:

Know Your Budget: It’s essential to understand what you can afford before jumping into the housing market. Don’t worry, though—your REALTOR® can help you with this. They’ll help you figure out a realistic price range and what monthly payments you can expect.

Get Pre-Approved for a Mortgage: This step is crucial. Before you start looking at homes, get pre-approved by a lender. This will give you a better idea of how much home you can afford and make you more competitive when you find a home you love.

Find the Right Area: Location is everything when buying a home. You want a neighborhood that’s close to work, schools, parks, and other amenities. In Southern NH, there are tons of great areas to choose from, including the charming homes in South Hudson. Whether you’re looking for a suburban retreat or something closer to the city, Southern NH homes for sale offer plenty of options.

Hire a REALTOR®: A skilled REALTOR® can make all the difference. They have insider knowledge of the market, and they know where to find the best deals, like hidden gems in South Hudson houses for sale. A good agent will guide you through the buying process, helping you avoid costly mistakes and ensuring that everything goes smoothly.

Let’s dive deeper into why buying a home is one of the smartest decisions you can make. There are so many benefits to homeownership, including:

Building Equity: Each mortgage payment you make increases your equity in the home. Over time, as your home appreciates in value, so does your investment.

Personalization: Unlike renting, where you may be limited on changes, owning a home lets you make it your own. Paint the walls, remodel the kitchen, or even add a pool if you want to! Your home becomes a true reflection of you.

Tax Breaks: Homeowners enjoy tax benefits that renters don’t. You can deduct mortgage interest, property taxes, and even some home improvement costs.

Predictable Payments: Rent is unpredictable, and it can increase year after year. With a fixed-rate mortgage, your payments stay the same, making it easier to budget for the future.

Long-Term Investment: As mentioned earlier, homeownership is an investment. Over time, your home can increase in value. If you decide to sell, you could earn a profit that you can use toward your next home.

Now that you know the benefits of owning a home, let’s talk about finding the right one. The good news is that there are plenty of amazing options out there, especially in Southern NH. From the peaceful neighborhoods of South Hudson to the beautiful properties throughout the region, Southern NH homes for sale have something for every buyer.

When you work with a REALTOR®, they’ll help you narrow down your options. They’ll ask you questions about your needs and wants—do you need a big yard? A certain number of bedrooms? An office space? Your REALTOR® will find homes that match your criteria, saving you time and energy. And they can show you properties that aren’t listed on public websites, giving you a leg up in a competitive market.

If you’re considering buying in the Southern NH area, South Hudson is a great option. South Hudson offers a mix of single-family homes, townhouses, and condos, all in a peaceful and welcoming community. You’ll love the nearby parks, excellent schools, and easy access to commuter routes. Plus, South Hudson is just a short drive from all the action in nearby Nashua and Manchester, making it an ideal location for anyone looking for a quiet neighborhood with easy access to city life.

Whether you’re searching for a cozy starter home or something larger for your growing family, there are South Hudson houses for sale that can fit your needs and budget.

Southern NH is full of charming towns, great schools, and beautiful properties. Whether you’re looking for a country cottage or a spacious family home, there are plenty of Southern NH homes for sale. You’ll find a wide variety of options in areas like Hudson, Nashua, Merrimack, and more. Each town offers its own unique charm, but all of them are just a short drive away from Boston, making them ideal for commuters.

If you’re tired of the rental rut and ready to become a homeowner, now is the time to start the search for your new home. Whether you’re interested in South Hudson houses for sale or Southern NH homes for sale, there are plenty of great options to choose from.

Don’t let fear or uncertainty hold you back—our experienced REALTORS® are here to help. We’ll guide you through the entire process, from finding the right property to closing the deal. It’s time to stop throwing away your rent money and start building a future with your own home.

Are you ready to leave the rental life behind and buy your first home? Let’s chat! Call us today at (603) 883-8840 to get started or browse through our listings of South Hudson Houses for Sale and Southern NH Houses for Sale. We’re here to help you every step of the way.

If you need more tips on buying a home and getting out of the rental rut, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Selling a home can be exciting, but what happens when your home just won’t sell? If your home is not selling, don’t panic. There are smart strategies to turn things around and get that “Sold” sign in your yard. Whether you're listing in Litchfield or browsing Southern NH Houses for Sale, these expert tips will help your home attract buyers and offers.

Pricing is everything in real estate. If your home isn’t selling, it might be overpriced. Buyers today have access to market data, so an overpriced home stands out—in the wrong way.

Compare with recently sold homes in Litchfield and Southern NH.

Check price reductions on similar houses for sale.

Consider a competitive pricing strategy to attract interest.

Your home’s online listing is the first impression buyers get. If the photos don’t shine, neither will your chances of selling.

Hire a professional real estate photographer.

Use high-quality images that showcase lighting and space.

Stage rooms to highlight their best features.

First impressions matter! If your home isn’t getting showings, the outside might be turning buyers away.

Freshen up landscaping, trim hedges, and plant flowers.

Paint the front door a bold, welcoming color.

Power wash siding, driveways, and walkways.

A well-staged home helps buyers see its full potential.

Declutter to make rooms feel bigger.

Use neutral décor so buyers can visualize themselves in the space.

Arrange furniture to highlight flow and function.

Small issues can make buyers nervous. Tackling minor repairs before listing (or while on the market) can make a big difference.

Fix leaky faucets, loose doorknobs, and cracked tiles.

Touch up paint on walls and trim.

Make sure all lights and fixtures work properly.

If buyers aren’t finding your home, your marketing might need a boost.

Ensure your listing is on multiple real estate platforms.

Use social media to promote your listing.

Highlight your home’s best features in descriptions.

Sometimes a little incentive can push a buyer to make an offer.

Offer to cover closing costs.

Provide a home warranty for peace of mind.

Include furniture or appliances in the sale.

Real estate markets change. If your home is listed during a slow season, you may need to be patient or adjust your strategy.

Work with your NH REALTOR to analyze market trends.

Consider temporary off-market strategies if demand is low.

If interest rates have changed, highlight affordability.

If all else fails, consider alternative selling methods.

Rent-to-own options may attract more buyers.

Work with an experienced agent who specializes in difficult sales.

Explore local real estate investor interest.

Feedback from buyers and agents is invaluable. If multiple buyers have the same concerns, address them!

Ask for honest feedback from showings.

Be open to adjusting your price or making improvements.

Keep your home show-ready at all times.

Selling a home can take patience and the right strategy. If your home is not selling, don’t lose hope. By making smart adjustments, improving presentation, and working with a skilled NH REALTOR, you can attract buyers and close the deal. Check out Litchfield Houses for Sale and other Southern NH Houses for Sale to stay informed on the local market trends!

Ready to sell? Let’s make it happen!

If you need more tips on why your home is not selling, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Looking to rent an apartment without the hassle? Don’t worry; you’re not alone! Figuring out the process can feel tricky, but with the right approach, it’s a breeze. Whether you’re searching near Nashua or browsing Southern NH houses for sale, this guide will help you simplify renting an apartment step by step.

The first step to simplify renting an apartment is to figure out how much you can spend.

Create a Budget: Include rent, utilities, and other monthly expenses.

Stick to Your Limits: Avoid the temptation to overspend.

Save for Upfront Costs: Plan for the security deposit, first month’s rent, and application fees.

If you’re considering alternatives, exploring Nashua houses for sale might reveal options with lower monthly costs.

Before you start looking, decide what’s most important to you.

Location: How close do you need to be to work, school, or public transportation?

Size: Do you need a one-bedroom, or is a larger space better for your needs?

Amenities: Think about features like parking, a gym, or in-unit laundry.

When comparing options, remember Southern NH houses for sale often offer more space than apartments.

Choosing the right neighborhood is crucial for your happiness and convenience.

Visit the Area: Take a walk or drive to get a feel for the surroundings.

Check Reviews: Read online reviews about the neighborhood and apartment complex.

Look for Essentials: Consider proximity to grocery stores, parks, and schools.

Neighborhoods near Nashua often balance quiet living with easy access to amenities.

Finding the right apartment takes time. Start your search a few months before your move.

Browse Listings Online: Use websites that let you filter by price, size, and location.

Ask for Recommendations: Friends, family, or coworkers might know of great places.

Contact Local REALTORS®: They can help with rentals and show you Southern NH houses for sale.

Starting early ensures you’ll have plenty of options and time to make a decision.

Always tour apartments in person before signing a lease.

Inspect the Space: Look for issues like leaks, stains, or damaged appliances.

Ask Questions: Clarify lease terms, parking policies, and maintenance responsibilities.

Meet the Landlord: A good landlord makes a big difference in your rental experience.

If you’re exploring Southern NH houses for sale, schedule tours to compare options.

Carefully read the lease agreement before signing.

Understand the Terms: Pay attention to rent due dates, pet policies, and notice periods.

Ask for Clarifications: Don’t hesitate to ask the landlord about unclear sections.

Keep a Copy: Always keep a signed copy of the lease for your records.

When considering South Nashua houses for sale, compare ownership costs with rental agreements.

Apartments go fast, so prepare your application documents ahead of time.

Gather Documents: You’ll likely need proof of income, references, and a valid ID.

Check Your Credit: Landlords often run credit checks to assess reliability.

Have Funds Ready: Be prepared to pay application fees and deposits quickly.

Being ready gives you a better chance of securing your dream apartment.

Once you’ve signed the lease, start planning your move.

Set a Moving Date: Coordinate with friends, family, or professional movers.

Pack Smart: Label boxes and pack essentials separately.

Update Your Address: Notify the post office, utilities, and important contacts.

Moving into Southern NH houses for sale or apartments becomes easier with early preparation.

A strong relationship with your landlord or property manager can simplify renting an apartment.

Report Issues Quickly: Let them know about maintenance needs right away.

Follow Lease Rules: Respect the terms you agreed to in the lease.

Stay Polite: Professional and friendly communication goes a long way.

Good communication makes your rental experience smoother and stress-free.

While renting offers flexibility, owning a home can provide stability and equity.

Evaluate Costs: Compare rental expenses with mortgage payments.

Think About the Future: Owning a home builds wealth over time.

Explore Nearby Markets: Check out Londonderry houses for sale and Southern NH houses for sale.

If you’re ready to take the next step, a REALTOR® can guide you through the buying process.

Southern NH offers diverse housing options, from cozy apartments to spacious family homes. With excellent schools, scenic views, and vibrant communities, it’s a top choice for renters and buyers alike.

South Nashua houses for sale often feature updated kitchens, large yards, and quiet neighborhoods. Southern NH houses for sale provide great options for families, professionals, and retirees.

With these tips, renting an apartment doesn’t have to be complicated. Whether you’re staying local or exploring Londonderry houses for sale, this guide will help you stay organized and stress-free.

Still have questions? Contact us today to learn more about rentals and homes for sale in Southern NH. Let’s find the perfect place for you!

Ready to Move?

If you need more tips for ways to simplify renting an apartment, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.