Tag Archives for " Southern NH Houses for Sale "

Fall is a season full of change—and for many homeowners, it’s also a time to make big decisions. One question that’s popping up more often is, “Should you sell your Nashua NH home in fall 2025?” The answer depends on your goals, the local market, and how ready you are.

Whether you're browsing South Nashua houses for sale or Southern NH houses for sale, understanding the fall market helps you make a confident move. Let’s break it down in a simple, laid-back way.

Why Fall Might Be the Right Time to Sell

Why Fall Might Be the Right Time to SellSpring and summer usually get all the attention in real estate. But fall has its own advantages.

Less competition from other listings

Serious buyers who want to close before winter

Cozy curb appeal with fall colors and decor

Fewer daylight hours for showings

Weather can be unpredictable

Some buyers wait for spring

Still, with the right strategy, fall can be a great time to sell your Nashua NH home.

Nashua NH Market Snapshot

Nashua NH Market SnapshotNashua’s real estate market remains strong in 2025. Home values are steady, and buyer interest is high.

Median home price: around $495,000

Homes sell in under 13 days on average

Most homes receive multiple offers

If your home is priced right and shows well, it can attract serious buyers—even in the fall.

What Buyers Want in Fall 2025

What Buyers Want in Fall 2025Fall buyers are focused. They’re not just browsing—they’re ready to move before the holidays or winter weather hits.

Job relocations before year-end

Families wanting to settle before school breaks

Investors looking for year-end deals

If your home checks the boxes, fall buyers will notice. That’s a great reason to sell your Nashua NH home now.

Pricing Your Home for Fall Success

Pricing Your Home for Fall SuccessPricing is everything. You want to attract attention without scaring buyers away.

Use a comparative market analysis (CMA)

Highlight upgrades and energy-efficient features

Avoid overpricing—it leads to longer market time

Homes in South Nashua and Southern NH are selling fast when priced right. A strong price helps you stand out.

Fall Staging That Sells

Fall Staging That SellsFall is cozy. Use that vibe to make your home feel warm and welcoming.

Add soft lighting and seasonal touches

Keep leaves raked and walkways clear

Use pumpkins, mums, and wreaths for curb appeal

Buyers love homes that feel inviting. Make yours shine with simple fall touches.

Should You Wait Until Spring 2026?

Should You Wait Until Spring 2026?Spring is popular, but it’s also competitive. More listings mean more choices for buyers.

More buyers in the market

Longer daylight hours

Fresh landscaping options

More competition

Delayed move timeline

Possible market shifts

If you’re ready now, fall might be the perfect time to sell your Nashua NH home.

South Nashua and Southern NH Are Still Hot

South Nashua and Southern NH Are Still HotSouth Nashua and nearby towns in Southern NH continue to attract buyers. The area offers great schools, safe neighborhoods, and easy commutes.

Lower property taxes than nearby states

Access to nature, shopping, and dining

Strong school districts and community feel

If your home is in Nashua, you’re in a prime spot to attract buyers looking in Southern NH.

Quick Fixes That Boost Value

Quick Fixes That Boost ValueBefore listing, take care of small repairs. These updates can help your home sell faster and for more money.

Touch up paint and clean windows

Fix leaky faucets and squeaky doors

Update lighting and cabinet hardware

These changes show buyers your home is well cared for—and ready to move in.

Marketing Your Home in Fall

Marketing Your Home in FallMarketing matters. You want your listing to stand out online and in person.

Use professional photos with fall lighting

Write a warm, inviting listing description

Share your listing on social media and local groups

Your REALTOR® can help you create a strategy that gets results.

Should You Sell Your Nashua NH Home in Fall 2025?

Should You Sell Your Nashua NH Home in Fall 2025?So, should you sell your Nashua NH home in fall 2025? If you’re ready to move, fall offers serious buyers, less competition, and cozy curb appeal.

With the right pricing, smart staging, and a trusted REALTOR®, you can make a confident move this season. Whether you're listing South Nashua houses for sale or Southern NH houses for sale, fall might be your best opportunity.

If you need more info on if you should sell your Nashua NH home in the fall, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

If you're thinking about moving to Southern New Hampshire, Nashua NH schools should be on your radar—especially if you have kids. Families love Nashua for its strong school system, welcoming neighborhoods, and easy access to city amenities.

Whether you're browsing Nashua houses for sale or Southern NH houses for sale, knowing which school zones to watch can help you make a smart move. Let’s explore the top school zones that make Nashua a great place to raise a family.

Why Nashua NH Schools Matter When Buying a Home

Why Nashua NH Schools Matter When Buying a HomeSchools affect more than just your child’s education. They also impact home value, resale potential, and neighborhood vibe.

Better education opportunities

Safer, more stable neighborhoods

Stronger property values

More community involvement

When you invest in Nashua NH schools, you’re also investing in your child’s future.

Top School Zones in Nashua NH

Top School Zones in Nashua NHNashua has several standout schools that consistently rank above average. Here are the top zones to watch in 2025:

1. Bicentennial Elementary School Zone

1. Bicentennial Elementary School ZoneBicentennial Elementary is one of Nashua’s highest-rated public schools.

Strong math and reading scores

Active parent-teacher organization

Safe and friendly environment

Homes range from $500,000 to $750,000

Mix of ranches, colonials, and split-levels

Close to parks and shopping

If you're looking at Nashua houses for sale, this zone is a favorite for families focused on Nashua NH schools.

2. New Searles Elementary School Zone

2. New Searles Elementary School ZoneNew Searles Elementary is known for its academic excellence and supportive staff.

High test scores and teacher ratings

Strong community involvement

Great enrichment programs

Homes range from $450,000 to $700,000

Quiet streets and large yards

Near conservation land and trails

This zone is perfect for families who want space and school quality in Nashua NH schools.

3. Charlotte Avenue Elementary School Zone

3. Charlotte Avenue Elementary School ZoneCharlotte Avenue Elementary offers a balanced mix of academics and arts.

Focus on creativity and core subjects

Inclusive and welcoming culture

Strong special education support

Homes range from $400,000 to $650,000

Close to downtown and commuter routes

Great for first-time buyers

Among Nashua NH schools, this zone offers value and convenience.

4. Nashua High School North Zone

4. Nashua High School North ZoneNashua High School North is known for its wide range of AP courses and extracurriculars.

Strong academics and STEM programs

Excellent sports and arts opportunities

High graduation and college acceptance rates

Homes range from $550,000 to over $900,000

Larger homes with modern features

Great for families focused on education

This zone adds long-term value to your home investment and ties directly into Nashua NH schools.

5. Academy for Science and Design Charter School Zone

5. Academy for Science and Design Charter School ZoneThis public charter school focuses on STEM education and ranks among the top in the state.

Advanced curriculum and hands-on learning

Small class sizes and strong teacher support

High test scores and national recognition

Homes near the school range from $500,000 to $800,000

Popular with tech-savvy families

Strong demand and resale potential

This zone is ideal for families who prioritize innovation and excellence in Nashua NH schools.

Tips for Buying Near Top School Zones

Tips for Buying Near Top School ZonesUse sites like GreatSchools or Niche

Look at test scores, reviews, and programs

Drive through during school hours

Talk to neighbors and parents

They know the school zones and market trends

Ask about future development and zoning changes

Even if your kids are young, plan ahead

Good schools help with resale value

Nashua Real Estate Snapshot

Nashua Real Estate SnapshotNashua continues to attract families from all over Southern NH. Here’s why:

Multiple top-rated public and charter schools

Great support for all learning styles

Low crime rates and friendly communities

Ideal for raising kids

Easy access to Manchester and Boston

Close to shopping, dining, and recreation

Whether you're looking at Nashua houses for sale or Southern NH houses for sale, Nashua NH schools should be part of your decision.

Smart Moves Start With Nashua NH Schools

Smart Moves Start With Nashua NH SchoolsChoosing the right home means choosing the right neighborhood—and that often starts with schools. Nashua NH schools offer families a chance to live in safe, welcoming communities with access to top education.

From elementary to high school, Nashua’s school zones are worth watching. So take your time, ask questions, and find the home that fits your family’s needs. Your next chapter starts here.

If you need more info on the top Nashua NH schools, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Looking to buy a home in Nashua this year? You’re not alone. Nashua NH neighborhoods are buzzing with activity in 2025. Buyers want charm, convenience, and value—and Nashua delivers.

Whether you're browsing South Nashua houses for sale or Southern NH houses for sale, knowing the best neighborhoods helps you make a smart move. Let’s explore five top picks that offer something for everyone.

1. North End Nashua: Historic Charm Meets Modern Living

1. North End Nashua: Historic Charm Meets Modern LivingNorth End Nashua is one of the city’s most beloved areas. It’s known for its tree-lined streets, historic homes, and peaceful vibe.

Victorian and Colonial-style homes

Close to Greeley Park and Nashua River

Walkable to downtown shops and restaurants

Median home prices around $550,000

Mix of older homes and tasteful renovations

Strong resale value and buyer demand

If you love character and community, North End is a top choice among Nashua NH neighborhoods.

2. Southwest Nashua: Nature and Neighborhoods in Harmony

2. Southwest Nashua: Nature and Neighborhoods in HarmonySouthwest Nashua blends suburban comfort with natural beauty. It’s home to Sky Meadow Country Club and Yudicky Farm Conservation Area.

Great schools like Bicentennial Elementary

Access to trails, ponds, and parks

Quiet streets and spacious lots

Homes range from $600,000 to over $1 million

Mid-century and newer builds

Ideal for families and nature lovers

South Nashua houses for sale in this area go fast—especially those near the country club.

3. West Hollis: Space, Style, and Easy Commuting

3. West Hollis: Space, Style, and Easy CommutingWest Hollis offers a mix of Colonial Revival and mid-century homes. It’s perfect for buyers who want space and style.

Close to Mine Falls Park and Route 111

Highly rated schools

Larger homes with big yards

Prices range from $500,000 to $900,000

Homes often have 3–5 bedrooms

Great for growing families

This is one of the Nashua NH neighborhoods where you get more house for your money.

4. Southeast Nashua: Shopping and Schools in One Spot

4. Southeast Nashua: Shopping and Schools in One SpotSoutheast Nashua is ideal for commuters and shoppers. It’s near Pheasant Lane Mall and Nashua Country Club.

Quick access to Massachusetts

Parks, restaurants, and retail nearby

Nashua High School South is highly rated

Homes range from $450,000 to $850,000

Mix of ranches, colonials, and townhomes

Popular with young professionals and families

Southern NH houses for sale in this area offer convenience and lifestyle.

5. Downtown Nashua: Urban Energy with Historic Roots

5. Downtown Nashua: Urban Energy with Historic RootsDowntown Nashua blends old-world charm with modern amenities. It’s perfect for buyers who want walkability and culture.

Victorian-inspired homes and condos

Main Street dining and shopping

Events at Greeley Park and Mine Falls Park

Prices range from $400,000 to over $1 million

Great mix of single-family homes and multi-units

Strong rental potential and investment value

Among Nashua NH neighborhoods, downtown offers the most vibrant lifestyle.

Tips for Choosing the Right Nashua Neighborhood

Tips for Choosing the Right Nashua NeighborhoodDo you want space, walkability, or school access?

Make a list before you start touring homes.

They know the market and can guide you.

Ask about trends, pricing, and future growth.

Drive through in the morning, afternoon, and evening.

Get a feel for traffic, noise, and activity.

Even if you don’t have kids, schools affect home value.

Nashua has several top-rated public and private options.

Top 5 Nashua NH Neighborhoods to Buy a Home in 2025

Top 5 Nashua NH Neighborhoods to Buy a Home in 2025From historic charm to modern convenience, Nashua NH neighborhoods offer something for every buyer. Whether you're looking at South Nashua houses for sale or Southern NH houses for sale, these five areas are worth exploring.

So take your time, ask questions, and find the neighborhood that fits your lifestyle. Your dream home—and your dream community—are waiting in Nashua.

If you need more information on the top 5 Nashua NH Neighborhoods, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

If you’re searching for a home in Southern New Hampshire, you’ll likely come across well water homes—especially in Londonderry. These homes offer independence from public water systems, but they also come with responsibilities.

Whether you're browsing Londonderry houses for sale or Southern NH houses for sale, understanding how well water works helps you make a smart, confident decision. Let’s walk through the basics in a laid-back, easy-to-follow way.

What Are Well Water Homes?

What Are Well Water Homes?Well water homes use private wells to supply water. The well pulls water from underground sources and pumps it into your home.

No monthly water bill

Water comes from your own land

You manage your water system

Many homes in Londonderry rely on wells. It’s common in rural and semi-rural areas across Southern NH.

Why Buyers Should Understand Well Water Systems

Why Buyers Should Understand Well Water SystemsWell water is safe and reliable—but it’s not the same as city water. You’ll need to know how it works and how to maintain it.

You’re responsible for water quality

Maintenance is key to long-term performance

Testing is needed before buying

Knowing what to expect helps you avoid surprises after closing.

Water Testing Is Essential

Water Testing Is EssentialBefore buying a well water home, always test the water. This ensures it’s safe to drink and free from harmful contaminants.

Bacteria (like coliform and E. coli)

Nitrates and nitrites

Radon and arsenic

Hardness and pH levels

Hire a certified lab or inspector

Ask your REALTOR® for local recommendations

Review results carefully before closing

Water testing is one of the most important steps when buying in Londonderry or anywhere in Southern NH.

Well System Basics Every Buyer Should Know

Well System Basics Every Buyer Should KnowUnderstanding the parts of a well system helps you spot issues and ask smart questions during your home search.

Well pump: Moves water from the ground to your home

Pressure tank: Keeps water pressure steady

Well casing: Protects the well from contamination

Water treatment system: Filters and softens water

Ask the seller for maintenance records and system age. Older systems may need upgrades.

Costs to Expect With Well Water Homes

Costs to Expect With Well Water HomesWell water homes save money on monthly bills, but they do come with occasional costs.

Water testing: $100–$300 annually

Pump replacement: $1,000–$2,000 every 10–15 years

Water treatment systems: $500–$3,000 depending on needs

Budgeting for these costs helps you stay ahead and avoid surprises.

Water Treatment Options for Londonderry Homes

Water Treatment Options for Londonderry HomesSome well water homes need treatment systems to improve taste, remove minerals, or eliminate contaminants.

Water softeners: Remove calcium and magnesium

Reverse osmosis: Filters out contaminants

UV systems: Kill bacteria and viruses

Carbon filters: Improve taste and odor

Ask your REALTOR® if the home already has treatment systems installed.

Pros of Buying a Well Water Home in Londonderry NH

Pros of Buying a Well Water Home in Londonderry NHWell water homes offer freedom and savings. Many buyers love the idea of managing their own water supply.

No water bills

Natural, untreated water

Independence from municipal systems

Often found in peaceful, spacious neighborhoods

If you’re looking at Londonderry houses for sale, well water homes are a great option for families, retirees, and nature lovers.

Cons to Consider Before Buying

Cons to Consider Before BuyingWell water homes aren’t for everyone. You’ll need to be proactive and informed.

Maintenance is your responsibility

Water quality can change over time

Repairs may be costly if neglected

Working with a knowledgeable REALTOR® helps you find homes with well-maintained systems and clear records.

Tips for Buying Well Water Homes in Southern NH

Tips for Buying Well Water Homes in Southern NHDon’t skip this step

Ask for recent test results if available

Older systems may need upgrades

Ask about the pump, tank, and filters

Make sure the home has what you need

Ask about maintenance and warranties

Deeper wells often have better water quality

Shallower wells may be more affected by surface contamination

They know the area and common well issues

They’ll guide you through inspections and testing

Well Water Homes in Londonderry and Southern NH

Well Water Homes in Londonderry and Southern NHLondonderry is known for its scenic charm and spacious lots. Many homes here use private wells. It’s part of the town’s rural appeal.

Peaceful neighborhoods

Great schools and parks

Easy access to Manchester and Boston

Southern NH towns like Hudson, Windham, and Pelham also have well water homes. If you’re looking for space and independence, these areas are worth exploring.

What you Should Know About Well Water Homes in Londonderry NH

What you Should Know About Well Water Homes in Londonderry NHBuying a well water home in Londonderry NH can be a great move—if you know what to expect. With proper testing, smart questions, and a little planning, you’ll enjoy clean, reliable water and a home that fits your lifestyle.

Whether you're browsing Londonderry houses for sale or Southern NH houses for sale, don’t let well water scare you. Just be informed, ask questions, and work with a REALTOR® who knows the area.

If you need more info on whether to buy a home with well water in Londonderry NH, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

This charming 5-bedroom, 2-bath Cape with an attached garage is full of potential and waiting for your finishing touches. 20 B St Hudson NH 03051 is located in one of Hudson’s most desirable neighborhoods, this property offers space, character, and an oversized lot perfect for family living. Let’s take a closer look at what makes this home special

The heart of the home is the eat-in kitchen at 20 B St Hudson NH 03051. It's fully applianced with wood cabinets and open to the dining area. If you're looking to enjoy a family dinner or having friends over for a party, this kitchen has the layout to accomodate your needs.

The living room at 20 B St Hudson is a bright and welcoming space, ideal for relaxing with loved ones or entertaining guests. Hardwood floors are hidden beneath the laminate and carpet, ready to be uncovered and restored to their original beauty. A convenient mudroom adds everyday functionality, making this home both practical and inviting.

With 5 bedrooms, the home at 20 B St Hudson NH has plenty of room for everyone. The first floor offers 2 bedrooms and a ¾ bath—perfect for guests, extended family, or a home office. Upstairs, you’ll find 3 additional bedrooms and a full bath, giving you the flexibility to create the spaces that fit your lifestyle.

The layout includes a ¾ bath on the main level and a full bath upstairs, providing comfort and convenience for family and guests. With a little personal touch, these spaces can be updated to reflect your style.

The full unfinished basement at 20 B St Hudson NH 03051 provides excellent storage and future potential for added living space. A wood stove with blower is already in place, offering a cost-saving or backup heating option. Combined with natural gas heat, this home is efficient and versatile.

Situated on an oversized .39 acre lot, this property offers sheds for storage, ample outdoor space for gardening, backyard barbecues, pets, or simply relaxing. With room to spread out, this backyard is perfect for year-round enjoyment.

20 B St Hudson NH 03051 is conveniently located near shopping, supermarkets, and Benson Park, with easy access to major highways for commuters. Hudson residents can also enjoy Robinson Pond, just 5 miles away, for summer fun and outdoor activities. This central location offers the best of both convenience and community.

If you’re looking to sell your Hudson home, this property shines with its generous space, great location, and incredible potential. Don’t miss this opportunity to make 20 B St your own! Contact Virginia Kazlouskas today to schedule a viewing and make 20 B St Hudson NH 03051 your new home!

Showings begin at the Open House on Friday, September 12, 2025, from 4:30–6PM, and Saturday, September 13, 2025, from 12–2PM.

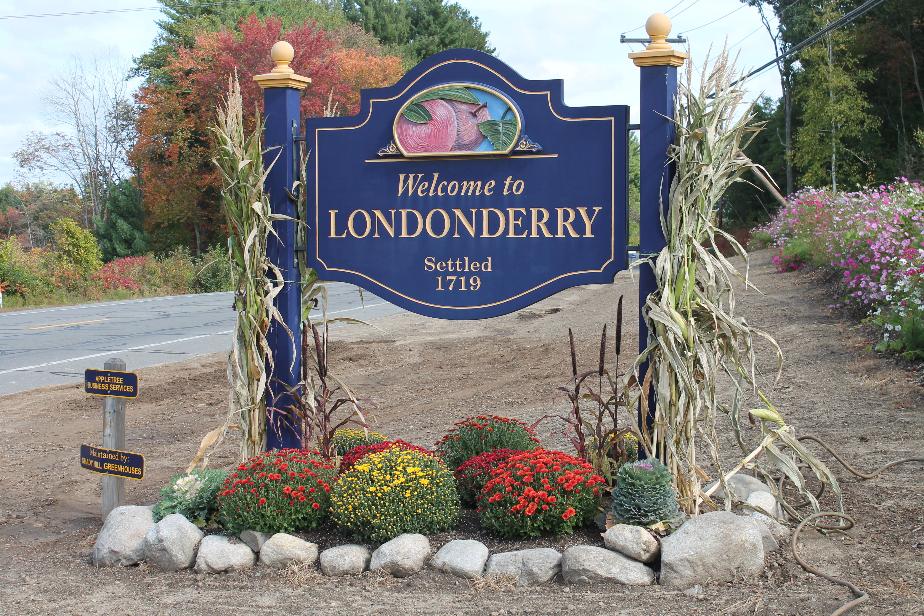

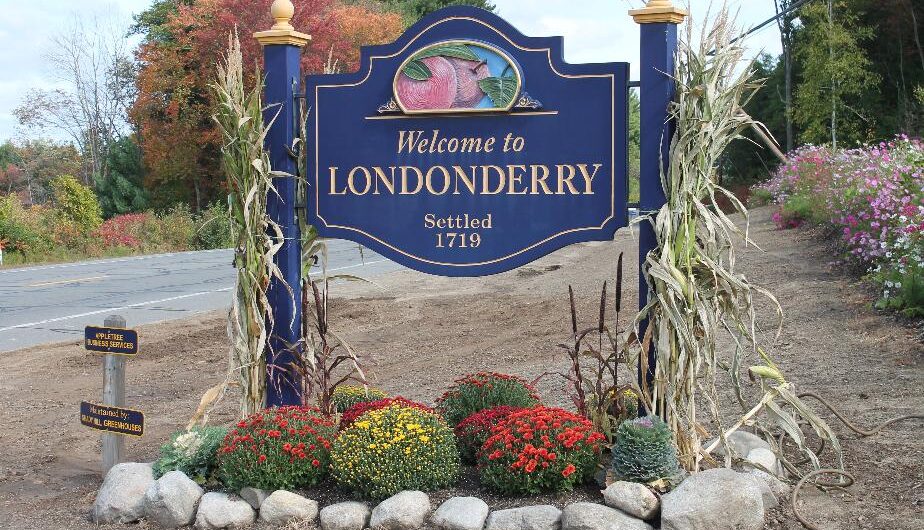

Fall is a season full of change—and for many homeowners, it’s also a time to make big decisions. One question that’s popping up more often is, “Should you sell your Londonderry NH home in fall 2025?” The answer depends on your goals, the local market, and how ready you are.

Whether you're browsing Londonderry houses for sale or Southern NH houses for sale, understanding the fall market helps you make a confident move. Let’s break it down in a simple, laid-back way.

Why Fall Might Be the Right Time to Sell

Why Fall Might Be the Right Time to SellSpring and summer usually get all the attention in real estate. But fall has its own advantages.

Less competition from other listings

Serious buyers who want to close before winter

Cozy curb appeal with fall colors and decor

Fewer daylight hours for showings

Weather can be unpredictable

Some buyers wait for spring

Still, with the right strategy, fall can be a great time to sell your Londonderry NH home.

Londonderry NH Market Snapshot

Londonderry NH Market SnapshotLondonderry’s real estate market remains strong in 2025. Home values are steady, and buyer interest is high.

Median home price: around $560,000

Homes sell in under 20 days on average

Most homes receive multiple offers

If your home is priced right and shows well, it can attract serious buyers—even in the fall.

What Buyers Want in Fall 2025

What Buyers Want in Fall 2025Fall buyers are focused. They’re not just browsing—they’re ready to move before the holidays or winter weather hits.

Job relocations before year-end

Families wanting to settle before school breaks

Investors looking for year-end deals

If your home checks the boxes, fall buyers will notice. That’s a great reason to sell your Londonderry NH home now.

Pricing Your Home for Fall Success

Pricing Your Home for Fall SuccessPricing is everything. You want to attract attention without scaring buyers away.

Use a comparative market analysis (CMA)

Highlight upgrades and energy-efficient features

Avoid overpricing—it leads to longer market time

Homes in South Londonderry and Southern NH are selling fast when priced right. A strong price helps you stand out.

Fall Staging That Sells

Fall Staging That SellsFall is cozy. Use that vibe to make your home feel warm and welcoming.

Add soft lighting and seasonal touches

Keep leaves raked and walkways clear

Use pumpkins, mums, and wreaths for curb appeal

Buyers love homes that feel inviting. Make yours shine with simple fall touches.

Should You Wait Until Spring 2026?

Should You Wait Until Spring 2026?Spring is popular, but it’s also competitive. More listings mean more choices for buyers.

More buyers in the market

Longer daylight hours

Fresh landscaping options

More competition

Delayed move timeline

Possible market shifts

If you’re ready now, fall might be the perfect time to sell your Londonderry NH home.

South Londonderry and Southern NH Are Still Hot

South Londonderry and Southern NH Are Still HotSouth Londonderry and nearby towns in Southern NH continue to attract buyers. The area offers great schools, safe neighborhoods, and easy commutes.

Lower property taxes than nearby states

Access to nature, shopping, and dining

Strong school districts and community feel

If your home is in Londonderry, you’re in a prime spot to attract buyers looking in Southern NH.

Quick Fixes That Boost Value

Quick Fixes That Boost ValueBefore listing, take care of small repairs. These updates can help your home sell faster and for more money.

Touch up paint and clean windows

Fix leaky faucets and squeaky doors

Update lighting and cabinet hardware

These changes show buyers your home is well cared for—and ready to move in.

Marketing Your Home in Fall

Marketing Your Home in FallMarketing matters. You want your listing to stand out online and in person.

Use professional photos with fall lighting

Write a warm, inviting listing description

Share your listing on social media and local groups

Your REALTOR® can help you create a strategy that gets results.

Should You Sell Your Londonderry NH Home in Fall 2025?

Should You Sell Your Londonderry NH Home in Fall 2025?So, should you sell your Londonderry NH home in fall 2025? If you’re ready to move, fall offers serious buyers, less competition, and cozy curb appeal.

With the right pricing, smart staging, and a trusted REALTOR®, you can make a confident move this season. Whether you're listing Londonderry houses for sale or Southern NH houses for sale, fall might be your best opportunity.

If you need more info on whether to sell your Londonderry NH home in the fall, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

If you're thinking about moving to Southern New Hampshire, Londonderry NH schools should be on your radar—especially if you have kids. Families love Londonderry for its quiet neighborhoods, strong community feel, and top-rated schools.

Whether you're browsing Londonderry houses for sale or Southern NH houses for sale, knowing which school zones to watch can help you make a smart move. Let’s explore the top school zones that make Londonderry a great place to raise a family.

Why Londonderry NH Schools Matter When Buying a Home

Why Londonderry NH Schools Matter When Buying a HomeSchools affect more than just your child’s education. They also impact home value, resale potential, and neighborhood vibe.

Better education opportunities

Safer, more stable neighborhoods

Stronger property values

More community involvement

When you invest in Londonderry NH schools, you’re also investing in your child’s future.

Top School Zones in Londonderry NH

Top School Zones in Londonderry NHLondonderry has several standout schools that consistently rank above average. Here are the top zones to watch in 2025:

1. Matthew Thornton Elementary School Zone

1. Matthew Thornton Elementary School ZoneMatthew Thornton Elementary serves grades 1–5 and is known for its caring teachers and strong academics.

Great parent involvement

Strong reading and math scores

Safe and welcoming environment

Homes range from $450,000 to $750,000

Mix of ranches, colonials, and split-levels

Close to parks and shopping

If you're looking at Londonderry houses for sale, this zone is a favorite for young families focused on Londonderry NH schools.

2. North Londonderry Elementary School Zone

2. North Londonderry Elementary School ZoneNorth Londonderry Elementary is another top-rated school with a reputation for excellence.

High test scores and teacher ratings

Active PTO and school events

Strong sense of community

Homes range from $500,000 to $800,000

Quiet streets and large yards

Near conservation land and trails

This zone is perfect for families who want space and school quality in Londonderry NH schools.

3. South Londonderry Elementary School Zone

3. South Londonderry Elementary School ZoneSouth Londonderry Elementary offers a balanced mix of academics and enrichment programs.

Focus on whole-child development

Strong special education support

Friendly and inclusive culture

Homes range from $400,000 to $700,000

Close to Route 102 and commuter routes

Great for first-time buyers

Among Londonderry NH schools, this zone offers value and convenience.

4. Londonderry Middle School Zone

4. Londonderry Middle School ZoneLondonderry Middle School serves grades 6–8 and prepares students for high school success.

Advanced math and science programs

Sports, clubs, and arts opportunities

Supportive staff and leadership

Homes range from $500,000 to $850,000

Near town center and recreation areas

Ideal for families with older kids

This zone is a great choice for long-term planning around Londonderry NH schools.

5. Londonderry Senior High School Zone

5. Londonderry Senior High School ZoneLondonderry High School is one of the top public high schools in Southern NH.

Strong academics and AP courses

Excellent sports and arts programs

High graduation and college acceptance rates

Homes range from $550,000 to over $900,000

Larger homes with modern features

Great for families focused on education

This zone adds long-term value to your home investment and ties directly into Londonderry NH schools.

Tips for Buying Near Top School Zones

Tips for Buying Near Top School ZonesUse sites like GreatSchools or Niche

Look at test scores, reviews, and programs

Drive through during school hours

Talk to neighbors and parents

They know the school zones and market trends

Ask about future development and zoning changes

Even if your kids are young, plan ahead

Good schools help with resale value

Londonderry Real Estate Snapshot

Londonderry Real Estate SnapshotLondonderry continues to attract families from all over Southern NH. Here’s why:

Multiple top-rated public schools

Great support for all learning styles

Low crime rates and friendly communities

Ideal for raising kids

Easy access to Manchester and Boston

Close to shopping, dining, and recreation

Whether you're looking at Londonderry houses for sale or Southern NH houses for sale, Londonderry NH schools should be part of your decision.

Smart Moves Start With Londonderry NH Schools

Smart Moves Start With Londonderry NH SchoolsChoosing the right home means choosing the right neighborhood—and that often starts with schools. Londonderry NH schools offer families a chance to live in safe, welcoming communities with access to top education.

From elementary to high school, Londonderry’s school zones are worth watching. So take your time, ask questions, and find the home that fits your family’s needs. Your next chapter starts here.

Whether you're looking at Londonderry houses for sale or Southern NH houses for sale, school zones should be part of your decision.

If you need more info on Londonderry NH schools, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Looking for a place that feels like home? Londonderry NH neighborhoods offer charm, space, and convenience. In 2025, buyers are drawn to Londonderry for its top-rated schools, scenic views, and easy access to major highways.

Whether you're browsing Londonderry houses for sale or Southern NH houses for sale, knowing the best neighborhoods helps you make a smart move. Let’s explore five standout areas that offer something special.

1. The Kings Neighborhood: Peaceful and Family-Friendly

1. The Kings Neighborhood: Peaceful and Family-FriendlyThe Kings is one of Londonderry’s most sought-after areas. It’s known for quiet streets and spacious homes.

Safe, walkable streets

Close to schools and parks

Strong sense of community

Homes range from $600,000 to over $850,000

Many feature 3–5 bedrooms and large yards

Great for families and long-term living

Among Londonderry NH neighborhoods, The Kings offers comfort and connection.

2. Mill Pond Area: Nature and Neighborhood Charm

2. Mill Pond Area: Nature and Neighborhood CharmMill Pond blends natural beauty with suburban living. It’s perfect for buyers who want peace and outdoor access.

Near trails, ponds, and conservation land

Quiet streets and friendly neighbors

Great for walking, biking, and relaxing

Homes range from $500,000 to $750,000

Cape and Colonial-style homes are common

Ideal for nature lovers and families

This area stands out among Londonderry NH neighborhoods for its scenic charm.

3. Winding Pond Road: Convenience and Community

3. Winding Pond Road: Convenience and CommunityWinding Pond Road offers townhomes and single-family homes in a well-kept setting. It’s great for first-time buyers.

Close to shopping and dining

Easy access to I-93 and Route 102

Strong HOA and community feel

Prices range from $350,000 to $600,000

Homes often have 2–3 bedrooms and modern layouts

Popular with young professionals and small families

If you're exploring Londonderry houses for sale, Winding Pond is a smart pick.

4. High Range Road Area: Space and Style

4. High Range Road Area: Space and StyleHigh Range Road features larger homes with big yards. It’s perfect for buyers who want space and privacy.

Quiet setting with upscale homes

Close to schools and recreation

Great for entertaining and relaxing

Homes range from $700,000 to over $1 million

Many have 4–5 bedrooms and finished basements

Ideal for multi-generational families

Among Londonderry NH neighborhoods, High Range Road offers luxury and lifestyle.

5. Pillsbury Road Area: Historic Charm and Modern Comfort

5. Pillsbury Road Area: Historic Charm and Modern ComfortPillsbury Road blends old-world charm with modern updates. It’s great for buyers who want character and convenience.

Historic homes with unique features

Close to orchards and town center

Strong community and local events

Prices range from $450,000 to $800,000

Mix of older homes and tasteful renovations

Strong resale value and buyer interest

If you're looking at Southern NH houses for sale, Pillsbury Road offers timeless appeal.

Tips for Choosing the Right Londonderry Neighborhood

Tips for Choosing the Right Londonderry NeighborhoodDo you want space, schools, or nature?

Make a list before touring homes.

They know the market and can guide you.

Ask about trends, pricing, and future growth.

Drive through in the morning, afternoon, and evening.

Get a feel for traffic, noise, and activity.

Even if you don’t have kids, schools affect home value.

Londonderry has a strong school district.

Historic homes with unique features

Close to orchards and town center

Strong community and local events

Prices range from $450,000 to $800,000

Mix of older homes and tasteful renovations

Strong resale value and buyer interest

If you're looking at Southern NH houses for sale, Pillsbury Road offers timeless appeal.

Tips for Choosing the Right Londonderry Neighborhood

Tips for Choosing the Right Londonderry NeighborhoodDo you want space, schools, or nature?

Make a list before touring homes.

They know the market and can guide you.

Ask about trends, pricing, and future growth.

Drive through in the morning, afternoon, and evening.

Get a feel for traffic, noise, and activity.

Even if you don’t have kids, schools affect home value.

Londonderry has a strong school district.

Top 5 Londonderry NH Neighborhoods to Buy a Home in 2025

Top 5 Londonderry NH Neighborhoods to Buy a Home in 2025From scenic charm to modern convenience, Londonderry NH neighborhoods offer something for every buyer. Whether you're looking at Londonderry houses for sale or Southern NH houses for sale, these five areas are worth exploring.

So take your time, ask questions, and find the neighborhood that fits your lifestyle. Your dream home—and your dream community—are waiting in Londonderry.

If you need more info on the top 5 Londonderry NH Neighborhoods, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

If you’re exploring Southern NH towns, the history of Londonderry NH is worth knowing. This town blends deep roots with modern living. From its early settlers to today’s thriving neighborhoods, Londonderry has a story that adds value to every home.

Whether you're browsing Londonderry houses for sale or Southern NH houses for sale, understanding the town’s past helps you appreciate its present.

Early Beginnings: From Nutfield to Londonderry

Early Beginnings: From Nutfield to LondonderryLondonderry started as Nutfield in 1719. A group of Scotch-Irish immigrants, led by Rev. James MacGregor, settled here after leaving Ireland. They were seeking peace, farmland, and religious freedom.

Nutfield was rich in nut trees and fertile land.

In 1722, the town was renamed Londonderry, honoring their Irish roots.

It became one of the first inland settlements in the Merrimack Valley.

This early foundation shaped the town’s strong community spirit and love for the land.

Colonial Growth and Farming Roots

Colonial Growth and Farming RootsLondonderry grew quickly. Families built homes, farms, and churches. The town became known for its agriculture, especially flax and linen production.

Londonderry Linen was famous across New England.

Apple orchards like Mack’s Apples date back to the 1700s.

Stone walls and open commons defined early neighborhoods.

These traditions still influence the town’s layout and real estate appeal today.

Expansion and New Towns

Expansion and New TownsAs Londonderry grew, parts of it became new towns. Derry, Windham, and Manchester all started as pieces of Londonderry.

Windham and Hudson split off in 1741.

Derryfield (now Manchester) was formed in 1751.

Derry became its own town in 1828.

Despite these changes, Londonderry kept its identity and continued to thrive.

Industry and Innovation

Industry and InnovationIn the 1800s, Londonderry saw growth in trade and manufacturing. Sawmills, tanneries, and railroads boosted the local economy.

This mix of progress and tradition still attracts buyers looking for homes with character.

Modern Londonderry: A Blend of Old and New

Modern Londonderry: A Blend of Old and NewToday, Londonderry is one of Southern NH’s most desirable towns. It offers a mix of historic charm and modern convenience.

If you’re browsing Londonderry houses for sale, you’ll find everything from Colonial homes to New Builds.

Landmarks That Tell the Story

Landmarks That Tell the StoryLondonderry’s landmarks reflect its rich history. They also add emotional value to nearby homes.

These places make Londonderry feel like home, and boost real estate appeal.

Community Events That Celebrate History

Community Events That Celebrate HistoryLondonderry loves its traditions. Annual events bring neighbors together and celebrate the town’s roots.

These events create a strong sense of community, something buyers look for when choosing a home.

Why History Matters in Real Estate

Why History Matters in Real EstateThe history of Londonderry NH adds depth to every home. Buyers feel connected to the town’s story, and that emotional pull can influence decisions.

Whether you're listing or buying, Londonderry’s history is a selling point.

Londonderry Real Estate Snapshot

Londonderry Real Estate SnapshotLondonderry continues to grow while honoring its past. The town offers a strong market for families, retirees, and professionals.

Median home price: around $560,000

Homes sell quickly, often with multiple offers

New developments blend with historic neighborhoods

If you’re exploring Southern NH houses for sale, Londonderry should be on your list.

The History of Londonderry NH – Roots, Growth & Real Estate Charm

The History of Londonderry NH – Roots, Growth & Real Estate CharmThe history of Londonderry NH isn’t just about dates and names. It’s about people, progress, and pride. It’s about how a small farming town became a vibrant place to live, work, and grow.

Whether you're buying or selling in Londonderry, knowing the town’s story adds meaning to your move. It helps you connect with the community and feel at home.

So next time you drive through Londonderry, take a moment to appreciate its roots. You’re not just looking at houses, you’re stepping into history.

If you need more info on the History of Londonderry NH, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

What Are Public Water Homes?

What Are Public Water Homes?Public water homes are connected to the town’s water supply. The water is treated and delivered by the municipality.

Water is managed by the town

Monthly water bills apply

Water quality is regularly monitored

Most homes in central Hudson use public water. It’s common in neighborhoods near schools, parks, and shopping.

Why Buyers Like Public Water Homes

Why Buyers Like Public Water HomesPublic water is convenient and reliable. You don’t have to worry about testing or maintaining the system.

Water is treated and safe

Repairs are handled by the town

Consistent pressure and supply

If you’re looking at South Hudson houses for sale, public water homes are a great option for busy families and first-time buyers.

Costs to Expect With Public Water Homes

Costs to Expect With Public Water HomesPublic water homes come with monthly bills. These costs vary based on usage and local rates.

Monthly water bill: $40–$100

Sewer fees may be included

Occasional rate increases by the town

Ask your REALTOR® for recent utility bills to estimate your monthly costs.

Water Quality and Safety

Water Quality and SafetyHudson’s public water is treated and tested regularly. The town follows strict guidelines to keep water safe.

Bacteria and viruses

Lead and copper levels

Chlorine and fluoride levels

pH and hardness

You can request a copy of the town’s water quality report. It’s usually available online or through the water department.

What Are Well Water Homes?

What Are Well Water Homes?Well water homes use private wells to supply water. The well pulls water from underground sources and pumps it into your home.

No monthly water bill

Water comes from your own land

You manage your water system

Many homes in rural parts of Hudson rely on wells. It’s common in areas with larger lots and more privacy.

Why Buyers Like Well Water Homes

Why Buyers Like Well Water HomesWell water homes offer freedom and savings. You’re not tied to a town system.

No water bills

Natural, untreated water

Independence from municipal systems

If you’re browsing Southern NH houses for sale, well water homes are popular with nature lovers and long-term homeowners.

Water Testing Is Essential

Water Testing Is EssentialBefore buying a water home with a well, always test the water. This ensures it’s safe to drink and free from harmful contaminants.

Bacteria (like coliform and E. coli)

Nitrates and nitrites

Radon and arsenic

Hardness and pH levels

Hire a certified lab or inspector. Ask your REALTOR® for local recommendations.

Well System Basics Every Buyer Should Know

Well System Basics Every Buyer Should KnowUnderstanding the parts of a well system helps you spot issues and ask smart questions during your home search.

Well pump: Moves water from the ground to your home

Pressure tank: Keeps water pressure steady

Well casing: Protects the well from contamination

Water treatment system: Filters and softens water

Ask the seller for maintenance records and system age. Older systems may need upgrades.

Costs to Expect With Well Water Homes

Costs to Expect With Well Water HomesWell water homes save money on monthly bills, but they do come with occasional costs.

Water testing: $100–$300 annually

Pump replacement: $1,000–$2,000 every 10–15 years

Water treatment systems: $500–$3,000 depending on needs

Budgeting for these costs helps you stay ahead and avoid surprises.

Water Treatment Options for Both Types

Water Treatment Options for Both TypesSome buyers prefer extra filtration, even with public water. Well water homes often need treatment systems.

Faucet filters for drinking water

Whole-house filtration systems

Water softeners for hard water

UV systems for bacteria

Ask your REALTOR® if the home already has any systems installed.

Tips for Buying Water Homes in Hudson NH

Tips for Buying Water Homes in Hudson NHRequest recent statements

Compare costs with similar homes

Look for lead, chlorine, and pH levels

Ask your REALTOR® for help finding it

Don’t skip this step

Ask for recent test results if available

Make sure the home has what you need

Ask about maintenance and warranties

They know the area and common water issues

They’ll guide you through inspections and paperwork

Water Homes in Hudson and Southern NH

Water Homes in Hudson and Southern NHHudson offers a mix of public and well water homes. You’ll find both in South Hudson and nearby towns.

Great schools and parks

Easy access to Nashua and Manchester

Strong community and services

Southern NH towns like Litchfield, Londonderry, and Pelham also offer a mix of water systems. If you’re looking for options, these areas are worth exploring.

What Every Buyer Should Know About Public and Well Water Homes in Hudson NH

What Every Buyer Should Know About Public and Well Water Homes in Hudson NHBuying a water home in Hudson NH can be a great move—if you know what to expect. With proper planning, smart questions, and a little research, you’ll enjoy clean, reliable water and a home that fits your lifestyle.

Whether you're browsing South Hudson houses for sale or Southern NH houses for sale, don’t overlook the importance of water systems. Just be informed, ask questions, and work with a REALTOR® who knows the area.

If you need more tips on a well water or public water home, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.