The Ultimate Guide to Understanding Home Inspections and Appraisals

If you're navigating today’s real estate market, you’ve probably heard about home inspections and appraisals. These two processes play a crucial role in any property transaction. But what exactly are they, and why do they matter? In this guide, we’ll break down the key differences and offer advice for both buyers and sellers to help you feel confident during your home purchase or sale.

1. What Are Home Inspections?

A home inspection is a thorough check of a property's condition. It’s usually done by a licensed home inspector. The inspector examines the home from top to bottom, looking for issues that may need fixing.

Key Areas Covered in a Home Inspection:

Roof and Attic: Checks for leaks, damage, and ventilation problems.

Foundation and Structure: Assesses the stability of the home's foundation and overall structure.

Electrical Systems: Looks for outdated wiring, faulty outlets, and potential hazards.

Plumbing: Checks for leaks, water pressure issues, and pipe conditions.

HVAC Systems: Examines heating, ventilation, and air conditioning units.

For buyers, a home inspection can reveal hidden problems that could be costly to repair. Sellers can also benefit by identifying and fixing issues before listing their home, making it more attractive to buyers.

2. What Are Appraisals?

An appraisal is an unbiased estimate of a property’s value, conducted by a licensed appraiser. The appraiser considers various factors, such as the home’s size, location, and condition, as well as recent sales of similar properties in the area.

Factors That Influence an Appraisal:

Comparable Sales (Comps): Recent sale prices of similar homes in the neighborhood.

Location: The desirability of the area, school quality, and local amenities.

Condition of the Property: The overall state of the home, including any upgrades or necessary repairs.

Market Trends: Current market conditions, like supply and demand.

For buyers, an appraisal ensures that you’re not paying more than the home is worth. For sellers, it helps set a fair market price.

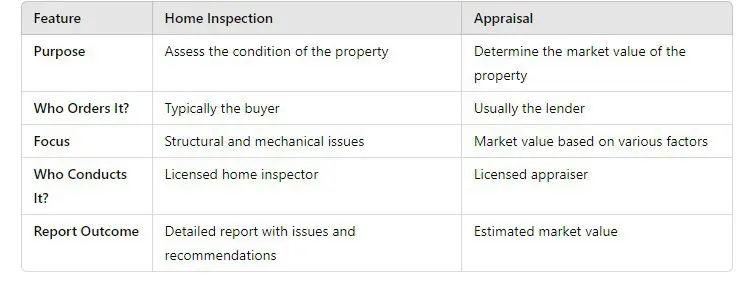

3. Key Differences Between Home Inspections and Appraisals

While both home inspections and appraisals are vital in real estate, they serve different purposes.

Understanding these differences is crucial for buyers and sellers to navigate the real estate process effectively.

4. Why Home Inspections Matter for Buyers

For buyers, a home inspection provides peace of mind. It ensures you’re making a sound investment by revealing potential problems before you close the deal.

Benefits of a Home Inspection for Buyers:

Uncovers Hidden Issues: Identify problems that aren't visible during a regular showing.

Negotiation Tool: Use the inspection report to negotiate repairs or a lower price.

Plan for Future Costs: Understand what repairs may be needed in the coming years.

If you're a buyer looking at Litchfield NH houses for sale, a home inspection can be your best friend. It gives you a clear picture of what you're getting into before you make such a big investment.

5. Why Appraisals Matter for Buyers

An appraisal protects buyers from overpaying for a property. Lenders require an appraisal to ensure the home’s value matches the purchase price.

Benefits of an Appraisal for Buyers:

Fair Market Value: Confirms that the purchase price reflects the home's actual value.

Loan Approval: Lenders use the appraisal to determine how much they’re willing to finance.

Investment Security: Ensures you’re not paying more than the home’s worth, which is important for long-term investment.

For buyers exploring Southern NH houses for sale, an appraisal provides valuable insights into the local market, helping you make an informed decision.

6. Why Home Inspections Matter for Sellers

Sellers can also benefit from a home inspection. By conducting an inspection before listing, you can address issues that might deter potential buyers.

Benefits of a Pre-Listing Inspection:

Fix Issues Early: Handle repairs before buyers see the home.

Boost Buyer Confidence: Buyers feel more comfortable making an offer on a well-maintained home.

Potential for Higher Offers: A home in good condition can attract better offers.

If you’re selling a home in Litchfield NH, a pre-listing inspection can help you set your property apart from others on the market.

7. Why Appraisals Matter for Sellers

An accurate appraisal helps sellers price their home competitively. It’s a key step in attracting buyers and securing a sale.

Benefits of an Appraisal for Sellers:

Set a Realistic Price: Avoid overpricing, which can deter buyers.

Supports Your Asking Price: Provide evidence of your home’s value to potential buyers.

Speeds Up the Sale: A fair price can reduce time on the market.

For sellers in Southern NH, understanding the local market conditions is crucial to setting a competitive price.

8. Common Issues Found During Home Inspections

Home inspections often uncover a range of issues. Here are some common problems:

Roof Damage: Missing shingles or leaks.

Plumbing Issues: Leaky pipes or outdated plumbing.

Electrical Problems: Faulty wiring or outdated systems.

Foundation Cracks: Structural concerns that may need repair.

Pest Infestations: Signs of termites or rodents.

For buyers of Litchfield NH houses for sale, knowing these common issues can help you be better prepared for the inspection process.

9. What Happens If the Appraisal Is Low?

A low appraisal can be a deal-breaker, but there are ways to handle it.

Options for Buyers and Sellers:

Renegotiate the Price: Buyers may ask the seller to lower the price to match the appraisal.

Dispute the Appraisal: Provide evidence of the home’s value, like recent sales data.

Make a Larger Down Payment: The buyer can increase their down payment to cover the gap.

Both buyers and sellers should be prepared for the possibility of a low appraisal and have a plan in place.

10. Tips for a Smooth Inspection and Appraisal

Whether you’re a buyer or seller, preparation can help make both processes go smoothly.

For Buyers:

Attend the Inspection: Be present to ask questions and get insights from the inspector.

Review the Report Carefully: Look over the inspection report and understand the findings.

For Sellers:

Prepare Your Home: Clean the house, make minor repairs, and create an inviting atmosphere.

Provide Documentation: Share information about recent repairs or upgrades with the appraiser.

For anyone dealing with Southern NH houses for sale, these tips can help ensure a smooth process from start to finish.

Understanding Home Inspections and Appraisals

Understanding how home inspections and appraisals work is crucial for both buyers and sellers. These processes provide valuable information, helping buyers make informed decisions and sellers set realistic prices.

By knowing what to expect and preparing ahead of time, you can navigate the real estate market with confidence. If you’re interested in exploring Litchfield NH houses for sale, make sure you’re ready for the inspection and appraisal steps. With the right preparation, you can enjoy a smooth transaction and a successful move.

If you are looking for to buy or sell soon, you can sign up for your dream home search or reach out to Our Agents for more information. If you need to sell your house click the link or give us a call at (603) 883-8840. We’d love to help you with your real estate needs.