Smart & Easy Tax Efficient Ways to Exit Real Estate Holdings

If you’re thinking about selling a property, you might wonder how to do it wisely. Many investors ask about tax efficient real estate exit strategies. That’s because taxes can eat up a chunk of your profits if you're not careful.

Whether you’ve owned a rental for years or just flipped a few properties, it’s smart to plan ahead. This blog will walk you through simple, easy-to-understand ways to exit your real estate investment while saving on taxes. Plus, if you’re eyeing South Hudson houses for sale or checking out Southern NH houses for sale, this guide will help you decide your next move with confidence.

💬 Want to Exit Real Estate Without Big Tax Bills?

Let’s be real. Selling a property can be exciting. You may want to cash out, retire, or invest elsewhere. But when you sell, taxes come into play—capital gains tax, depreciation recapture, and possibly state taxes.

Without a good plan, you might owe tens of thousands in taxes. That’s money you worked hard to earn. Good news? You can avoid some of that burden with a little planning and the right exit strategy.

💡 Tip 1: Use a 1031 Exchange

One of the most common tax-saving tools is the 1031 Exchange. It lets you sell one investment property and buy another without paying taxes right away.

How it works:

You sell one investment property.

You use the money to buy another similar property.

Taxes are delayed until you sell the new one (unless you do another exchange).

Why it’s awesome:

You keep your profits working for you. No giant tax bill means more cash to buy a better or bigger property—maybe even a South Hudson house for sale that fits your next investment plan.

🏠 Tip 2: Convert the Property to Your Primary Residence

Have you rented out a home for years but think you’d like to live there? You might be able to reduce capital gains taxes by moving in.

Here’s the scoop:

If you live in the home for two of the past five years before selling, you could avoid taxes on up to $250,000 in gains (or $500,000 for married couples).

This strategy only works in specific situations, but it’s worth talking about with your tax advisor. It’s a great way to exit with less tax and more reward.

🔁 Tip 3: Gift the Property

If you’re nearing retirement or don’t need the cash, consider gifting the property to a family member or to a trust. It’s a strategy often used in estate planning.

Why gift?

It can lower your taxable estate.

You might help a child or loved one avoid the high taxes you’d face.

If you give to a charity, you might get a tax deduction.

Just remember: gifting has rules. And it might still trigger some taxes, so always check with a pro.

🧾 Tip 4: Sell in a Low-Income Year

This might sound strange, but it works. If you know you’ll have a year with little income—maybe you're retiring or changing jobs—it could be a good time to sell.

Why?

Lower income = lower tax bracket.

That means less tax on your capital gains.

You keep more of your money for your next move.

Timing matters. If the market’s hot and your income is low, that’s a win-win.

🕰️ Tip 5: Sell Over Time With Seller Financing

Here’s a creative trick: You become the bank. With seller financing, you let the buyer make payments to you instead of paying all at once.

Benefits:

You spread out the capital gains tax over several years.

You earn interest, which adds to your return.

The buyer wins too—especially if banks won’t give them a loan.

If you're flexible and want steady income instead of one big check, this can be a great choice.

🏘️ Tip 6: Donate the Property

Feeling generous? Donating your property to a nonprofit or charity could come with major tax perks.

Why donate:

No capital gains tax.

You may get a tax deduction for the full market value.

You help a good cause and create a legacy.

Some investors even create donor-advised funds. That way, the gift can support charities for years to come—plus, you still get the tax break.

💼 Tip 7: Use an Installment Sale

An installment sale is like seller financing, but it’s all about spreading out the taxes.

How it works:

The buyer pays you over time.

You report a bit of the gain each year, not all at once.

It smooths out your income and lowers your yearly tax.

This works best if you trust the buyer and don’t need all the money upfront.

📊 Tip 8: Sell to a Family Member Strategically

Want to pass property to your kids? You can sell at market value, let them make payments, or even help with a down payment.

Why it helps:

Keeps property in the family.

Helps you manage taxes in a way that works best for your situation.

Keeps real estate wealth growing across generations.

Make sure you follow IRS rules—especially around “fair market value.” A tax advisor can help avoid pitfalls here.

📍 Smart Exits in Southern NH Real Estate

In hot markets like South Hudson and Southern NH, demand remains strong. That makes now a solid time to consider your tax efficient real estate exit. Whether you’re eyeing South Hudson houses for sale or you're done being a landlord, there are great ways to move forward with ease.

Here are a few more benefits of planning your exit well:

You avoid last-minute tax surprises.

You get peace of mind knowing you’ve kept more of your money.

You can move on to the next adventure—maybe downsizing, retiring, or reinvesting.

🔍 When to Talk to a Pro

Let’s be honest: tax laws can be confusing. While this blog breaks it down simply, your personal situation might need more detail.

Always talk with:

A tax advisor

A real estate attorney

Your REALTOR® (like us!)

These pros help you spot the best tax-saving moves and avoid costly mistakes.

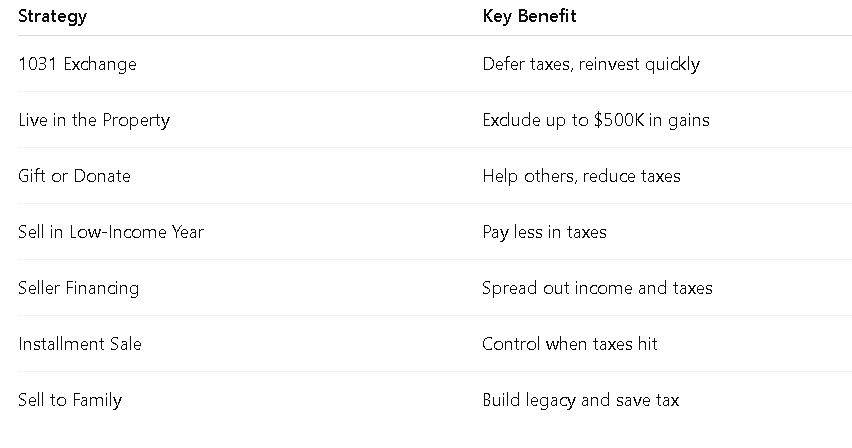

✅ Quick Recap of Exit Strategies

Here’s a simple checklist of the top tax efficient real estate exit tips:

Use this list to start your plan, then reach out to a local expert in Southern NH real estate to talk options.

🔚 Be Smart, Be Tax Wise

Selling your investment property doesn’t have to be stressful. With smart planning and the right advice, you can leave with more cash and fewer tax headaches.

Think about where you are in life. Maybe it’s time to let go of the landlord role. Maybe you're upgrading to a new place. Or maybe you're eyeing those South Hudson houses for sale that feel more like home.

Whatever your next move is, make it count. Choose a tax efficient real estate exit and take control of your future.

📈 Why You Need a Plan to Exit Real Estate

Looking for a professional, low-stress way to sell your home or investment property in Southern NH? We’re here for you! Whether you’re exploring South Hudson houses for sale or ready to move on from rental life, let’s make a plan that works for your goals—and your wallet.

🤝 Need Help Selling Smart?

Reach out anytime. Let’s talk about your exit strategy—and what’s next.

If you need more information on a tax efficient real estate exit, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.