Tag Archives for " South Nashua "

Becoming a first time home buyer New Hampshire is exciting and a little scary at the same time. You may be thinking about budgets, loans, and where to live. You may also be exploring South Nashua houses for sale while wondering if now is the right time. The good news is that buying a house in NH can be simple when you follow clear steps and have the right support.

First time buyers often feel overwhelmed at first. However, once you understand the process, things feel much more manageable. With planning and expert guidance, you can move forward with confidence. That is where preparation makes all the difference.

New Hampshire offers strong communities and beautiful scenery. In addition, the state provides great schools, parks, and local businesses. Many buyers search for affordable homes in New Hampshire because they want value and lifestyle together.

Buying a house in NH also gives you long term stability. Instead of paying rent, you build equity over time. As a result, you create financial growth while enjoying your own space. That is powerful for any first time home buyer New Hampshire.

Furthermore, many towns offer different price points. Some buyers focus on South Nashua houses for sale because of location and commuting options. Others prefer smaller towns with quiet neighborhoods. Either way, New Hampshire offers choices.

The first step is understanding your budget. Before you tour homes, speak with a trusted lender. This helps you learn about mortgage options New Hampshire buyers can use. Pre approval shows sellers you are serious and ready.

Next, review your income and monthly expenses. Look at savings and credit score as well. Strong credit often leads to better loan terms. Therefore, take time to review your finances carefully.

Buying a house in NH becomes easier when you know your numbers. You avoid stress and focus only on homes within reach. That clarity brings confidence.

Many first time buyers think they need twenty percent down. However, that is not always true. Mortgage options New Hampshire lenders offer include FHA, conventional, and VA loans.

FHA loans often require lower down payments. Conventional loans may work well if you have solid credit. Meanwhile, VA loans help eligible veterans and service members.

In addition, some programs focus on first time buyers. These programs often provide flexible credit guidelines. As a result, more buyers can qualify for affordable homes in New Hampshire.

Talk with your lender about each option. Ask about interest rates and monthly payments. Compare carefully so you choose wisely.

Saving for a down payment can feel like the hardest part. However, down payment assistance NH programs can help. These programs may offer grants or low interest second loans.

For many first time home buyer New Hampshire clients, this support changes everything. Instead of waiting years, they move forward sooner. That can be life changing.

In addition, some programs help with closing costs. Therefore, ask your lender and REALTOR about current options. Guidelines can change, so up to date information matters.

With smart planning and down payment assistance NH resources, homeownership becomes realistic and achievable.

Location shapes your daily life. Therefore, think about work commute, schools, and lifestyle. Some buyers love being near shopping and highways. Others want quiet streets and more space.

South Nashua houses for sale often attract buyers who commute to Massachusetts. The location offers convenience and access. At the same time, neighborhoods feel welcoming and established.

Affordable homes in New Hampshire exist in many areas. However, prices vary by town and neighborhood. Your REALTOR can help you compare options clearly.

When you explore homes, visit at different times of day. Notice traffic, noise, and overall feel. That helps you make a smart long term choice.

Online searches are a great place to begin. However, not every listing site shows accurate data. Therefore, work with a local REALTOR who provides full MLS access.

Affordable homes in New Hampshire can move quickly. As a result, you need alerts and fast communication. When the right property appears, you want to see it right away.

Create a list of must have features. For example, think about bedrooms, bathrooms, and yard size. Then consider features that are nice but not required.

Buying a house in NH means balancing wants and needs. Flexibility often leads to better results. At the same time, never ignore your core priorities.

Once you start touring, pay attention to layout and condition. Look beyond paint colors and decor. Focus on structure, roof, heating system, and windows.

As a first time home buyer New Hampshire, ask questions freely. There is no such thing as a silly question. Your REALTOR is there to guide you.

In competitive markets, homes may receive multiple offers. Therefore, stay prepared and responsive. Quick decisions sometimes matter.

Still, never rush blindly. A thoughtful approach protects your investment. Smart buyers stay calm and informed.

When you find the right home, your REALTOR will help craft an offer. Offer price matters, but terms matter too. Sellers look at financing strength and flexibility.

If you are buying a house in NH in a busy market, strong pre approval helps. In addition, clear communication keeps things smooth.

South Nashua houses for sale sometimes attract multiple buyers. Therefore, strategy becomes important. Your agent will review comparable sales and market trends.

A well structured offer increases your chances of success. At the same time, stay within your budget. Smart decisions today protect your future.

After your offer is accepted, inspections begin. A home inspection reviews major systems and structure. This step protects you from surprises.

If issues appear, your REALTOR helps negotiate solutions. Sometimes sellers agree to repairs or credits. Clear communication leads to fair outcomes.

Next comes the appraisal. The lender orders this to confirm value. Most affordable homes in New Hampshire appraise without issue when priced correctly.

Stay organized during this stage. Provide documents quickly when requested. Smooth communication keeps closing on track.

Closing day feels exciting and emotional. However, preparation reduces stress. Review documents carefully before signing.

Your lender provides final loan details. Make sure numbers match your expectations. Ask questions if anything seems unclear.

As a first time home buyer New Hampshire, this moment represents achievement. You move from planning to ownership. That is a powerful milestone.

Once you receive the keys, celebrate responsibly. You earned this success through preparation and smart choices.

Some buyers change jobs during the loan process. That can delay approval. Therefore, keep employment stable until after closing.

Others make large purchases before closing. Avoid new debt, including cars or furniture. Lenders recheck credit before final approval.

Buying a house in NH requires patience. Emotional decisions can cause regret. Instead, rely on data and professional advice.

Also, avoid skipping inspections. Even newer homes need evaluation. Protecting your investment always matters.

Homeownership builds equity over time. Each payment reduces your loan balance. Meanwhile, property values may grow.

Affordable homes in New Hampshire often become valuable long term assets. Therefore, think beyond today’s price. Consider future appreciation and community growth.

South Nashua houses for sale have shown steady demand over the years. Location and convenience drive interest. As a result, buyers often see strong resale potential.

For a first time home buyer New Hampshire, this means stability and opportunity. You create a foundation for your financial future.

The process includes contracts, deadlines, and negotiations. Therefore, expert support protects you. A knowledgeable REALTOR explains each step clearly.

Mortgage options New Hampshire lenders offer can feel complex. However, professionals simplify the details. That clarity builds confidence.

In addition, REALTORS understand local trends. They analyze comparable sales and pricing patterns. This insight helps you avoid overpaying.

Buying a house in NH should feel empowering, not confusing. The right team makes that possible.

Every journey starts with a single step. First, speak with a lender about mortgage options New Hampshire programs provide. Next, connect with a local REALTOR who understands your goals.

Explore affordable homes in New Hampshire with realistic expectations. Stay open minded and focused. Ask questions and stay informed.

If you are considering South Nashua houses for sale, review current listings and market trends carefully. With preparation and expert advice, a first time home buyer New Hampshire can succeed with clarity and confidence. Your path to homeownership in New Hampshire starts now, and South Nashua houses for sale may offer the perfect place to begin.

If you need more tips on first time home buyer New Hampshire, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Finding homes for sale in Nashua NH can feel exciting and overwhelming at the same time. Buyers want clarity and insight. Understanding the local market helps you make informed decisions. Nashua offers a variety of homes from cozy starter houses to spacious family residences.

The demand for homes for sale in Nashua NH is steady. Buyers are attracted to excellent schools, convenient commuting options, and vibrant community life. Knowing this allows you to approach the search with confidence.

Local homes for sale Nashua NH are listed across multiple platforms, including online MLS listings and real estate listings Nashua NH. This broad availability provides ample choices for home seekers.

Nashua blends suburban living with city convenience. Parks, shopping, restaurants, and services are close by. Commuters enjoy easy access to major highways.

Homes for sale NH in this area attract buyers seeking a balanced lifestyle. Families appreciate schools and community programs, while professionals value proximity to work.

Houses for sale near Nashua NH often offer a mix of styles, lot sizes, and amenities. This diversity allows buyers to find a home that truly fits their lifestyle.

Different neighborhoods in Nashua cater to different needs. South Nashua offers quiet residential streets and family-friendly environments. The central area provides easy access to shopping and entertainment. North Nashua blends suburban and urban living with larger properties.

When searching for homes for sale in Nashua NH, consider the neighborhood that matches your daily life. Schools, commuting routes, and community feel all play a role in long-term satisfaction.

Real estate listings Nashua NH provide detailed information about each area, including property types and recent sales trends. This insight helps buyers narrow their choices effectively.

Understanding your budget is key when searching for homes for sale NH. Consider your income, savings, and monthly expenses carefully. Pre-approval for a mortgage strengthens your position.

Local homes for sale Nashua NH vary widely in price depending on location, size, and condition. Knowing your limits helps you focus on viable options.

Consulting with lenders and reviewing houses for sale near Nashua NH ensures you have realistic expectations. This preparation streamlines the home buying process.

Start with a clear list of priorities. Bedrooms, bathrooms, lot size, and style matter. Then use online platforms to find homes that meet your criteria.

Real estate listings Nashua NH offer advanced filters to make searching efficient. Save favorites and monitor price changes regularly.

Visiting local homes for sale NH in person provides a better feel for the property. Pictures are helpful, but walking through a home gives insight into flow and layout.

A local realtor can guide you through homes for sale in Nashua NH with expertise. They know neighborhoods, recent sales, and buyer preferences.

Local homes for sale Nashua NH are best navigated with professional support. Realtors can schedule viewings, negotiate terms, and provide market insight.

MLS listings New Hampshire offer comprehensive data, but a realtor translates it into actionable advice. Their guidance helps you find the right home faster.

Once you find a home, making a strong offer matters. Consider the market, property condition, and your budget.

Houses for sale near Nashua NH sometimes attract multiple buyers. A competitive offer with favorable terms increases your chance of success.

Real estate listings Nashua NH often show recent sales to inform your offer. Understanding comparable properties ensures you make a reasonable bid.

After an accepted offer, inspections and appraisals follow. These steps confirm the home’s condition and value. Being prepared reduces stress.

Local homes for sale Nashua NH move smoothly through closing when buyers are organized. Coordinating with your realtor and lender keeps the process on track.

Homes for sale in Nashua NH often require clear communication and quick responses to avoid delays. A proactive approach ensures a smooth transaction.

Nashua NH offers a range of homes for all lifestyles. South Nashua, central, and north neighborhoods each provide unique benefits. Local homes for sale Nashua NH continue to attract buyers due to location, schools, and amenities.

Finding homes for sale in Nashua NH is easier with preparation, a clear budget, and professional guidance. Houses for sale near Nashua NH are diverse, so knowing your priorities is essential.

Real estate listings Nashua NH and MLS resources provide a wealth of information, but personal exploration and local expertise make the difference.

Homes for sale in Nashua NH offer opportunities for buyers seeking comfort, community, and long-term value. Approach the search with strategy and confidence.

If you need more tips on homes for sale in Nashua NH, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Selling a home is a major decision. In South Nashua, it can also be a strong opportunity. Many sellers want a clear plan, steady guidance, and honest advice. This guide was written to help you understand the process from start to finish.

Understanding homes for sale in New Hampshire is the first step. Buyers are active, informed, and focused on value. South Nashua continues to draw attention because of its location and everyday convenience.

South Nashua homes for sale appeal to buyers who want comfort and access. When sellers understand buyer priorities, preparation becomes easier and more effective.

South Nashua offers a setting that many buyers want. Shopping, dining, and services sit close by. Major roads are easy to reach without living on busy streets.

Because of this, South Nashua homes for sale often receive steady interest. Buyers appreciate the balance between privacy and convenience. This steady demand supports sellers who price and prepare correctly.

Homes here attract a wide range of buyers. Some are moving locally, while others are relocating from nearby states. This diversity helps keep demand consistent.

Every successful sale begins with market knowledge. South Nashua follows its own patterns. These patterns influence pricing, timing, and buyer behavior.

Reviewing New Hampshire real estate listings helps sellers see current competition. It also shows how buyers compare homes online. This step is essential.

MLS listings New Hampshire data adds deeper insight. It reveals recent sales, average days on market, and pricing trends. These details guide smart decisions.

Price is one of the most important choices you make. Buyers respond quickly to value. A well priced home creates interest and urgency.

Overpricing often slows momentum. When a home sits too long, buyers may question value. Correct pricing helps avoid this issue.

Comparing houses for sale in NH and recent closed sales helps refine expectations. Local expertise keeps pricing realistic and competitive.

Preparation shapes first impressions. Buyers decide how they feel within moments. Clean and well cared for homes create trust.

Simple updates can deliver strong results. Fresh paint, clear spaces, and good lighting matter. Outdoor areas also deserve attention.

South Nashua homes for sale that show pride of ownership often receive stronger offers. Preparation supports both price and speed.

Staging does not mean removing all personality. It means helping buyers see potential. Neutral spaces feel larger and brighter.

Furniture placement guides flow. Clean surfaces help buyers focus on features. These steps improve photos and showings.

Buyers searching homes for sale near me NH often decide based on photos. Presentation plays a major role online.

Strong marketing tells a clear story. It explains why your home matters. Professional photography builds emotional connection.

Online exposure is critical. Buyers rely on New Hampshire real estate listings during their search. Clear descriptions and accurate details matter.

Local marketing adds value. It highlights features that matter most to South Nashua buyers. This approach attracts serious interest.

Many sellers worry about timing. While seasons matter, preparation matters more. Homes listed when ready perform better.

Spring and early summer often bring activity. Fall can also be strong with motivated buyers. Winter sales succeed with proper pricing.

If you plan to buy a home in New Hampshire after selling, timing deserves careful coordination. Planning reduces stress.

Receiving offers can feel exciting and overwhelming. Price matters, but terms matter too. Each detail affects the outcome.

Contingencies, timelines, and financing deserve attention. Strong offers balance all elements.

Clear guidance helps sellers compare options confidently. This clarity leads to better decisions.

Negotiation is part of the process. It should feel professional and focused. Emotions can stay out of decisions.

Strong negotiation protects your goals while keeping buyers engaged. Clear communication matters.

Experienced support helps manage this stage smoothly. It often leads to better results.

Once under contract, inspections follow. Buyers want reassurance about condition. Preparation helps this stage move smoothly.

Appraisals focus on value. Pricing correctly from the start reduces risk. Well maintained homes perform better.

South Nashua homes for sale that are cared for often move through this phase without delays.

Closing brings everything together. Paperwork, timelines, and coordination all matter. Clear communication keeps things on track.

Knowing what to expect reduces stress. It also helps sellers plan their next move.

A smooth closing feels rewarding. It marks the successful end of a major step.

South Nashua continues to show steady demand. Buyers value location, layout, and convenience. This supports long term value.

Even during slower markets, interest remains. Homes here tend to age well in the market.

When reviewing MLS listings New Hampshire, South Nashua often shows consistent activity.

Some sellers price based on emotion. Others delay preparation. These choices can affect results.

Ignoring market feedback can slow a sale. Adjustments should feel strategic, not reactive.

Working with accurate information helps sellers avoid common pitfalls.

South Nashua remains a strong choice for sellers. Demand stays steady due to location and lifestyle. Preparation makes the difference.

South Nashua homes for sale benefit from buyer interest and long term appeal. These qualities matter in today’s market.

If you are selling homes for sale in New Hampshire, South Nashua offers real opportunity. A clear plan supports success.

South Nashua homes for sale continue to attract attention. Sellers who prepare thoughtfully often achieve strong results.

If you are thinking about selling, information is your strongest tool. Understanding value, timing, and preparation builds confidence.

A local conversation can help clarify your options. It can also answer questions without pressure.

When you are ready to explore your next move, a thoughtful plan can make selling in South Nashua feel smooth and rewarding.

If you need more tips on homes for sale in New Hampshire, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Looking at homes for sale in New Hampshire can feel exciting and overwhelming at the same time. Many buyers feel hopeful, curious, and cautious. This is normal and expected. The good news is that New Hampshire offers many options for different budgets and lifestyles. You can find quiet towns, active cities, and scenic spaces close to nature.

When people search for homes for sale in New Hampshire, they often want value and comfort. They want a place that feels right. Some buyers look for South Nashua houses for sale because of location and convenience. Others search for homes for sale near me NH to stay close to work or family. No matter the goal, the journey starts with good information.

New Hampshire offers a strong sense of community and balance. Many towns provide charm and character. You can enjoy mountains, lakes, and the coast within a short drive. This variety attracts families, retirees, and first time buyers.

The state also has a stable housing market. New Hampshire real estate listings show steady demand. Buyers often see homes hold value over time. This brings peace of mind and long term confidence. When you buy a home in New Hampshire, you invest in more than walls and land.

The housing market in New Hampshire changes by area. Some towns move fast while others offer more time. MLS listings New Hampshire give buyers a clear view of what is available. These listings update often and show key details.

Prices can vary by town, size, and condition. Houses for sale in NH range from cozy condos to large single family homes. Knowing the market helps buyers act with confidence. A local REALTOR can explain trends and guide smart choices.

New Hampshire offers many home styles. You can find classic Colonials, charming Capes, and modern builds. Condos and townhomes are also popular. Each option fits a different lifestyle.

Some buyers prefer low maintenance living. Others want space and privacy. New Hampshire real estate listings include both. When reviewing houses for sale in NH, it helps to list your must haves early. This keeps the search focused and less stressful.

South Nashua houses for sale continue to attract strong interest. This area offers easy highway access and shopping nearby. Many buyers enjoy the mix of suburban comfort and city convenience. Schools, parks, and services are close by.

Homes here often move quickly. MLS listings New Hampshire show frequent updates in this area. Buyers should be ready to act when the right home appears. A clear plan helps avoid missed chances.

Most buyers start online. Searching homes for sale near me NH is common and helpful. Online tools allow filters by price, size, and location. Photos and virtual tours add value.

Still, online searches have limits. Some details do not show on a screen. A REALTOR can provide insight beyond the listing. They know neighborhoods, history, and future plans. This guidance saves time and reduces surprises.

Home tours bring listings to life. You can feel the space and imagine daily routines. Pay attention to layout, light, and flow. These details matter more than paint color.

It helps to take notes during tours. Many houses for sale in NH can blur together. A simple list keeps thoughts clear. Ask questions and trust your instincts. Comfort and fit are important signs.

Price matters, but value matters more. A home priced right reflects condition, location, and market demand. New Hampshire real estate listings provide comparison tools. These help buyers see fair ranges.

An experienced REALTOR reviews recent sales. They explain why prices differ. This knowledge helps buyers make strong offers. It also reduces the risk of overpaying.

A strong offer is clear and fair. It considers price, terms, and timing. In competitive areas, clean offers stand out. This does not always mean the highest price.

Flexibility can help. Adjusting closing dates or contingencies may appeal to sellers. A REALTOR explains options and risks. This support builds confidence during negotiations.

Once accepted, inspections protect buyers. They reveal condition and safety issues. Most homes have minor findings. This is normal and manageable.

Buyers can request repairs or credits. Clear communication keeps deals moving. MLS listings New Hampshire often note inspection outcomes. Staying calm and informed helps the process feel smoother.

Financing is a key step. Buyers should talk with lenders early. Pre approval strengthens offers and speeds closings. It also sets a clear budget.

Loan options vary. Fixed rates, adjustable rates, and programs exist. A trusted lender explains choices in simple terms. This clarity reduces stress and surprises.

A local REALTOR is a guide and advocate. They understand towns, pricing, and timing. They also manage details and deadlines. This support is valuable, especially for first time buyers.

REALTORS access MLS listings New Hampshire and private insights. They protect your interests and answer questions. Buying a home should feel supported, not rushed.

Timing matters, but perfection is rare. The best time to buy depends on goals. Some buyers want speed. Others want selection. New Hampshire offers both at different times.

Staying informed helps. Market updates and local trends guide decisions. A REALTOR shares what matters most for your situation.

Once under contract, planning begins. Buyers arrange movers, utilities, and services. Creating a checklist helps. Small steps add up to smooth moves.

New homeowners often feel excited and nervous. This is normal. Support and preparation make the transition easier. Soon, the new space feels like home.

Life in New Hampshire offers balance. Many enjoy outdoor activities and local events. Town centers and trails create connection.

Homeownership builds roots. Whether you chose South Nashua houses for sale or another town, pride follows. A home becomes part of your story.

Homes need care over time. Routine maintenance protects value. Simple tasks prevent larger issues. This keeps homes comfortable and strong.

New Hampshire homes often age well with care. Houses for sale in NH reflect this pride. Buyers benefit from owners who maintain their homes.

Searching for homes for sale in New Hampshire is a personal journey. Each buyer brings unique needs and dreams. With the right support, the process feels clear and rewarding.

Whether you focus on South Nashua houses for sale or explore wider areas, patience helps. Use trusted New Hampshire real estate listings and local guidance. When you buy a home in New Hampshire, you invest in comfort, community, and future memories.

If you need more tips on homes for sale in New Hampshire, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

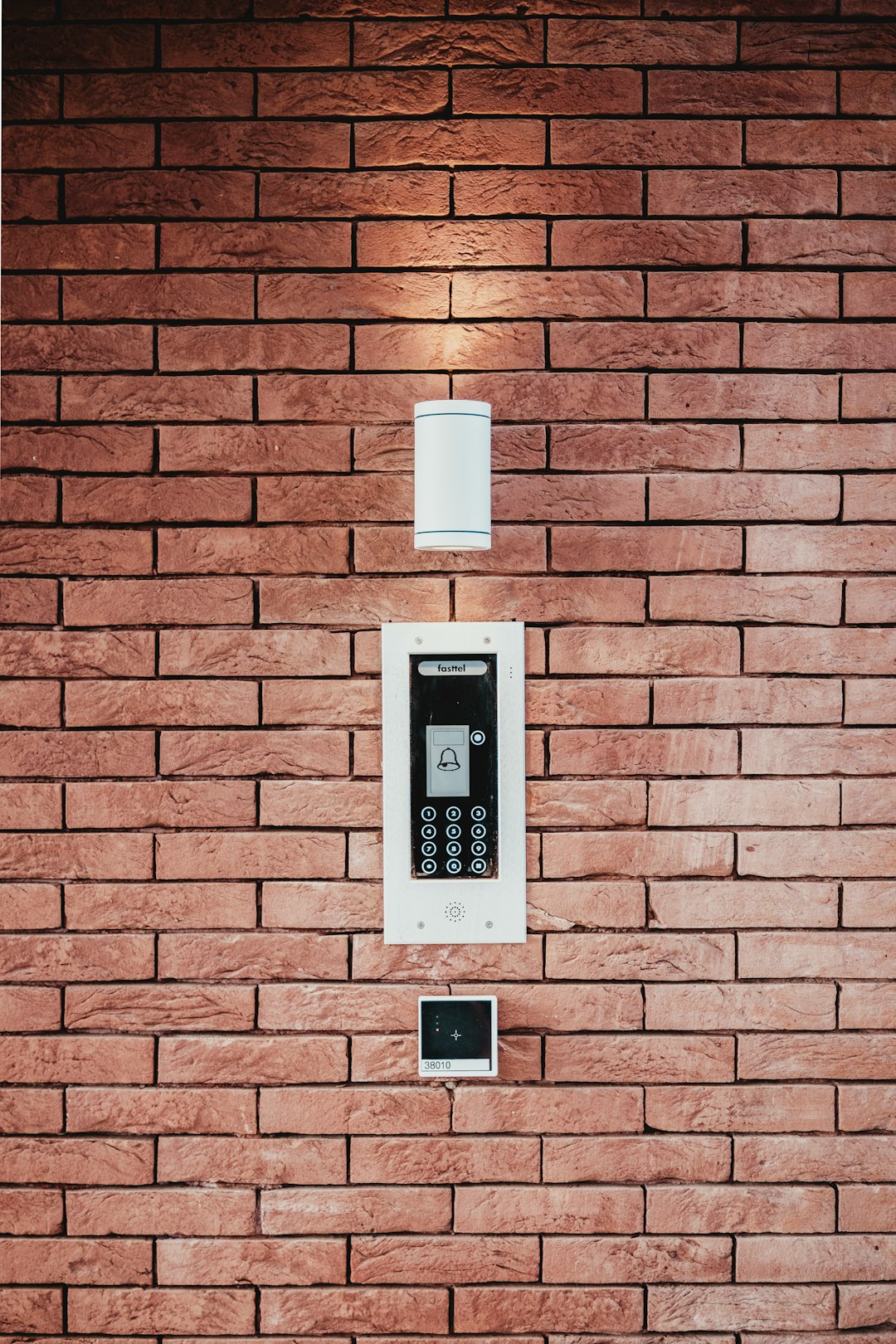

Top home security cameras play a growing role in how buyers feel about a home. Safety, comfort, and peace of mind now guide many real estate decisions. In New Hampshire, buyers often ask about smart security before making offers. This comes up often when viewing South Nashua houses for sale and Southern NH Houses for sale. Because of this, understanding camera options helps sellers and buyers feel confident.

Home security cameras feel less complex than before. Many systems now install easily and work right away. They also blend into the home without distraction. For homeowners, these systems add daily comfort. For buyers, they signal care and modern living.

Security affects how people feel inside a home. Buyers want to feel safe the moment they walk in. A visible camera system creates trust and reassurance. Therefore, homes with security features often feel more appealing.

In real estate, perception matters. Even simple systems can improve first impressions. Buyers see cameras as a sign of smart ownership. As a result, listings with security features often gain more interest.

In New Hampshire markets, safety ranks high for families and retirees. Buyers want peace of mind in every season. Because winters bring longer nights, security feels even more important.

Top home security cameras do more than watch doors. They support lifestyle and property value. Buyers see them as practical upgrades, not luxury extras. This mindset helps listings stand out.

Cameras can lower insurance costs in some cases. They also help owners monitor property when away. Because of this, cameras support both financial and emotional value.

For sellers, leaving a system in place can help negotiations. Buyers feel they gain something extra. That feeling often leads to stronger offers.

Storage options matter to buyers. Cloud storage offers easy access and backup. Local storage appeals to those who value privacy.

Buyers ask how long footage stays available. They also ask who can access it. Clear answers help build confidence.

Privacy settings matter too. Cameras should respect neighbors and family spaces. Responsible setup supports trust and peace of mind.

Some camera styles stand out to buyers. Doorbell cameras remain very popular. They offer convenience and security in one device.

Bullet cameras cover wide outdoor areas. Dome cameras feel discreet and professional. Each style serves a different need.

Buyers appreciate when sellers explain these choices. Simple guidance helps them see value. This clarity supports better decisions.

Families value safety above most features. Cameras help parents feel calm. They also help kids feel protected.

Seeing activity around the home builds awareness. Alerts notify parents of movement. This support feels reassuring during busy schedules.

In family focused areas, security matters more. Buyers exploring South Nashua houses for sale often ask about safety features. Cameras help answer those concerns.

Security cameras also reflect neighborhood care. They show pride and awareness. This can influence buyer perception of the area.

When many homes have cameras, buyers feel safer. This sense of community matters. It also supports property values.

In Southern NH Houses for sale for sale, buyers often notice these details. Small signs of care add up during decision making.

Landlords use cameras to protect property. They also help manage rentals from afar. This adds efficiency and oversight.

Tenants appreciate secure buildings. Clear rules and visible cameras build trust. However, privacy must remain respected.

For investors, cameras protect income and assets. They also reduce risk. This makes them a smart addition to rentals.

New Hampshire weather affects camera choice. Cold winters demand durable equipment. Cameras must handle snow and ice.

Buyers ask about temperature ratings. They want systems that work year round. Because of this, quality matters.

Sellers who choose weather ready cameras gain an edge. These systems feel reliable and thoughtful.

Easy installation matters to buyers. Many prefer systems that need little setup. Clear instructions and simple apps help.

Professional installation adds value for some. It ensures proper placement and coverage. However, many buyers like doing it themselves.

In real estate, ease often wins. Systems that feel simple attract wider interest.

Buyers consider cost carefully. They want fair pricing and clear benefits. Cameras that offer strong value stand out.

Subscription fees can raise questions. Buyers want to know monthly costs. Transparency helps build trust.

When sellers explain value clearly, buyers respond well. Cameras then feel like smart investments.

Some insurance providers offer discounts. Cameras reduce risk and claims. Buyers like potential savings.

Not all systems qualify. Buyers should check with providers. Still, the possibility adds appeal.

In listings, this benefit can be mentioned. It shows thoughtful ownership and planning.

REALTORS can highlight security in listings. Photos and descriptions matter. Clear mention of cameras adds interest.

During showings, sellers can explain features. This builds confidence. Buyers appreciate honesty and clarity.

Security features help listings feel complete. They also support emotional comfort during tours.

Buyers ask if systems stay with the home. They want to know how to use them. They also ask about privacy.

Clear answers help deals move forward. REALTORS play a key role here. Knowledge builds trust.

Top home security cameras often spark positive conversations. They show modern care and awareness.

Camera technology continues to improve. Better video and smarter alerts lead the way. Buyers expect these improvements.

In the future, cameras may predict patterns. They may also integrate deeper with homes. This progress excites buyers.

Homes that already use modern systems feel ahead. This supports long term value.

Buying a home feels emotional. Safety plays a big role. Cameras support that feeling.

When buyers feel safe, they relax. Relaxed buyers make confident decisions. This benefits everyone.

Top home security cameras support peace of mind. That peace often seals the deal.

Top home security cameras now feel essential, not optional. They support safety, value, and buyer confidence. In New Hampshire, these systems match lifestyle and climate needs. Buyers looking at South Nashua houses for sale often see cameras as a strong benefit. The same holds true for Southern NH Houses for sale where safety remains a top priority. With smart choices, cameras help homes feel protected and ready for the future.

If you need more tips on top home security cameras, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Choosing a golf course home feels exciting and rewarding for many buyers. It blends lifestyle, beauty, and long term value in one setting. In New Hampshire, buyers often explore this option while touring South Nashua houses for sale and Southern NH Houses for sale. A golf course home offers more than a view, since it creates a daily experience many people love. Because of this, these properties continue to attract strong interest across the market.

Living near a course brings calm and open space. Buyers enjoy scenic views and quiet mornings. They also enjoy the sense of community that often comes with golf neighborhoods. For many, this choice feels like a personal win and a smart real estate move.

Golf course homes offer a unique lifestyle. Open greens create a peaceful setting. Wide views add natural beauty and light.

Buyers often feel relaxed the moment they arrive. This emotional response matters in real estate. When people feel good, they connect faster with a home.

These properties also feel special. Limited supply adds appeal. Therefore, demand often stays steady even during slower markets.

Life near a golf course feels calm and active at the same time. Residents enjoy walking paths and fresh air. Many courses maintain beautiful landscapes year round.

Neighbors often share similar interests. This builds a friendly and social environment. Community events and gatherings feel common.

Even non golfers enjoy the setting. The space and quiet create a retreat feel. This lifestyle draws buyers of all ages.

Views matter more than many realize. Looking out over green space feels soothing. It also brings changing scenery through the seasons.

Homes with course views often feel brighter. Natural light fills rooms. This improves mood and comfort.

Buyers touring South Nashua houses for sale often pause longer at homes with views. That extra moment builds connection and interest.

Golf course homes often hold value well. Location and setting support pricing. Buyers view these homes as premium options.

Because supply stays limited, demand remains strong. This helps protect value over time. Owners often see steady appreciation.

In Southern NH Houses for sale, golf communities stand out. Buyers recognize the added benefit and plan accordingly.

Many golf course homes offer more privacy. Fairways create distance between homes. This spacing feels rare and valuable.

Backyards often feel larger without fences. Open views replace close neighbors. This adds to the sense of peace.

Privacy remains a top buyer request. Golf course settings answer that need naturally.

While benefits feel clear, buyers should consider details. Course location matters within the community. Homes near tees differ from homes near greens.

Noise and activity vary by spot. Some buyers enjoy watching play. Others prefer quieter sections.

A REALTOR can guide buyers through these choices. Local knowledge makes a big difference.

Many golf communities include homeowner associations. These groups manage shared spaces. Fees support course upkeep and amenities.

Buyers should review rules and costs. Understanding expectations avoids surprises later.

Well managed associations add value. They protect appearance and community standards.

New Hampshire seasons shape the experience. Spring and summer bring lush greens. Fall adds color and beauty.

Winter changes views yet keeps open space. Snow covered fairways still feel peaceful.

Buyers appreciate year round scenery. Golf course homes offer beauty in every season.

Golfers enjoy easy access to the course. Morning rounds feel simple and fun. Practice becomes part of daily life.

This convenience adds lifestyle value. Time saved feels meaningful.

Homes near courses attract active buyers. These buyers often commit quickly.

Many buyers do not play golf. Still, they love the setting. Open land and quiet streets appeal widely.

Walking paths and views support wellness. Nature feels close without extra travel.

This broad appeal supports resale value. Golf course homes attract many buyer types.

Some courses sit near town centers. Others feel more private. Buyers should consider daily needs.

Access to shops and schools matters. Commute times also play a role.

In areas with Southern NH Houses for sale, golf communities often balance access and retreat. This mix feels ideal for many buyers.

Resale potential stays strong for these homes. Many buyers search specifically for course settings.

Marketing these homes highlights lifestyle and views. Photos and descriptions matter greatly.

Because demand stays steady, sellers often feel confident. This confidence supports pricing strength.

From an investment view, these homes perform well. Stable demand reduces risk.

They also attract quality buyers. Pride of ownership feels common in these communities.

Long term planning often includes resale appeal. Golf course homes fit that plan well.

Local expertise matters greatly here. Each course and community differs.

A knowledgeable REALTOR explains pros and cons clearly. This guidance builds trust.

Buyers feel confident when questions get answered early. This leads to smoother transactions.

Buyers ask about course access and fees. They also ask about rules and privacy.

Clear answers help buyers decide faster. Transparency builds comfort.

REALTORS who prepare these answers add strong value.

Lenders often view golf course homes favorably. Appraisals reflect setting and demand.

Comparable sales matter. Strong past sales support value.

Buyers should work with experienced lenders. This ensures smooth financing.

Many buyers describe a feeling when touring these homes. Calm and joy stand out.

This emotional pull influences decisions. Homes that feel special stand apart.

Golf course settings create that feeling often. This supports quicker offers.

Families enjoy safe streets and open space. Kids play and explore with ease.

Community events often include families. This builds connection and comfort.

Buyers seeking balance find it here. Lifestyle and safety align well.

Retirees value quiet and beauty. Golf course homes meet these needs.

Second home buyers also enjoy ease and upkeep. Many communities offer maintenance support.

These buyer groups add to demand. This keeps markets active.

Compared to busy streets, these homes feel calm. Compared to wooded lots, they feel open.

Each option has value. However, golf course homes combine many benefits.

Buyers often return to this choice after exploring others.

Choosing a golf course home blends lifestyle, comfort, and long term value. Buyers enjoy beauty, privacy, and strong community feel. In New Hampshire, this choice continues to attract attention and respect. Buyers exploring South Nashua houses for sale often see golf communities as premium options. The same holds true for Southern NH Houses for sale where demand remains steady and strong. With thoughtful planning and local guidance, this choice truly feels like scoring a hole in one.

If you need more tips on (idea here), or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Redecorate home apps are changing how people plan home updates. Homeowners now use phones to picture new spaces with ease. This matters in real estate because design affects value and emotion. Buyers touring South Nashua houses for sale and Southern NH Houses for sale often picture changes before making offers. Therefore, these apps help buyers and sellers feel confident and excited.

Phone based design tools feel friendly and simple. They help people test ideas without stress. Many homeowners enjoy seeing instant results. For REALTORS, these apps support better conversations and smarter choices.

Design impacts how buyers feel in a home. When spaces feel fresh, buyers feel welcome. Redecorating apps help people see potential instead of flaws. Because of this, they support stronger first impressions.

In real estate, vision sells homes. Buyers often struggle to imagine changes. Apps solve this problem with clear visuals. This helps homes sell faster and feel more valuable.

In New Hampshire, many homes have strong bones. Simple updates make a big difference. These apps guide smart updates without major costs.

Buyers use apps to test furniture and colors. This helps them connect emotionally. Sellers use apps to plan staging and updates. Both sides gain clarity.

Apps reduce fear of making mistakes. People feel free to explore ideas. Because of this, confidence grows.

REALTORS can suggest apps as helpful tools. This builds trust and value. It also keeps conversations relaxed and productive.

The first app focuses on room planning. Users take a photo and add furniture. The app adjusts scale and lighting. This feels realistic and helpful.

Homeowners enjoy moving items with a finger. They see what fits and what does not. This saves time and money.

For buyers, this app helps picture life in the home. It supports decisions during tours and showings.

Sellers often wonder what to change. This app answers that question. It shows which layouts feel open and inviting.

Small changes often bring big impact. Moving furniture can improve flow. Buyers notice this right away.

In markets like South Nashua houses for sale, presentation matters. Clean layouts help homes stand out online and in person.

Color choices affect mood and value. This app lets users test paint colors instantly. Walls change with a tap.

Users see how light affects color. This helps avoid poor choices. Soft tones often feel best for resale.

Buyers touring Southern NH Houses for sale for sale respond well to calm colors. This app helps sellers choose wisely.

Color sets emotion. Neutral tones feel safe and inviting. Bold colors can limit appeal.

This app removes guesswork. Sellers gain confidence before painting. Buyers feel relaxed during tours.

Because paint costs less, it offers strong return. Apps guide these smart updates with ease.

This app focuses on décor and style. Users place sofas, tables, and art in rooms. The results feel real and fun.

People enjoy seeing style options. Modern, classic, and cozy looks appear easily. This inspires creativity.

For buyers, this app helps imagine personal touches. It turns houses into future homes.

Many buyers struggle with empty rooms. Décor apps fill that gap. They show scale and purpose.

REALTORS can suggest this app during showings. It helps buyers connect emotionally. Emotional connection often leads to offers.

This tool works well for condos and homes alike. It supports confidence across price ranges.

This app uses smart technology. Users answer questions about style and budget. The app suggests full room designs.

It feels like working with a designer. Yet it costs much less. This appeals to many homeowners.

In real estate, this app helps plan updates before listing. It also helps buyers plan after purchase.

AI tools feel simple and helpful. They reduce stress and doubt. Users follow guided steps.

Because choices feel guided, people act faster. This supports timely updates and decisions.

Homes prepared with care attract stronger interest. This app supports that process.

This app focuses on structure and flow. Users scan rooms to create floor plans. They then test layout changes.

This helps with open concepts and room changes. People see walls and space clearly. This supports renovation planning.

Buyers appreciate knowing what is possible. This app answers those questions early.

Understanding layout reduces fear. Buyers want to know space works for them. Floor plans provide clarity.

This app helps buyers feel prepared. It also helps sellers explain possibilities.

In competitive markets, clarity matters. Tools like this support confident offers.

Design choices affect value perception. Clean, modern spaces feel worth more. Apps guide these choices.

Small updates often improve appeal. Paint, layout, and décor matter. Apps help prioritize changes.

In New Hampshire, thoughtful updates stand out. These apps support smart investments.

Before listing, sellers often ask what to update. Apps provide visual answers. This saves time and cost.

REALTORS can review app results with sellers. Together they plan updates. This teamwork builds trust.

Listings prepared with care attract more views. Apps support this preparation step.

This app focuses on structure and flow. Users scan rooms to create floor plans. They then test layout changes.

This helps with open concepts and room changes. People see walls and space clearly. This supports renovation planning.

Buyers appreciate knowing what is possible. This app answers those questions early.

Understanding layout reduces fear. Buyers want to know space works for them. Floor plans provide clarity.

This app helps buyers feel prepared. It also helps sellers explain possibilities.

In competitive markets, clarity matters. Tools like this support confident offers.

Design choices affect value perception. Clean, modern spaces feel worth more. Apps guide these choices.

Small updates often improve appeal. Paint, layout, and décor matter. Apps help prioritize changes.

In New Hampshire, thoughtful updates stand out. These apps support smart investments.

Before listing, sellers often ask what to update. Apps provide visual answers. This saves time and cost.

REALTORS can review app results with sellers. Together they plan updates. This teamwork builds trust.

Listings prepared with care attract more views. Apps support this preparation step.

Not every home matches buyer taste. Apps help buyers look past décor. They see potential instead.

This matters during tours. Buyers feel less stuck on surface details. They focus on layout and location.

In areas like South Nashua houses for sale, this mindset helps buyers act faster.

New builds also benefit from apps. Buyers choose finishes and layouts. Apps show results clearly.

This reduces confusion and regret. Buyers feel involved and excited.

For REALTORS, apps support smoother transactions. Happy buyers lead to strong referrals.

Seeing ideas come to life sparks joy. People feel hopeful and inspired. This emotion matters in real estate.

Apps create positive experiences. Buyers remember homes that felt exciting. Sellers feel proud of preparation.

Positive emotion supports strong decisions. These tools help create that feeling.

Families value ease and speed. Apps fit into busy lives. They work anytime and anywhere.

Parents plan updates after bedtime. Kids enjoy seeing changes too. This makes the process fun.

Homes that support family life attract attention. Apps help plan those spaces well.

Apps often include cost estimates. This helps users plan realistically. Budgets stay under control.

Buyers appreciate knowing future costs. Sellers plan updates without surprises.

Clear costs support smarter decisions. This builds trust and comfort.

Modern tools show care and knowledge. Buyers trust sellers who plan well. Apps support that image.

REALTORS who suggest apps add value. They feel helpful and current.

Technology used wisely strengthens relationships. It also improves outcomes.

Redecorate home apps make design simple and fun. They help people see potential and plan smart updates. In New Hampshire, these tools support strong real estate decisions. Buyers exploring South Nashua houses for sale often use apps to imagine changes. The same is true for Southern NH Houses for sale where vision shapes confidence. With the right apps, homes feel ready, welcoming, and full of promise.

If you need more info on redecorate home apps, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Real Estate Investment 2026 is shaping how buyers and investors plan for the future. Many people want safety, growth, and steady income. In New Hampshire, smart investing still starts with local knowledge and timing. Areas like South Nashua houses for sale and Southern NH Houses for sale continue to draw attention from both new and experienced investors. Therefore, understanding the market now helps investors move with confidence later.

The 2026 market feels steady but selective. Rates, prices, and inventory all matter. However, opportunity still exists for those who plan well. Investors who stay patient and informed often win. This guide shares current conditions, strong locations, and proven strategies that work in today’s market.

The real estate market in 2026 feels more balanced than past years. Prices remain strong, yet growth feels calmer. Buyers act with care and sellers price with strategy. Because of this, smart investors focus on value instead of hype.

Interest rates matter more now. They influence monthly costs and long term returns. Even so, many buyers accept rates as the new normal. Therefore, deals still happen when numbers make sense. Investors who run clear math stay ahead.

Inventory remains tight in many New Hampshire towns. This supports prices and rental demand. However, some areas offer more options than others. Knowing where to look makes a big difference in Real Estate Investment 2026 success.

New Hampshire offers strong lifestyle appeal. It also offers steady job markets and stable communities. These factors support long term housing demand. Investors like markets that feel safe and predictable.

The state has no sales tax or income tax on wages. This attracts residents and retirees. As population holds steady, housing demand stays strong. Therefore, rental and resale opportunities remain healthy.

Southern New Hampshire stands out for access and growth. It offers proximity to jobs and highways. This makes it attractive for commuters and families. Because of this, investors often focus on this region first.

Location still drives success. In 2026, buyers want convenience, safety, and quality schools. Towns near highways and job centers lead the list. Investors should watch areas with steady demand.

South Nashua houses for sale attract attention due to location and amenities. The area offers shopping, dining, and easy travel. Rental demand stays strong from professionals and families. Therefore, this market suits both short and long term investors.

Southern NH Houses for sale for sale also draw wide interest. Many buyers look for value just outside city centers. These towns offer space, charm, and strong community feel. As a result, they often deliver stable appreciation.

Single family homes remain popular in Real Estate Investment 2026. They attract long term renters and future buyers. Maintenance feels simpler compared to larger properties. Because of this, many investors start here.

Families often rent before buying. This supports steady rental income. Also, single family homes tend to hold value well. Investors gain both cash flow and appreciation over time.

In New Hampshire, these homes perform well in strong school districts. They also appeal to relocating buyers. Therefore, single family rentals remain a solid base strategy.

Multi family homes offer higher income potential. They also spread risk across units. If one unit turns over, others still produce income. Because of this, many investors move into this space.

In 2026, small multi family properties feel easier to manage. Duplexes and triplexes fit local zoning well. They also blend into neighborhoods. This helps maintain value and community support.

Financing may require stronger numbers. However, returns often justify the effort. For investors focused on income, multi family homes remain powerful tools.

Condos and townhomes attract a wide range of renters. Young professionals and downsizers often choose them. Maintenance responsibilities stay lower, which appeals to busy owners.

In Southern New Hampshire, these properties sit near jobs and services. This boosts rental demand. Investors benefit from predictable costs and stable occupancy.

HOA fees matter and require review. However, many investors accept them for ease. In Real Estate Investment 2026, convenience often equals value.

Short term rentals remain popular but require care. Rules vary by town and change over time. Investors must review local laws before buying.

Tourism areas still support this strategy. Lakes, mountains, and seasonal attractions draw visitors. However, income may fluctuate by season. Therefore, planning matters.

Some investors mix short and long term rentals. This adds flexibility. Still, local compliance remains key to success.

Buy and hold remains a favorite strategy in 2026. It focuses on long term growth and rental income. Investors ride out market shifts and build equity.

This strategy suits stable markets like New Hampshire. Prices may rise slowly, yet consistency matters. Over time, rent growth improves returns.

Tax benefits also support this approach. Depreciation and expenses help reduce taxable income. Because of this, many investors choose buy and hold for security.

Fix and improve strategies still exist. However, costs remain high for labor and materials. Investors must budget carefully and allow extra time.

Homes needing light updates perform best. Paint, flooring, and fixtures offer strong returns. Major structural work adds risk and delay.

In Real Estate Investment 2026, speed and planning matter. Investors who know their numbers still succeed. Those who rush often struggle.

Financing shapes every deal. In 2026, lenders remain cautious yet active. Strong credit and reserves matter more than ever.

Fixed rate loans offer predictability. Adjustable loans may offer short term savings but add risk. Investors must match loans to their plans.

Some investors use partnerships to grow faster. Others leverage equity from existing homes. Smart financing supports long term success.

Risk management matters in every market. In 2026, investors plan for slower growth. They also prepare for higher holding costs.

Cash reserves protect against surprises. Vacancy, repairs, and rate changes happen. Investors who plan ahead feel less stress.

Diversification also helps. Owning different property types spreads risk. This approach supports stable returns over time.

Rental demand stays strong across New Hampshire. Many renters wait longer to buy. This supports occupancy and rent growth.

Remote work still shapes choices. Renters seek space and comfort. Properties with offices or bonus rooms stand out.

In areas like South Nashua houses for sale, rental demand remains high. Access and amenities drive interest. Therefore, well located rentals perform well.

Investors often choose between appreciation and cash flow. In reality, balance works best. Properties that offer both feel safer.

Some areas offer higher rent yields. Others offer stronger price growth. Knowing goals helps guide choices.

In Southern NH Houses for sale for sale, many markets offer balance. Investors gain steady rent and long term value. This mix suits many plans.

Tax planning plays a key role in returns. Investors should work with professionals. Proper planning protects income and growth.

Depreciation lowers taxable income. Expense tracking adds savings. Long term ownership may reduce capital gains later.

In Real Estate Investment 2026, tax awareness adds power. Smart planning often separates average from strong investors.

Local REALTORS add insight and access. They know neighborhoods, pricing, and trends. This knowledge saves time and money.

REALTORS also help spot value. They guide negotiations and inspections. For investors, this support reduces risk.

In New Hampshire, local experience matters. Town rules and markets vary. A trusted REALTOR becomes a key partner.

Every investment needs an exit plan. Investors should decide early how they will sell or refinance. This guides purchase decisions.

Some plan to sell after appreciation. Others plan to hold for life. Both paths work with clear planning.

In 2026, flexibility matters. Markets change and life changes too. A clear exit strategy keeps options open.

Investing involves emotion. Fear and excitement can cloud judgment. Successful investors stay calm and patient.

They focus on numbers and goals. They avoid chasing trends without research. This discipline supports long term success.

Real Estate Investment 2026 rewards steady thinkers. Those who stay grounded often win.

Real Estate Investment 2026 offers opportunity for prepared investors. The market favors planning, patience, and local knowledge. New Hampshire continues to attract buyers and renters. Markets like South Nashua houses for sale remain strong for both income and growth. Southern NH Houses for sale also offer balance and long term value. With the right strategy, investors can move forward with confidence and clarity.

If you need more tips on real estate investment 2026, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Home Design Trends 2026 are shaping how buyers feel about homes across New Hampshire. This shift matters to sellers, buyers, and REALTORS alike. Many clients ask what features help value grow and comfort last. In markets like South Nashua houses for sale and Southern NH Houses for sale, these trends guide smart choices and strong offers. Therefore, knowing what buyers want helps listings shine and homes sell faster.

Design in 2026 feels calm, warm, and personal. Buyers want homes that feel safe and easy to enjoy. They also want spaces that work for daily life. Because work, school, and rest often happen in one place, design must support balance. As a result, thoughtful layouts and honest materials now lead the market.

Home design impacts first impressions and long term value. Buyers decide fast, often within seconds. Therefore, a home that feels current gains attention and interest. Design also affects appraisal confidence and buyer emotion.

In New Hampshire, weather and lifestyle shape choices. People want homes that feel cozy in winter and bright in summer. They also want strong construction and smart upgrades. Because of that, Home Design Trends 2026 focus on comfort and durability. These qualities support pricing strength in both starter homes and luxury listings.

Design trends also guide renovation plans. Sellers who update wisely often see better returns. Meanwhile, buyers use trends to judge future costs. Therefore, REALTORS who explain trends add real value to every conversation.

Natural materials feel honest and timeless. Wood, stone, and clay now lead interior choices. Buyers love these textures because they feel warm and real. Also, these materials age well and suit many styles.

Wood tones look softer and lighter in 2026. Floors show grain and character. Cabinets favor simple shapes and warm finishes. Stone appears in kitchens and baths, often with subtle patterns. Because of this, spaces feel grounded and calm.

These choices appeal to buyers in South Nashua houses for sale who want lasting value. They also attract buyers exploring Southern NH Houses for sale for sale who seek comfort and style. Natural materials help homes feel rooted and welcoming.

Color trends in 2026 feel gentle and relaxed. Buyers prefer soft shades that soothe the mind. Warm whites, light beiges, and muted greens appear often. These colors reflect light and make rooms feel larger.

Bold colors still appear but in smaller ways. Accent walls and decor add interest without stress. Because of this, buyers can imagine their own style in the space. That sense of ease helps homes sell faster.

Neutral palettes also photograph well. Online listings gain more clicks and saves. Therefore, color choice supports marketing success. It also helps appraisers see broad appeal and value.

Open layouts remain popular, yet they feel more defined. Buyers want connection without chaos. Therefore, design uses zones instead of wide open rooms. Rugs, lighting, and ceiling details help define space.

Kitchens still open to living areas. However, storage and function matter more. Pantries grow larger and islands serve many uses. Because families gather there, kitchens must work hard.

These layouts fit many buyers in Southern NH Houses for sale for sale. They also help South Nashua houses for sale stand out in busy markets. Purposeful openness feels modern and practical.

Flexibility ranks high in Home Design Trends 2026. Buyers want rooms that adapt. Offices become guest rooms or workout spaces. Dining rooms shift into study areas or play zones.

Design now supports change. Built in storage helps rooms shift roles. Sliding doors offer privacy when needed. Because of this, homes serve more needs without added square footage.

This flexibility boosts buyer confidence. People feel ready for future changes. Therefore, flexible homes often receive stronger offers and faster sales.

Energy smart homes draw strong interest. Buyers want lower bills and better comfort. Features like good insulation and efficient windows matter more than ever. These upgrades feel practical and responsible.

Heating systems also evolve. Heat pumps gain popularity across New Hampshire. They offer steady comfort and lower energy use. Because winters feel long, buyers value reliable systems.

These features support value in South Nashua houses for sale. They also appeal to buyers searching Southern NH Houses for sale for sale. Energy smart homes feel future ready and wise.

Wellness plays a key role in Home Design Trends 2026. Buyers want homes that support health and peace. Natural light ranks high on wish lists. Large windows and skylights help mood and focus.

Air quality also matters. Ventilation systems and low odor materials gain favor. Because people spend more time indoors, comfort feels vital. Quiet spaces and soft lighting help reduce stress.

Bathrooms feel more like retreats. Simple fixtures and warm finishes create calm. Therefore, wellness focused design adds emotional value and buyer appeal.

Outdoor spaces now feel like extensions of the home. Buyers want patios, decks, and porches they can use often. Even small yards gain purpose with smart design.

Fire pits and covered seating extend seasons. Gardens offer beauty and food. Because nature feels grounding, outdoor living adds strong appeal. It also supports entertaining and family time.

Homes with inviting outdoor spaces stand out in listings. This trend supports value across price ranges. It also fits New Hampshire lifestyles well.

Clutter free homes feel peaceful and functional. Therefore, storage design matters more in 2026. Buyers look for smart closets, mudrooms, and pantry space.

Entry areas handle coats, shoes, and bags. This helps keep living areas clean. Built in shelves add function without crowding. Because storage hides mess, homes feel larger.

These solutions attract buyers in South Nashua houses for sale. They also help Southern NH Houses for sale for sale compete well. Good storage supports daily ease and long term value.

Kitchens remain the heart of the home. In 2026, they feel warm and simple. Clean lines replace ornate details. Hardware feels solid and easy to use.

Appliances blend into cabinets. This creates a calm look. Countertops show subtle patterns and soft edges. Because kitchens host daily life, comfort matters most.

These kitchens photograph well and impress buyers. They also age gracefully. Therefore, kitchen design remains a strong selling point.

Bathrooms shift toward spa inspired comfort. Buyers want spaces that feel clean and quiet. Walk in showers gain popularity. Tubs remain but feel simple and deep.

Materials feel warm and natural. Lighting feels soft and flattering. Storage keeps counters clear. Because mornings set the tone, buyers value calm bathrooms.

These spaces add emotional appeal. They also support higher perceived value. Therefore, bathroom updates often deliver strong returns.

Smart home features continue to grow. However, buyers want simple and reliable systems. Lighting, security, and climate controls top the list.

Technology should feel easy, not flashy. Hidden wiring and clean panels keep spaces neat. Because buyers vary in comfort, systems must feel optional.

These features attract tech aware buyers. They also support safety and efficiency. Therefore, smart design adds quiet value to listings.

Exterior design still drives first impressions. Buyers judge quickly from the street. Therefore, clean lines and welcoming entries matter.

Siding colors feel natural and soft. Landscaping looks simple and cared for. Lighting highlights paths and doors. Because curb appeal sets emotion, it influences showings.

Strong exteriors help South Nashua houses for sale gain attention. They also support Southern NH Houses for sale for sale in competitive areas. First impressions truly count.

Home Design Trends 2026 favor lasting choices. Buyers prefer homes that age well. Therefore, classic shapes and honest materials lead.

Trends now feel slower and thoughtful. People want homes that grow with them. Because moving costs feel high, buyers plan to stay longer.

Timeless design supports resale value. It also reduces future update needs. Therefore, it feels both smart and comforting.

REALTORS play a key role in explaining trends. Clients trust guidance that feels clear and honest. Therefore, sharing design insights builds confidence.

Agents can suggest simple updates before listing. They can also help buyers see potential. Because trends guide taste, they shape decisions.

In New Hampshire markets, this knowledge sets professionals apart. It also builds trust and long term relationships.

Home Design Trends 2026 reflect how people want to live now. Comfort, flexibility, and calm guide every choice. These trends support value, emotion, and daily ease. Buyers exploring South Nashua houses for sale respond well to these features. The same holds true for Southern NH Houses for sale as demand stays strong. Therefore, understanding design trends helps every buyer and seller make smarter moves with confidence.

If you need more tips on home design trends 2026, or are ready to sell your house give us a call at (603) 883-8840. You can also sign up for your dream home search or reach out to Our Agents for more information. We’d love to help you with your real estate needs.

Getting your home ready for visitors can feel exciting. It can also feel a little stressful if you do not know where to start. With the right plan, you can make a warm and welcoming space that feels good for everyone. This blog will guide you through simple ideas that help you get your home ready fast and with ease. These tips are perfect for any home and work great when you want to impress your visitors without feeling overwhelmed. The focus keyphrase guest prep will help you remember the simple steps you can follow each time you are expecting guests.

As a REALTOR in New Hampshire, I often see how a clean and inviting home makes a strong impact. Buyers love homes that feel peaceful and well cared for. Sellers feel proud when their home shines. These tips will help you prepare for visitors and keep your home looking its best. This is also helpful if you are thinking about selling soon. A home that feels warm and ready for company often feels ready for buyers too. This is why guest prep is so useful for both homeowners and future sellers who want to stand out in the Southern NH market. If you are looking for South Nashua houses for sale or Southern NH houses for sale, you already know how attractive a tidy and thoughtful home can feel.

Guest prep is more than cleaning. It is about creating an experience. Your visitors notice more than you think. They see how cozy the sofa looks. They enjoy the smell of a clean kitchen. They smile when they see a tidy bathroom with fresh towels. These little moments add up and help your guests feel special. The best part is that guest prep does not require fancy items. Most of the time, simple touches can have the biggest impact.

When you take time for guest prep, your home feels comfortable, organized and peaceful. This helps you enjoy your time with your visitors rather than rushing around at the last minute. It also boosts your confidence because your home reflects the care you put into it. Many homeowners in Southern New Hampshire feel the same way. They want their homes to feel warm, inviting and ready for friends and family.

Your entryway creates the first impression. It is the first place guests see and the first moment they feel your home’s energy. When this space is clean and uncluttered, it sends a warm signal that says you care.

Start by clearing shoes, coats or bags that tend to pile up. Wipe the door and clean the doorknob. Sweep the floor and shake out any rugs. These simple steps help the space look polished. If you want to make the entryway feel extra cozy, place a small plant or a bowl for keys. The goal is to create a simple and welcoming space that puts your guests at ease the moment they walk inside.

Homeowners looking at South Nashua houses for sale or Southern NH houses for sale often pay attention to this area. A tidy entryway sets a strong tone and makes visitors want to see more of the home.

The living room is where you may spend most of your time with guests. This space should feel relaxed and comfortable. During your guest prep, start by fluffing the pillows and folding any blankets. Clear off coffee tables and wipe down surfaces so the room feels fresh. You can also add a scented candle with a soft fragrance like vanilla or fresh linen. Scents help create emotion and comfort.

Next, think about lighting. Soft lighting makes the room feel calm. Use table lamps if overhead lights feel harsh. Light is powerful and plays a big role in how your guests feel in the space.

Many buyers touring Southern NH houses for sale talk about how they imagine themselves relaxing in the living room. A tidy and welcoming space helps them picture that life with ease. This is why living room guest prep has value even beyond hosting. It helps you see your home with fresh eyes.

Guests love to gather in the kitchen. This room brings people together and usually becomes the center of conversation. Because of this, kitchen guest prep is important. Start by clearing counters so the space looks open. Wipe appliances, clean the sink and empty the trash. These steps make your kitchen feel clean and ready.

A simple tray with snacks or a fruit bowl adds a warm touch. It tells your guests you planned ahead for them. You can also place a clean dish towel near the sink and make sure the dishwasher is empty if you expect dishes.

Kitchens often make a big impact on buyers too. If you follow the same kitchen guest prep steps before a showing, the home feels more appealing. Clean kitchens help South Nashua houses for sale and Southern NH houses for sale look polished and move-in ready.

Outdoor spaces matter if guests will walk through the yard or patio. Sweep the walkway and bring in any clutter. Clean outdoor seating and add a few cushions. Even small outdoor areas benefit from quick guest prep. Fresh air, neat lines and tidy spaces make your home feel cared for both inside and out.

If you are planning to sell soon, outdoor areas are a major selling point. Homes with clean yards attract serious buyers. This is common for South Nashua houses for sale and Southern NH houses for sale where outdoor living is popular.

Guest prep does not need to feel strict. Some of the most powerful touches are personal and simple. A framed photo, a handwritten welcome note or a favorite treat can make guests smile. These little details help guests feel loved.

A playlist with calm background music also adds emotion and creates a cozy setting. Music helps people relax. It sets the tone for your time together and makes the home feel peaceful.

Personal touches also help a home feel lived in when staged for buyers. People love homes with warmth and charm. They imagine joyful memories there.

Air quality matters more than most people think. Open windows to let in fresh air before guests arrive. A short burst of outdoor air helps remove stale smells. You can also use a diffuser with a mild scent. Just keep it soft so it does not overwhelm your visitors.

Fresh air makes a strong impact during home showings too. Buyers feel more comfortable in homes with clean, light scents. This is true for South Nashua houses for sale and Southern NH houses for sale where many buyers focus on comfort and peace.

Clutter makes a home feel stressful. When you expect guests, take a few minutes to pick up toys, mail or random items. Place them in a basket or drawer. Your home does not need to look perfect. It just needs to feel calm.

Clutter free homes also show better in the real estate market. Buyers notice when spaces feel open and organized. They find it easier to imagine their own belongings there. These simple guest prep steps help both homeowners and sellers.

The most important step in guest prep is to relax. Visitors come to spend time with you. They do not expect perfection. When your home feels warm and inviting, you can enjoy your time together without worrying about every detail. A comfortable host makes guests feel comfortable too.

This same mindset helps homeowners who plan to sell soon. A relaxed and confident approach makes the process easier. Homes in Southern NH show better when the seller feels calm and ready.

Guest prep is simple when you follow these easy steps. Your home feels warm, inviting and ready for company. Clean spaces, soft lighting, fresh air and small personal touches make a big difference. These ideas help you enjoy your visitors and feel proud of your home.

They also help if you are thinking about selling in the Southern NH market. Buyers love homes that feel cared for and peaceful. Whether you are hosting friends or preparing for showings, these steps can help your home shine. If you need help finding South Nashua houses for sale or Southern NH houses for sale, our office is always here to guide you.

Your home can feel cozy, joyful and ready for every visitor. With thoughtful guest prep, you can create wonderful memories and share your beautiful space with the people you love.